Strict liability insurance information

Home » Trending » Strict liability insurance informationYour Strict liability insurance images are ready. Strict liability insurance are a topic that is being searched for and liked by netizens today. You can Get the Strict liability insurance files here. Get all royalty-free vectors.

If you’re searching for strict liability insurance pictures information linked to the strict liability insurance keyword, you have visit the ideal blog. Our site always gives you suggestions for seeing the highest quality video and picture content, please kindly search and locate more enlightening video content and images that fit your interests.

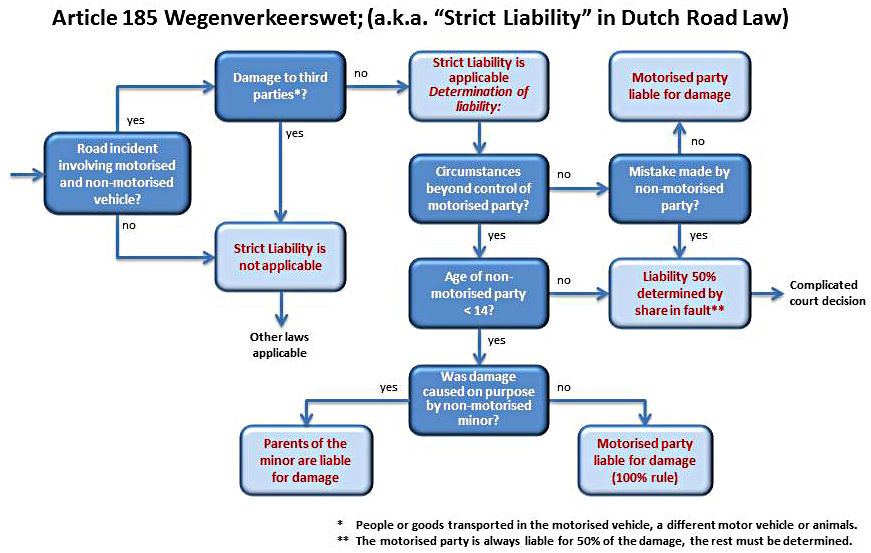

Strict Liability Insurance. Strict liability, also referred to as “absolute liability,” applies to such issues as injuries or other damages caused by a defective product, damages caused by animals, and engaging in certain hazardous activities. Strict liability offences are primarily regulatory offences aimed at businesses in relation to health and safety. Strict liability is a theory that imposes legal responsibility for damages or injuries even if the person who was found strictly liable did not act with fault or negligence. Dalam hukum pidana dan perdata, strict liability adalah standar pertanggungjawaban di mana seseorang secara hukum bertanggung jawab atas konsekuensi yang mengalir dari suatu kegiatan bahkan tanpa adanya kesalahan atau maksud kriminal dari pihak tergugat.

Understanding Comparative Fault, Contributory Negligence From claimsjournal.com

Understanding Comparative Fault, Contributory Negligence From claimsjournal.com

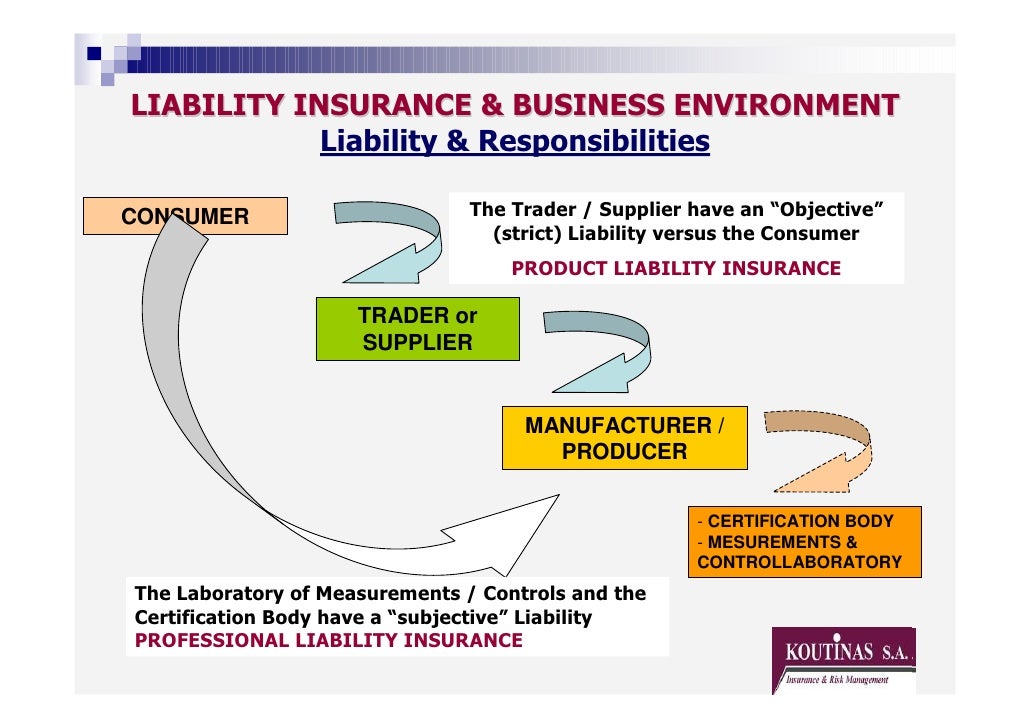

In practice, this means businesses that design, manufacture, wholesale, or sell products need robust liability insurance to protect. It typically applies in criminal, corporations, and tort law and may result because the party has created or enable a dangerous situation, so if it leads to damages, the party becomes liable. In tort law, strict liability is the imposition of liability on a party without a finding of fault (such as negligence or tortious intent). The manufacturer, wholesaler, distributor and retailers. A business can insure itself against a wide range of liabilities arising including those arising under strict liability in civil law. Such liability is faced by a manufacturer or seller of defective or dangerous products.

Strict liability crimes are crimes which require no proof of mens rea in relation to one or more aspects of the actus reus.

Strict liability, often referred to as absolute liability , applies in situations in which an inherently dangerous activity causes damages or injuries to someone. Strict liability (glossary word) liability assigned without regard to negligence or fault. As a result, the costs of injuries shifted to those who market the products: Strict liability, sometimes called absolute liability, is the legal responsibility for damages, or injury, even if the person found strictly liable was not at fault or negligent. Strict liability — a legal doctrine under which liability is imposed with respect to injury or damage arising from certain types of hazardous activities. The law imposes strict liability to situations which are considered as inherently dangerous.

Source: john-s-allen.com

Source: john-s-allen.com

Such liability is faced by a manufacturer or seller of defective or dangerous products. Strict product liability relaxes the burden of proof a plaintiff must meet in pursuing legal action against a small business. For example, under strict liability standards, the manufacturer or distributor of a dangerous product is liable to a person who is injured by the product, regardless of the degree of. The manufacturer, wholesaler, distributor and retailers. The claimant need only prove that the tort occurred and that the defendant was responsible.

Source: jklawoffices.com

Source: jklawoffices.com

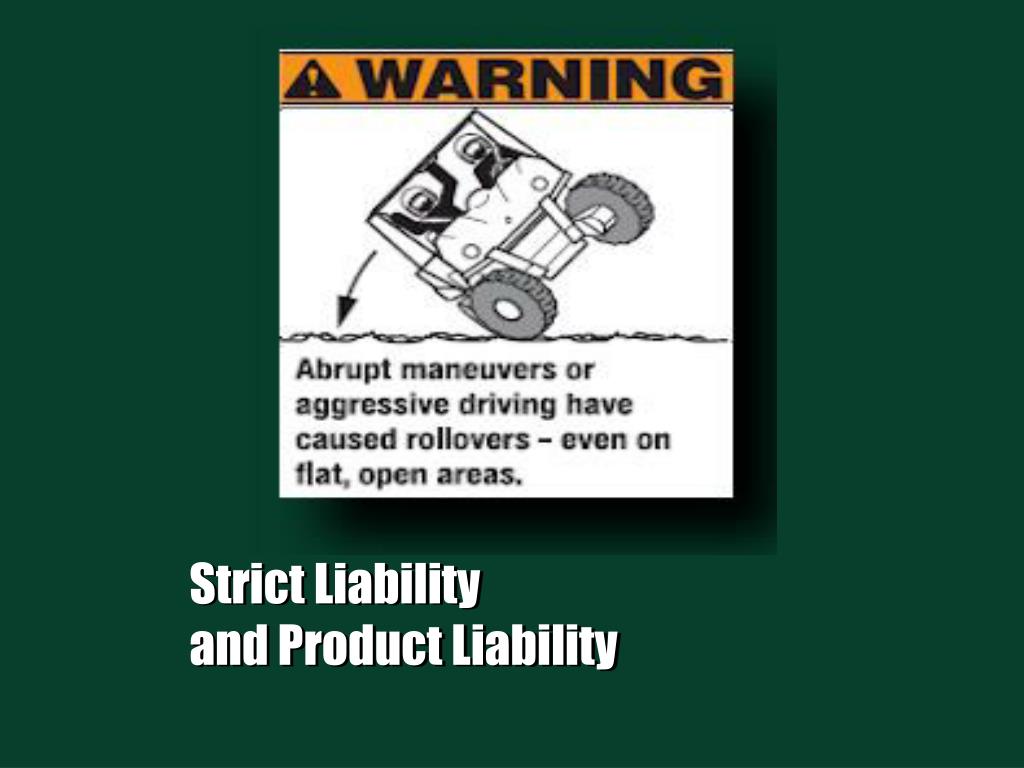

Also many driving offences are crimes of strict liability eg. Strict liability (glossary word) liability assigned without regard to negligence or fault. Such liability is faced by a manufacturer or seller of defective or dangerous products. The claimant need only prove that the tort occurred and that the defendant was responsible. Strict liability — a legal doctrine under which liability is imposed with respect to injury or damage arising from certain types of hazardous activities.

Source: slideserve.com

Source: slideserve.com

In practice, this means businesses that design, manufacture, wholesale, or sell products need robust liability insurance to protect. Dalam hukum pidana dan perdata, strict liability adalah standar pertanggungjawaban di mana seseorang secara hukum bertanggung jawab atas konsekuensi yang mengalir dari suatu kegiatan bahkan tanpa adanya kesalahan atau maksud kriminal dari pihak tergugat. Strict liability is a legal standard that places absolute responsibility on a certain party for damages, regardless of who is actually at fault. Strict liability is the chosen liability rule in the bunkers convention, and insurance is also required. As a result, the costs of injuries shifted to those who market the products:

Source: slideshare.net

Source: slideshare.net

In general terms your liability insurance can meet the costs of compensation that becomes payable as a result, your legal defence charges but not any fines or penalties that you receive as a consequence of a breach. In general terms your liability insurance can meet the costs of compensation that becomes payable as a result, your legal defence charges but not any fines or penalties that you receive as a consequence of a breach. Other users also searched for some of the following glossary words and faqs. A business can insure itself against a wide range of liabilities arising including those arising under strict liability in civil law. Dalam hukum pidana dan perdata, strict liability adalah standar pertanggungjawaban di mana seseorang secara hukum bertanggung jawab atas konsekuensi yang mengalir dari suatu kegiatan bahkan tanpa adanya kesalahan atau maksud kriminal dari pihak tergugat.

Source: enpuften.blogspot.com

Liability insurance adalah asuransi yang menjamin tanggung jawab hukum terhadap kerugian yang dialami pihak ketiga baik berupa kerugian materiil harta benda (property damage) maupun cidera badan (bodily injury) yang disebabkan oleh suatu peritiwa atau kejadian sehubungan dengan kegiatan usaha atau aktivitas tertanggung. Strict liability — a legal doctrine under which liability is imposed with respect to injury or damage arising from certain types of hazardous activities. Animal bites (in certain states), manufacturing defects, and abnormally dangerous activities. Whether the tort was based on intentionality, negligence, or strict liability, this type of insurance policy could help cover the following: Even if there is no intention or negligence in the actions of the people responsible, they will still be held liable, regardless of fault.

Source: travelers.com

Source: travelers.com

Animal bites (in certain states), manufacturing defects, and abnormally dangerous activities. Strict liability has been applied to certain activities in tort , such as holding an employer absolutely liable for the torts of her employees, but today it is most commonly associated with defectively manufactured. Strict product liability relaxes the burden of proof a plaintiff must meet in pursuing legal action against a small business. Decennial liability is a strict liability applied to construction projects whereby the contractor and/or the design consultant will be held liable (in the absence of any evidence of breach of contract or negligence), to compensate an owner or employer in the event of defective works in built structures. Liability insurance adalah asuransi yang menjamin tanggung jawab hukum terhadap kerugian yang dialami pihak ketiga baik berupa kerugian materiil harta benda (property damage) maupun cidera badan (bodily injury) yang disebabkan oleh suatu peritiwa atau kejadian sehubungan dengan kegiatan usaha atau aktivitas tertanggung.

This theory usually applies in three types of situations: Strict liability is the chosen liability rule in the bunkers convention, and insurance is also required. For example, under strict liability standards, the manufacturer or distributor of a dangerous product is liable to a person who is injured by the product, regardless of the degree of. But the strict liability doctrine came into play after 1963. Other users also searched for some of the following glossary words and faqs.

Source: slideserve.com

Source: slideserve.com

The basic logic behind strict liability is that the manufacturers, distributors and retailers of a product that causes bodily injury or property damage are more responsible than the consumer. Strict liability is a theory that imposes legal responsibility for damages or injuries even if the person who was found strictly liable did not act with fault or negligence. In tort law, strict liability is the imposition of liability on a party without a finding of fault (such as negligence or tortious intent). Also many driving offences are crimes of strict liability eg. An individual or entity may be held strictly liable in both civil and criminal actions.

Source: sfvbareferral.com

Source: sfvbareferral.com

Strict liability — a legal doctrine under which liability is imposed with respect to injury or damage arising from certain types of hazardous activities. A business can insure itself against a wide range of liabilities arising including those arising under strict liability in civil law. Strict liability has been applied to certain activities in tort , such as holding an employer absolutely liable for the torts of her employees, but today it is most commonly associated with defectively manufactured. In tort law, strict liability is the imposition of liability on a party without a finding of fault (such as negligence or tortious intent). Strict product liability relaxes the burden of proof a plaintiff must meet in pursuing legal action against a small business.

Source: danieledekoter.wordpress.com

Source: danieledekoter.wordpress.com

Strict liability (glossary word) liability assigned without regard to negligence or fault. Strict liability, often referred to as absolute liability , applies in situations in which an inherently dangerous activity causes damages or injuries to someone. Other users also searched for some of the following glossary words and faqs. Whether the tort was based on intentionality, negligence, or strict liability, this type of insurance policy could help cover the following: Strict liability, sometimes called absolute liability, is the legal responsibility for damages, or injury, even if the person found strictly liable was not at fault or negligent.

Source: slideserve.com

Source: slideserve.com

Whether the tort was based on intentionality, negligence, or strict liability, this type of insurance policy could help cover the following: Such liability is faced by a manufacturer or seller of defective or dangerous products. The plaintiff only needs proof that the tort occurred and that the defendant was responsible. Strict liability is a legal standard that places absolute responsibility on a certain party for damages, regardless of who is actually at fault. In general terms your liability insurance can meet the costs of compensation that becomes payable as a result, your legal defence charges but not any fines or penalties that you receive as a consequence of a breach.

Source: slideshare.net

Source: slideshare.net

Strict liability is the chosen liability rule in the bunkers convention, and insurance is also required. Decennial liability is a strict liability applied to construction projects whereby the contractor and/or the design consultant will be held liable (in the absence of any evidence of breach of contract or negligence), to compensate an owner or employer in the event of defective works in built structures. Strict liability is the chosen liability rule in the bunkers convention, and insurance is also required. The manufacturer, wholesaler, distributor and retailers. A business can insure itself against a wide range of liabilities arising including those arising under strict liability in civil law.

Source: propertyinsurancecoveragelaw.com

Source: propertyinsurancecoveragelaw.com

Strict liability has been applied to certain activities in tort , such as holding an employer absolutely liable for the torts of her employees, but today it is most commonly associated with defectively manufactured. Liability insurance adalah asuransi yang menjamin tanggung jawab hukum terhadap kerugian yang dialami pihak ketiga baik berupa kerugian materiil harta benda (property damage) maupun cidera badan (bodily injury) yang disebabkan oleh suatu peritiwa atau kejadian sehubungan dengan kegiatan usaha atau aktivitas tertanggung. Strict liability crimes are crimes which require no proof of mens rea in relation to one or more aspects of the actus reus. Strict liability has been applied to certain activities in tort , such as holding an employer absolutely liable for the torts of her employees, but today it is most commonly associated with defectively manufactured. As a result, it makes running a business much riskier than under standard liability rules.

Source: slideshare.net

Source: slideshare.net

Strict liability crimes are crimes which require no proof of mens rea in relation to one or more aspects of the actus reus. Strict liability, often referred to as absolute liability , applies in situations in which an inherently dangerous activity causes damages or injuries to someone. It typically applies in criminal, corporations, and tort law and may result because the party has created or enable a dangerous situation, so if it leads to damages, the party becomes liable. That said, a general liability policy won’t cover everything. Strict liability offences are primarily regulatory offences aimed at businesses in relation to health and safety.

Source: cossioinsurance.com

Source: cossioinsurance.com

The claimant need only prove that the tort occurred and that the defendant was responsible. However, even when a strict liability exists, there are some defences available to the defendant. Liability insurance adalah asuransi yang menjamin tanggung jawab hukum terhadap kerugian yang dialami pihak ketiga baik berupa kerugian materiil harta benda (property damage) maupun cidera badan (bodily injury) yang disebabkan oleh suatu peritiwa atau kejadian sehubungan dengan kegiatan usaha atau aktivitas tertanggung. Strict liability applies to certain causes of action that require no wrongful intent at all on the part of the tortfeasor. Other users also searched for some of the following glossary words and faqs.

Source: shareyouressays.com

Source: shareyouressays.com

That said, a general liability policy won’t cover everything. An individual or entity may be held strictly liable in both civil and criminal actions. As a result, the costs of injuries shifted to those who market the products: Even if there is no intention or negligence in the actions of the people responsible, they will still be held liable, regardless of fault. Strict liability, also referred to as “absolute liability,” applies to such issues as injuries or other damages caused by a defective product, damages caused by animals, and engaging in certain hazardous activities.

Source: claimsjournal.com

Source: claimsjournal.com

Such liability is faced by a manufacturer or seller of defective or dangerous products. Strict liability crimes are crimes which require no proof of mens rea in relation to one or more aspects of the actus reus. Such liability is faced by a manufacturer or seller of defective or dangerous products. For example, under strict liability standards, the manufacturer or distributor of a dangerous product is liable to a person who is injured by the product, regardless of the degree of. Other users also searched for some of the following glossary words and faqs.

Source: safaughnan.ie

Source: safaughnan.ie

This theory usually applies in three types of situations: Dalam hukum pidana dan perdata, strict liability adalah standar pertanggungjawaban di mana seseorang secara hukum bertanggung jawab atas konsekuensi yang mengalir dari suatu kegiatan bahkan tanpa adanya kesalahan atau maksud kriminal dari pihak tergugat. The claimant need only prove that the tort occurred and that the defendant was responsible. The manufacturer, wholesaler, distributor and retailers. Strict liability is the chosen liability rule in the bunkers convention, and insurance is also required.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title strict liability insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information