Subcontractor default insurance Idea

Home » Trend » Subcontractor default insurance IdeaYour Subcontractor default insurance images are available. Subcontractor default insurance are a topic that is being searched for and liked by netizens now. You can Download the Subcontractor default insurance files here. Get all royalty-free images.

If you’re looking for subcontractor default insurance pictures information related to the subcontractor default insurance interest, you have come to the right site. Our site frequently gives you hints for downloading the maximum quality video and image content, please kindly surf and locate more informative video articles and images that fit your interests.

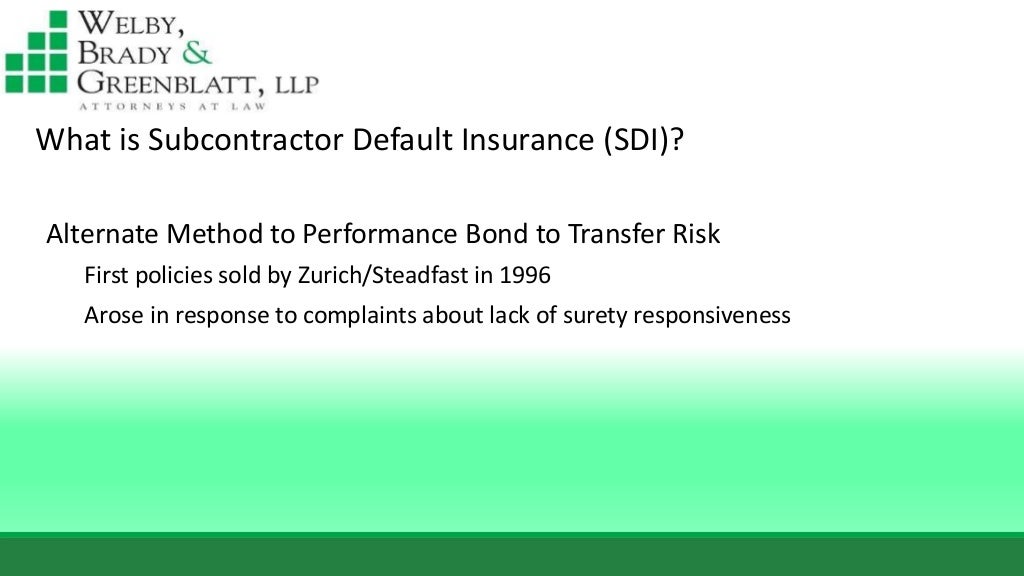

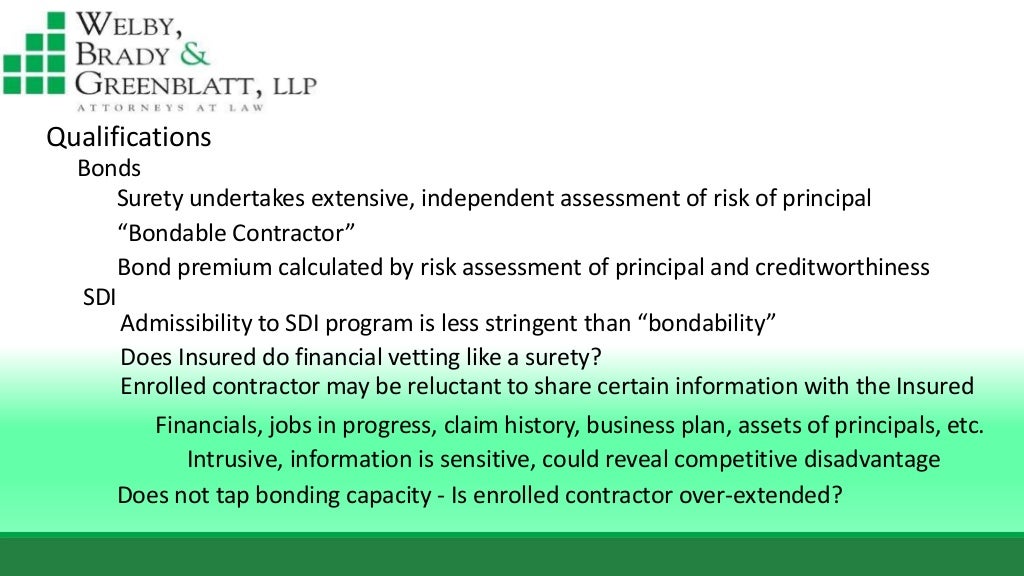

Subcontractor Default Insurance. There’s good news to share for those in the commercial construction trade: Under an sdi policy, a general contractor enrolls all prequalified subcontractors for a specific project or policy term. Market in the late 1990s, is an insurance product designed to protect businesses from losses arising when a subcontractor defaults on its obligations. Unlike subcontractor surety bonds, sdi is an agreement between the contractor and the insurance company.

Monitor Subcontractor Insurance In Quickbooks From slideshare.net

Monitor Subcontractor Insurance In Quickbooks From slideshare.net

Unlike subcontractor surety bonds, sdi is an agreement between the contractor and the insurance company. Subcontractor default insurance (sdi) in the united states, subcontractor default insurance (sdi), commonly known by its popular brand name subguard, is a safeguarding tool for contractors to mitigate the risk of their subcontractors defaulting. With subcontractor default insurance, you decide if the subcontractor breached their contract. The year ahead is likely to usher in a new era in subcontractor default insurance, or sdi. What is subcontractor default insurance? Subcontractor default insurance (sdi) can offer an alternative approach.

The coverage is an alternative to a surety bond and is purchased from an insurance carrier in order to protect the general contractor from the subcontractors they hire.

There seems to be a lot of confusion out there relating to the difference between subcontractor default insurance and subcontractor performance bonds. The year ahead is likely to usher in a new era in subcontractor default insurance, or sdi. A policy can cover costs that are directly The coverage is an alternative to a surety bond and is purchased from an insurance carrier in order to protect the general contractor from the subcontractors they hire. What is subcontractor default insurance? Below are various resources on the topic of subcontractor default insurance (sdi).

![]() Source: businessinsurance.com

Source: businessinsurance.com

Subcontractor default insurance is an agreement between you and the insurance company. What is subcontractor default insurance? Subcontractor default insurance vs subcontractor performance bonds. It can provide savings to the gc and more control in case of a default. Under an sdi policy, a general contractor enrolls all prequalified subcontractors for a specific project or policy term.

Source: slideshare.net

Source: slideshare.net

Willis towers watson developed the concept and launched the first subcontractor default insurance (sdi) policy in north america over 20 years ago to offer a risk management alternative to traditional surety programs. Subcontractor default insurance vs subcontractor performance bonds. Rather than being a guarantee like a surety bond, it is an insurance product. Willis towers watson developed the concept and launched the first subcontractor default insurance (sdi) policy in north america over 20 years ago to offer a risk management alternative to traditional surety programs. It can provide savings to the gc and more control in case of a default.

Source: gdiinsurance.com

Source: gdiinsurance.com

The coverage is an alternative to a surety bond and is purchased from an insurance carrier in order to protect the general contractor from the subcontractors they hire. What is subcontractor default insurance? Market in the late 1990s, is an insurance product designed to protect businesses from losses arising when a subcontractor defaults on its obligations. If so, you can make a claim straight away. Subcontractor default insurance (sdi) powerful protection for the construction industry libertymutualsurety.com this document provides a general description of this program and/or service.

Source: hendershot-consulting.com

Source: hendershot-consulting.com

If so, you can make a claim straight away. When a subcontractor fails to fulfill its commitments to a project due to default, it can cause the project to be substantially delayed. As there is new legislation in place now that could force general contractors to pay for. Since then, many in the construction industry have implemented sdi programs to ensure risk on their construction projects is. See your policy, bond, service contract, or program documentation for actual terms and conditions.

Source: pinnaclesurety.com

Source: pinnaclesurety.com

With subcontractor default insurance, you decide if the subcontractor breached their contract. It may also result in significant financial loss owing to the expense of replacing the subcontractor and, if required, pursuing legal action. The policy specifies that the insurance company will compensate the general contractor for resulting losses from the subcontractor’s default. Had been the only insurer that offered sdi, in a line that it called subguard. As there is new legislation in place now that could force general contractors to pay for.

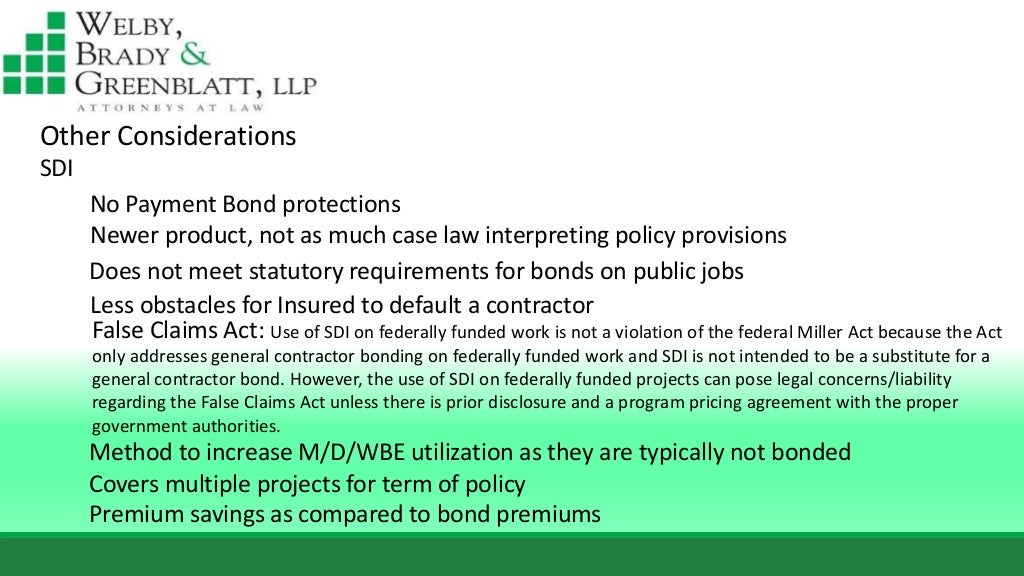

Source: slideshare.net

Source: slideshare.net

Subcontractor default insurance (sdi) in the united states, subcontractor default insurance (sdi), commonly known by its popular brand name subguard, is a safeguarding tool for contractors to mitigate the risk of their subcontractors defaulting. With subcontractor default insurance, you decide if the subcontractor breached their contract. The policy specifies that the insurance company will compensate the general contractor for resulting losses from the subcontractor’s default. There’s good news to share for those in the commercial construction trade: It can provide savings to the gc and more control in case of a default.

Source: slideshare.net

Source: slideshare.net

Subcontractor default insurance vs subcontractor performance bonds. Learn more about this insurance coverage here. Subcontractor default insurance vs subcontractor performance bonds. Sdi, which entered the u.s. Rather than being a guarantee like a surety bond, it is an insurance product.

Source: hendershot-consulting.com

The subcontractor default insurance (sdi) group within arch construction, works with agents and brokers to offer an insurance alternative to subcontractor surety bonds, which allows general contractors to retain greater control over the risk associated with subcontractor performance. Insurance and surety are underwritten by liberty mutual There’s good news to share for those in the commercial construction trade: Generally, contractors protect themselves from that risk by purchasing bonds, and now, also subcontractor default insurance. That slowly changed, however, as other insurance companies grew more comfortable with the idea.

Source: lorman.com

Source: lorman.com

If so, you can make a claim straight away. Under an sdi policy, a general contractor enrolls all prequalified subcontractors for a specific project or policy term. Market in the late 1990s, is an insurance product designed to protect businesses from losses arising when a subcontractor defaults on its obligations. For years, zurich insurance ltd. Willis towers watson developed the concept and launched the first subcontractor default insurance (sdi) policy in north america over 20 years ago to offer a risk management alternative to traditional surety programs.

Source: slideshare.net

Source: slideshare.net

Hudson’s subcontractor default insurance (sdi) provides the control and flexibility a general contractor needs to help successfully complete a project on schedule and on budget. What is subcontractor default insurance? Willis towers watson developed the concept and launched the first subcontractor default insurance (sdi) policy in north america over 20 years ago to offer a risk management alternative to traditional surety programs. Since then, many in the construction industry have implemented sdi programs to ensure risk on their construction projects is. Borrower shall obtain and thereafter maintain in full force and effect subcontractor default insurance for all subcontractors with limits of no less than $50,000,000 per claim and $100,000,000 in the aggregate and include a “financial interest endorsement” naming lender as insured party.

Source: youtube.com

Source: youtube.com

Rather than being a guarantee like a surety bond, it is an insurance product. Subcontractor default insurance vs subcontractor performance bonds. With subcontractor default insurance, you decide if the subcontractor breached their contract. Below are various resources on the topic of subcontractor default insurance (sdi). A subcontractor default on a construction project is one of the greatest risks faced by the general contractor in constructing a project.

Source: pinnaclesurety.com

Source: pinnaclesurety.com

As there is new legislation in place now that could force general contractors to pay for. A subcontractor default on a construction project is one of the greatest risks faced by the general contractor in constructing a project. It can provide savings to the gc and more control in case of a default. Subcontractor default insurance (sdi) in the united states, subcontractor default insurance (sdi), commonly known by its popular brand name subguard, is a safeguarding tool for contractors to mitigate the risk of their subcontractors defaulting. The policy specifies that the insurance company will compensate the general contractor for resulting losses from the subcontractor’s default.

Source: hubinternational.com

Source: hubinternational.com

Since then, many in the construction industry have implemented sdi programs to ensure risk on their construction projects is. Willis towers watson developed the concept and launched the first subcontractor default insurance (sdi) policy in north america over 20 years ago to offer a risk management alternative to traditional surety programs. Sdi is a type of coverage for contractors that helps pay for losses when a subcontractor defaults on their work. If so, you can make a claim straight away. A subcontractor default on a construction project is one of the greatest risks faced by the general contractor in constructing a project.

Source: mgsuretybonds.com

Source: mgsuretybonds.com

Generally, contractors protect themselves from that risk by purchasing bonds, and now, also subcontractor default insurance. Hudson’s subcontractor default insurance (sdi) provides the control and flexibility a general contractor needs to help successfully complete a project on schedule and on budget. Subcontractor default insurance vs subcontractor performance bonds. Subcontractor default insurance is an agreement between you and the insurance company. Unlike subcontractor surety bonds, sdi is an agreement between the contractor and the insurance company.

Source: slideshare.net

Source: slideshare.net

Sdi, which entered the u.s. If so, you can make a claim straight away. What is subcontractor default insurance? Subcontractor default insurance vs subcontractor performance bonds. The policy specifies that the insurance company will compensate the general contractor for resulting losses from the subcontractor’s default.

Source: m3ins.com

Source: m3ins.com

A policy can cover costs that are directly Rather than being a guarantee like a surety bond, it is an insurance product. When a subcontractor fails to fulfill its commitments to a project due to default, it can cause the project to be substantially delayed. Market in the late 1990s, is an insurance product designed to protect businesses from losses arising when a subcontractor defaults on its obligations. Hudson’s subcontractor default insurance (sdi) provides the control and flexibility a general contractor needs to help successfully complete a project on schedule and on budget.

Source: psfinc.com

Source: psfinc.com

It can provide savings to the gc and more control in case of a default. Hudson’s subcontractor default insurance (sdi) provides the control and flexibility a general contractor needs to help successfully complete a project on schedule and on budget. Subcontractor default insurance (sdi) provides coverage for economic loss incurred by a general contractor or construction manager caused by a default of performance of their subcontractor(s), including both direct and indirect costs. With subcontractor default insurance, you decide if the subcontractor breached their contract. Subcontractor default insurance (sdi) provides insurance for general contractors against default from a subcontractor.

Source: slideshare.net

Source: slideshare.net

Subcontractor default insurance is a widely used product by general contractors, but often misunderstood. To guard against this, you can choose either subcontractor default insurance or subcontractor performance. Insurance and surety are underwritten by liberty mutual Sdi, which entered the u.s. What is subcontractor default insurance?

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title subcontractor default insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information