Subcontractor insurance information

Home » Trend » Subcontractor insurance informationYour Subcontractor insurance images are available. Subcontractor insurance are a topic that is being searched for and liked by netizens today. You can Find and Download the Subcontractor insurance files here. Find and Download all royalty-free photos.

If you’re searching for subcontractor insurance images information connected with to the subcontractor insurance topic, you have come to the ideal site. Our site always gives you hints for downloading the maximum quality video and picture content, please kindly surf and find more informative video content and graphics that match your interests.

Subcontractor Insurance. Each state and industry have different rules about how much insurance subcontractor. That’s why our subcontractor insurance provides you the coverage you need, with policies that can include general liability insurance, plus protection for your tools and equipment. It depends on what industry you’re in, your annual income and where you’re based. Whatever your business type, public liability insurance is an important consideration.

Subcontractor Insurance Quotes Requirements 1300 670 250 From smartbusinessinsurance.com.au

Subcontractor Insurance Quotes Requirements 1300 670 250 From smartbusinessinsurance.com.au

Subcontractor insurance protects your 1099 contracting business from lawsuits with rates as low as $37/mo. Subcontractor insurance protects the contractor. Below are some answers to commonly asked 1099 subcontracting insurance questions: However, that is not the only industry they are used in. Most of the time, you won’t have to have general liability insurance or any other kind of insurance. Who needs subcontractor insurance cover?

If so, you can make a claim straight away.

The cost of insurance for subcontractors varies. You need a flexible insurance broker on your side who can accommodate the strict requirements that you might have from your general contractors or project owners. The general liability policy shall include an additional insured endorsement naming contractor and owner as additional insured under the policy. Professional liability policies cost from around $35 a month. Public liability insurance for subcontractors for less than £59* per year. Contractors insurance protects tradesman and subcontractors from a variety of liability exposures.

Source: clipitsolutions.co.uk

Source: clipitsolutions.co.uk

Three primary types of subcontractor insurance Below are some answers to commonly asked 1099 subcontracting insurance questions: Public liability insurance for subcontractors for less than £59* per year. Commercial property insurance is an important coverage that protects your tools, equipment, inventory, furniture, and fixtures. Subcontractor insurance protects the contractor.

Source: webberinsurance.com.au

Source: webberinsurance.com.au

Below are some answers to commonly asked 1099 subcontracting insurance questions: If a subcontractor does not have insurance coverage and an accident occurs, the general contractor or employer handles the damage. Most of the time, subcontractors don’t need their own insurance, but your general contractor or employer might. Each state and industry have different rules about how much insurance subcontractor. But you should check that this is the case.

Source: derecktor.com

Source: derecktor.com

Subcontractor default insurance (sdi) provides coverage for economic loss incurred by a general contractor or construction manager caused by a default of performance of their subcontractor(s), including both direct and indirect costs. With subcontractor default insurance, you decide if the subcontractor breached their contract. Public liability insurance for subcontractors for less than £59* per year. Most of the time, you won’t have to have general liability insurance or any other kind of insurance. There are a few policies you should consider, especially if you hire subcontractors to help you with your projects.

General liability insurance starts from $30 a month. If you are a trade based subcontractor you may also require tools cover , marine transport, personal accident and commercial motor. Public liability insurance for subcontractors for less than £59* per year. Subcontractors come in many different forms, with the most common example being tradesmen. What policies do you need?

If so, you can make a claim straight away. General liability insurance starts from $30 a month. Subcontractor insurance protects the contractor. Subcontractor insurance protects your 1099 contracting business from lawsuits with rates as low as $37/mo. Labour only and bona fide subcontractors.

Source: slideshare.net

Source: slideshare.net

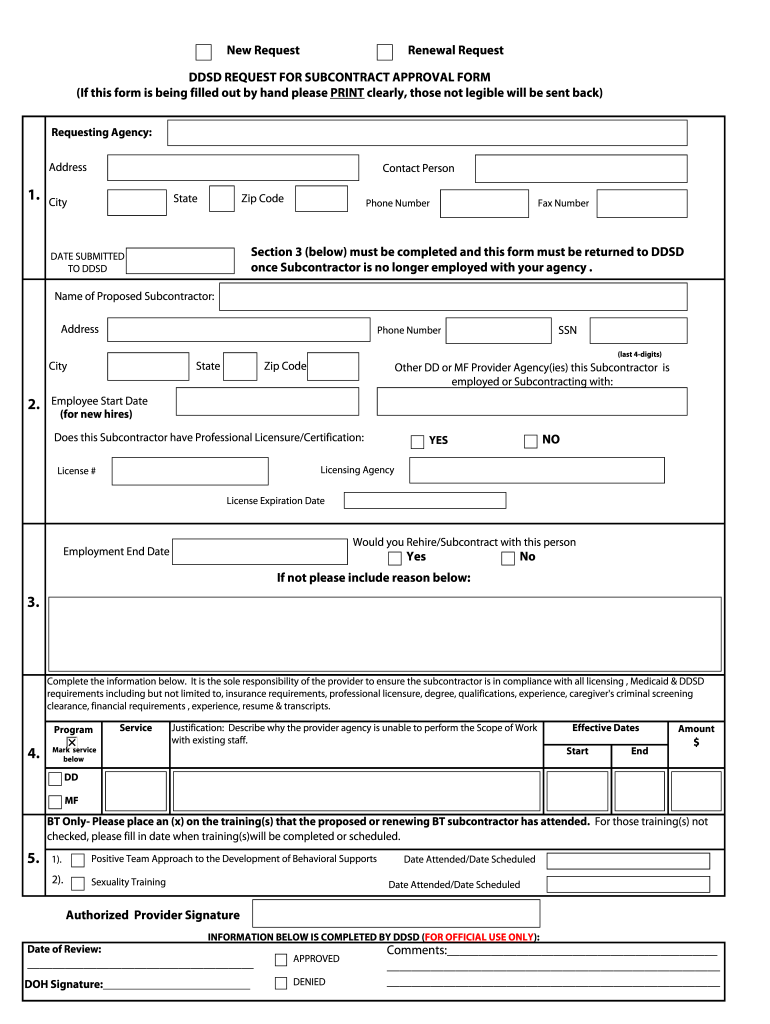

There are, ordinarily, two types of subcontractor; In the context of insurance, subcontractors are not always covered by the liability insurance policy of the contractor. Subcontractor insurance is not a requirement, but a contractor can stipulate a subcontractor carries certain coverage. A subcontractor is contractor who is hired by a contractor to help him or her complete a job. There are a few policies you should consider, especially if you hire subcontractors to help you with your projects.

Source: subcontractor-application-form.pdffiller.com

Source: subcontractor-application-form.pdffiller.com

Below are some answers to commonly asked 1099 subcontracting insurance questions: Subcontractors come in many different forms, with the most common example being tradesmen. Subcontractor insurance protects your 1099 contracting business from lawsuits with rates as low as $37/mo. Though insurance typically does not impact the services you provide, it does help instill confidence in your skills and reliability. Because unlike most businesses, your insurance must fulfill.

Source: slideshare.net

Source: slideshare.net

This insurance policy can cover situations including property damage or injuries, which can happen regardless of your specific job. But you should check that this is the case. There is sometimes a misconception that a subcontractor doesn’t need their own business insurance, as they will be covered by the builder’s insurance. Though insurance typically does not impact the services you provide, it does help instill confidence in your skills and reliability. Public liability insurance for subcontractors for less than £59* per year.

Source: uslegalforms.com

Source: uslegalforms.com

And in the event that something goes wrong, the last thing you want to worry about is drastic monetary repercussions. Though insurance typically does not impact the services you provide, it does help instill confidence in your skills and reliability. With subcontractor default insurance, you decide if the subcontractor breached their contract. Commercial property insurance is an important coverage that protects your tools, equipment, inventory, furniture, and fixtures. Usually, if you are labour only, you will be deemed to be an employee or working under the direction of the main contractor and should be covered by their insurance.

Source: dexform.com

Source: dexform.com

The most popular forms of insurance when becoming a subcontractor are public liability and income protection, along with a few other forms of cover such as tool insurance. It depends on what industry you’re in, your annual income and where you’re based. However, that is not the only industry they are used in. Subcontractor insurance protects your 1099 contracting business from lawsuits with rates as low as $37/mo. What policies do you need?

Source: lorman.com

Source: lorman.com

The most popular forms of insurance when becoming a subcontractor are public liability and income protection, along with a few other forms of cover such as tool insurance. Subcontractor liability insurance it can be useful to have subcontractor general liability insurance. Who needs subcontractor insurance cover? Contractors insurance protects tradesman and subcontractors from a variety of liability exposures. Subcontractor default insurance is an agreement between you and the insurance company.

Source: m3ins.com

Source: m3ins.com

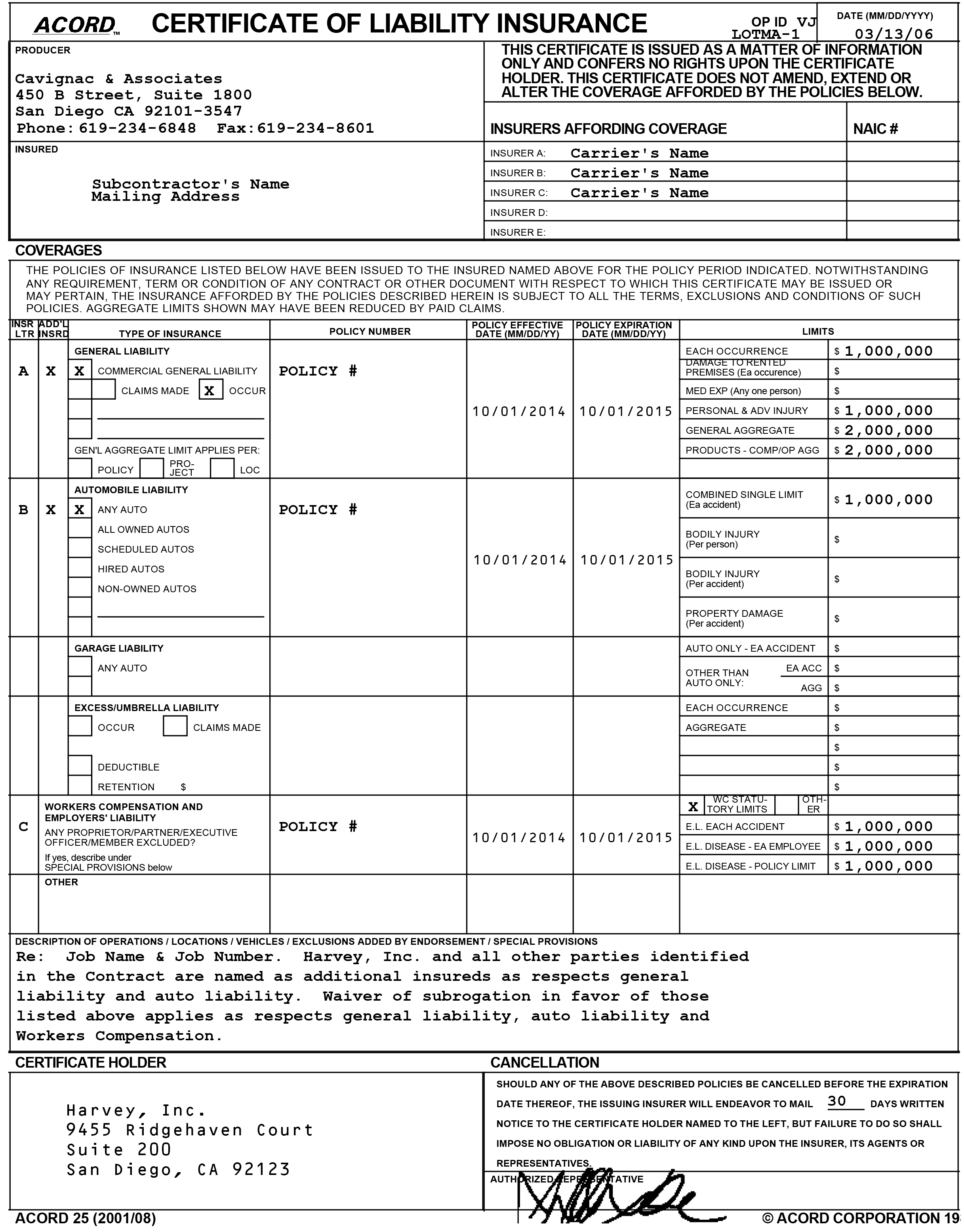

In the context of insurance, subcontractors are not always covered by the liability insurance policy of the contractor. Public liability insurance for subcontractors for less than £59* per year. The general liability policy shall include an additional insured endorsement naming contractor and owner as additional insured under the policy. The cost of insurance for subcontractors varies. Get a fast quote and your certificate of insurance now.

Source: smartbusinessinsurance.com.au

Source: smartbusinessinsurance.com.au

It’s important for subcontractors to have their own insurance coverage to bear the risk of loss associated with their work in the event of a lawsuit. Subcontractors are commonly used in construction. Not on comparison sites — save money by coming direct to us. Most of the time, subcontractors don’t need their own insurance, but your general contractor or employer might. There is a good chance the general liability insurance of whoever hired you will not extend to a subcontractor.

Source: paxtonaz.com

Source: paxtonaz.com

Subcontractor liability insurance it can be useful to have subcontractor general liability insurance. Subcontractor insurance is not a requirement, but a contractor can stipulate a subcontractor carries certain coverage. But you should check that this is the case. Whatever your business type, public liability insurance is an important consideration. This insurance policy can cover situations including property damage or injuries, which can happen regardless of your specific job.

Source: formsbirds.com

Source: formsbirds.com

Most of the time, subcontractors don’t need their own insurance, but your general contractor or employer might. Commercial property insurance is an important coverage that protects your tools, equipment, inventory, furniture, and fixtures. Subcontractor default insurance is an agreement between you and the insurance company. Three primary types of subcontractor insurance This insurance policy can cover situations including property damage or injuries, which can happen regardless of your specific job.

Source: fotorise.com

Source: fotorise.com

If so, you can make a claim straight away. How much does commercial property insurance cost? Subcontractor default insurance (sdi) provides coverage for economic loss incurred by a general contractor or construction manager caused by a default of performance of their subcontractor(s), including both direct and indirect costs. Get a fast quote and your certificate of insurance now. In the context of insurance, subcontractors are not always covered by the liability insurance policy of the contractor.

Source: harveyusa.com

Source: harveyusa.com

Usually, if you are labour only, you will be deemed to be an employee or working under the direction of the main contractor and should be covered by their insurance. How much does commercial property insurance cost? Though insurance typically does not impact the services you provide, it does help instill confidence in your skills and reliability. Our subcontractor insurance policies give you plenty of options for between £1 million and £5 million public liability cover, and you can add tools and plant machinery protection too. If so, you can make a claim straight away.

Source: boxinsurance.com

Source: boxinsurance.com

Subcontractor liability insurance it can be useful to have subcontractor general liability insurance. It is agreed that subcontractor’s general liability policy shall be the primary policy insuring for While some commercial general liability policies exclude independent contractors, even if yours doesn’t, you should still include in the. There are a few policies you should consider, especially if you hire subcontractors to help you with your projects. Who needs subcontractor insurance cover?

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title subcontractor insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information