Subrogation health insurance information

Home » Trend » Subrogation health insurance informationYour Subrogation health insurance images are ready in this website. Subrogation health insurance are a topic that is being searched for and liked by netizens today. You can Download the Subrogation health insurance files here. Get all free photos.

If you’re looking for subrogation health insurance pictures information linked to the subrogation health insurance keyword, you have visit the ideal site. Our website always gives you hints for seeing the highest quality video and picture content, please kindly hunt and locate more enlightening video articles and images that fit your interests.

Subrogation Health Insurance. The subrogation right is generally specified in contracts between the insurance company and the insured party. Once, by having your health insurance company pay for your medical care, and then trying to recover again by actually receiving from the insurance company in the personal injury claim the value of your medical bills. Healthcare subrogation may arise when someone with health insurance becomes injured in an accident for which someone else is liable. In simple language, when an insurance company pays you the amount you claimed in a situation where the third party was responsible for the damage in question, you subrogate your rights to the.

Health insurance subrogation insurance From greatoutdoorsabq.com

Health insurance subrogation insurance From greatoutdoorsabq.com

Most people have both auto insurance and health insurance, each of which can use subrogation. Indeed, no insurance contract or health service s plan that provides hospital, medical, surgical, and related benefits can include a subrogation clause against any person’s right to recovery for personal injuries from a third person. This is a complex area of law only handled by a few firms. To improve, insurers must create a subrogation programme and keep it active. Health insurance will pay your medical bills regardless of how you were injured. Subrogation claims are generally made by your health insurance provider after you receive a settlement or judgment in your personal injury claim.

If your health insurance provider paid your medical expenses prior to your settlement, they may be allowed to receive a portion of the settlement you received to cover their expenses paid out for your medical bills.

This may be possible through a Health insurance will pay your medical bills regardless of how you were injured. There are times when your health insurance company will pay medical bills for you that were for injuries caused by another person. Sometimes the coverage from various policies overlaps. Subrogation, in the context of personal injury cases, is the manner in which it’s determined who pays for an injured party’s medical treatment and how much they pay for it. Most people have both auto insurance and health insurance, each of which can use subrogation.

Source: articles-junction.blogspot.com

Source: articles-junction.blogspot.com

If your health insurance provider paid your medical expenses prior to your settlement, they may be allowed to receive a portion of the settlement you received to cover their expenses paid out for your medical bills. Subrogation is the substitution of one person in the place of another with reference to a claim, demand or right. Healthcare subrogation may arise when someone with health insurance becomes injured in an accident for which someone else is liable. This is a complex area of law only handled by a few firms. If a plan is funded through insurance purchased by the employer or union, it will be treated as any other group health insurer for determining whether a subrogation claim is enforceable.

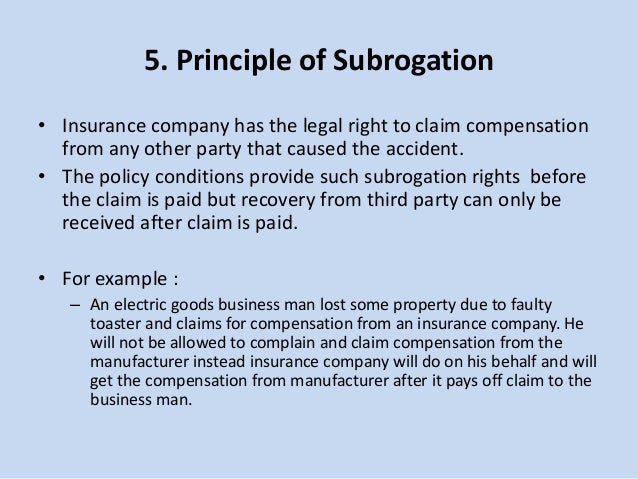

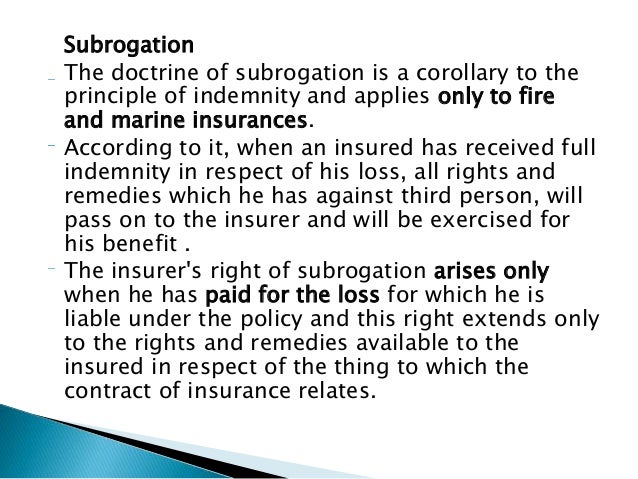

Source: slideserve.com

Source: slideserve.com

Subrogation is the right of an insurer to pursue the party that caused the loss to the insured in an attempt to recover funds paid in the claim. For example, a health insurance company may pay the injured’s medical bills and attempt to recover its expenses from the liable party (“tortfeasor”). The subrogation right is generally specified in contracts between the insurance company and the insured party. Once, by having your health insurance company pay for your medical care, and then trying to recover again by actually receiving from the insurance company in the personal injury claim the value of your medical bills. When a person is injured in a minnesota car accident, minnesota slip and fall, or some has another minnesota personal injury claim, often that person incurs medical bills.

Source: dyngen.org

Source: dyngen.org

Advocates of subrogation rights assert, among other arguments, that subrogation prevents double compensation for a loss and that subrogation recoveries help control health insurance premiums ( e.g., health plan week, 2010; Indeed, no insurance contract or health service s plan that provides hospital, medical, surgical, and related benefits can include a subrogation clause against any person’s right to recovery for personal injuries from a third person. Trustee lenders subrogating trustee’s indemnity rights. Subrogation claims are generally made by your health insurance provider after you receive a settlement or judgment in your personal injury claim. Examples of subrogation clauses include:

Source: aleneanhemys.blogspot.com

Source: aleneanhemys.blogspot.com

Over 1 million hospitals, clinics and physicians worldwide. In health insurance, subrogation refers to the legal right of an insurance company — after payment of a loss — to recover monies from the responsible (4). An insurance subrogation claim involves three parties: To improve, insurers must create a subrogation programme and keep it active. The act of subrogation primarily occurs between your insurance company and that of another person’s insurance company.

Source: abiteofculture.com

Source: abiteofculture.com

In health insurance, subrogation refers to the legal right of an insurance company — after payment of a loss — to recover monies from the responsible (4). This may be possible through a The subrogation right is generally specified in contracts between the insurance company and the insured party. In simple language, when an insurance company pays you the amount you claimed in a situation where the third party was responsible for the damage in question, you subrogate your rights to the. If a plan is funded through insurance purchased by the employer or union, it will be treated as any other group health insurer for determining whether a subrogation claim is enforceable.

Source: aleneanhemys.blogspot.com

Source: aleneanhemys.blogspot.com

Subrogation is when your own health insurance company seeks reimbursement from you for payments it made out on your behalf to your hospitals, doctors, and therapists. This may be possible through a Examples of subrogation clauses include: Subrogation, in the context of personal injury cases, is the manner in which it’s determined who pays for an injured party’s medical treatment and how much they pay for it. Advocates of subrogation rights assert, among other arguments, that subrogation prevents double compensation for a loss and that subrogation recoveries help control health insurance premiums ( e.g., health plan week, 2010;

Source: alishia-castro.blogspot.com

Source: alishia-castro.blogspot.com

This is a complex area of law only handled by a few firms. Most people have both auto insurance and health insurance, each of which can use subrogation. In simple language, when an insurance company pays you the amount you claimed in a situation where the third party was responsible for the damage in question, you subrogate your rights to the. The subrogation right is generally specified in contracts between the insurance company and the insured party. The contracts may contain special clauses that provide the right to the insurance company to start the process of recovering the payment of the insurance claim from the party that caused the damages to the insured party.

Source: butlerwootenpeak.com

Source: butlerwootenpeak.com

For example, a health insurance company may pay the injured’s medical bills and attempt to recover its expenses from the liable party (“tortfeasor”). If your health insurance provider paid your medical expenses prior to your settlement, they may be allowed to receive a portion of the settlement you received to cover their expenses paid out for your medical bills. But the particular clause in the contract that covers subrogation keeps you from double dipping, it keeps you from recovering twice. Subrogation is the substitution of one person in the place of another with reference to a claim, demand or right. Subrogation is when your own health insurance company seeks reimbursement from you for payments it made out on your behalf to your hospitals, doctors, and therapists.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

Once, by having your health insurance company pay for your medical care, and then trying to recover again by actually receiving from the insurance company in the personal injury claim the value of your medical bills. Filing an auto insurance claim against a third party driver. Subrogation is the substitution of one person in the place of another with reference to a claim, demand or right. To improve, insurers must create a subrogation programme and keep it active. The contracts may contain special clauses that provide the right to the insurance company to start the process of recovering the payment of the insurance claim from the party that caused the damages to the insured party.

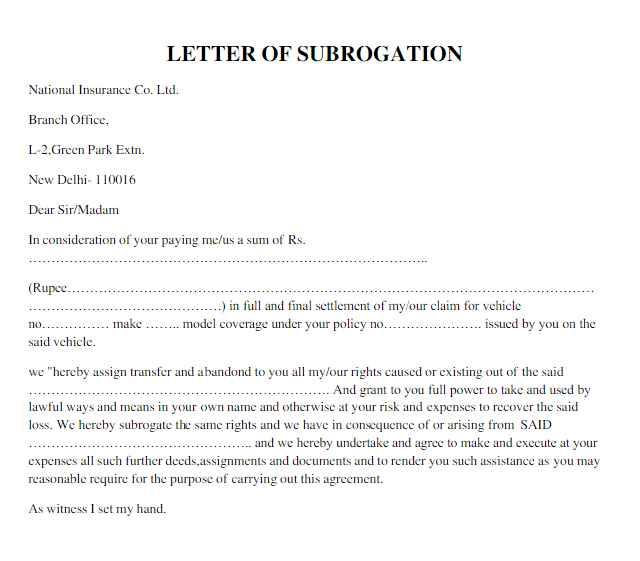

Source: templateroller.com

Source: templateroller.com

Subrogation is used by insurance companies to recover money they have spent on your behalf from the person or business that caused your injury. If your health insurance provider paid your medical expenses prior to your settlement, they may be allowed to receive a portion of the settlement you received to cover their expenses paid out for your medical bills. Subrogation is when your own health insurance company seeks reimbursement from you for payments it made out on your behalf to your hospitals, doctors, and therapists. This may be possible through a Healthcare subrogation may arise when someone with health insurance becomes injured in an accident for which someone else is liable.

Source: youtube.com

Source: youtube.com

Subrogation is the process by which health insurance plans recover medical costs from the appropriate party. The act of subrogation primarily occurs between your insurance company and that of another person’s insurance company. Most people have both auto insurance and health insurance, each of which can use subrogation. Subrogation is the right of an insurer to pursue the party that caused the loss to the insured in an attempt to recover funds paid in the claim. Healthcare subrogation may arise when someone with health insurance becomes injured in an accident for which someone else is liable.

Source: mjqlaw.com

Source: mjqlaw.com

Subrogation is the right of an insurer to pursue the party that caused the loss to the insured in an attempt to recover funds paid in the claim. Health insurance will pay your medical bills regardless of how you were injured. Subrogation is the right of an insurer to pursue the party that caused the loss to the insured in an attempt to recover funds paid in the claim. An insurance subrogation claim involves three parties: This is a complex area of law only handled by a few firms.

Source: acko.com

Source: acko.com

To improve, insurers must create a subrogation programme and keep it active. Trustee lenders subrogating trustee’s indemnity rights. There are times when your health insurance company will pay medical bills for you that were for injuries caused by another person. Training on subrogation is a must, as well as assigning someone to lead the charge. The contracts may contain special clauses that provide the right to the insurance company to start the process of recovering the payment of the insurance claim from the party that caused the damages to the insured party.

Source: wolfenditarray.blogspot.com

Source: wolfenditarray.blogspot.com

In health insurance, subrogation refers to the legal right of an insurance company — after payment of a loss — to recover monies from the responsible (4). There are times when your health insurance company will pay medical bills for you that were for injuries caused by another person. Trustee lenders subrogating trustee’s indemnity rights. When they do, their health insurance policy is paying the medical. Filing an auto insurance claim against a third party driver.

Source: youtube.com

Source: youtube.com

Indeed, no insurance contract or health service s plan that provides hospital, medical, surgical, and related benefits can include a subrogation clause against any person’s right to recovery for personal injuries from a third person. This is a complex area of law only handled by a few firms. Subrogation is when your own health insurance company seeks reimbursement from you for payments it made out on your behalf to your hospitals, doctors, and therapists. Health insurance will pay your medical bills regardless of how you were injured. Training on subrogation is a must, as well as assigning someone to lead the charge.

Source: fratusbrady.com

Source: fratusbrady.com

The subrogation right is generally specified in contracts between the insurance company and the insured party. If a plan is funded through insurance purchased by the employer or union, it will be treated as any other group health insurer for determining whether a subrogation claim is enforceable. Subrogation is the right of an insurer to pursue the party that caused the loss to the insured in an attempt to recover funds paid in the claim. Examples of subrogation clauses include: When someone goes to their doctor after an accident, they typically use some form of health insurance.

Source: slideshare.net

Source: slideshare.net

Examples of subrogation clauses include: Subrogation is when your own health insurance company seeks reimbursement from you for payments it made out on your behalf to your hospitals, doctors, and therapists. There are times when your health insurance company will pay medical bills for you that were for injuries caused by another person. In health insurance, subrogation refers to the legal right of an insurance company — after payment of a loss — to recover monies from the responsible (4). Examples of subrogation clauses include:

Source: valientemott.com

Source: valientemott.com

Subrogation is the process by which health insurance plans recover medical costs from the appropriate party. Subrogation is when your own health insurance company seeks reimbursement from you for payments it made out on your behalf to your hospitals, doctors, and therapists. Filing an auto insurance claim against a third party driver. For example, a health insurance company may pay the injured’s medical bills and attempt to recover its expenses from the liable party (“tortfeasor”). Subrogation, in the context of personal injury cases, is the manner in which it’s determined who pays for an injured party’s medical treatment and how much they pay for it.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title subrogation health insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information