Sue insurance company for bad faith information

Home » Trending » Sue insurance company for bad faith informationYour Sue insurance company for bad faith images are ready in this website. Sue insurance company for bad faith are a topic that is being searched for and liked by netizens now. You can Find and Download the Sue insurance company for bad faith files here. Get all free photos and vectors.

If you’re looking for sue insurance company for bad faith images information related to the sue insurance company for bad faith keyword, you have visit the ideal site. Our website frequently provides you with hints for downloading the highest quality video and image content, please kindly search and find more informative video articles and graphics that fit your interests.

Sue Insurance Company For Bad Faith. Insurance companies may request paperwork that was never mentioned in a policy, for example, or they may require you to submit both a preliminary claim report and a formal proof of loss form. This includes collecting all relevant documents, requesting a review of the claim, and sending a demand letter. If you believe that an insurance company isn’t negotiating in good faith, can you sue them for acting in bad faith? Every aspect of cases like.

Can You Sue an Insurance Company for Bad Faith? From louislawgroup.com

Can You Sue an Insurance Company for Bad Faith? From louislawgroup.com

Some laws require an insurance company acting in bad faith to pay basic damages to help compensate the victim for having a claim denied, above and beyond (6). Refusing to pay for a policyholder’s legitimate case For example, if they don’t pay valid claims against the insurance policy that they sold to a client. In exchange, the insurance company agrees to provide them with a source of income should they become too disabled to work. First, you need to review your insurance policy. (2018) plaintiff fern johnson filed a lawsuit against her employer, ups, and liberty mutual as its insurance company, as part of a workers’ compensation claim.

The primary goal is to get the money you need to repair or replace your damaged property after a storm, fire, vandalism, or another covered issue.

It is entirely possible to sue your insurance company when they act in bad faith. If your insurance company is asking for an unusual amount of documentation from you or your physician, then it could be the basis for a bad faith claim. It is entirely possible to sue your insurance company when they act in bad faith. You need to obtain a full version of your contract and review every document. This is a form provided by the florida department of financial services (“dfs”) that is filled out online (link here) and submitted, i.e., filed, and then served upon your insurance company.filing a crn starts a clock. The primary goal is to get the money you need to repair or replace your damaged property after a storm, fire, vandalism, or another covered issue.

Source: cochranlaw.com

Source: cochranlaw.com

Bad faith means that the insurance company did something unfair or dishonest with their clients. Review these insurance company bad faith tactics and examples to help identify if your insurance company is acting in bad faith. Every aspect of cases like. An example of this could be tampering with a witness or. If you believe that an insurance company isn’t negotiating in good faith, can you sue them for acting in bad faith?

Source: thecallahanlawfirm.com

Source: thecallahanlawfirm.com

Review these insurance company bad faith tactics and examples to help identify if your insurance company is acting in bad faith. How do you sue an insurance company for bad faith? The policyholder makes monthly payments to the insurance company; Recognizing these signs is your first step in determining how to sue an insurance company for bad faith. If your insurance company is asking for an unusual amount of documentation from you or your physician, then it could be the basis for a bad faith claim.

Source: burakofflaw.com

Source: burakofflaw.com

If the insurance company acts in bad faith, you and your attorney can sue them in court. Can i sue an insurance company for acting in bad faith? Fleming demonstrates that an insurance company can be liable for an amount in excess of its policy limits if it fails to act in good faith and without negligence in settling claims for its insured. Can i sue my insurance company for bad faith advice. Recognizing these signs is your first step in determining how to sue an insurance company for bad faith.

Source: arkadvisors.co

Source: arkadvisors.co

This will require the help of an attorney, who will represent you in court. How do you sue an insurance company for bad faith? If you find yourself in a position where you’re questioning the dependability of your insurance company, contact corless barfield for a free consultation. Based on the contents of your policy, you should be able to tell if a violation occurred. A claim of bad faith against an insurance company arises only if the company’s adjuster has lied, committed fraud, or has gotten in the way of you pursuing the claim.

Source: bergerlawsc.com

Source: bergerlawsc.com

Pouring on the poor communication. The primary goal is to get the money you need to repair or replace your damaged property after a storm, fire, vandalism, or another covered issue. Fleming demonstrates that an insurance company can be liable for an amount in excess of its policy limits if it fails to act in good faith and without negligence in settling claims for its insured. If your insurance company has denied your claim in bad faith, or if it is delaying the processing of your claim in bad faith, you may have grounds to file a lawsuit and you should speak with an attorney, promptly. How do you sue an insurance company for bad faith?

Source: fhleoa.org

Source: fhleoa.org

You can sue an insurance company when it acts in bad faith under civil remedy with your policy. Only the policyholder can sue the insurance carrier for bad faith, because the covenant of good faith is based on the contractual relationship between the two. In that scenario, you can sue an insurance company for bad faith. These are the steps will help you to know the process of suing the insurance company for bad faith: You must show that the insurance company failed to act in good faith when it comes to processing your claim and honoring the terms of your policy.

Source: tuckermillerlaw.com

Source: tuckermillerlaw.com

The presence of any one of. That is why to bring you back the money you invested in the insurance company, you will need a bad faith insurance lawyer. These are the steps will help you to know the process of suing the insurance company for bad faith: This will require the help of an attorney, who will represent you in court. Recognizing these signs is your first step in determining how to sue an insurance company for bad faith.

![]() Source: npa1.org

Source: npa1.org

An insurance company also behaves in bad faith when they neglect to inform policyholders about policy limitations and exclusions before. Some laws require an insurance company acting in bad faith to pay basic damages to help compensate the victim for having a claim denied, above and beyond (6). In the lawsuit, you state what the insurance company did or failed to do that amounts to good faith. The policyholder makes monthly payments to the insurance company; Every aspect of cases like.

Source: robertkbeck.com

Source: robertkbeck.com

If your insurance company has denied your claim in bad faith, or if it is delaying the processing of your claim in bad faith, you may have grounds to file a lawsuit and you should speak with an attorney, promptly. Based on the contents of your policy, you should be able to tell if a violation occurred. You can sue an insurance company when it acts in bad faith under civil remedy with your policy. To sue an insurance company for bad faith, you file a lawsuit in the appropriate court. You must show that the insurance company failed to act in good faith when it comes to processing your claim and honoring the terms of your policy.

Source: louislawgroup.com

Source: louislawgroup.com

An example of this could be tampering with a witness or. In that scenario, you can sue an insurance company for bad faith. The policyholder makes monthly payments to the insurance company; An insurance company also behaves in bad faith when they neglect to inform policyholders about policy limitations and exclusions before. These are the steps will help you to know the process of suing the insurance company for bad faith:

Source: dmasseylaw.com

Source: dmasseylaw.com

First, you need to review your insurance policy. United parcel service, inc., liberty mutual fire insurance co. Fleming demonstrates that an insurance company can be liable for an amount in excess of its policy limits if it fails to act in good faith and without negligence in settling claims for its insured. The lawyer will fight for you and helps you to give you back your money and the compensation of the precious time you wasted in the process. Florida law allows you to pursue a civil claim when your insurance company fails to honor your contract or otherwise works against your best interests.

Source: corlessbarfield.com

Source: corlessbarfield.com

Can i sue an insurance company for acting in bad faith? Review these insurance company bad faith tactics and examples to help identify if your insurance company is acting in bad faith. Failure to act in good faith and without negligence means that. You must show that the insurance company failed to act in good faith when it comes to processing your claim and honoring the terms of your policy. For example, if they don’t pay valid claims against the insurance policy that they sold to a client.

Source: nylawyer.net

Source: nylawyer.net

(2018) plaintiff fern johnson filed a lawsuit against her employer, ups, and liberty mutual as its insurance company, as part of a workers’ compensation claim. A claim of bad faith against an insurance company arises only if the company’s adjuster has lied, committed fraud, or has gotten in the way of you pursuing the claim. This is what an insured brings to the court to decide when suing an insurance company for bad faith, and hopefully force the insurance company’s hand in making a timely, reasonable decision. This includes collecting all relevant documents, requesting a review of the claim, and sending a demand letter. When insurance bad faith occurs, you can take action and decide that you won’t settle for less.

Review these insurance company bad faith tactics and examples to help identify if your insurance company is acting in bad faith. This includes collecting all relevant documents, requesting a review of the claim, and sending a demand letter. These are the steps will help you to know the process of suing the insurance company for bad faith: Pouring on the poor communication. In the lawsuit, you state what the insurance company did or failed to do that amounts to good faith.

Source: youtube.com

Source: youtube.com

These are the steps will help you to know the process of suing the insurance company for bad faith: That is why to bring you back the money you invested in the insurance company, you will need a bad faith insurance lawyer. If your insurance company is asking for an unusual amount of documentation from you or your physician, then it could be the basis for a bad faith claim. Bad faith means that the insurance company did something unfair or dishonest with their clients. The lawyer will fight for you and helps you to give you back your money and the compensation of the precious time you wasted in the process.

Source: npa1.org

Source: npa1.org

Fleming demonstrates that an insurance company can be liable for an amount in excess of its policy limits if it fails to act in good faith and without negligence in settling claims for its insured. If your insurance company is asking for an unusual amount of documentation from you or your physician, then it could be the basis for a bad faith claim. You must show that the insurance company failed to act in good faith when it comes to processing your claim and honoring the terms of your policy. However, there is a reason to be suspect. To be able to sue your insurance company for bad faith, you have to file a valid civil remedy notice (“crn”) first.

Source: fhleoa.org

Source: fhleoa.org

Florida law allows you to pursue a civil claim when your insurance company fails to honor your contract or otherwise works against your best interests. How to sue an insurance company for bad faith a disability insurance policy is a contract between the insurance company and the policyholder. Can i sue an insurance company for acting in bad faith? If your insurance company is asking for an unusual amount of documentation from you or your physician, then it could be the basis for a bad faith claim. Review these insurance company bad faith tactics and examples to help identify if your insurance company is acting in bad faith.

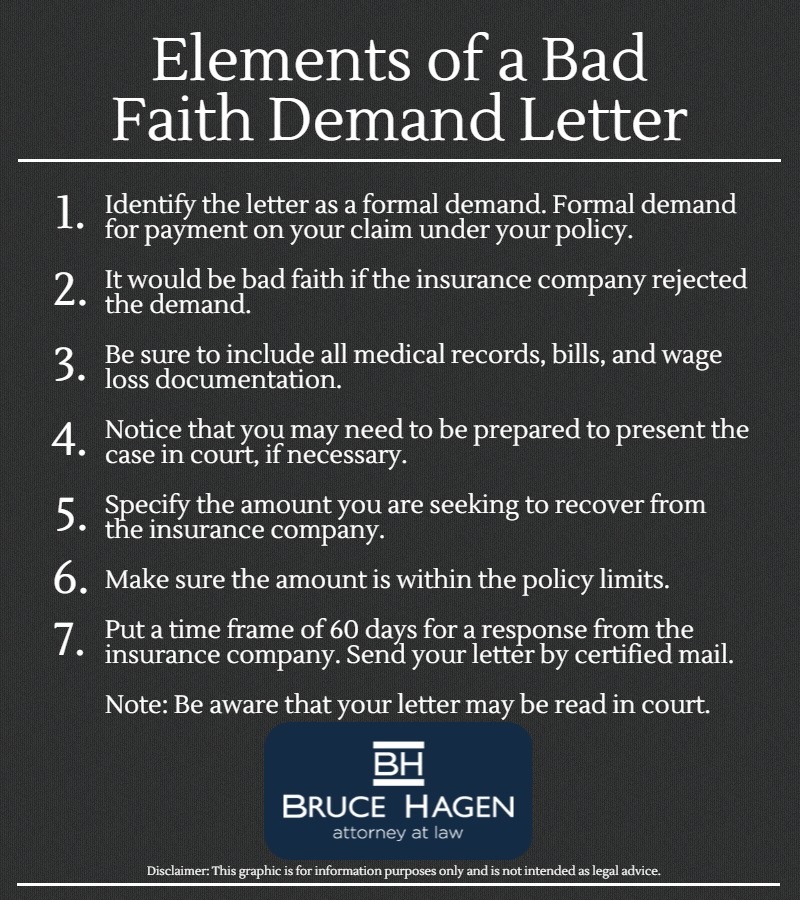

Source: hagen-law.com

Source: hagen-law.com

How do you sue an insurance company for bad faith? However, there is a reason to be suspect. If your insurance company stops communicating well once you’ve submitted a claim, there is no guarantee they are acting in bad faith. (2018) plaintiff fern johnson filed a lawsuit against her employer, ups, and liberty mutual as its insurance company, as part of a workers’ compensation claim. Bad faith is broadly defined as dishonest or unfair practices.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title sue insurance company for bad faith by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information