Super visa canada insurance requirements Idea

Home » Trend » Super visa canada insurance requirements IdeaYour Super visa canada insurance requirements images are available. Super visa canada insurance requirements are a topic that is being searched for and liked by netizens today. You can Find and Download the Super visa canada insurance requirements files here. Download all royalty-free photos and vectors.

If you’re searching for super visa canada insurance requirements pictures information related to the super visa canada insurance requirements topic, you have visit the right site. Our site frequently gives you suggestions for seeing the highest quality video and image content, please kindly hunt and locate more enlightening video articles and images that fit your interests.

Super Visa Canada Insurance Requirements. One of the key requirements for obtaining the super visa is insurance. Medical insurance must be purchased from a canadian insurance company prior to your planned arrival policy must be valid for at least one year from the date of entry policy must provide a minimum of $100,000 in medical coverage policy must cover medical care, hospitalization and repatriation One of the requirements of being approved for a super visa is that you have medical insurance from a canadian insurance company that covers you for at least one year from the date of entry to canada. Parents and grandparents who are entitled to visit for 6 months without a visa can apply directly at the closest canadian visa office by providing proof that they meet the.

Super Visa for Canada Parents and Grandparents Morevisas From morevisas.com

Super Visa for Canada Parents and Grandparents Morevisas From morevisas.com

According to ircc, the super visa medical insurance you obtain must fulfil all of the following criteria in order to be accepted: This is what super visa insurance or super visa health insurance is. As a requirement of the parent and grandparent super visa, applicants must have proof of canadian medical insurance coverage for a period of at least one year and for a minimum coverage amount of at least $100,000 for healthcare, hospitalization, and repatriation. What are the requirements for a super visa application? Inclusion for as long as 365 days in canada and no expiry date prohibition the capacity to come back to. To apply for super visa you must have a proper medical emergency insurance policy with a minimum coverage of $100,000 and for a period of 1 year.

Super visa applications can be completed either online, or submitted via paper application to the nearest canadian visa post.

Medical insurance must be purchased from a canadian insurance company prior to your planned arrival policy must be valid for at least one year from the date of entry policy must provide a minimum of $100,000 in medical coverage policy must cover medical care, hospitalization and repatriation To apply for a super visa in canada, visitors entering the country must have at least $100,000 in health coverage issued by a canadian insurance company. The coverage for the insurance must be a minimum of $100,000 cad or more. Super visa insurance requirement sum4141s full member mar 22, 2021 34 1 toronto may 5, 2021 #1 hello, 1. Basically canada wants to make sure that you’re not going to be a financial burden on the publicly. It must have a minimum coverage level of cad $100,000 and be valid for each time the parent or grandparent enters canada.

Source: youtube.com

Source: youtube.com

As a requirement of the parent and grandparent super visa, applicants must have proof of canadian medical insurance coverage for a period of at least one year and for a minimum coverage amount of at least $100,000 for healthcare, hospitalization, and repatriation. The coverage for the insurance must be a minimum of $100,000 cad or more. Canada�s super visa insurance requirements, purchasing coverage, and faqs. Super visa applicants must submit insurance confirmation and payment receipt as proof that they have purchased private medical insurance from a canadian insurance company, which should be valid for one year and offers a minimum coverage of $100,000 for health care, hospitalization, and repatriation. Super visa insurance as part of the eligibility requirements, the visitor must purchase a medical insurance plan from a canadian company, valid for at least one year from the date of arrival and with at least $100,000 in benefit coverage.

Source: chesspecialrisk.ca

Source: chesspecialrisk.ca

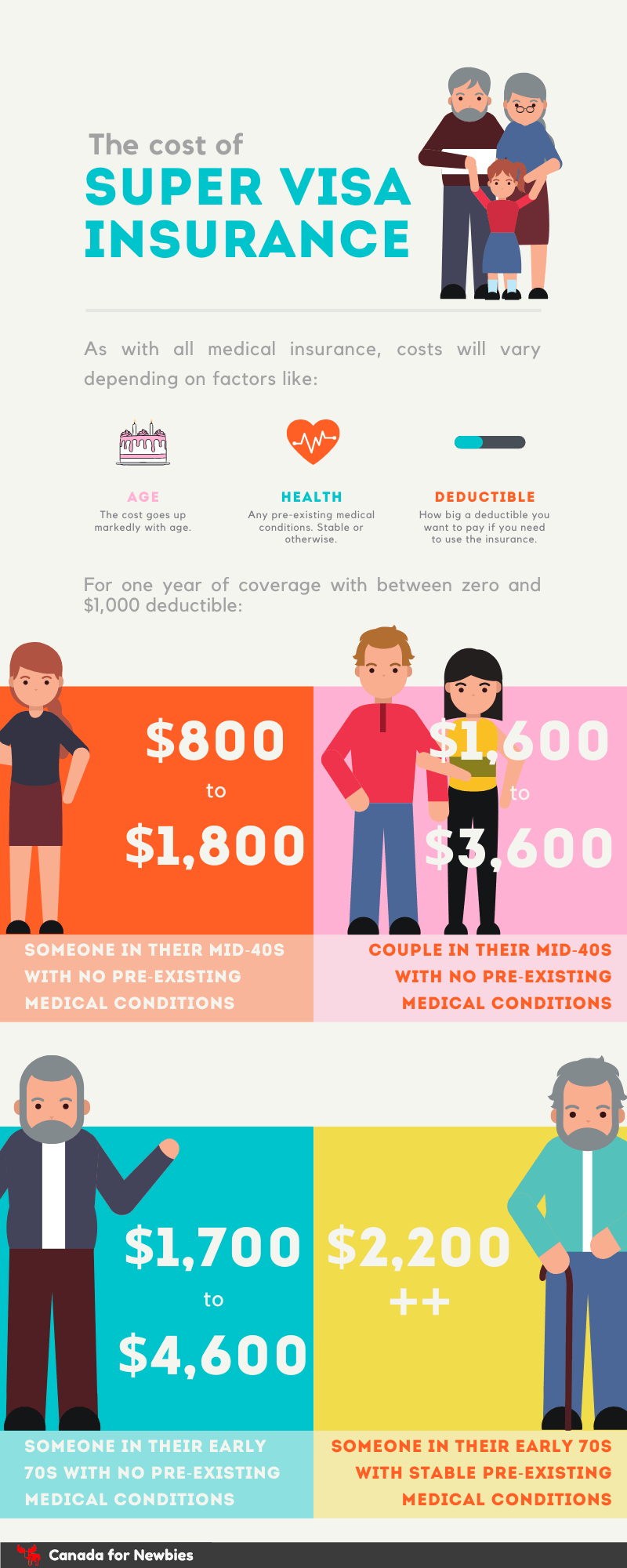

Although the canadian insurance industry was caught off guard with the government�s decision to make insurance part of the super visa application process, the industry response has helped to increase the number of policies available and lower costs. What are the requirements for a super visa application? The super visa insurance requirements are as follows: Every year or two, though, the. Has a minimum coverage of $100,000.

Source: indocanadianbusinesspages.com

Source: indocanadianbusinesspages.com

Introduced in 2011, the super visa is an option for parents and grandparents of canadian citizens and permanent residents to visit relatives in canada for extended periods of time without the need to renew their status. • super visa insurance offers health coverage of a minimum of $100,000 up to 365 days; Super visa insurance canada must: It must have a minimum coverage level of cad $100,000 and be valid for each time the parent or grandparent enters canada. As mentioned in requirement 4 above, you must have medical insurance to cover your trip to canada that’s valid for at least a year.

Source: morevisas.com

Source: morevisas.com

Although the canadian insurance industry was caught off guard with the government�s decision to make insurance part of the super visa application process, the industry response has helped to increase the number of policies available and lower costs. Super visa insurance as part of the eligibility requirements, the visitor must purchase a medical insurance plan from a canadian company, valid for at least one year from the date of arrival and with at least $100,000 in benefit coverage. Documents which prove that you have private medical insurance that is valid for a minimum of one year from a canadian insurance company that covers the following: Every year or two, though, the. Has a minimum coverage of $100,000.

Source: apacimmigration.ca

Source: apacimmigration.ca

It will also inform you about canada’s health care system, provide links to additional helpful resources, and review the travelance products that meet the super visa health insurance requirements. As mentioned in requirement 4 above, you must have medical insurance to cover your trip to canada that’s valid for at least a year. This ensures visitors can pay for their health care if they become sick or injured while in canada. This is what super visa insurance or super visa health insurance is. According to ircc, the super visa medical insurance you obtain must fulfil all of the following criteria in order to be accepted:

Source: canadafornewbies.com

Source: canadafornewbies.com

Health care, repatriation, and hospitalization. The coverage for the insurance must be a minimum of $100,000 cad or more. Super visa applicants must submit proof that they have purchased private medical insurance from a canadian insurance company which is valid for a minimum of one year and offers a minimum of $100,000 in coverage for health care, hospitalization and repatriation. Proof that the medical insurance premium has been paid. This insurance is referred to as super visa insurance and.

Source: thevisa.ca

Source: thevisa.ca

Parents and grandparents who are entitled to visit for 6 months without a visa can apply directly at the closest canadian visa office by providing proof that they meet the. All applicants will need to show they have emergency medical health insurance coverage from canadian insurance company. Documents which prove that you have private medical insurance that is valid for a minimum of one year from a canadian insurance company that covers the following: Every year or two, though, the. Super visa applications can be completed either online, or submitted via paper application to the nearest canadian visa post.

Source: indianbusinesscanada.com

Source: indianbusinesscanada.com

The super visa insurance requirements are as follows: All applicants will need to show they have emergency medical health insurance coverage from canadian insurance company. A minimum of $100,000 cad in emergency medical travel insurance coverage in place for at least one year after arriving in canada. The coverage for the insurance must be a minimum of $100,000 cad or more. Cover health care, hospitalization and repatriation be valid for each entry to canada and available for review by a point of entry (poe) officer

Source: eclassify.ca

Source: eclassify.ca

Although the canadian insurance industry was caught off guard with the government�s decision to make insurance part of the super visa application process, the industry response has helped to increase the number of policies available and lower costs. What are the requirements for a super visa application? About the super visa the canadian super visa is. It must have a minimum coverage level of cad $100,000 and be valid for each time the parent or grandparent enters canada. As a requirement of the parent and grandparent super visa, applicants must have proof of canadian medical insurance coverage for a period of at least one year and for a minimum coverage amount of at least $100,000 for healthcare, hospitalization, and repatriation.

Source: clker.com

Basically canada wants to make sure that you’re not going to be a financial burden on the publicly. • super visa insurance offers health coverage of a minimum of $100,000 up to 365 days; It must have a minimum coverage level of cad $100,000 and be valid for each time the parent or grandparent enters canada. Proof that the medical insurance premium has been paid. As a requirement of the parent and grandparent super visa, applicants must have proof of canadian medical insurance coverage for a period of at least one year and for a minimum coverage amount of at least $100,000 for healthcare, hospitalization, and repatriation.

Source: indianbusinesscanada.com

Source: indianbusinesscanada.com

This ensures visitors can pay for their health care if they become sick or injured while in canada. Super visa applicants must submit proof that they have purchased private medical insurance from a canadian insurance company which is valid for a minimum of one year and offers a minimum of $100,000 in coverage for health care, hospitalization and repatriation. Super visa insurance as part of the eligibility requirements, the visitor must purchase a medical insurance plan from a canadian company, valid for at least one year from the date of arrival and with at least $100,000 in benefit coverage. The coverage for the insurance must be a minimum of $100,000 cad or more. According to ircc, the super visa medical insurance you obtain must fulfil all of the following criteria in order to be accepted:

![Super Visa Insurance Canada Cost Requirements [2020 updated] Super Visa Insurance Canada Cost Requirements [2020 updated]](https://1.bp.blogspot.com/-PuKH5MJHAP8/Xm3Mq9QqcHI/AAAAAAAAAFo/wuq17tzjQzU2F4HSS76qIW0iGQ2B0RCpACNcBGAsYHQ/w1200-h630-p-k-no-nu/Super%2Bvisa%2Binsurance.jpg) Source: canadalabours.com

Source: canadalabours.com

Super visa insurance requirement sum4141s full member mar 22, 2021 34 1 toronto may 5, 2021 #1 hello, 1. • super visa insurance offers health coverage of a minimum of $100,000 up to 365 days; Although the canadian insurance industry was caught off guard with the government�s decision to make insurance part of the super visa application process, the industry response has helped to increase the number of policies available and lower costs. Every year or two, though, the. Proof that the medical insurance premium has been paid.

Source: eclassify.ca

Source: eclassify.ca

Has a minimum coverage of $100,000. Basically canada wants to make sure that you’re not going to be a financial burden on the publicly. This is what super visa insurance or super visa health insurance is. As a requirement of the parent and grandparent super visa, applicants must have proof of canadian medical insurance coverage for a period of at least one year and for a minimum coverage amount of at least $100,000 for healthcare, hospitalization, and repatriation. This ensures visitors can pay for their health care if they become sick or injured while in canada.

Source: ourbis.ca

Source: ourbis.ca

Medical insurance must be purchased from a canadian insurance company prior to your planned arrival policy must be valid for at least one year from the date of entry policy must provide a minimum of $100,000 in medical coverage policy must cover medical care, hospitalization and repatriation Every year or two, though, the. You will need to have medical insurance for a super visa, which called super visa insurance. Parents and grandparents who are entitled to visit for 6 months without a visa can apply directly at the closest canadian visa office by providing proof that they meet the. Super visa insurance canada must:

Source: slideshare.net

Source: slideshare.net

• super visa insurance offers health coverage of a minimum of $100,000 up to 365 days; A minimum of $100,000 cad in emergency medical travel insurance coverage in place for at least one year after arriving in canada. Medical insurance must be purchased from a canadian insurance company prior to your planned arrival policy must be valid for at least one year from the date of entry policy must provide a minimum of $100,000 in medical coverage policy must cover medical care, hospitalization and repatriation Among the eligibility requirements for a parent and grandparent super visa is proof of valid super visa insurance. All applicants will need to show they have emergency medical health insurance coverage from canadian insurance company.

Source: slideshare.net

Source: slideshare.net

Super visa applications can be completed either online, or submitted via paper application to the nearest canadian visa post. It must have a minimum coverage level of cad $100,000 and be valid for each time the parent or grandparent enters canada. About the super visa the canadian super visa is. Inclusion for as long as 365 days in canada and no expiry date prohibition the capacity to come back to. One of the requirements of being approved for a super visa is that you have medical insurance from a canadian insurance company that covers you for at least one year from the date of entry to canada.

Source: pinterest.com

Source: pinterest.com

To apply for a super visa in canada, visitors entering the country must have at least $100,000 in health coverage issued by a canadian insurance company. Super visa insurance as part of the eligibility requirements, the visitor must purchase a medical insurance plan from a canadian company, valid for at least one year from the date of arrival and with at least $100,000 in benefit coverage. To apply for super visa you must have a proper medical emergency insurance policy with a minimum coverage of $100,000 and for a period of 1 year. One of the key requirements for obtaining the super visa is insurance. Parents and grandparents who are entitled to visit for 6 months without a visa can apply directly at the closest canadian visa office by providing proof that they meet the.

Source: indianbusinesscanada.com

Source: indianbusinesscanada.com

Super visa insurance requirement sum4141s full member mar 22, 2021 34 1 toronto may 5, 2021 #1 hello, 1. Medical insurance must be purchased from a canadian insurance company prior to your planned arrival policy must be valid for at least one year from the date of entry policy must provide a minimum of $100,000 in medical coverage policy must cover medical care, hospitalization and repatriation The super visa insurance requirements are as follows: Medical insurance requirements for super visa. Although the canadian insurance industry was caught off guard with the government�s decision to make insurance part of the super visa application process, the industry response has helped to increase the number of policies available and lower costs.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title super visa canada insurance requirements by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information