Superannuation life insurance payout Idea

Home » Trending » Superannuation life insurance payout IdeaYour Superannuation life insurance payout images are ready in this website. Superannuation life insurance payout are a topic that is being searched for and liked by netizens now. You can Find and Download the Superannuation life insurance payout files here. Get all free vectors.

If you’re searching for superannuation life insurance payout images information linked to the superannuation life insurance payout topic, you have come to the ideal blog. Our website frequently provides you with hints for viewing the maximum quality video and picture content, please kindly hunt and locate more informative video content and images that fit your interests.

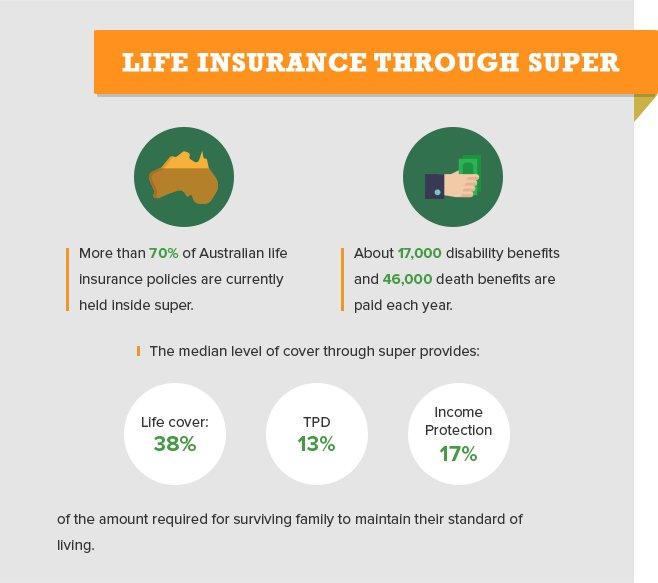

Superannuation Life Insurance Payout. But your total tpd payout amount could be a lot higher if you have multiple policies. If you need help to complete this schedule, contact the large service team at the ato on (02) 9685 8735. If you need help call your super fund or speak to a financial adviser. If you pass away, your beneficiaries can access your superannuation fund and receive the life insurance benefit.

LIFE INSURANCE THROUGH SUPER From lifeinsurancecomparison.com.au

LIFE INSURANCE THROUGH SUPER From lifeinsurancecomparison.com.au

Some government and military super funds pay pensions to surviving partners or children. Statistics from the australian prudential regulation authority for the year ended june 30 reveal that insurance bought through super funds paid out 85 cents of every dollar of premium in claims for death and 95 cents for total and permanent disability (tpd) claims. Tpd payout amounts typically range between $60,000 and $300,000, with many payouts being over $200,000. Superannuation and insurance can be complex. However, your payout usually won’t be taxed if your death benefit is paid to a financial dependant beneficiary, for example, your spouse or children under the age of 18. Easy to pay — insurance premiums are automatically deducted from your super balance.

Sam died on 1 january, 2016 and the fund trustee paid sam�s death benefit of $500,000 to his daughter jessica in accordance with sam�s binding nomination.

But your total tpd payout amount could be a lot higher if you have multiple policies. It starts once you’ve turned 25; If you need help to complete this schedule, contact the large service team at the ato on (02) 9685 8735. Cheaper premiums — premiums are often cheaper as the super fund buys insurance policies in bulk. Some government and military super funds pay pensions to surviving partners or children. If you have a life insurance policy and pass away, the lump sum benefit will usually get paid to the person(s) you nominated to receive it, your beneficiaries.

Source: apnaplan.com

Source: apnaplan.com

If you need help call your super fund or speak to a financial adviser. The payment can be used to support your spouse and children, pay down debts, or serve some other estate planning purpose, such as meeting tax obligations, providing cash to a beneficiary in lieu of other assets, or giving money to charity. The changes ensure that inactive accounts with low balances won’t be affected by ongoing insurance premiums and fees. If you need help call your super fund or speak to a financial adviser. Into the member’s superannuation account and then on to sis dependant(s)2 as per valid binding nomination or if none, as per trustee discretion to the policy owner or nominated beneficiary into the member’s superannuation account to the policy owner form of payment sis dependants can receive the payment as either a lump sum, or as a pension4 5

Source: slideserve.com

Source: slideserve.com

These are also available on your superannuation insurer’s website. Benefit taxed no tax on benefit payment unless the policy was taken out for key person insurance. This is because life insurance policies form part of a superannuation fund’s “death benefit”, and whether a death benefit is taxable depends on if the beneficiary is considered a dependent, under superannuation and. When it comes to life insurance, it pays to read the fine print. The changes ensure that inactive accounts with low balances won’t be affected by ongoing insurance premiums and fees.

Source: mcgeoughfinancial.ie

Source: mcgeoughfinancial.ie

This is because life insurance policies form part of a superannuation fund’s “death benefit”, and whether a death benefit is taxable depends on if the beneficiary is considered a dependent, under superannuation and. Easy to pay — insurance premiums are automatically deducted from your super balance. But your total tpd payout amount could be a lot higher if you have multiple policies. Sam died on 1 january, 2016 and the fund trustee paid sam�s death benefit of $500,000 to his daughter jessica in accordance with sam�s binding nomination. Members of superannuation funds may hold up to 3 types of insurance:

Source: thebalance.com

Source: thebalance.com

The changes ensure that inactive accounts with low balances won’t be affected by ongoing insurance premiums and fees. When completing your application form, you must submit the names and details of the recipient(s) who you want to receive the proceeds of your life insurance policy. The payment represents a refund of the 15% contributions tax paid by the deceased member over their lifetime. If you are preparing the tax return for a life insurance company, these instructions will help you to complete the life insurance companies. Pros and cons of life insurance through super pros.

Source: authorstream.com

Source: authorstream.com

Temporary incapacity which causes the fund member to temporarily cease working. Cheaper premiums — premiums are often cheaper as the super fund buys insurance policies in bulk. Some government and military super funds pay pensions to surviving partners or children. Into the member’s superannuation account and then on to sis dependant(s)2 as per valid binding nomination or if none, as per trustee discretion to the policy owner or nominated beneficiary into the member’s superannuation account to the policy owner form of payment sis dependants can receive the payment as either a lump sum, or as a pension4 5 Smsfs are allowed to provide any type of insurance cover that meets one of the following superannuation conditions of release:

Source: nerdwallet.com

Source: nerdwallet.com

Into the member’s superannuation account to the policy owner form of payment sis dependants can receive the payment as either a lump sum or as a pension2 lump sum the fund member can elect for either a lump sum or pension3 lump sum how is the lump sum payment taxed? Life insurance held within superannuation can help with a payout for your family if you die, get severely ill or become permanently disabled and can no longer work. The period between your death and when your beneficiaries receive the insurance payout is usually referred to as the waiting period and is usually around one to two months with a straightforward claim. When it comes to life insurance, it pays to read the fine print. The payment can be used to support your spouse and children, pay down debts, or serve some other estate planning purpose, such as meeting tax obligations, providing cash to a beneficiary in lieu of other assets, or giving money to charity.

Source: lifeinsurancecomparison.com.au

Source: lifeinsurancecomparison.com.au

However, your payout usually won’t be taxed if your death benefit is paid to a financial dependant beneficiary, for example, your spouse or children under the age of 18. If you need help call your super fund or speak to a financial adviser. The changes ensure that inactive accounts with low balances won’t be affected by ongoing insurance premiums and fees. Death cover this policy pays a lump sum if you pass away during the policy�s term. Your insured benefit amount will be clearly identified on your superannuation member statement.

Source: longevityinsurance.com

But, when it comes to claiming a life insurance benefit from a policy held within a superannuation fund, things become a little more complicated. Life insurance held within superannuation can help with a payout for your family if you die, get severely ill or become permanently disabled and can no longer work. If paid to a tax dependant4, the entire lump sum is tax free Benefit taxed no tax on benefit payment unless the policy was taken out for key person insurance. If you suffer a serious injury that causes an inability to work, income protection can help you bridge the gap while you recover.

Source: insuranceupdates.org

Source: insuranceupdates.org

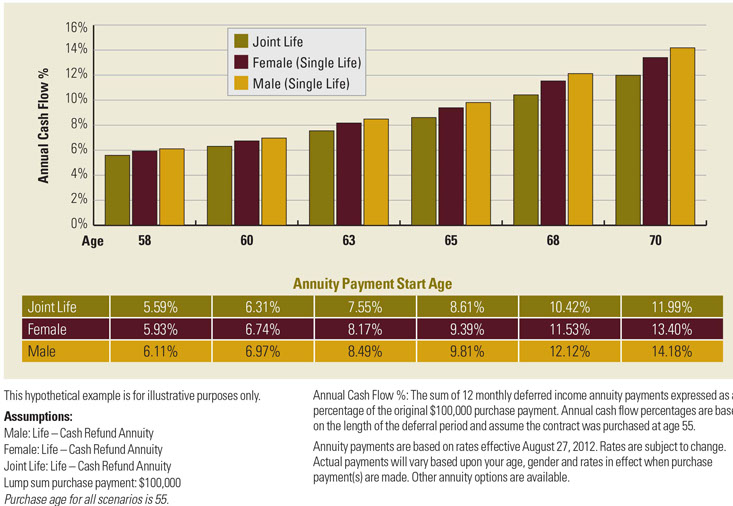

This superannuation insurance can be paid out to the account holder in the form of disability benefits, which are usually processed as either total or permanent disability payments, or as income protection payments. Death (life insurance)permanent incapacity which causes the fund member to permanently cease working (total and permanent disability insurance or tpd); Life insurance through super may have cheaper premiums, but benefit levels tend to be lower and there is reduced choice of policies when compared to life insurance outside of super. Most super funds require a copy of the death certificate and most recent will before paying a claim. Your insured benefit amount will be clearly identified on your superannuation member statement.

Source: moneytalkph.com

Source: moneytalkph.com

The payment represents a refund of the 15% contributions tax paid by the deceased member over their lifetime. When completing your application form, you must submit the names and details of the recipient(s) who you want to receive the proceeds of your life insurance policy. It starts once you’ve turned 25; Into the member’s superannuation account to the policy owner form of payment sis dependants can receive the payment as either a lump sum or as a pension2 lump sum the fund member can elect for either a lump sum or pension3 lump sum how is the lump sum payment taxed? This superannuation insurance can be paid out to the account holder in the form of disability benefits, which are usually processed as either total or permanent disability payments, or as income protection payments.

Source: magazine.northeast.aaa.com

Source: magazine.northeast.aaa.com

Your insured benefit amount will be clearly identified on your superannuation member statement. However, your payout usually won’t be taxed if your death benefit is paid to a financial dependant beneficiary, for example, your spouse or children under the age of 18. Some government and military super funds pay pensions to surviving partners or children. Terms and conditions of these are set out in the product disclosure statement (pds) when you take out your cover. When a loved one passes away, the hardship following their death is often compounded if they were a source of income for their dependents.

Source: retirementsolvedplatform.com

Source: retirementsolvedplatform.com

Most super funds require a copy of the death certificate and most recent will before paying a claim. And when your super balance reaches $6,000; The payment can be used to support your spouse and children, pay down debts, or serve some other estate planning purpose, such as meeting tax obligations, providing cash to a beneficiary in lieu of other assets, or giving money to charity. If you need help call your super fund or speak to a financial adviser. Your insured benefit amount will be clearly identified on your superannuation member statement.

Source: ifec.org.hk

Source: ifec.org.hk

Superannuation and insurance can be complex. And when your super balance reaches $6,000; It starts once you’ve turned 25; Into the member’s superannuation account and then on to sis dependant(s)2 as per valid binding nomination or if none, as per trustee discretion to the policy owner or nominated beneficiary into the member’s superannuation account to the policy owner form of payment sis dependants can receive the payment as either a lump sum, or as a pension4 5 Death (life insurance)permanent incapacity which causes the fund member to permanently cease working (total and permanent disability insurance or tpd);

Source: lifeinsurancecomparison.com.au

Source: lifeinsurancecomparison.com.au

Life insurance is also referred to as death benefits. Some government and military super funds pay pensions to surviving partners or children. The changes ensure that inactive accounts with low balances won’t be affected by ongoing insurance premiums and fees. This superannuation insurance can be paid out to the account holder in the form of disability benefits, which are usually processed as either total or permanent disability payments, or as income protection payments. The payment is only payable where the death benefit is being paid as a lump sum to an eligible dependant of the deceased member, who is either a:

When completing your application form, you must submit the names and details of the recipient(s) who you want to receive the proceeds of your life insurance policy. Total and permanent disability insurance (tpd) tpd inside superannuation premium deductibility deductible to the fund only (not to the individual). Most super funds require a copy of the death certificate and most recent will before paying a claim. And when your super balance reaches $6,000; The cost is automatically deducted from your super account.

Source: e3e3chobots.blogspot.com

Source: e3e3chobots.blogspot.com

Members of superannuation funds may hold up to 3 types of insurance: If you suffer a serious injury that causes an inability to work, income protection can help you bridge the gap while you recover. Tpd payout amounts typically range between $60,000 and $300,000, with many payouts being over $200,000. If you need help call your super fund or speak to a financial adviser. The changes ensure that inactive accounts with low balances won’t be affected by ongoing insurance premiums and fees.

Source: provassn.com

Source: provassn.com

Members of superannuation funds may hold up to 3 types of insurance: All australian super funds have life insurance or death benefits included in their policy. These are also available on your superannuation insurer’s website. The cost is automatically deducted from your super account. Your insured benefit amount will be clearly identified on your superannuation member statement.

Source: retirementliving.com

Source: retirementliving.com

And when your super balance reaches $6,000; And when your super balance reaches $6,000; When completing your application form, you must submit the names and details of the recipient(s) who you want to receive the proceeds of your life insurance policy. The cost is automatically deducted from your super account. Life insurance through super may have cheaper premiums, but benefit levels tend to be lower and there is reduced choice of policies when compared to life insurance outside of super.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title superannuation life insurance payout by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information