Supplemental ad d insurance information

Home » Trend » Supplemental ad d insurance informationYour Supplemental ad d insurance images are ready. Supplemental ad d insurance are a topic that is being searched for and liked by netizens today. You can Get the Supplemental ad d insurance files here. Get all royalty-free photos and vectors.

If you’re looking for supplemental ad d insurance images information related to the supplemental ad d insurance topic, you have come to the right blog. Our website always provides you with suggestions for viewing the maximum quality video and picture content, please kindly hunt and find more informative video articles and images that fit your interests.

Supplemental Ad D Insurance. Supplemental ad&d insurance is one of the many enhanced options you can choose in conjunction with the basic life insurance plan. If you elect an amount that exceeds the guaranteed issue amount of $80,000 , you will need to Employers often require you to buy a supplemental policy for yourself before being eligible for supplemental spouse or. The accidental death and dismemberment (ad&d) portion is automatically included with supplemental spouse life and provides the dependent with additional insurance coverage for the loss of life or loss due to injuries sustained in an accident on or off the job.*.

What Is Supplemental AD&D Insurance? Pocket Sense From pocketsense.com

What Is Supplemental AD&D Insurance? Pocket Sense From pocketsense.com

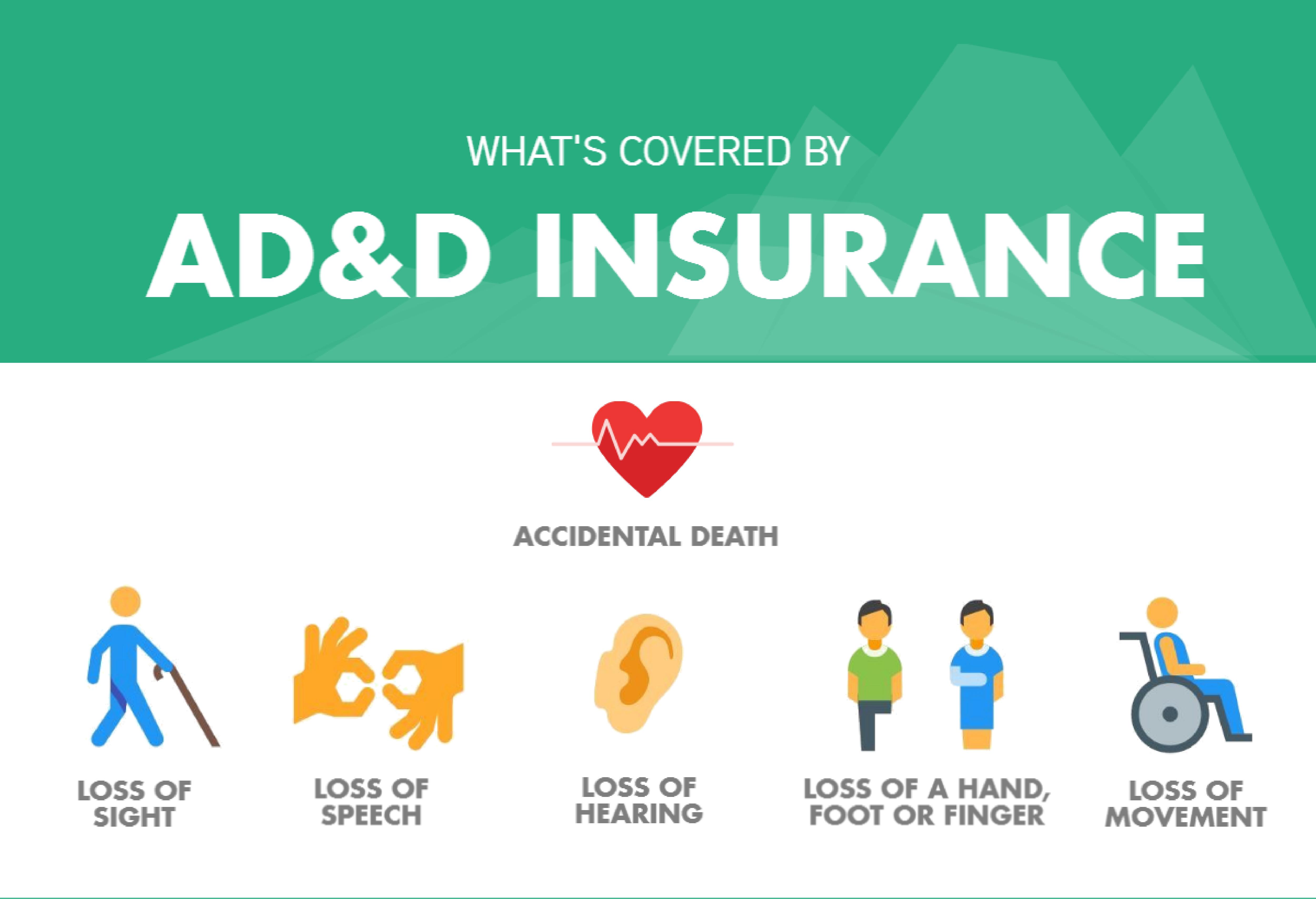

Some supplemental policies are specifically for accidental death and dismemberment (ad&d). Supplemental ad&d is a type of insurance that pays out clearly defined cash benefits if an accident causes death, blindness or the loss of one or more limbs. Ad&d insurance is one of the most commonly offered workplace benefits among those surveyed. Not heart attacks or strokes. The employee is automatically the beneficiary of any benefits that become payable. Supplemental life and ad&d insurance you can purchase supplemental life and ad&d insurance in increments of $10,000.

Supplemental ad&d is a type of insurance that pays out clearly defined cash benefits if an accident causes death, blindness or the loss of one or more limbs.

Some employers provide employees with the option to purchase supplemental life insurance that increases coverage and does not have stipulations, such as ad&d or. Ad&d is purposed to serve as a supplement to regular life insurance as coverage is limited to certain types of accidents. Ad&d insurance also pays out part of the benefit in some instances of injury or accidental loss of limbs. Think of ad&d insurance as a supplemental policy to your life and disability insurance policies. Be sure to choose a beneficiary (ies) for any supplemental coverage you choose for yourself. If you elect an amount that exceeds the guaranteed issue amount of $80,000 , you will need to

Source: enriquecimientodelosmasjovenes.blogspot.com

Source: enriquecimientodelosmasjovenes.blogspot.com

Not heart attacks or strokes. You may not elect coverage for your spouse if. Ad&d insurance will cover only deaths and injuries from accidents—not natural causes or illnesses. The maximum amount you can purchase cannot be more than 5 times your annual salary or $300,000. Supplemental life and ad&d insurance you can purchase supplemental life and ad&d insurance in increments of $10,000.

Source: imprecisaoemelodia.blogspot.com

Ad&d insurance pays out if you die or are seriously injured in an accident. Supplemental ad&d insurance is one of the many enhanced options you can choose in conjunction with the basic life insurance plan. Supplemental life and ad&d insurance in increments of $5,000, $5,000 minimum to a maximum of $250,000. Supplemental accidental death & dismemberment (ad&d) insurance overview. Best and standard & poor’s (s&p).1 although aflac earned a small percentage of complaints with the national.

Source: theinsurancenerd.com

Source: theinsurancenerd.com

But you can also add an ad&d rider to your life policy. Ad&d coverage is an important, but often overlooked, component of a life insurance plan. Some employers provide employees with the option to purchase supplemental life insurance that increases coverage and does not have stipulations, such as ad&d or. The maximum amount you can purchase cannot be more than 5 times your annual salary or $300,000. Some supplemental policies are specifically for accidental death and dismemberment (ad&d).

Source: imprecisaoemelodia.blogspot.com

The maximum amount you can purchase cannot be more than 5 times your annual salary or $300,000. You can purchase additional life and ad&d insurance for yourself, as well as coverage for your spouse/domestic partner and your child(ren). You pay the full cost of any supplemental life insurance and/or supplemental ad&d insurance coverage. This means they will only cover you if your death is caused by an. Ad&d insurance pays out if you die or are seriously injured in an accident.

Pros and cons of accidental death and dismemberment insurance Some employers provide employees with the option to purchase supplemental life insurance that increases coverage and does not have stipulations, such as ad&d or. Supplemental ad&d coverage provides an insurance benefit in the event of death or dismemberment resulting from a covered accident. What is supplemental ad&d insurance? You may not elect coverage for your spouse if.

Source: enriquecimientodelosmasjovenes.blogspot.com

Source: enriquecimientodelosmasjovenes.blogspot.com

More than 50 million people count on aflac for their supplemental insurance needs. Some employers provide employees with the option to purchase supplemental life insurance that increases coverage and does not have stipulations, such as ad&d or. Supplemental ad&d insurance, sometimes offered alone or as a supplement to other life insurance programs, provides additional money to your beneficiaries in the event you die or become dismembered in an accident. Best and standard & poor’s (s&p).1 although aflac earned a small percentage of complaints with the national. You are automatically the beneficiary for any dependents covered under supplemental ad&d insurance.

Source: pocketsense.com

Source: pocketsense.com

The employee is automatically the beneficiary of any benefits that become payable. You pay the full cost of any supplemental life insurance and/or supplemental ad&d insurance coverage. Supplemental ad&d is a type of insurance that pays out clearly defined cash benefits if an accident causes death, blindness or the loss of one (9). Supplemental ad&d can play a critical role, but it�s wise to think of it as added protection rather than solely relying on ad&d coverage. More than 50 million people count on aflac for their supplemental insurance needs.

Source: referenceinsurance.blogspot.com

Source: referenceinsurance.blogspot.com

Supplemental ad&d insurance, sometimes offered alone or as a supplement to other life insurance programs, provides additional money to your beneficiaries in the event you die or become dismembered in an accident. No benefit is payable if the. However, coverage cannot exceed 100% of the employee’s supplemental life and ad&d amount. You can purchase additional life and ad&d insurance for yourself, as well as coverage for your spouse/domestic partner and your child(ren). Ad&d insurance will cover only deaths and injuries from accidents—not natural causes or illnesses.

Source: referenceinsurance.blogspot.com

The accidental death and dismemberment (ad&d) portion is automatically included with supplemental spouse life and provides the dependent with additional insurance coverage for the loss of life or loss due to injuries sustained in an accident on or off the job.. Some supplemental policies are specifically for accidental death and dismemberment (ad&d). Supplemental spouse life/ad&d insurance allows the employee to buy more life insurance than the basic amount provided by the employer. It’s important to designate beneficiaries to ensure your supplemental ad&d insurance benefits go to the people you want if something were to happen to you. The accidental death and dismemberment (ad&d) portion is automatically included with supplemental spouse life and provides the dependent with additional insurance coverage for the loss of life or loss due to injuries sustained in an accident on or off the job..

Source: enriquecimientodelosmasjovenes.blogspot.com

Source: enriquecimientodelosmasjovenes.blogspot.com

The maximum amount you can purchase cannot be more than 5 times your annual salary or $300,000. If you have life insurance through your employer, the coverage provided by your company may actually be ad&d. Supplemental ad&d is a type of insurance that pays out clearly defined cash benefits if an accident causes death, blindness or the loss of one or more limbs. Supplemental ad&d insurance is one of the many enhanced options you can choose in conjunction with the basic life insurance plan. The employee is automatically the beneficiary of any benefits that become payable.

Source: enriquecimientodelosmasjovenes.blogspot.com

Ad&d insurance is one of the most commonly offered workplace benefits among those surveyed. Supplemental ad&d insurance, sometimes offered alone or as a supplement to other life insurance programs, provides additional money to your beneficiaries in the event you die or become dismembered in an accident. This means they will only cover you if your death is caused by an. If you can afford it, a separate ad&d policy can supplement your life insurance coverage. Be sure to choose a beneficiary (ies) for any supplemental coverage you choose for yourself.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

You can purchase additional life and ad&d insurance for yourself, as well as coverage for your spouse/domestic partner and your child(ren). Supplemental ad&d insurance, sometimes offered alone or as a supplement to other life insurance programs, provides additional money to your beneficiaries in the event you die or become dismembered in an accident. What is supplemental ad&d insurance? If you can afford it, a separate ad&d policy can supplement your life insurance coverage. You may not elect coverage for your spouse if.

Source: hub.jhu.edu

Source: hub.jhu.edu

Ad&d insurance also pays out part of the benefit in some instances of injury or accidental loss of limbs. Supplemental life and ad&d insurance you can purchase supplemental life and ad&d insurance in increments of $10,000. This means they will only cover you if your death is caused by an. If you can afford it, a separate ad&d policy can supplement your life insurance coverage. Supplemental ad&d insurance, sometimes offered alone or as a supplement to other life insurance programs, provides additional money to your beneficiaries in the event you die or become dismembered in an accident.

Source: epsilonbeg.blogspot.com

Source: epsilonbeg.blogspot.com

The accidental death and dismemberment (ad&d) portion is automatically included with supplemental spouse life and provides the dependent with additional insurance coverage for the loss of life or loss Ad&d insurance also pays out part of the benefit in some instances of injury or accidental loss of limbs. Ad&d insurance is one of the most commonly offered workplace benefits among those surveyed. Supplemental spouse life/ad&d insurance allows the employee to buy more life insurance than the basic amount provided by the employer. What’s covered by ad&d insurance?

Source: imprecisaoemelodia.blogspot.com

Source: imprecisaoemelodia.blogspot.com

Supplemental life and ad&d insurance in increments of $5,000, $5,000 minimum to a maximum of $250,000. Employers often require you to buy a supplemental policy for yourself before being eligible for supplemental spouse or. Some employers provide employees with the option to purchase supplemental life insurance that increases coverage and does not have stipulations, such as ad&d or. Supplemental ad&d is a type of insurance that pays out clearly defined cash benefits if an accident causes death, blindness or the loss of one or more limbs. Supplemental ad&d insurance, sometimes offered alone or as a supplement to other life insurance programs, provides additional money to your beneficiaries in the event you die or become dismembered in an accident.

Source: imprecisaoemelodia.blogspot.com

Source: imprecisaoemelodia.blogspot.com

You are automatically the beneficiary for any dependents covered under supplemental ad&d insurance. Your policy will outline how much of the benefit you�ll receive for different types of injuries. Supplemental ad&d can play a critical role, but it�s wise to think of it as added protection rather than solely relying on ad&d coverage. Supplemental life and ad&d insurance in increments of $5,000, $5,000 minimum to a maximum of $250,000. Supplemental life and ad&d insurance you can purchase supplemental life and ad&d insurance in increments of $10,000.

Source: floridabar.memberbenefits.com

Source: floridabar.memberbenefits.com

You pay the full cost of any supplemental life insurance and/or supplemental ad&d insurance coverage. Think of ad&d insurance as a supplemental policy to your life and disability insurance policies. Supplemental life and ad&d insurance you can purchase supplemental life and ad&d insurance in increments of $10,000. Supplemental accidental death & dismemberment (ad&d) insurance overview. Be sure to choose a beneficiary (ies) for any supplemental coverage you choose for yourself.

Source: imprecisaoemelodia.blogspot.com

Source: imprecisaoemelodia.blogspot.com

Supplement dependent ad&d insurance coverage is designed to protect you against certain financial burdens in the event a coverage dependent dies of an accidental death. What is supplemental ad&d insurance? It’s important to designate beneficiaries to ensure your supplemental ad&d insurance benefits go to the people you want if something were to happen to you. Ad&d coverage is an important, but often overlooked, component of a life insurance plan. Think of ad&d insurance as a supplemental policy to your life and disability insurance policies.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title supplemental ad d insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information