Supplemental life insurance vs ad d information

Home » Trend » Supplemental life insurance vs ad d informationYour Supplemental life insurance vs ad d images are ready. Supplemental life insurance vs ad d are a topic that is being searched for and liked by netizens now. You can Find and Download the Supplemental life insurance vs ad d files here. Download all free photos.

If you’re looking for supplemental life insurance vs ad d pictures information related to the supplemental life insurance vs ad d topic, you have come to the right site. Our site frequently gives you suggestions for seeking the highest quality video and picture content, please kindly search and find more enlightening video articles and graphics that fit your interests.

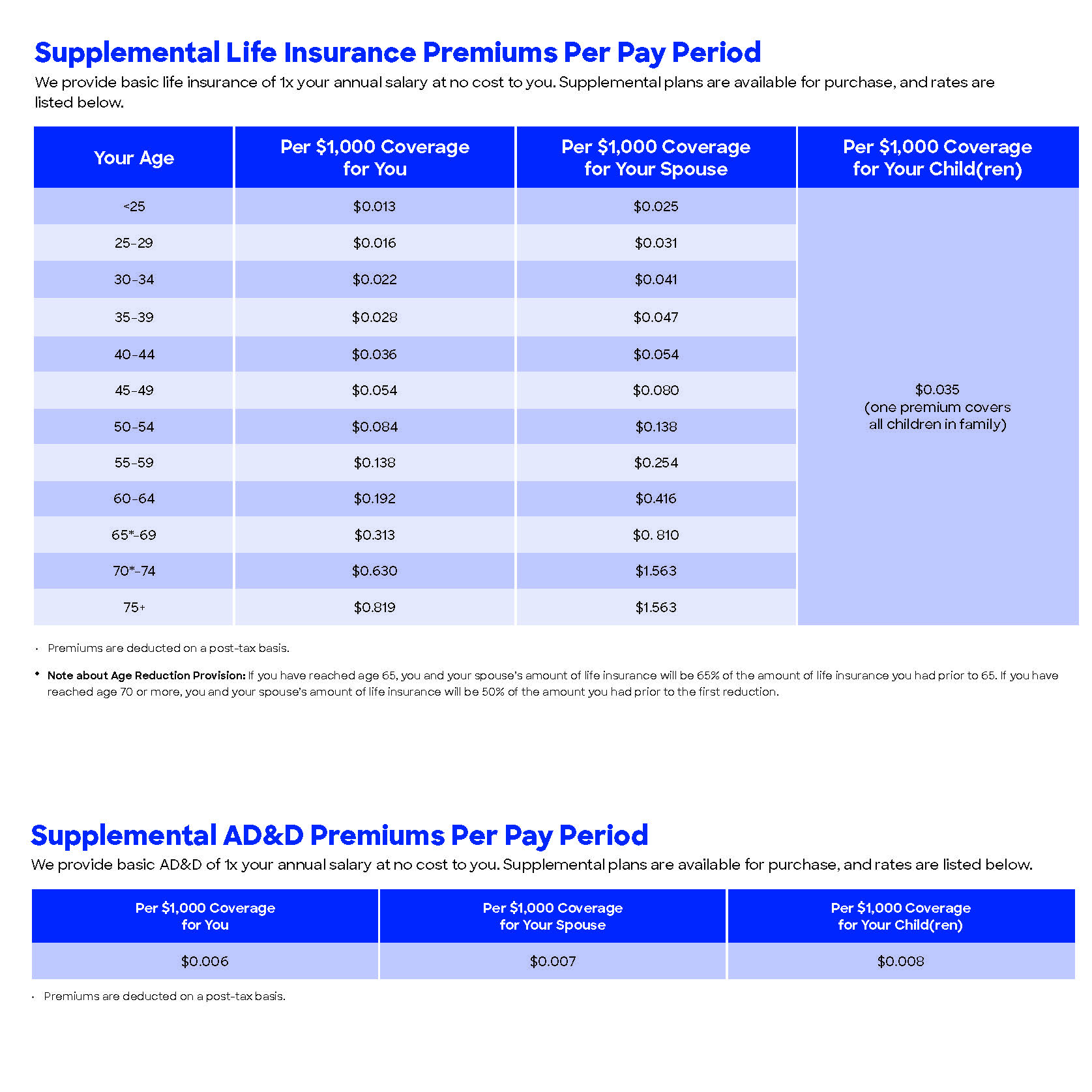

Supplemental Life Insurance Vs Ad D. Can you claim both life. All coverage terminates upon employee’s retirement. Millennials tend to move more frequently geographically than other age. Life insurance policies from most insurers offer a variety of optional features and riders, and ad&d provides additional coverage at a surprisingly low price.

What Is Supplemental Life Insurance And Ad&D Epsilonbeg From epsilonbeg.blogspot.com

What Is Supplemental Life Insurance And Ad&D Epsilonbeg From epsilonbeg.blogspot.com

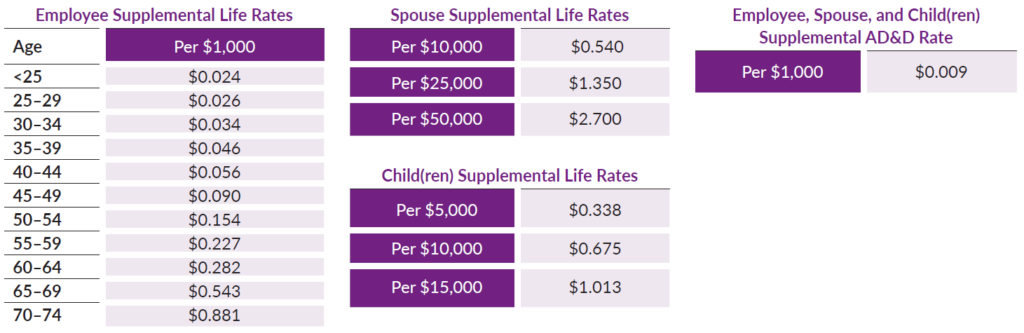

To 25% of the original amount at age 75. Spouse supplemental life and ad&d coverage reduces the same as the employee’s. Ad&d coverage costs considerably less than a standard life insurance policy, primarily because it pays out under. Far more deaths occur as the result of illness than accident. Basic life insurance is different from supplemental life insurance. Supplemental life and ad&d insurance in increments of $5,000, $5,000 minimum to a maximum of $250,000.

Ad&d is a supplemental type of life insurance and should not be considered acceptable as a substitute for a traditional life insurance policy.

Spouse supplemental life and ad&d coverage reduces the same as the employee’s. Supplemental life insurance would pay for death by any reason. So, if your goal is to provide your family with a financial safety net regardless of how you die, life insurance is the right purchase. Basic life insurance is different from supplemental life insurance. Supplemental insurance is not usually available on a term life policy because that type of coverage is already constrained within certain defined limits and conditions, but is more often taken out to supplement a whole or. Nov 18, 2020 — think of ad&d insurance as a supplemental policy to your life and disability insurance policies.

Source: mts.mybenefitsapp.com

Source: mts.mybenefitsapp.com

That�s why they�re often referred to as supplemental ad&d. Supplemental term life insurance through an employer does not provide the benefits of life insurance available in the marketplace, especially for millennials. Supplemental life and ad&d insurance in increments of $5,000, $5,000 minimum to a maximum of $250,000. However, coverage cannot exceed 100% of the employee’s supplemental life and ad&d amount. Ad&d coverage costs considerably less than a standard life insurance policy, primarily because it pays out under.

Source: hub.jhu.edu

Source: hub.jhu.edu

If the policy pays, it�ll be a pleasant bonus for your beneficiaries, but you shouldn�t count on it. Supplement ad&d insurance would only pay for death or dismemberment due to accident. Supplemental insurance is not usually available on a term life policy because that type of coverage is already constrained within certain defined limits and conditions, but is more often taken out to supplement a whole or. Spouse supplemental life and ad&d coverage reduces the same as the employee’s. Dec 23, 2020 — accidental death and dismemberment:

Source: vricares.com

Source: vricares.com

Supplemental ad&d can play a critical role, but (10). Supplemental term life insurance through an employer does not provide the benefits of life insurance available in the marketplace, especially for millennials. Do i still pay my life Supplement ad&d insurance would only pay for death or dismemberment due to accident. You may not elect coverage for your spouse if.

Source: escolaclasse10dorf2.blogspot.com

Source: escolaclasse10dorf2.blogspot.com

If you have life insurance through your employer, the coverage provided by your company may actually be ad&d insurance. Check your benefits paperwork or speak with a benefits administrator to confirm what causes of death are insured by your policy. Life insurance is a private contract between you and a life insurance company. Supplemental accidental death and dismemberment (ad&d) insurance: Life insurance policies from most insurers offer a variety of optional features and riders, and ad&d provides additional coverage at a surprisingly low price.

Source: employeeconnects.com

Source: employeeconnects.com

Some supplemental policies are specifically for accidental death and dismemberment (ad&d). The insurance company provides a death benefit to you in exchange for premium payments. This provides a death benefit in addition to your basic policy if you die or are. Supplement ad&d insurance would only pay for death or dismemberment due to accident. What does supplemental life and ad&d mean?

Source: pocketsense.com

Source: pocketsense.com

Ad&d is a supplemental type of life insurance and should not be considered acceptable as a substitute for a traditional life insurance policy. Some employers provide employees with the option to purchase supplemental life insurance that increases coverage and does not have stipulations, such as ad&d or. Employee supplemental life and ad&d coverage reduces to 65% of the face amount at age 65; In this scenario, it makes sense to buy supplemental life insurance. First, the coverage may be a form of accidental death and dismemberment (ad&d) insurance, which only pays the beneficiaries if the employee dies from an accident or loses a limb, hearing or sight as a result of an accident.

Source: michigan.gov

Source: michigan.gov

All coverage terminates upon employee’s retirement. Ad&d is a supplemental type of life insurance and should not be considered acceptable as a substitute for a traditional life insurance policy. In comparison, ad&d protection is only of marginal value. Supplemental accidental death and dismemberment (ad&d) insurance: Ad&d coverage costs considerably less than a standard life insurance policy, primarily because it pays out under.

Source: referenceinsurance.blogspot.com

Source: referenceinsurance.blogspot.com

Supplemental life insurance vs ad&d (accidental death and dismemberment) some employer additional coverage has other limitations such as accidental death and dismemberment which means the insurance will only pay out only if you expire from an “accident only.” Millennials tend to move more frequently geographically than other age. Supplement ad&d insurance would only pay for death or dismemberment due to accident. When you�re deciding on your coverage, life insurance is fundamental for most young couples. The insurance company provides a death benefit to you in exchange for premium payments.

Source: sec.gov

Source: sec.gov

When you�re deciding on your coverage, life insurance is fundamental for most young couples. In this scenario, it makes sense to buy supplemental life insurance. Supplemental life insurance would pay for death by any reason. So, if your goal is to provide your family with a financial safety net regardless of how you die, life insurance is the right purchase. This covers your eligible dependents.

Source: hub.jhu.edu

Source: hub.jhu.edu

Check your benefits paperwork or speak with a benefits administrator to confirm what causes of death are insured by your policy. You may not elect coverage for your spouse if. Supplemental ad&d can play a critical role, but (10). All coverage terminates upon employee’s retirement. Ad&d coverage costs considerably less than a standard life insurance policy, primarily because it pays out under.

Source: epsilonbeg.blogspot.com

Source: epsilonbeg.blogspot.com

This provides a death benefit in addition to your basic policy if you die or are. Supplemental life and ad&d insurance in increments of $5,000, $5,000 minimum to a maximum of $250,000. The insurance company provides a death benefit to you in exchange for premium payments. For other businesses, voluntary life insurance may only refer to additional accidental death and dismemberment (ad&d) or burial insurance. Spouse supplemental life and ad&d coverage reduces the same as the employee’s.

Source: floridabar.memberbenefits.com

Source: floridabar.memberbenefits.com

Ad&d coverage costs considerably less than a standard life insurance policy, primarily because it pays out under. Some supplemental policies are specifically for accidental death and dismemberment (ad&d). Supplement ad&d insurance would only pay for death or dismemberment due to accident. If your life or group policy includes ad&d, don�t include the benefit amount in your planning. For other businesses, voluntary life insurance may only refer to additional accidental death and dismemberment (ad&d) or burial insurance.

Source: enriquecimientodelosmasjovenes.blogspot.com

Source: enriquecimientodelosmasjovenes.blogspot.com

Dec 23, 2020 — accidental death and dismemberment: Far more deaths occur as the result of illness than accident. Nov 18, 2020 — think of ad&d insurance as a supplemental policy to your life and disability insurance policies. Basic life insurance is different from supplemental life insurance. Do i need both life insurance and ad&d?

Source: youtube.com

Source: youtube.com

This provides a death benefit in addition to your basic policy if you die or are. All coverage terminates upon employee’s retirement. When you�re deciding on your coverage, life insurance is fundamental for most young couples. However, if you’d like to add supplemental coverage that is greater than your employer’s set. If you feel that your employer�s life insurance amount is not sufficient for your needs, purchase the supplement life policy.

Source: epsilonbeg.blogspot.com

Source: epsilonbeg.blogspot.com

Life insurance pays a death benefit in the event of almost any type of death, whereas ad&d insurance will only cover a death that happened as the result of an accident. Supplemental life insurance is when a rider is purchased to increase the value of the policy without taking out a new life insurance policy altogether. Supplemental ad&d can play a critical role, but (10). Does ad&d pay in addition to life insurance? This provides a death benefit in addition to your basic policy if you die or are.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

If your life or group policy includes ad&d, don�t include the benefit amount in your planning. Nov 18, 2020 — think of ad&d insurance as a supplemental policy to your life and disability insurance policies. In comparison, ad&d protection is only of marginal value. If your life or group policy includes ad&d, don�t include the benefit amount in your planning. First, the coverage may be a form of accidental death and dismemberment (ad&d) insurance, which only pays the beneficiaries if the employee dies from an accident or loses a limb, hearing or sight as a result of an accident.

Source: bswhealth.com

Source: bswhealth.com

This provides a death benefit in addition to your basic policy if you die or are. Supplemental ad&d can play a critical role, but (10). Unlike many term or whole life insurance policies from private insurers, supplemental life insurance through your employer may allow you to increase or decrease coverage amounts at certain times. To 25% of the original amount at age 75. You can buy ad&d policies alone, but they are more commonly added to another product.

Source: enriquecimientodelosmasjovenes.blogspot.com

Source: enriquecimientodelosmasjovenes.blogspot.com

Check your benefits paperwork or speak with a benefits administrator to confirm what causes of death are insured by your policy. First, the coverage may be a form of accidental death and dismemberment (ad&d) insurance, which only pays the beneficiaries if the employee dies from an accident or loses a limb, hearing or sight as a result of an accident. Do i still pay my life Spouse supplemental life and ad&d coverage reduces the same as the employee’s. Dec 23, 2020 — accidental death and dismemberment:

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title supplemental life insurance vs ad d by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information