Surplus lines insurance florida information

Home » Trend » Surplus lines insurance florida informationYour Surplus lines insurance florida images are available. Surplus lines insurance florida are a topic that is being searched for and liked by netizens now. You can Find and Download the Surplus lines insurance florida files here. Download all free photos and vectors.

If you’re looking for surplus lines insurance florida images information related to the surplus lines insurance florida topic, you have visit the right blog. Our website frequently provides you with suggestions for viewing the maximum quality video and picture content, please kindly search and find more enlightening video content and images that match your interests.

Surplus Lines Insurance Florida. The purpose of the florida surplus lines service office (fslso) are to protect consumers seeking insurance in this state, permit surplus lines insurance to (13). Will acree 500 international pkwy lake mary, fl 32746 phone: The bill removed the $35 fee cap. Refund requests should be sent to publicinfo@fslso.com.

Don Deising The grease that keeps Florida’s business From floridapolitics.com

Don Deising The grease that keeps Florida’s business From floridapolitics.com

The purpose of the florida surplus lines service office (fslso) are to protect consumers seeking insurance in this state, permit surplus lines insurance to (13). The florida surplus lines service office does not provide legal or tax advice. Whenever agents, brokers, companies, or policyholders have specific questions pertaining to business practices, tax implications or statutory interpretation, we urge the respective parties to seek the counsel of a competent attorney or tax consultant licensed in the appropriate jurisdiction and area of. The state licensing exam is based upon the. Excess and surplus lines insurance enable consumers to obtain casualty or property insurance cover via an insurance market that is regulated by the respective state. We serve retail insurance agents for all surplus lines insurance in florida.

Surplus lines insurance in florida.

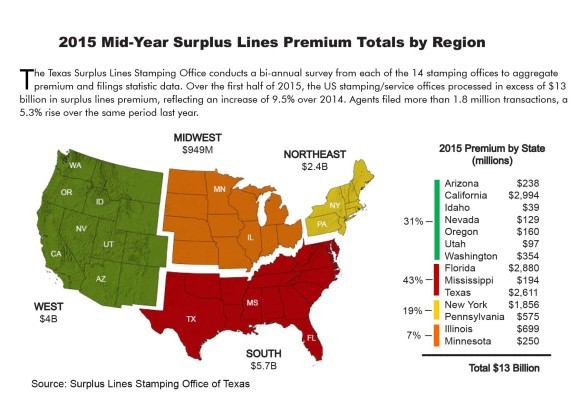

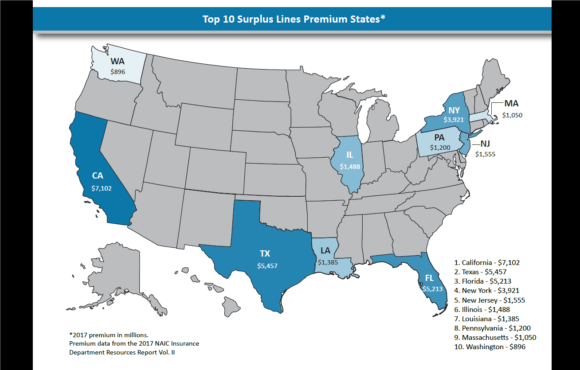

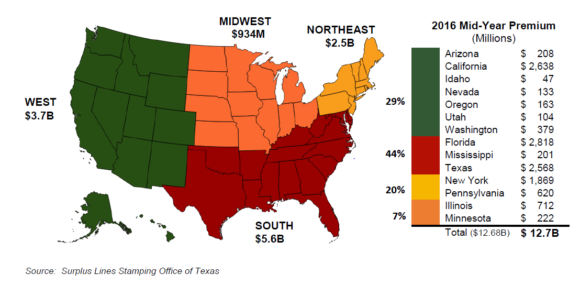

According to the florida surplus lines service office, 2021 surplus lines premium volume was over $9.5 billion and represents over 1.2 million policies and consumers who, without the surplus lines market, would have a difficult time obtaining insurance, if they were able to secure it at all. If you can dream it, surplus lines insurance can cover it! A general lines agent, who cannot obtain coverage for a consumer in the standard market, can contact a florida licensed surplus lines agent to provide the coverage the. Since they are not strictly regulated by. If you find yourself in a situation where you might need surplus lines coverage, you should seek advice from a licensed surplus lines insurance provider, or an attorney. Though it generally only comprises roughly 10% of the total florida property and casualty insurance marketplace, surplus lines insurance accounted for over $5.8 billion in premium in 2018 alone from insurers domiciled in the united states and abroad.

Source: myfsla.com

Source: myfsla.com

If you can dream it, surplus lines insurance can cover it! If you find yourself in a situation where you might need surplus lines coverage, you should seek advice from a licensed surplus lines insurance provider, or an attorney. According to the florida surplus lines service office, 2021 surplus lines premium volume was over $9.5 billion and represents over 1.2 million policies and consumers who, without the surplus lines market, would have a difficult time obtaining insurance, if they were able to secure it at all. While they are not regulated by the florida department of insurance, they are regulated in other ways. 363306 florida surplus lines service office *fslso is the current study manual vendor for the surplus lines agent state licensing examination.

While they are not regulated by the florida department of insurance, they are regulated in other ways. Surplus lines policies • must have a notice that reads: “ this insurance is issued pursuant to the florida surplus lines law. Since they are not strictly regulated by. As surplus lines insurance broker, we don’t deal directly with the public but work with florida insurance agents.

Source: ilsainc.com

Source: ilsainc.com

Surplus lines insurance in florida. Since they are not strictly regulated by. That practice is cumbersome to insurers. In some states, it is called an excess line insurance policy. Though it generally only comprises roughly 10% of the total florida property and casualty insurance marketplace, surplus lines insurance accounted for over $5.8 billion in premium in 2018 alone from insurers domiciled in the united states and abroad.

Source: ilsainc.com

Source: ilsainc.com

The florida surplus lines service office does not provide legal or tax advice. Under existing florida law, if a surplus lines company wants to write in florida, it must incorporate and be domiciled in another state. Surplus lines insurance in florida. Eligibility and filing requirements (all insurers): In contrast, an excess and surplus lines (e&s) insurance company is not required to be licensed by the state of florida.

Source: insurancejournal.com

Source: insurancejournal.com

Before choosing a surplus lines company as an option, for certain types of coverage, the law requires the agent to first receive Surplus line insurance can be used by companies or. We have been independently owned and operated for over 30 years. The purpose of the florida surplus lines service office (fslso) are to protect consumers seeking insurance in this state, permit surplus lines insurance to (13). A general lines agent, who cannot obtain coverage for a consumer in the standard market, can contact a florida licensed surplus lines agent to provide the coverage the.

Source: insurancejournal.com

Source: insurancejournal.com

The state licensing exam is based upon the. Eligibility and filing requirements (all insurers): Refund requests should be sent to publicinfo@fslso.com. This is called a surplus line insurance policy. In some states, it is called an excess line insurance policy.

Source: surplusmanual.lockelord.com

Source: surplusmanual.lockelord.com

This is called a surplus line insurance policy. If you find yourself in a situation where you might need surplus lines coverage, you should seek advice from a licensed surplus lines insurance provider, or an attorney. Under existing florida law, if a surplus lines company wants to write in florida, it must incorporate and be domiciled in another state. (2) it is declared that the purposes of the surplus lines law are to provide orderly access for the insuring public of this state to insurers not authorized to transact insurance in this state. The $35 fee cap has been in place since 2001.

Source: fl.oltraining.com

Source: fl.oltraining.com

The $35 fee cap has been in place since 2001. Florida does not allow domestic surplus lines insurers in the state. If you can dream it, surplus lines insurance can cover it! According to the florida surplus lines service office, 2021 surplus lines premium volume was over $9.5 billion and represents over 1.2 million policies and consumers who, without the surplus lines market, would have a difficult time obtaining insurance, if they were able to secure it at all. As surplus lines insurance broker, we don’t deal directly with the public but work with florida insurance agents.

Source: floridapolitics.com

Source: floridapolitics.com

If you can dream it, surplus lines insurance can cover it! Since they are not strictly regulated by. The surplus lines market plays an important role in. It can, however, conduct business in the state. According to the florida surplus lines service office, 2021 surplus lines premium volume was over $9.5 billion and represents over 1.2 million policies and consumers who, without the surplus lines market, would have a difficult time obtaining insurance, if they were able to secure it at all.

Source: youtube.com

Source: youtube.com

Since these insurers are not licensed in your state, they are not regulated by your state�s department of insurance in the same way as licensed insurers (they are, however, regulated in the state or country where they are domiciled or located). “ this insurance is issued pursuant to the florida surplus lines law. Though it generally only comprises roughly 10% of the total florida property and casualty insurance marketplace, surplus lines insurance accounted for over $5.8 billion in premium in 2018 alone from insurers domiciled in the united states and abroad. Since they are not strictly regulated by. It requires that the fee be “reasonable” and that it be itemized separately to the customer.

Source: graceybacker.com

Source: graceybacker.com

If you find yourself in a situation where you might need surplus lines coverage, you should seek advice from a licensed surplus lines insurance provider, or an attorney. This is called a surplus line insurance policy. According to the florida surplus lines service office, 2021 surplus lines premium volume was over $9.5 billion and represents over 1.2 million policies and consumers who, without the surplus lines market, would have a difficult time obtaining insurance, if they were able to secure it at all. Surplus lines insurance in florida. In some states, it is called an excess line insurance policy.

Source: insurancejournal.com

Source: insurancejournal.com

As surplus lines insurance broker, we don’t deal directly with the public but work with florida insurance agents. In order for a surplus lines insurer to be on florida’s list of eligible surplus lines insurers, it must go through the same eligibility application process prior to implementation of nrra and submit the filings listed below. Surplus lines insurance in florida. In some states, it is called an excess line insurance policy. Before choosing a surplus lines company as an option, for certain types of coverage, the law requires the agent to first receive

Source: statelicense.examreview.net

Source: statelicense.examreview.net

The state licensing exam is based upon the. The florida surplus lines service office does not provide legal or tax advice. Before choosing a surplus lines company as an option, for certain types of coverage, the law requires the agent to first receive In contrast, an excess and surplus lines (e&s) insurance company is not required to be licensed by the state of florida. In some states, it is called an excess line insurance policy.

Source: graceybacker.com

Source: graceybacker.com

The $35 fee cap has been in place since 2001. Though it generally only comprises roughly 10% of the total florida property and casualty insurance marketplace, surplus lines insurance accounted for over $5.8 billion in premium in 2018 alone from insurers domiciled in the united states and abroad. Excess and surplus lines insurance enable consumers to obtain casualty or property insurance cover via an insurance market that is regulated by the respective state. Persons insured by surplus lines carriers do not have the protection of the florida insurance guaranty act to the extent of any right of recovery for the obligation of an insolvent insurer.” The florida surplus lines service office does not provide legal or tax advice.

Source: myfsla.com

Source: myfsla.com

Eligibility and filing requirements (all insurers): While they are not regulated by the florida department of insurance, they are regulated in other ways. We serve retail insurance agents for all surplus lines insurance in florida. The purpose of the florida surplus lines service office (fslso) are to protect consumers seeking insurance in this state, permit surplus lines insurance to (13). If you can dream it, surplus lines insurance can cover it!

Source: goldcoastschools.com

Source: goldcoastschools.com

That practice is cumbersome to insurers. Eligibility and filing requirements (all insurers): It can, however, conduct business in the state. Whenever agents, brokers, companies, or policyholders have specific questions pertaining to business practices, tax implications or statutory interpretation, we urge the respective parties to seek the counsel of a competent attorney or tax consultant licensed in the appropriate jurisdiction and area of. Surplus line insurance can be used by companies or.

Source: insurancejournal.com

Source: insurancejournal.com

A general lines agent, who cannot obtain coverage for a consumer in the standard market, can contact a florida licensed surplus lines agent to provide the coverage the. “ this insurance is issued pursuant to the florida surplus lines law. This is called a surplus line insurance policy. Hello, we are decotis specialty insurance. The surplus lines market plays an important role in.

363306 florida surplus lines service office *fslso is the current study manual vendor for the surplus lines agent state licensing examination. The purpose of the florida surplus lines service office (fslso) are to protect consumers seeking insurance in this state, permit surplus lines insurance to (13). Eligibility and filing requirements (all insurers): If you find yourself in a situation where you might need surplus lines coverage, you should seek advice from a licensed surplus lines insurance provider, or an attorney. A general lines agent, who cannot obtain coverage for a consumer in the standard market, can contact a florida licensed surplus lines agent to provide the coverage the consumer needs.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title surplus lines insurance florida by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information