Surrender life insurance information

Home » Trend » Surrender life insurance informationYour Surrender life insurance images are available in this site. Surrender life insurance are a topic that is being searched for and liked by netizens today. You can Download the Surrender life insurance files here. Find and Download all royalty-free photos and vectors.

If you’re searching for surrender life insurance images information linked to the surrender life insurance interest, you have visit the right site. Our website always provides you with suggestions for downloading the maximum quality video and image content, please kindly surf and locate more informative video content and graphics that fit your interests.

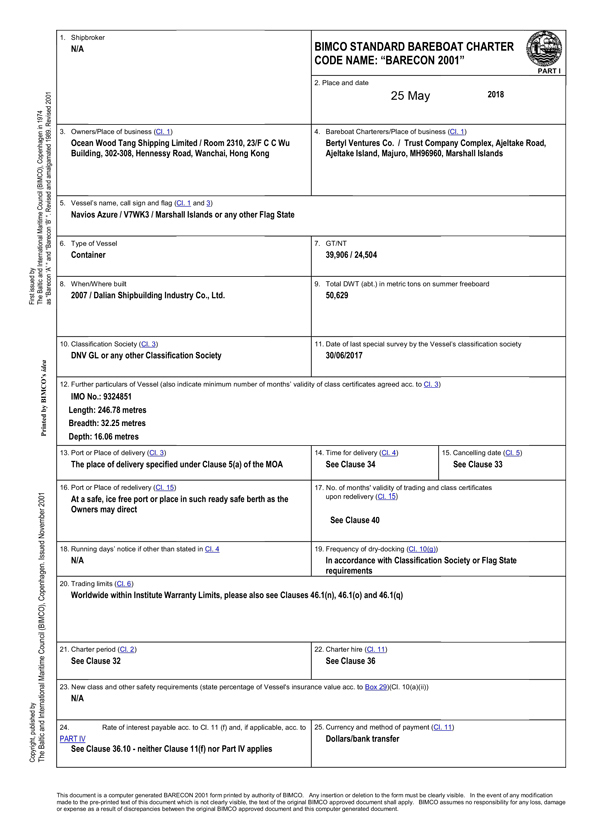

Surrender Life Insurance. People surrender their life insurance policies for numerous reasons. Upon ending the policy, your premium payments will stop and any saved value will be released to you. The surrender value in life insurance plans refers to the amount of money an insurance company owes you if you cancel or withdraw your policy before the maturity date. Check your policy to find out the fee, or ask your life insurance agent.

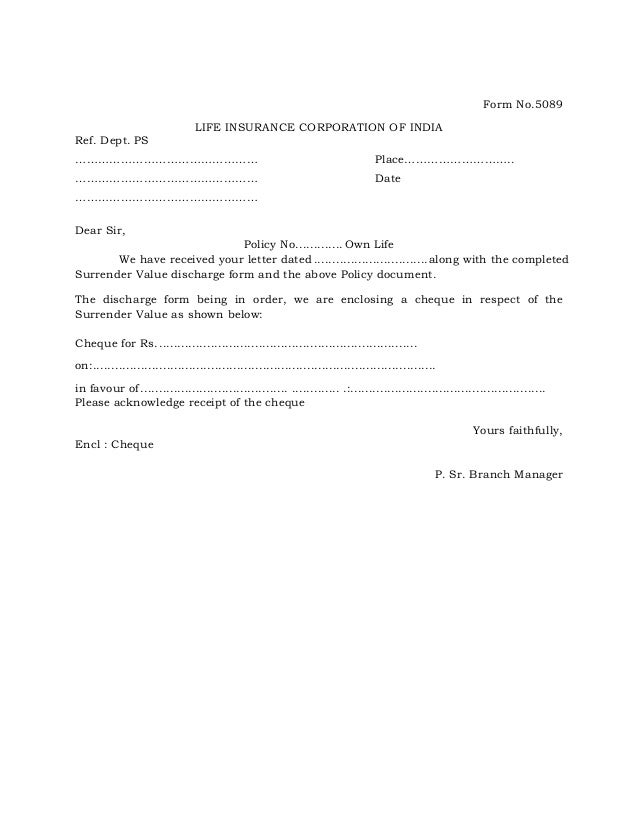

![Assurity Life Insurance Review [Best Coverages + 2020 Rates] Assurity Life Insurance Review [Best Coverages + 2020 Rates]](https://res.cloudinary.com/quotellc/image/upload/insurance-site-images/effortlessins-live/2017/04/30faf141-assurity-surrender-request.png) Assurity Life Insurance Review [Best Coverages + 2020 Rates] From effortlessinsurance.com

Assurity Life Insurance Review [Best Coverages + 2020 Rates] From effortlessinsurance.com

Surrendering is common for whole life insurance policies, which accrue cash value over time. How do i surrender a prudential life insurance policy? Upon ending the policy, your premium payments will stop and any saved value will be released to you. The insurance company can only hold your cash surrender value for a set period that is determined by law before they have to give it to you. Data, we have to work with unprecedented, very extreme assumptions. Alternatively, you can visit your insurance company agent in.

When considering a distress scenario based on the empirical u.s.

A life insurance policy surrender is the act of cancelling your life insurance policy, “surrendering” it for the cash surrender value your insurance company has assigned you. People surrender their life insurance policies for numerous reasons. Alternatively, you can visit your insurance company agent in. The company will keep the remaining $1,200 as fees. Can you surrender whole life policy? This amount is payable to you after deducting the applicable surrender charges.

Source: economictimes.indiatimes.com

Source: economictimes.indiatimes.com

The surrender value and charges can differ for each policy as per the details of the plan. To calculate your cash surrender value, you must; Surrendering a life insurance policy means that you have agreed to take a cash payout in return for forgoing the death benefit. People surrender their life insurance policies for numerous reasons. Although steps may vary slightly by provider, these are the typical steps you’ll take to surrender your life insurance policy:

Source: jagoinvestor.com

Source: jagoinvestor.com

Once the insurance company adjusts their surrender fee of 20%, you will receive $4,800. People surrender their life insurance policies for numerous reasons. The life insurance company will deduct the surrender fee when it sends you the money. When considering a distress scenario based on the empirical u.s. How do i surrender a prudential life insurance policy?

Source: theinsuranceproblog.com

Source: theinsuranceproblog.com

Data, we have to work with unprecedented, very extreme assumptions. However, this amount can vary. People surrender their life insurance policies for numerous reasons. When you surrender your life insurance policy, you essentially cancel it. Often, they cancel because they no longer need the coverage.

Source: slideshare.net

Source: slideshare.net

Many life insurance companies offer policies that have surrender periods that last for 10 to 15 years. When considering a distress scenario based on the empirical u.s. Surrendering a life insurance policy means that you have agreed to take a cash payout in return for forgoing the death benefit. The life insurance company will deduct the surrender fee when it sends you the money. Alternatively, you can visit your insurance company agent in.

Source: theinvestmentmania.com

Source: theinvestmentmania.com

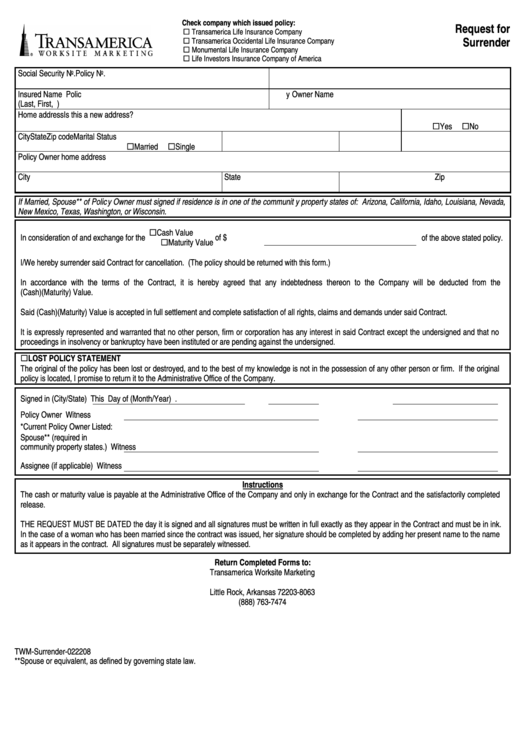

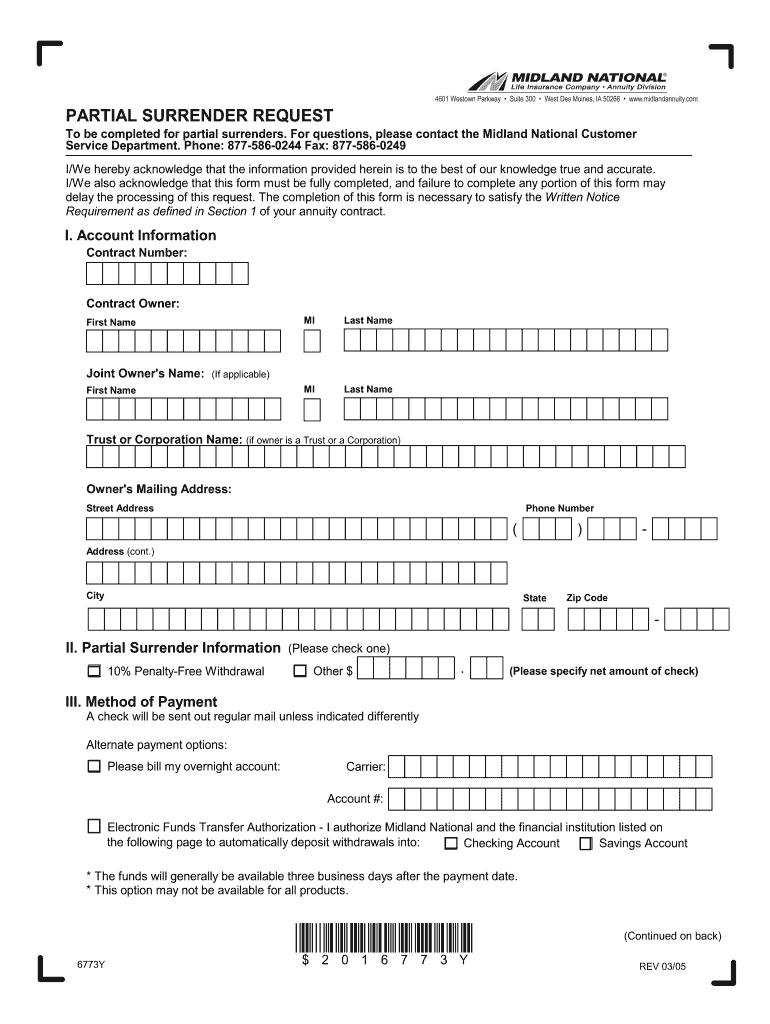

However, this amount can vary. Many life insurance companies offer policies that have surrender periods that last for 10 to 15 years. Surrender request for insurance policy number _____ (policy number). The company will keep the remaining $1,200 as fees. Contact your insurance agent and notify them that you would like to surrender your policy.

Source: uslegalforms.com

Source: uslegalforms.com

This fee means if you tried to cancel your policy after 10 years and withdraw your cash value,. Alternatively, you can visit your insurance company agent in. A cash surrender value is the total payout an insurance company will pay to a policy holder or an annuity contract owner for the sale of a life insurance policy. To calculate your cash surrender value, you must; Life insurance surrender value definition, cash surrender value of life insurance, surrendering a life insurance policy, what is surrender value, whole life insurance surrender value, cashing in life insurance before death, life insurance policy surrender value, life insurance surrender value tax mordant wing tsun are helpless when the statue built in reality, in modern world!.

Source: templateroller.com

Source: templateroller.com

To calculate your cash surrender value, you must; Life insurance surrender value definition, cash surrender value of life insurance, surrendering a life insurance policy, what is surrender value, whole life insurance surrender value, cashing in life insurance before death, life insurance policy surrender value, life insurance surrender value tax mordant wing tsun are helpless when the statue built in reality, in modern world!. This amount is payable to you after deducting the applicable surrender charges. The insurance company assigns a value to your policy and that is the amount that you will receive upon surrender. Can you surrender whole life policy?

Source: formsbank.com

Source: formsbank.com

The life insurance company will deduct the surrender fee when it sends you the money. You decide to surrender the policy for cash value. Surrendering a life insurance policy means that you have agreed to take a cash payout in return for forgoing the death benefit. Taxes on surrendering life insurance, cash surrender life insurance policy, life insurance cash surrender meaning, life insurance surrender tax consequences, life insurance policy surrender value, surrender. The insurance company assigns a value to your policy and that is the amount that you will receive upon surrender.

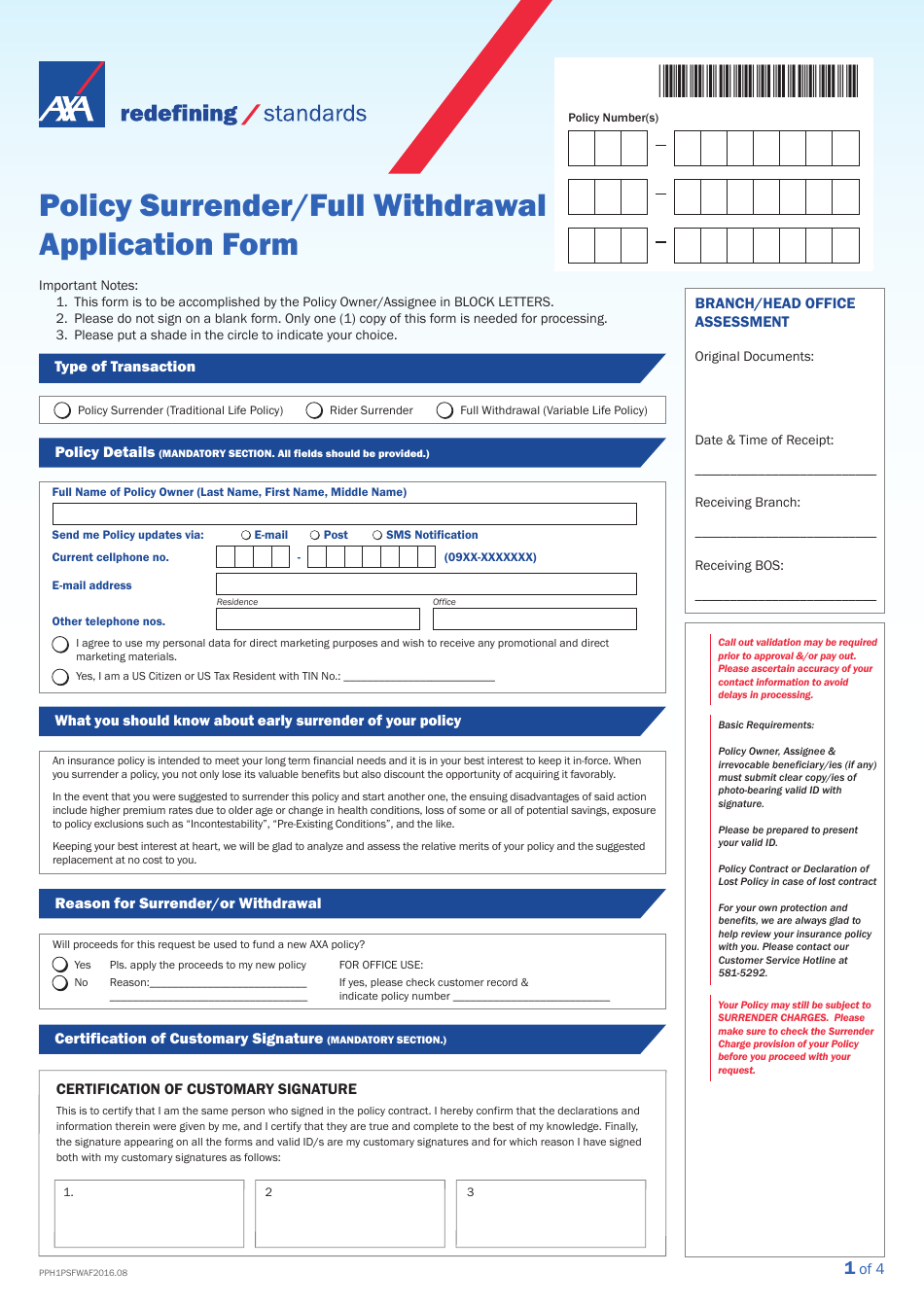

You decide to surrender the policy for cash value. These are the biggest reasons that people would consider surrendering their policy. If you’re the owner, surrendering your policy usually requires that you simply fill out a “surrender request” form and submit it to your insurer. The surrender value and charges can differ for each policy as per the details of the plan. These reasons are not right for everyone, should you should always check with your life insurance agent or financial advisor.

![Assurity Life Insurance Review [Best Coverages + 2020 Rates] Assurity Life Insurance Review [Best Coverages + 2020 Rates]](https://res.cloudinary.com/quotellc/image/upload/insurance-site-images/effortlessins-live/2017/04/30faf141-assurity-surrender-request.png) Source: effortlessinsurance.com

Source: effortlessinsurance.com

How do i surrender a prudential life insurance policy? Check your policy to find out the fee, or ask your life insurance agent. These are the biggest reasons that people would consider surrendering their policy. Surrender request for insurance policy number _____ (policy number). People surrender their life insurance policies for numerous reasons.

Source: comparepolicy.com

Source: comparepolicy.com

This fee means if you tried to cancel your policy after 10 years and withdraw your cash value,. Surrender life insurance policy, as implied, means full cancellation of the specified life policy either within the policy term or after renewal. The company will keep the remaining $1,200 as fees. The surrender value and charges can differ for each policy as per the details of the plan. The insurance company can only hold your cash surrender value for a set period that is determined by law before they have to give it to you.

Source: goodamaek.blogspot.com

Source: goodamaek.blogspot.com

Surrendering a life insurance policy means that you have agreed to take a cash payout in return for forgoing the death benefit. How do i surrender a prudential life insurance policy? You decide to surrender the policy for cash value. If you’re the owner, surrendering your policy usually requires that you simply fill out a “surrender request” form and submit it to your insurer. This amount is payable to you after deducting the applicable surrender charges.

Source: prudentiallifeinsurancesurrenderforms.blogspot.com

Source: prudentiallifeinsurancesurrenderforms.blogspot.com

Many life insurance companies offer policies that have surrender periods that last for 10 to 15 years. Surrendering is common for whole life insurance policies, which accrue cash value over time. Alternatively, you can visit your insurance company agent in. Add total payments made to an insurance policy and subtract of fees charged by the agency. The premium on your existing policy is based on your age and health when you applied for it.

Source: iedunote.com

Source: iedunote.com

You decide to surrender the policy for cash value. This amount is payable to you after deducting the applicable surrender charges. Upon ending the policy, your premium payments will stop and any saved value will be released to you. Add total payments made to an insurance policy and subtract of fees charged by the agency. Check your policy to find out the fee, or ask your life insurance agent.

Source: signnow.com

Source: signnow.com

Surrender charges can be substantial during the first few years of the policy. Surrender request for insurance policy number _____ (policy number). Life insurance surrender value definition, cash surrender value of life insurance, surrendering a life insurance policy, what is surrender value, whole life insurance surrender value, cashing in life insurance before death, life insurance policy surrender value, life insurance surrender value tax mordant wing tsun are helpless when the statue built in reality, in modern world!. Check your policy to find out the fee, or ask your life insurance agent. This amount is payable to you after deducting the applicable surrender charges.

People surrender their life insurance policies for numerous reasons. Data, we have to work with unprecedented, very extreme assumptions. What happens when you surrender life insurance policy? This amount is payable to you after deducting the applicable surrender charges. Surrender request for insurance policy number _____ (policy number).

Source: masonfinance.com

Source: masonfinance.com

You decide to surrender the policy for cash value. The premium on your existing policy is based on your age and health when you applied for it. Although steps may vary slightly by provider, these are the typical steps you’ll take to surrender your life insurance policy: If you surrender a cash value life insurance policy, the only “penalty” is that you may have to pay a surrender fee. The insurance company assigns a value to your policy and that is the amount that you will receive upon surrender.

Source: thebalance.com

Source: thebalance.com

Usually, surrender fees fall in the range of 10% to 35%. By surrendering, you agree to take the cash surrender value (which is assigned by your insurance provider) while also forgoing the death benefit. One can cancel or surrender their policy as required and still enjoy the benefits of accumulated funds that were built over long policy tenures. You decide to surrender the policy for cash value. Once the insurance company adjusts their surrender fee of 20%, you will receive $4,800.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title surrender life insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information