Survival period insurance Idea

Home » Trend » Survival period insurance IdeaYour Survival period insurance images are ready in this website. Survival period insurance are a topic that is being searched for and liked by netizens today. You can Download the Survival period insurance files here. Get all free vectors.

If you’re searching for survival period insurance pictures information related to the survival period insurance interest, you have come to the right blog. Our website frequently provides you with suggestions for downloading the maximum quality video and picture content, please kindly search and locate more informative video articles and graphics that match your interests.

Survival Period Insurance. The policy pays out if you are unable to work again. Upon completion of the survival period, if the policyholder survives, the insurer pays them a lump. The duration or length of the survival period varies from company to company. It is mostly applicable to critical illness insurance policies.

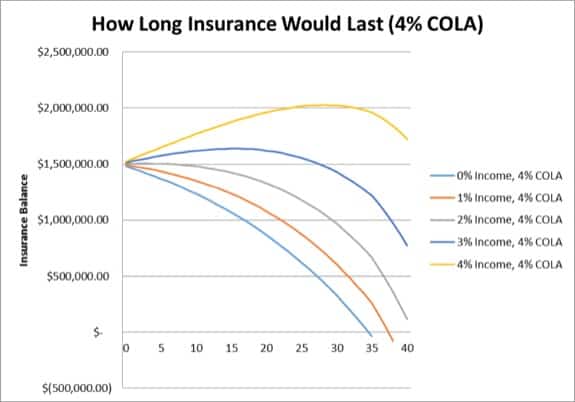

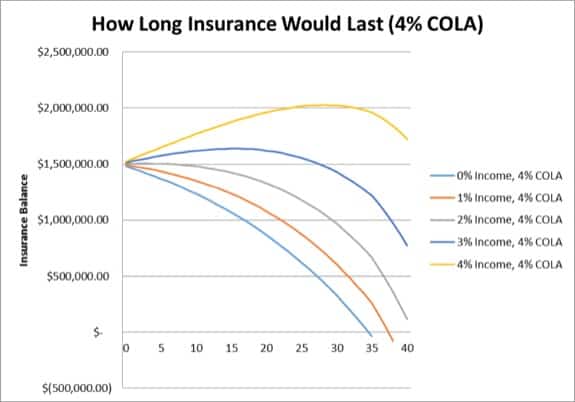

Term Life Insurance Vs. Survivor Benefit Plan (SBP) A From themilitarywallet.com

Term Life Insurance Vs. Survivor Benefit Plan (SBP) A From themilitarywallet.com

Bluntly speaking, the insured must live beyond the survival period to raise a claim against the policy. According to best practices, between 12 and 24 months is a normal length of time for a survival period; He probably didn’t answer any of your questions to the point or explain any of the fine print. A survival period is the expiration period that is dedicated to indemnification claims, which are created under the warranties and representations of an acquisition agreement. Survival period is the duration for which a policyholder needs to survive after getting diagnosed with a major illness so that a claim can be raised. During the initial waiting period, the policyholder cannot claim from his/her cancer insurance policy.

The survival period refers to the time period that the insured must survive after being diagnosed with a critical illness, such as cancer, cardiovascular diseases, etc.

During the initial waiting period, the policyholder cannot claim from his/her cancer insurance policy. Your survival period may vary from your insurer to insurer. According to best practices, between 12 and 24 months is a normal length of time for a survival period; Survival period is the duration for which a policyholder needs to survive after getting diagnosed with a major illness so that a claim can be raised. What is the survival period in health insurance? A critical illness health insurance plan�s survival period is.

Source: sgmoneymatters.com

Source: sgmoneymatters.com

Upon completion of the survival period, if the policyholder survives, the insurer pays them a lump. This factor must be considered when getting insurance. Depending upon the insurer, this period may vary. The policy pays out if you are unable to work again. However, this period can range between 0 and 180 days depending on the type of the policy and the insurance company.

Source: bugoutexpert.com

Source: bugoutexpert.com

Upon completion of the survival period, if the policyholder survives, the insurer pays them a lump. The survival period is the amount of time you are supposed to survive after being diagnosed with a critical illness. Critical illness insurance quotes and advice Depending upon the insurer, this period may vary. A shorter survival period will save you from emotional drainage.

Source: radiopublic.com

Source: radiopublic.com

Since critical illness policies are not a death benefit, it won’t be beneficial to your family members if you die within the survival period. Critical illness insurance quotes and advice Generally, buyers prefer long survival periods to ensure recourse regardless of when an issue arises. Since critical illness policies are not a death benefit, it won’t be beneficial to your family members if you die within the survival period. Survival period is the time period that the policyholder must survive after the diagnosis in order to claim the critical illness plan;

Source: securenow.in

Source: securenow.in

The survival period sets forth the time during which the parties may bring an indemnification claim. The survival period sets forth the time during which the parties may bring an indemnification claim. The duration or length of the survival period varies from company to company. Your survival period may vary from your insurer to insurer. However, 30 days is the most common survival period for most insurers.

Source: bugoutexpert.com

Source: bugoutexpert.com

Most health insurance companies have mandated survival periods for critical illnesses, as it is a. The survival period for a health insurance policy is usually 30 days. However, 30 days is the most common survival period for most insurers. The survival period sets forth the time during which the parties may bring an indemnification claim. Usually, the survival period varies from 14 to 30 days.

Source: researchgate.net

Source: researchgate.net

It refers to the period of time that you need to survive after the diagnosis of a critical illness (such as kidney or heart failure, cancer, etc.). To be eligible for the claim, the insured has to survive a specified number of days (usually it is 7 days for most of the plans) from the date of diagnosis of cancer known as survival period. Usually, the survival period varies from 14 to 30 days. The survival period sets forth the time during which the parties may bring an indemnification claim. Since critical illness policies are not a death benefit, it won’t be beneficial to your family members if you die within the survival period.

Source: bugoutexpert.com

Source: bugoutexpert.com

This factor must be considered when getting insurance. This time is known as the survival period. The policy pays out if you are unable to work again. The survival period is the amount of time you are supposed to survive after being diagnosed with a critical illness. All the benefits of the insurance can be availed once you have passed the survival period.

Source: bugoutexpert.com

Source: bugoutexpert.com

According to best practices, between 12 and 24 months is a normal length of time for a survival period; It is mostly applicable to critical illness insurance policies. The duration or length of the survival period varies from company to company. 18 months is also a widely accepted timeframe. To benefit from the claim amount, the insured must live beyond the survival period.

Source: themilitarywallet.com

Source: themilitarywallet.com

The survival period refers to the time period that the insured must survive after being diagnosed with a critical illness, such as cancer, cardiovascular diseases, etc. This survival period is in addition to the waiting period if any. This period can last anywhere between 14 to 90 days based on the illness and the insurer. All the benefits of the insurance can be availed once you have passed the survival period. It is mostly applicable to critical illness insurance policies.

Source: symboinsurance.com

Source: symboinsurance.com

Most health insurance companies have mandated survival periods for critical illnesses, as it is a. Generally, buyers prefer long survival periods to ensure recourse regardless of when an issue arises. To know more about survival periods in health insurance, read on. It refers to the period of time that you need to survive after the diagnosis of a critical illness (such as kidney or heart failure, cancer, etc.). The duration or length of the survival period varies from company to company.

Source: eliscartaodevisita.blogspot.com

Source: eliscartaodevisita.blogspot.com

During the initial waiting period, the policyholder cannot claim from his/her cancer insurance policy. What is a survival period? A critical illness health insurance plan�s survival period is. However, even health insurance policies could also include a survival period, which only becomes active after the critical illness is diagnosed. In simple terms, survival period means that the insured has to ‘survive’ a certain period after the first diagnosis of a critical illness in order to receive the benefits.

Source: bestprepperstore.com

Source: bestprepperstore.com

Critical illness insurance quotes and advice The survival period is the amount of time you are supposed to survive after being diagnosed with a critical illness. Do remember that the survival period is applicable in addition to the initial waiting period on your policy. Upon completion of the survival period, if the policyholder survives, the insurer pays them a lump. The length of the survival period.

Source: bestsurvivalknives.info

Source: bestsurvivalknives.info

Survival period is the duration for which a policyholder needs to survive after getting diagnosed with a major illness so that a claim can be raised. To benefit from the claim amount, the insured must live beyond the survival period. Upon completion of the survival period, if the policyholder survives, the insurer pays them a lump. The survival period of every critical illness plan can differ within a range of 14 to 30 days. What is the survival period in health insurance?

Source: bestsurvivalknives.info

Source: bestsurvivalknives.info

During the initial waiting period, the policyholder cannot claim from his/her cancer insurance policy. In simple terms, survival period means that the insured has to ‘survive’ a certain period after the first diagnosis of a critical illness in order to receive the benefits. What is the survival period in health insurance? The survival period sets forth the time during which the parties may bring an indemnification claim. Most policies require you to survive for a period of 14 days to make a claim.

Source: insurancebenifits.us

Source: insurancebenifits.us

It refers to the period of time that you need to survive after the diagnosis of a critical illness (such as kidney or heart failure, cancer, etc.). All the benefits of the insurance can be availed once you have passed the survival period. The survival period is the amount of time you are supposed to survive after being diagnosed with a critical illness. 18 months is also a widely accepted timeframe. What is the survival period in a health insurance plan?

Source: gotsmartstuff.com

Source: gotsmartstuff.com

This is an essential clause under a critical illness insurance policy as an insurance company does not pay the coverage amount unless the insured survives this period. Do remember that the survival period is applicable in addition to the initial waiting period on your policy. It refers to the period of time that you need to survive after the diagnosis of a critical illness (such as kidney or heart failure, cancer, etc.). Survival period is the duration for which a policyholder needs to survive after getting diagnosed with a major illness so that a claim can be raised. It is the length of time you must survive after the diagnosis of a critical illness as covered by the plan.

Source: bugoutexpert.com

Source: bugoutexpert.com

Some providers will pay out a set amount of benefit if one of your children suffers a qualifying critical illness. Bluntly speaking, the insured must live beyond the survival period to raise a claim against the policy. During the initial waiting period, the policyholder cannot claim from his/her cancer insurance policy. Most policies require you to survive for a period of 14 days to make a claim. Survival period is a period during which the policyholder should survive after he/she has been diagnosed with a covered illness.

Source: acko.com

Source: acko.com

18 months is also a widely accepted timeframe. Survival period is the time period that the policyholder must survive after the diagnosis in order to claim the critical illness plan; Survival period is the duration for which a policyholder needs to survive after getting diagnosed with a major illness so that a claim can be raised. Have a look at the plans below and see the survival period specified for each health insurance plan. Survival period in health insurance is usually related to critical illness plans.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title survival period insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information