Suze orman opinion on whole life insurance Idea

Home » Trending » Suze orman opinion on whole life insurance IdeaYour Suze orman opinion on whole life insurance images are available. Suze orman opinion on whole life insurance are a topic that is being searched for and liked by netizens now. You can Find and Download the Suze orman opinion on whole life insurance files here. Find and Download all free images.

If you’re searching for suze orman opinion on whole life insurance images information connected with to the suze orman opinion on whole life insurance interest, you have pay a visit to the right blog. Our site frequently gives you suggestions for refferencing the maximum quality video and picture content, please kindly hunt and locate more informative video content and graphics that fit your interests.

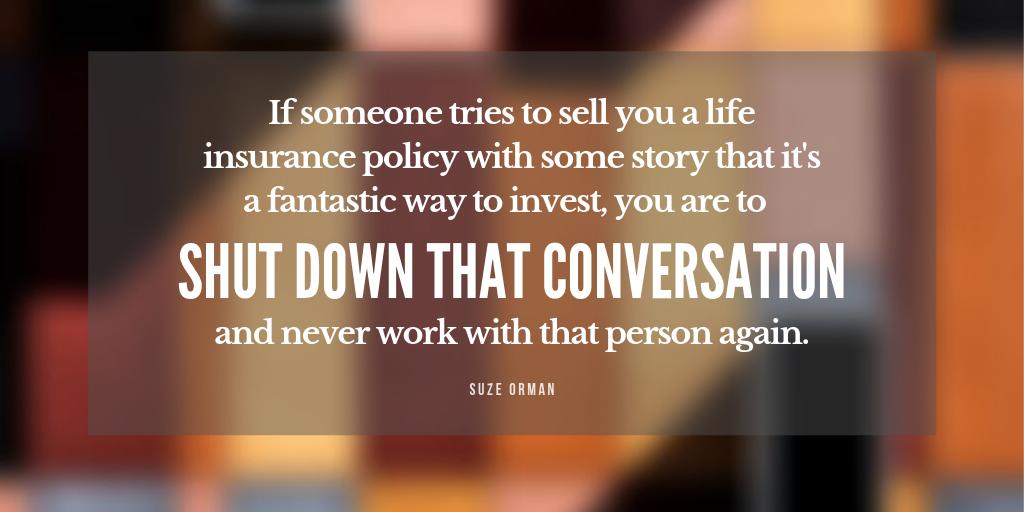

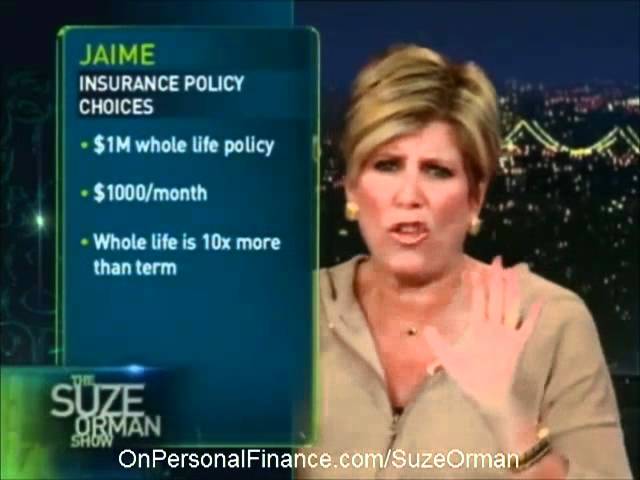

Suze Orman Opinion On Whole Life Insurance. Suze says, “ stop, stop, there isn�t a friend in the world, not one friend in the world that if it was a true friend would recommend you buy a whole life insurance policy. Suze orman explaining life insurance in general life insurance. $500,000 worth of whole life coverage = $14,000 per year. But if anyone—spouse, child, partner, parent,.

What Does Suze Orman Say About Life Insurance? Term or From lifeinsuranceblog.net

What Does Suze Orman Say About Life Insurance? Term or From lifeinsuranceblog.net

How seniors can choose the best life insurance life. Susan orman on life insurance about press copyright contact us creators advertise developers terms privacy policy & safety how youtube works test new features © 2022 google llc According to multiple public remarks on the subject she believes that unless you have a permanent need for life insurance—such as a special needs child—term insurance is the better deal for you. Get an experts opinion on life insurance capstone. She seems unaware of how they can be structured to grow cash value much faster and even more safely than banks and other highly liquid alternatives. Guaranteed acceptance life insurance is designed to appeal to older americans who want to make sure that when they die there is ample money for their heirs to pay for a funeral, and any outstanding bills, such as medical bills.

Considering that she�s 69 years old, she has a good handle on how seniors should.

Financial guru suze orman recommends taking stock of your which include universal and whole life insurance, which last until you die. If you love suze orman then you might want to understand more about her stance on whole life insurance. Here is a conversation with a guest calling in which will shed some light on her thoughts on term life insurance vs whole life. Check out more videos about term life insurance vs. Okay, i absolutely adore suze orman. Life insurance is meant to provide financial protection for those who are dependent on you at a point in your life when you have yet to build up other assets.

Source: youtube.com

Source: youtube.com

Suze orman is a personal financial guru that generally believes that term life insurance is the best use of life insurance for most americans. Like dave ramsey’s life insurance views, orman gets super upset and animated even at the question if you should buy term or whole life. Here is a conversation with a guest calling in which will shed some light on her thoughts on term life insurance vs whole life. A sweet 30 something woman asked her i am married with two young children. She believes that if there is anyone in your life who relies on your income, you need life insurance. orman goes on to.

Source: kangsantri008.blogspot.com

Source: kangsantri008.blogspot.com

According to multiple public remarks on the subject she believes that unless you have a permanent need for life insurance—such as a special needs child—term insurance is the better deal for you. Okay, now that you know it’s affordable, let’s review my key life insurance rules: A schnook, somebody who wants to take you, somebody who is in my opinion not a friend maybe, but there is no way a friend would do it ” gee tell us how you really feel. Like other financial artists like dave ramsey. Suze orman explaining life insurance in general life insurance.

Source: wholesalerforknockoffhandbags.blogspot.com

Source: wholesalerforknockoffhandbags.blogspot.com

She seems unaware of how they can be structured to grow cash value much faster and even more safely than banks and other highly liquid alternatives. A few other online life insurance. In orman’s opinion, they do nothing for you and everything for the salesperson on this hate list are three types of permanent life insurance: She believes that if there is anyone in your life who relies on your income, you need life insurance. orman goes on to. First because her life story is very encouraging (you should google it), and second because she pretty much goes straight to the point.

Source: prudentiallifeinsurancesurrenderforms.blogspot.com

Source: prudentiallifeinsurancesurrenderforms.blogspot.com

She believes that if there is anyone in your life who relies on your income, you need life insurance. orman goes on to. I am not a fan of this type of life insurance. Like dave ramsey’s life insurance views, orman gets super upset and animated even at the question if you should buy term or whole life. Okay, now that you know it’s affordable, let’s review my key life insurance rules: Life insurance is meant to provide financial protection for those who are dependent on you at a point in your life when you have yet to build up other assets.

Source: wholesalerforknockoffhandbags.blogspot.com

Source: wholesalerforknockoffhandbags.blogspot.com

If you love suze orman then you might want to understand more about her stance on whole life insurance. Susan orman on life insurance about press copyright contact us creators advertise developers terms privacy policy & safety how youtube works test new features © 2022 google llc Once you have accumulated assets that your dependents can fall back on— say, a sizable retirement fund or other significant investments— you no longer need life insurance. Get an experts opinion on life insurance capstone. If you love suze orman then you might want to understand more about her stance on whole life insurance.

Source: kangsantri008.blogspot.com

Source: kangsantri008.blogspot.com

Our financial advisor signed us up for a variable life. In his opinion, it is better to invest the money he will save on buying cheaper money. She believes that if there is anyone in your life who relies on your income, you need life insurance. orman goes on to. Our financial advisor signed us up for a variable life. Over the years, suze orman has discussed life insurance in detail.

Source: wholesales-price.blogspot.com

She believes that if there is anyone in your life who relies on your income, you need life insurance. orman goes on to. Once you have accumulated assets that your dependents can fall back on— say, a sizable retirement fund or other significant investments— you no longer need life insurance. Suze orman is a personal financial guru that generally believes that term life insurance is the best use of life insurance for most americans. For a term over 20 years, whole life insurance tends to be more cost effective. Considering that she�s 69 years old, she has a good handle on how seniors should.

Source: vimeo.com

Source: vimeo.com

Suze orman�s advice on when to buy life insurance is very straightforward. According to multiple public remarks on the subject she believes that unless you have a permanent need for life insurance—such as a special needs child—term insurance is the better deal for you. Here is a conversation with a guest calling in which will shed some light on her thoughts on term life insurance vs whole life. She believes that if there is anyone in your life who relies on your income, you need life insurance. orman goes on to. Guaranteed acceptance life insurance is designed to appeal to older americans who want to make sure that when they die there is ample money for their heirs to pay for a funeral, and any outstanding bills, such as medical bills.

Source: insurancequotes2day.com

Source: insurancequotes2day.com

I am not a fan of this type of life insurance. A sweet 30 something woman asked her i am married with two young children. About press copyright contact us creators advertise developers terms privacy policy & safety how youtube works test new features press copyright contact us creators. But if anyone—spouse, child, partner, parent,. She seems unaware of how they can be structured to grow cash value much faster and even more safely than banks and other highly liquid alternatives.

Source: keikaiookami.blogspot.com

Source: keikaiookami.blogspot.com

She believes the only type of life insurance you should bother with is term life insurance. Whoo boy, did my blood pressure rise. Suze has stated many times to never buy permanent insurance, and has harshly criticized (and often given misleading information) on whole life policies. 48 inspirational suze orman quotes 1. Ad compare & save on life insurance plans designed for expats & foreign citizens abroad.

Source: youtube.com

Source: youtube.com

Protect anyone dependent on your income. Suze has stated many times to never buy permanent insurance, and has harshly criticized (and often given misleading information) on whole life policies. Ad compare & save on life insurance plans designed for expats & foreign citizens abroad. Suze orman’s advice on life insurance. About press copyright contact us creators advertise developers terms privacy policy & safety how youtube works test new features press copyright contact us creators.

Source: marketrealist.com

Source: marketrealist.com

Ad compare & save on life insurance plans designed for expats & foreign citizens abroad. Get an experts opinion on life insurance capstone. Financial guru suze orman recommends taking stock of your which include universal and whole life insurance, which last until you die. Variable, universal and whole life insurance. If you are single with no children and no one relies on your income, you don’t need life insurance.

Source: policygenius.com

Source: policygenius.com

Over the years, suze orman has discussed life insurance in detail. Life insurance in brampton in 2020 life insurance quotes. She believes that if there is anyone in your life who relies on your income, you need life insurance. orman goes on to. $500,000 worth of whole life coverage = $14,000 per year. First because her life story is very encouraging (you should google it), and second because she pretty much goes straight to the point.

Source: pinterest.com

Source: pinterest.com

Whoo boy, did my blood pressure rise. First because her life story is very encouraging (you should google it), and second because she pretty much goes straight to the point. Like other financial artists like dave ramsey. A sweet 30 something woman asked her i am married with two young children. Suze orman takes a call from yvette who calls in to ask about the differences with life insurance term vs whole life insurance.

Source: insuranceandquotes.info

Source: insuranceandquotes.info

Suze orman explaining life insurance in general life insurance. Ad compare & save on life insurance plans designed for expats & foreign citizens abroad. Suze orman’s take in the following video, suze orman shows a 39 year old man who recently bought a 1 million whole life policy what he should do instead. A few other online life insurance. Suze orman weighs in her opinion on life insurance term vs whole life insurance basequotes.com base quotes offers the lowest online quote term insurance from the top life insurance companies across the us.

Source: kangsantri008.blogspot.com

Source: kangsantri008.blogspot.com

In his opinion, it is better to invest the money he will save on buying cheaper money. For a term over 20 years, whole life insurance tends to be more cost effective. Suze thinks permanent life insurance like whole life or indexed universal life (iuf) is a bad investment. I am not a fan of this type of life insurance. She believes the only type of life insurance you should bother with is term life insurance.

Source: insureye.com

Source: insureye.com

Like other financial artists like dave ramsey. Suze orman explaining life insurance in general life insurance. A caller has phoned in asking suze�s advice on whether to purchase a whole life policy recommended by a friend. Suze orman’s advice on life insurance. Whoo boy, did my blood pressure rise.

Source: pinterest.com

Source: pinterest.com

I am not a fan of this type of life insurance. But if anyone—spouse, child, partner, parent,. Here is a conversation with a guest calling in which will shed some light on her thoughts on term life insurance vs whole life. Suze has stated many times to never buy permanent insurance, and has harshly criticized (and often given misleading information) on whole life policies. For a term over 20 years, whole life insurance tends to be more cost effective.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title suze orman opinion on whole life insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information