Swiss re sigma world insurance in 2018 pdf information

Home » Trend » Swiss re sigma world insurance in 2018 pdf informationYour Swiss re sigma world insurance in 2018 pdf images are ready. Swiss re sigma world insurance in 2018 pdf are a topic that is being searched for and liked by netizens today. You can Find and Download the Swiss re sigma world insurance in 2018 pdf files here. Download all royalty-free photos and vectors.

If you’re searching for swiss re sigma world insurance in 2018 pdf images information linked to the swiss re sigma world insurance in 2018 pdf topic, you have come to the ideal blog. Our site always provides you with hints for viewing the maximum quality video and image content, please kindly hunt and locate more informative video content and images that fit your interests.

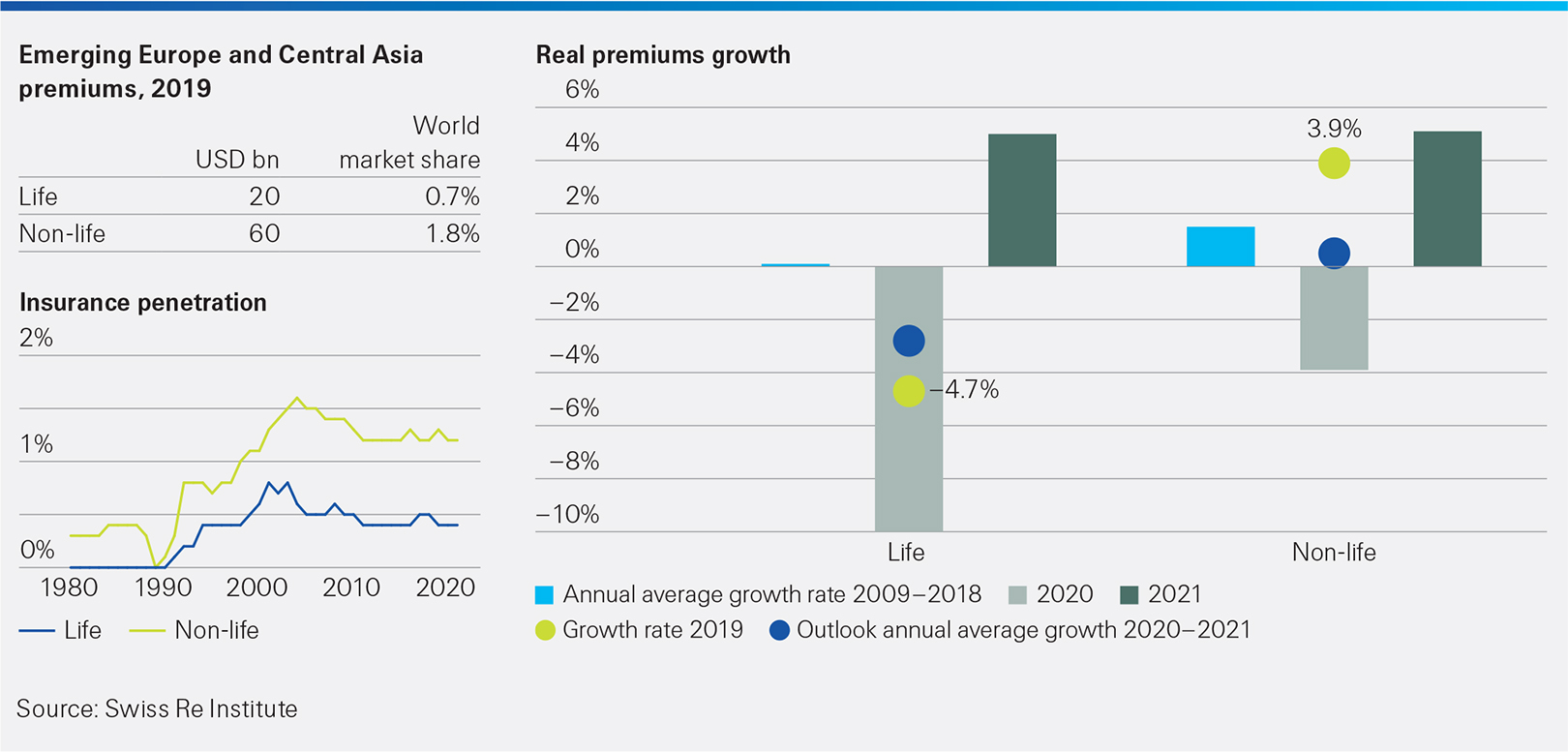

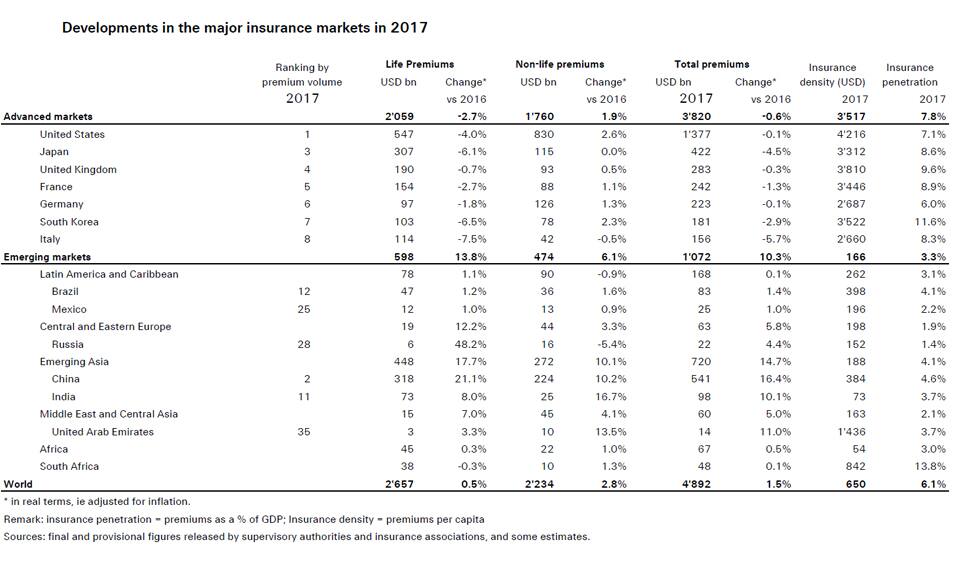

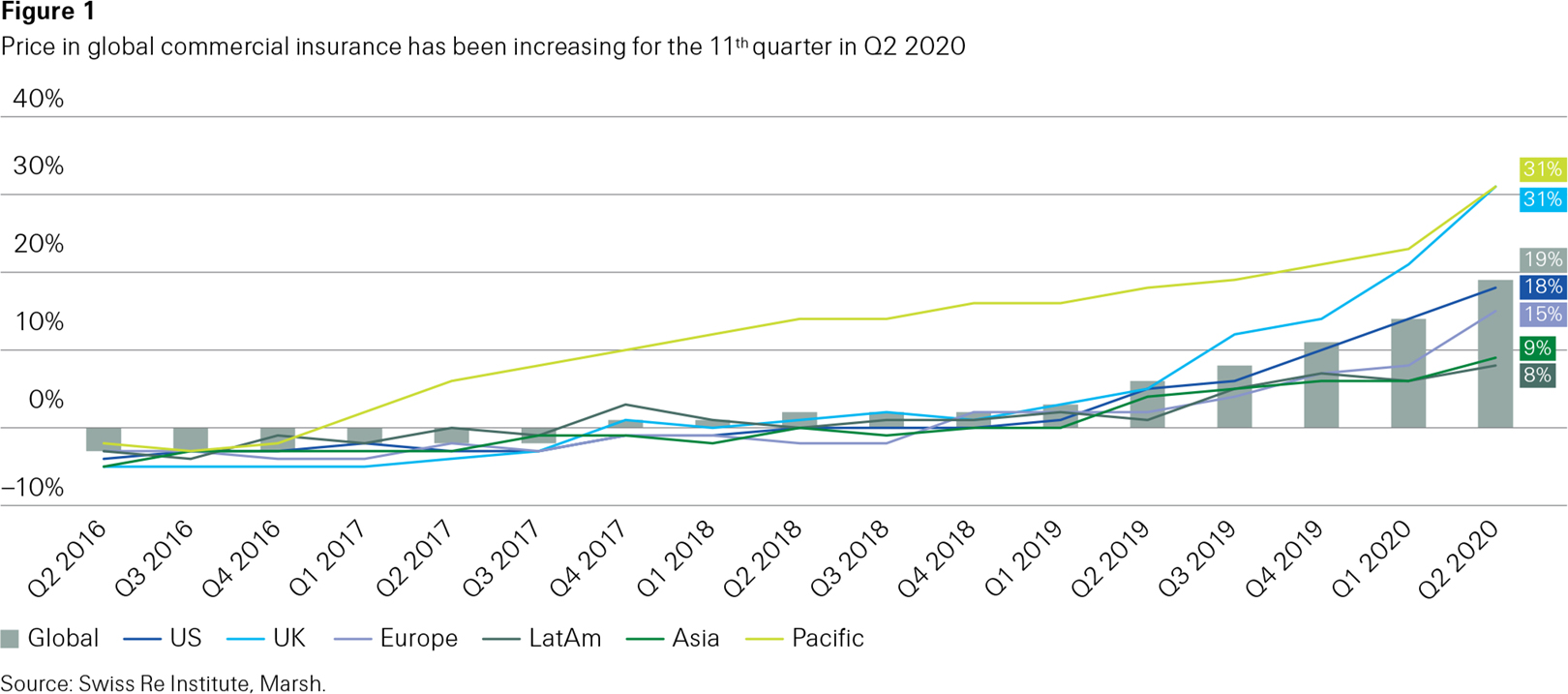

Swiss Re Sigma World Insurance In 2018 Pdf. World insurance premiums fell 1.3 percent in 2020, adjusted for inflation, to $6.3 trillion. Nonlife premiums in the emerging economies grew 7.8% in 2015, after inflation adjustment. World insurance premiums macroeconomic resilience index insurance resilience index and protection gap catastrophes climate resilience scores methodology (pdf) methodology (pdf) methodology (pdf) methodology (pdf. Currently, bangladesh’s insurance sector comprises 46 general insurance companies and 32 life insurance companies.

Gregory Berthier Swiss Re From laberthier.blogspot.com

Gregory Berthier Swiss Re From laberthier.blogspot.com

The world insurance sigma covers premiums written in the global primary insurance industry. Nonlife premiums in the emerging economies grew 7.8% in 2015, after inflation adjustment. Currently, bangladesh’s insurance sector comprises 46 general insurance companies and 32 life insurance companies. This page gives quick access to all the resources. But for 2017 and 2018 combined, the impact of. World insurance premiums fell 1.3 percent in 2020, adjusted for inflation, to $6.3 trillion.

Premium growth facts 20.1% 79.9%

The world insurance report 2021 from capgemini and efma explores how the current distribution models are being challenged and how technology can supercharge channel effectiveness and revenue. Premium growth facts 20.1% 79.9% We forecast that global growth will weaken to around 2.8% in 2020, as advanced markets and china slow while emerging economies strengthen. The world insurance report 2021 from capgemini and efma explores how the current distribution models are being challenged and how technology can supercharge channel effectiveness and revenue. Swiss re’s sigma 3/2021, world insurance: From 11% in 2018, china�s share of global premiums will rise to 20% by 2029.

Source: insurance-canada.ca

Source: insurance-canada.ca

World insurance premiums macroeconomic resilience index insurance resilience index and protection gap catastrophes climate resilience scores methodology (pdf) methodology (pdf) methodology (pdf) methodology (pdf. World insurance premiums fell 1.3 percent in 2020, adjusted for inflation, to $6.3 trillion. Nonlife premiums in the emerging economies grew 7.8% in 2015, after inflation adjustment. 0% 05 2020 global insurance outlook The world insurance sigma covers premiums written in the global primary insurance industry.

Source: swissre.com

Source: swissre.com

Premium growth facts 20.1% 79.9% We forecast that global growth will weaken to around 2.8% in 2020, as advanced markets and china slow while emerging economies strengthen. Premium growth facts 20.1% 79.9% Currently, bangladesh’s insurance sector comprises 46 general insurance companies and 32 life insurance companies. World insurance premiums fell 1.3 percent in 2020, adjusted for inflation, to $6.3 trillion.

Source: swissre.com

Swiss re institute sigma no 3/2019 1 executive summary global economic growth supported the insurance sector in 2018, with real gross domestic product (gdp)1 up 3.2%. The recovery gains pace is based on direct premium data from 147 countries, with detailed information on the largest 88 markets. From 11% in 2018, china�s share of global premiums will rise to 20% by 2029. Discover what insurers can do to digitally empower their channels and expand their distribution ecosystem to enhance customer engagement and sales effectiveness. The world insurance report 2021 from capgemini and efma explores how the current distribution models are being challenged and how technology can supercharge channel effectiveness and revenue.

World insurance premiums fell 1.3 percent in 2020, adjusted for inflation, to $6.3 trillion. This page gives quick access to all the resources. From 11% in 2018, china�s share of global premiums will rise to 20% by 2029. Swiss re institute sigma no 3/2019 1 executive summary global economic growth supported the insurance sector in 2018, with real gross domestic product (gdp)1 up 3.2%. We forecast that global growth will weaken to around 2.8% in 2020, as advanced markets and china slow while emerging economies strengthen.

Source: pkv-vorteile.de

Source: pkv-vorteile.de

Discover what insurers can do to digitally empower their channels and expand their distribution ecosystem to enhance customer engagement and sales effectiveness. World insurance premiums fell 1.3 percent in 2020, adjusted for inflation, to $6.3 trillion. Published annually, it has become one of the fixtures of the sigma programme since 1968, the publication�s inaugural year. Swiss re’s sigma 3/2021, world insurance: Sustainable re/insurance spans both the liability and the asset sides of our balance sheet, as well as our own operations.

Source: insurance-canada.ca

Source: insurance-canada.ca

The recovery gains pace is based on direct premium data from 147 countries, with detailed information on the largest 88 markets. Premium growth facts 20.1% 79.9% World insurance premiums macroeconomic resilience index insurance resilience index and protection gap catastrophes climate resilience scores methodology (pdf) methodology (pdf) methodology (pdf) methodology (pdf. From 11% in 2018, china�s share of global premiums will rise to 20% by 2029. Swiss re sigma no 3/2016 “world insurance in 2015:

Source: swissre.com

Source: swissre.com

The recovery gains pace is based on direct premium data from 147 countries, with detailed information on the largest 88 markets. Swiss re institute sigma no 3/2019 1 executive summary global economic growth supported the insurance sector in 2018, with real gross domestic product (gdp)1 up 3.2%. The recovery gains pace is based on direct premium data from 147 countries, with detailed information on the largest 88 markets. But for 2017 and 2018 combined, the impact of. In the advanced economies, nonlife premiums grew by 2.6% in 2015.

Source: insurance-canada.ca

Source: insurance-canada.ca

0% 05 2020 global insurance outlook This page gives quick access to all the resources. Us highlights swiss re institute 3 sigma 1/2018: Currently, bangladesh’s insurance sector comprises 46 general insurance companies and 32 life insurance companies. Swiss re sigma no 3/2016 “world insurance in 2015:

Source: swissre.com

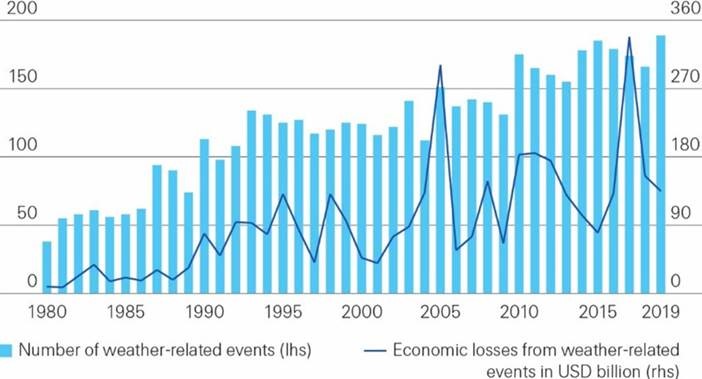

Discover what insurers can do to digitally empower their channels and expand their distribution ecosystem to enhance customer engagement and sales effectiveness. This page gives quick access to all the resources. Global insured losses from disaster events last year totaled $85 billion, swiss re ltd. The world insurance sigma covers premiums written in the global primary insurance industry. World insurance premiums macroeconomic resilience index insurance resilience index and protection gap catastrophes climate resilience scores methodology (pdf) methodology (pdf) methodology (pdf) methodology (pdf.

Source: swissre.com

Source: swissre.com

Us highlights swiss re institute 3 sigma 1/2018: Swiss re institute sigma no 3/2019 1 executive summary global economic growth supported the insurance sector in 2018, with real gross domestic product (gdp)1 up 3.2%. In the advanced economies, nonlife premiums grew by 2.6% in 2015. Global insured losses from disaster events last year totaled $85 billion, swiss re ltd. From 11% in 2018, china�s share of global premiums will rise to 20% by 2029.

Source: insurance-canada.ca

Source: insurance-canada.ca

The world insurance report 2021 from capgemini and efma explores how the current distribution models are being challenged and how technology can supercharge channel effectiveness and revenue. Steady growth amid regional disparities”; World insurance premiums macroeconomic resilience index insurance resilience index and protection gap catastrophes climate resilience scores methodology (pdf) methodology (pdf) methodology (pdf) methodology (pdf. Swiss re institute sigma no 3/2019 1 executive summary global economic growth supported the insurance sector in 2018, with real gross domestic product (gdp)1 up 3.2%. 0% 05 2020 global insurance outlook

We forecast that global growth will weaken to around 2.8% in 2020, as advanced markets and china slow while emerging economies strengthen. Sustainable re/insurance spans both the liability and the asset sides of our balance sheet, as well as our own operations. Premium growth facts 20.1% 79.9% World insurance premiums macroeconomic resilience index insurance resilience index and protection gap catastrophes climate resilience scores methodology (pdf) methodology (pdf) methodology (pdf) methodology (pdf. Swiss re’s sigma 3/2021, world insurance:

Source: researchgate.net

Source: researchgate.net

In the advanced economies, nonlife premiums grew by 2.6% in 2015. Swiss re’s sigma 3/2021, world insurance: World insurance premiums macroeconomic resilience index insurance resilience index and protection gap catastrophes climate resilience scores methodology (pdf) methodology (pdf) methodology (pdf) methodology (pdf. Swiss re institute sigma no 3/2019 1 executive summary global economic growth supported the insurance sector in 2018, with real gross domestic product (gdp)1 up 3.2%. We forecast that global growth will weaken to around 2.8% in 2020, as advanced markets and china slow while emerging economies strengthen.

Source: reinsurancene.ws

Source: reinsurancene.ws

National association of insurance commissioners source: The recovery gains pace is based on direct premium data from 147 countries, with detailed information on the largest 88 markets. Swiss re’s sigma 3/2021, world insurance: This page gives quick access to all the resources. But for 2017 and 2018 combined, the impact of.

Source: moneycontrol.com

Source: moneycontrol.com

From 11% in 2018, china�s share of global premiums will rise to 20% by 2029. We forecast that global growth will weaken to around 2.8% in 2020, as advanced markets and china slow while emerging economies strengthen. But for 2017 and 2018 combined, the impact of. Sustainable re/insurance spans both the liability and the asset sides of our balance sheet, as well as our own operations. World insurance premiums fell 1.3 percent in 2020, adjusted for inflation, to $6.3 trillion.

Source: laberthier.blogspot.com

Source: laberthier.blogspot.com

The recovery gains pace is based on direct premium data from 147 countries, with detailed information on the largest 88 markets. We forecast that global growth will weaken to around 2.8% in 2020, as advanced markets and china slow while emerging economies strengthen. Global insured losses from disaster events last year totaled $85 billion, swiss re ltd. But for 2017 and 2018 combined, the impact of. Nonlife premiums in the emerging economies grew 7.8% in 2015, after inflation adjustment.

Source: us.dujuz.com

Source: us.dujuz.com

We forecast that global growth will weaken to around 2.8% in 2020, as advanced markets and china slow while emerging economies strengthen. In the advanced economies, nonlife premiums grew by 2.6% in 2015. Swiss re’s sigma 3/2021, world insurance: The central narrative of this year�s annual world insurance sigma is the continued rise of the emerging markets, mostly emerging asia and china in particular, as the main drivers of industry growth. This page gives quick access to all the resources.

Source: tradingeconomics.com

Source: tradingeconomics.com

Swiss re’s sigma 3/2021, world insurance: Discover what insurers can do to digitally empower their channels and expand their distribution ecosystem to enhance customer engagement and sales effectiveness. In the advanced economies, nonlife premiums grew by 2.6% in 2015. World insurance premiums macroeconomic resilience index insurance resilience index and protection gap catastrophes climate resilience scores methodology (pdf) methodology (pdf) methodology (pdf) methodology (pdf. We forecast that global growth will weaken to around 2.8% in 2020, as advanced markets and china slow while emerging economies strengthen.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title swiss re sigma world insurance in 2018 pdf by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information