Tail insurance medical information

Home » Trend » Tail insurance medical informationYour Tail insurance medical images are available in this site. Tail insurance medical are a topic that is being searched for and liked by netizens now. You can Find and Download the Tail insurance medical files here. Get all royalty-free photos.

If you’re searching for tail insurance medical images information related to the tail insurance medical topic, you have visit the ideal blog. Our website always provides you with suggestions for downloading the highest quality video and picture content, please kindly search and find more enlightening video articles and graphics that fit your interests.

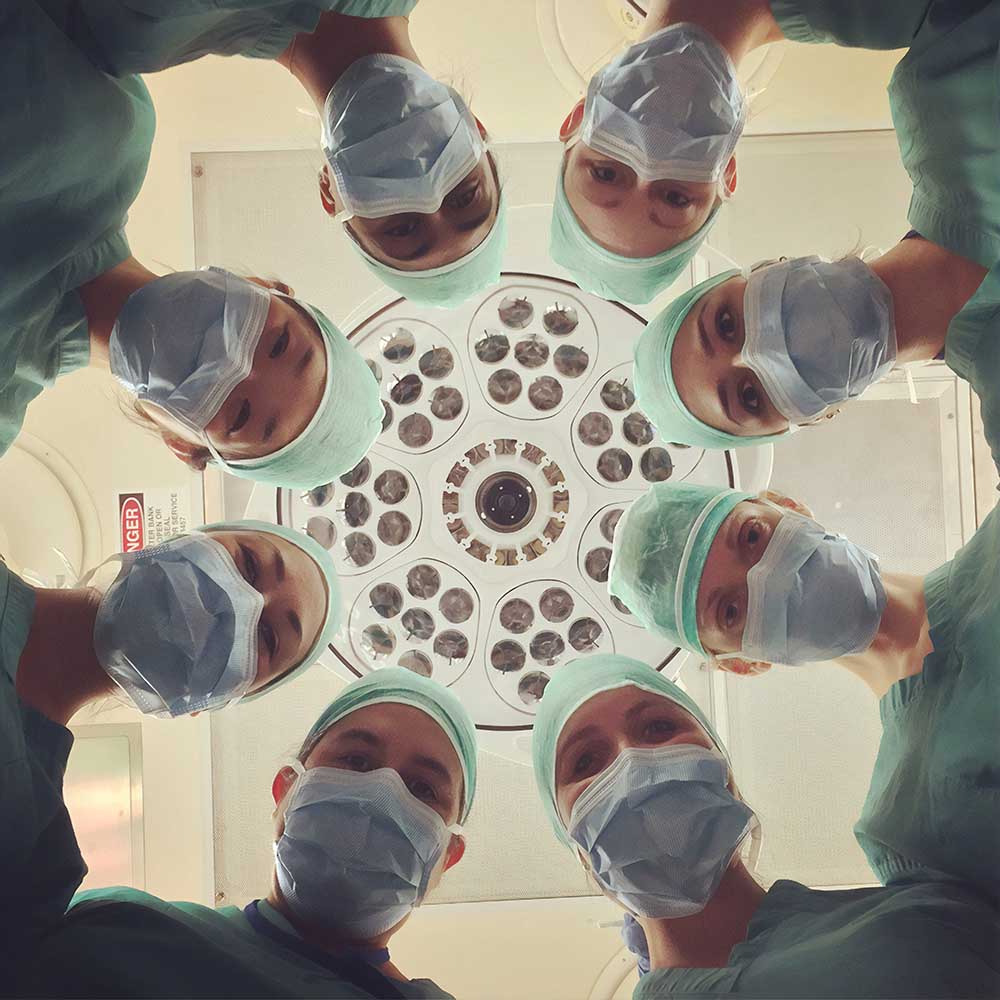

Tail Insurance Medical. This post will help doctors understand what tail insurance is, why they need it, how much tail costs, and offer practical advice on how to obtain affordable malpractice tail coverage. Tail coverage is an “extended reporting endorsement” to us insurance folks. Insurance that covers medical professionals after they’ve left a job is called tail insurance. Doctor a�s insurance policy is in effect from january 1, 2010 through december 31, 2020.

How Much Does Dental Malpractice Insurance Cost at Insurance From revisi.net

How Much Does Dental Malpractice Insurance Cost at Insurance From revisi.net

The premium charge for tail coverage varies from carrier to carrier and. Tail coverage provides insurance for medical malpractice claims made after a doctor’s malpractice insurance policy has ended, as long as the (15). This coverage is also known as an extended reporting period. Erp (tail) coverage insurance providing comprehensive malpractice tail insurance to physicians & healthcare providers in california, arizona & nevada. That is your basis for this calculus: Call us today @ clifton insurance agency.

That is your basis for this calculus:

What is tail coverage for medical malpractice? You need to either purchase the extended reporting endorsement (“tail”) from your current carrier or purchase prior acts (“nose”) coverage from the new insurance carrier. Healthcare providers need medical malpractice insurance to protect themselves from medical malpractice lawsuits. It gives your business protection for claims that are reported after your insurance policy ends. Call us today @ clifton insurance agency. A personal loan could come in handy to purchase coverage and extend malpractice insurance in (16).

Source: radsresident.com

Source: radsresident.com

The premium charge for tail coverage varies from carrier to carrier and. This post will help doctors understand what tail insurance is, why they need it, how much tail costs, and offer practical advice on how to obtain affordable malpractice tail coverage. Physicians who meet certain criteria will qualify for free tail coverage when they retire completely from the practice of medicine. Medical malpractice insurance is very different from other types of insurance that we buy on a regular basis so it is important for new practitioners to understand how these policies work. Insurance that covers medical professionals after they’ve left a job is called tail insurance.

Source: pandcinsurance.org

Source: pandcinsurance.org

You need to either purchase the extended reporting endorsement (“tail”) from your current carrier or purchase prior acts (“nose”) coverage from the new insurance carrier. Erp (tail) coverage insurance providing comprehensive malpractice tail insurance to physicians & healthcare providers in california, arizona & nevada. Malpractice insurance covers the costs of legal fees and settlements in the event of a malpractice lawsuit. Multiply that basis x 2.0 or 2.5 (or somewhere in between); It protects physicians when a former patient claims malpractice that took place during the physician�s previous plan�s coverage period.

Source: profrisk.com

Source: profrisk.com

√ physicians and surgeons √ allied & advanced healthcare providers √ not necessary for any policy written as occurence form √ often creative ways to get around purchasing tail coverage Tail coverage is typically one premium payment. You need to either purchase the extended reporting endorsement (“tail”) from your current carrier or purchase prior acts (“nose”) coverage from the new insurance carrier. This post will help doctors understand what tail insurance is, why they need it, how much tail costs, and offer practical advice on how to obtain affordable malpractice tail coverage. Medical malpractice nose and tail insurance.

Source: presidioinsurance.com

Source: presidioinsurance.com

Ask your insurance carrier for the last year’s non discounted annual premium. Erp (tail) coverage insurance providing comprehensive malpractice tail insurance to physicians & healthcare providers in california, arizona & nevada. Tail coverage is important because so many medical malpractice insurance claims are made months after the patient interaction occurs, and some may even be made years after the interaction. This coverage is also known as an extended reporting period. In contrast to a standard policy, tail coverage provides protection for medical malpractice claims that are reported after the provider�s policy expired or was cancelled.

Source: medpli.com

Source: medpli.com

Tail calculation for a standard medical malpractice insurance policy: Here is an example of how tail coverage works: A personal loan could come in handy to purchase coverage and extend malpractice insurance in (16). √ physicians and surgeons √ allied & advanced healthcare providers √ not necessary for any policy written as occurence form √ often creative ways to get around purchasing tail coverage It protects physicians when a former patient claims malpractice that took place during the physician�s previous plan�s coverage period.

Source: medpli.com

Source: medpli.com

This post will help doctors understand what tail insurance is, why they need it, how much tail costs, and offer practical advice on how to obtain affordable malpractice tail coverage. The worst part about this is that the physician needs to pay for their malpractice tail coverage in full within 30 days of either leaving their group or leaving private practice. Once you leave your job, however,. Healthcare providers need medical malpractice insurance to protect themselves from medical malpractice lawsuits. However, the extension only applies to wrongful acts that happened while the malpractice insurance policy was still in force, and it does not apply to wrongful acts that.

Source: medpli.com

Source: medpli.com

Contact your insurance agent to determine the cost of obtaining tail coverage. A personal loan could come in handy to purchase coverage and extend malpractice insurance in (16). Multiply that basis x 2.0 or 2.5 (or somewhere in between); Tail coverage is an “extended reporting endorsement” to us insurance folks. Medical malpractice insurance is very different from other types of insurance that we buy on a regular basis so it is important for new practitioners to understand how these policies work.

Source: hcpnational.com

Source: hcpnational.com

Please contact the doctors insurance agency for more information about the process involved in acquiring tail coverage. Doctor a�s insurance policy is in effect from january 1, 2010 through december 31, 2020. Even if your insurance policy was active while you were treating the patient, if a claim is brought against you after you have let your coverage lapse, it will not be covered. The premium charge for tail coverage varies from carrier to carrier and. Review your medical professional liability insurance policy to determine whether free tail coverage is offered.

Source: caitlin-morgan.com

Source: caitlin-morgan.com

Tail coverage is important because so many medical malpractice insurance claims are made months after the patient interaction occurs, and some may even be made years after the interaction. Insurance that covers medical professionals after they’ve left a job is called tail insurance. However, the extension only applies to wrongful acts that happened while the malpractice insurance policy was still in force, and it does not apply to wrongful acts that. Tail coverage can be purchased for an additional premium. Review your medical professional liability insurance policy to determine whether free tail coverage is offered.

Source: revisi.net

Source: revisi.net

The premium charge for tail coverage varies from carrier to carrier and. √ physicians and surgeons √ allied & advanced healthcare providers √ not necessary for any policy written as occurence form √ often creative ways to get around purchasing tail coverage Regardless of the type of medicine you practice, physicians need to make sure they cover their “nose” and their “tail”. Tail coverage is typically one premium payment. You need to either purchase the extended reporting endorsement (“tail”) from your current carrier or purchase prior acts (“nose”) coverage from the new insurance carrier.

Source: medpli.com

Source: medpli.com

Ask your insurance carrier for the last year’s non discounted annual premium. Healthcare providers need medical malpractice insurance to protect themselves from medical malpractice lawsuits. But not all insurance coverage works in the same way. Tail coverage extends the reporting period of malpractice insurance so that medical practitioners can report a wrongful act even after their malpractice insurance lapsed or was cancelled. “tail insurance” means the same thing as the formal term “extended reporting period (erp)”, in the scope of medical malpractice insurance.

Source: gallaghermalpractice.com

Source: gallaghermalpractice.com

A personal loan could come in handy to purchase coverage and extend malpractice insurance in (16). In contrast to a standard policy, tail coverage provides protection for medical malpractice claims that are reported after the provider�s policy expired or was cancelled. This coverage is also known as an extended reporting period. Erp (tail) coverage insurance providing comprehensive malpractice tail insurance to physicians & healthcare providers in california, arizona & nevada. Tail coverage provides insurance for medical malpractice claims made after a doctor’s malpractice insurance policy has ended, as long as the (15).

Source: advancedprofessional.com

Source: advancedprofessional.com

In contrast to a standard policy, tail coverage provides protection for medical malpractice claims that are reported after the provider�s policy expired or was cancelled. A personal loan could come in handy to purchase coverage and extend malpractice insurance in (16). You need to either purchase the extended reporting endorsement (“tail”) from your current carrier or purchase prior acts (“nose”) coverage from the new insurance carrier. Once you leave your job, however,. Please contact the doctors insurance agency for more information about the process involved in acquiring tail coverage.

Source: wrong-sidenews.blogspot.com

If so, you may need to obtain tail coverage. Tail coverage is important because so many medical malpractice insurance claims are made months after the patient interaction occurs, and some may even be made years after the interaction. Tail coverage can be purchased for an additional premium. This coverage is also known as an extended reporting period. Erp (tail) coverage insurance providing comprehensive malpractice tail insurance to physicians & healthcare providers in california, arizona & nevada.

Source: presidioinsurance.com

Source: presidioinsurance.com

Once you leave your job, however,. Many physicians believe that they are paying a lot of money for their medical malpractice insurance, but medical malpractice tail insurance is usually 1.5 to 2.5 times their current premium. Multiply that basis x 2.0 or 2.5 (or somewhere in between); Tail coverage is meant to address this problem by providing coverage for medical malpractice claims made after an insurance policy has ended. Insurance that covers medical professionals after they’ve left a job is called tail insurance.

Source: clickingfrogs.com

Source: clickingfrogs.com

Tail coverage is an “extended reporting endorsement” to us insurance folks. Tail calculation for a standard medical malpractice insurance policy: Tail coverage is important because so many medical malpractice insurance claims are made months after the patient interaction occurs, and some may even be made years after the interaction. Medical malpractice nose and tail insurance. It gives your business protection for claims that are reported after your insurance policy ends.

Source: cutcompcosts.com

Source: cutcompcosts.com

Healthcare providers need medical malpractice insurance to protect themselves from medical malpractice lawsuits. You need to either purchase the extended reporting endorsement (“tail”) from your current carrier or purchase prior acts (“nose”) coverage from the new insurance carrier. That is your basis for this calculus: This post will help doctors understand what tail insurance is, why they need it, how much tail costs, and offer practical advice on how to obtain affordable malpractice tail coverage. It protects physicians when a former patient claims malpractice that took place during the physician�s previous plan�s coverage period.

Source: medpli.com

Source: medpli.com

Tail coverage is an “extended reporting endorsement” to us insurance folks. Doctor a�s insurance policy is in effect from january 1, 2010 through december 31, 2020. Malpractice insurance covers the costs of legal fees and settlements in the event of a malpractice lawsuit. Tail insurance, or extended reporting period (erp) coverage, is the mechanism that allows future reporting of claims that have not yet been brought to your attention. Insurance that covers medical professionals after they’ve left a job is called tail insurance.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title tail insurance medical by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information