Tail malpractice insurance information

Home » Trend » Tail malpractice insurance informationYour Tail malpractice insurance images are available in this site. Tail malpractice insurance are a topic that is being searched for and liked by netizens now. You can Find and Download the Tail malpractice insurance files here. Find and Download all free photos.

If you’re searching for tail malpractice insurance images information related to the tail malpractice insurance interest, you have visit the right site. Our website frequently provides you with hints for seeking the maximum quality video and picture content, please kindly surf and find more informative video content and graphics that match your interests.

Tail Malpractice Insurance. Doctor a�s insurance policy is in effect from january 1, 2010 through december 31, 2020. How much does malpractice insurance tail coverage cost? After 2 or 3 years, the doctor wants to leave the group. If you retire from practice, take a sabbatical, or if your medical malpractice policy cancels or.

7 Secrets of Tail Malpractice Coverage your Agent Won’t From cunninghamgroupins.com

7 Secrets of Tail Malpractice Coverage your Agent Won’t From cunninghamgroupins.com

In contrast to the standard malpractice insurance, tail coverage insurance offers a physician protection for all malpractice claims reported after the doctor’s policy has expired or after its cancellation. This may be permitted under the statute of limitations, especially if the state uses a discovery rule that can extend the limitations period. Who pays the tail?” make sure responsibility for tail coverage if you leave the group is. “the group pays for malpractice insurance, and tail coverage is often not spelled out if the physician leaves. Medical malpractice insurance is very different from other types of insurance that we buy on a regular basis so it is important for new practitioners to understand how these policies work. You’ll be responsible for keeping your payments up to date to maintain coverage.

Learn about what tail coverage insurance is, how long it should last and more from the hartford.

Generally, it is 1 ½ to 2 times your annual premium. Learn about what tail coverage insurance is, how long it should last and more from the hartford. The most common way to obtain tail coverage is to purchase it from the same carrier that issued the policy being cancelled or terminated. Tail coverage will only protect you for past events, not any new events from services provided after you leave the firm. When doctors enter into employment agreements, medical malpractice insurance coverage is likely addressed. Get a business insurance quote today.

Source: perronservices.com

Source: perronservices.com

After 2 or 3 years, the doctor wants to leave the group. Your malpractice insurance still needs to be renewed at the end of every coverage period. Tail coverage in medical malpractice insurance policies sometimes a plaintiff in a medical malpractice claim brings the case years after the malpractice has occurred. This is only an estimate, and different types of packages exist that will change how much you pay for your tail coverage. Doctor a�s insurance policy is in effect from january 1, 2010 through december 31, 2020.

Source: cunninghamgroupins.com

Source: cunninghamgroupins.com

How much does malpractice insurance tail coverage cost? Tail malpractice insurance rates differ across insurance providers, but you can expect to pay anywhere from 1.5 to 2 times your current annual premium. Tail coverage will only protect you for past events, not any new events from services provided after you leave the firm. When doctors enter into employment agreements, medical malpractice insurance coverage is likely addressed. Your previous employer has provided your medical malpractice insurance up to this point, but now you need a tail policy to ensure you are protected since lawsuits can be brought for acts.

Source: vintageins.com

Source: vintageins.com

Tail malpractice insurance rates differ across insurance providers, but you can expect to pay anywhere from 1.5 to 2 times your current annual premium. Your previous employer has provided your medical malpractice insurance up to this point, but now you need a tail policy to ensure you are protected since lawsuits can be brought for acts. Doctor a�s insurance policy is in effect from january 1, 2010 through december 31, 2020. Also known as an extended reporting endorsement. The premium charge for tail coverage varies from carrier to carrier and.

Source: radsresident.com

Source: radsresident.com

In contrast to the standard malpractice insurance, tail coverage insurance offers a physician protection for all malpractice claims reported after the doctor’s policy has expired or after its cancellation. Medical malpractice insurance is very different from other types of insurance that we buy on a regular basis so it is important for new practitioners to understand how these policies work. After you receive your tail malpractice insurance quote from your current insurance company, give us a call — or fill out our tail malpractice insurance quote form above. Tail insurance covers the gap between when a physician leaves an employer and when the statute of limitations on filing a medical malpractice claims ends. You’ll be responsible for keeping your payments up to date to maintain coverage.

Source: gallaghermalpractice.com

Source: gallaghermalpractice.com

Tail coverage will only protect you for past events, not any new events from services provided after you leave the firm. If you are a physician with a medical malpractice policy, then you have likely heard the importance of also obtaining tail coverage, or a tail insurance policy. Tail coverage in medical malpractice insurance policies sometimes a plaintiff in a medical malpractice claim brings the case years after the malpractice has occurred. If you retire from practice, take a sabbatical, or if your medical malpractice policy cancels or. Medical malpractice nose and tail insurance.

Source: fishbowlapp.com

Source: fishbowlapp.com

Every insurance carrier has their own “tail factors” based on their underwriting guidelines and actuarial rules, so you may see a range in tail costs by carrier. When doctors enter into employment agreements, medical malpractice insurance coverage is likely addressed. Learn about what tail coverage insurance is, how long it should last and more from the hartford. A good rule of thumb is to plan for 2x your premium, but you can ask your agent for a. After you receive your tail malpractice insurance quote from your current insurance company, give us a call — or fill out our tail malpractice insurance quote form above.

Source: equotemd.com

Source: equotemd.com

Learn about what tail coverage insurance is, how long it should last and more from the hartford. The physician’s policy was in effect until december 2010. If you are a physician with a medical malpractice policy, then you have likely heard the importance of also obtaining tail coverage, or a tail insurance policy. Your previous employer has provided your medical malpractice insurance up to this point, but now you need a tail policy to ensure you are protected since lawsuits can be brought for acts. When doctors enter into employment agreements, medical malpractice insurance coverage is likely addressed.

Source: hcpnational.com

Source: hcpnational.com

Shorter tail is less expensive than unlimited tail. This is only an estimate, and different types of packages exist that will change how much you pay for your tail coverage. You’ll be responsible for keeping your payments up to date to maintain coverage. There are many malpractice insurance companies ready to compete for your tail policy. A good rule of thumb is to plan for 2x your premium, but you can ask your agent for a.

Source: teamais.net

Source: teamais.net

Some would argue that any price is worth staying protected after your. Medical malpractice nose and tail insurance. Medical malpractice insurance is very different from other types of insurance that we buy on a regular basis so it is important for new practitioners to understand how these policies work. Who pays the tail?” make sure responsibility for tail coverage if you leave the group is. Regardless of the type of medicine you practice, physicians need to make sure they cover their “nose” and their “tail”.

Source: sopyla.com

Source: sopyla.com

If your annual rate is $25,000 for malpractice insurance, your tail insurance would cost around $50,000. Unlimited tail or explore the option of a limited tail (1, 2, 3 or 5 years). The physician’s policy was in effect until december 2010. Some would argue that any price is worth staying protected after your. Doctor a�s insurance policy is in effect from january 1, 2010 through december 31, 2020.

Source: perronservices.com

Source: perronservices.com

Regardless of the type of medicine you practice, physicians need to make sure they cover their “nose” and their “tail”. Generally, it is 1 ½ to 2 times your annual premium. Tail insurance for medical malpractice insurance policies: Tail coverage in medical malpractice insurance policies sometimes a plaintiff in a medical malpractice claim brings the case years after the malpractice has occurred. Medical malpractice nose and tail insurance.

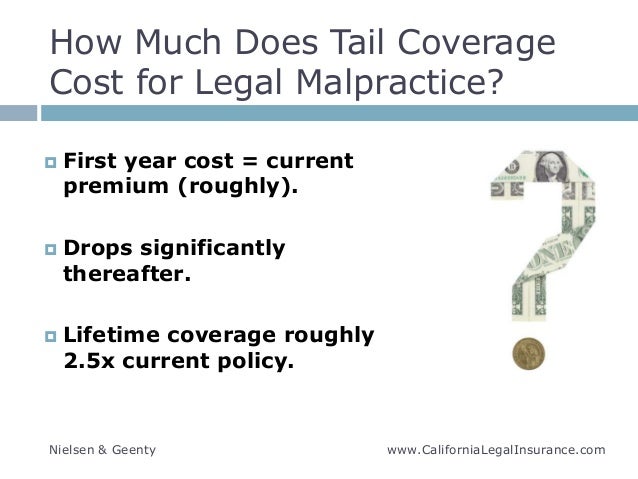

Source: slideshare.net

Source: slideshare.net

How much does malpractice insurance tail coverage cost? Regardless of the type of medicine you practice, physicians need to make sure they cover their “nose” and their “tail”. If you retire from practice, take a sabbatical, or if your medical malpractice policy cancels or. Doctor a�s insurance policy is in effect from january 1, 2010 through december 31, 2020. The most common way to obtain tail coverage is to purchase it from the same carrier that issued the policy being cancelled or terminated.

Source: slideshare.net

Source: slideshare.net

This may be permitted under the statute of limitations, especially if the state uses a discovery rule that can extend the limitations period. Ability to cover across multiple states and job exposures. Who pays the tail?” make sure responsibility for tail coverage if you leave the group is. Tail malpractice insurance rates differ across insurance providers, but you can expect to pay anywhere from 1.5 to 2 times your current annual premium. After you receive your tail malpractice insurance quote from your current insurance company, give us a call — or fill out our tail malpractice insurance quote form above.

Source: diederichhealthcare.com

Source: diederichhealthcare.com

Learn about what tail coverage insurance is, how long it should last and more from the hartford. Tail malpractice insurance rates differ across insurance providers, but you can expect to pay anywhere from 1.5 to 2 times your current annual premium. Every insurance carrier has their own “tail factors” based on their underwriting guidelines and actuarial rules, so you may see a range in tail costs by carrier. The cost of tail coverage for physicians is typically 200% of the annual premium at your malpractice policy’s end date. Shorter tail is less expensive than unlimited tail.

Source: wrong-sidenews.blogspot.com

For this reason, malpractice tail insurance is also referred to as an extended reporting period. For this reason, malpractice tail insurance is also referred to as an extended reporting period. Medical malpractice insurance is very different from other types of insurance that we buy on a regular basis so it is important for new practitioners to understand how these policies work. Also known as an extended reporting endorsement. The cost of tail coverage for physicians is typically 200% of the annual premium at your malpractice policy’s end date.

Source: caitlin-morgan.com

Source: caitlin-morgan.com

The most common way to obtain tail coverage is to purchase it from the same carrier that issued the policy being cancelled or terminated. But not all insurance coverage works in the same way. In contrast to the standard malpractice insurance, tail coverage insurance offers a physician protection for all malpractice claims reported after the doctor’s policy has expired or after its cancellation. Don�t get locked into taking the often very expensive tail coverage offered by your current carrier. Who pays the tail?” make sure responsibility for tail coverage if you leave the group is.

Source: physicianspractice.com

Source: physicianspractice.com

You’ll be responsible for keeping your payments up to date to maintain coverage. After you receive your tail malpractice insurance quote from your current insurance company, give us a call — or fill out our tail malpractice insurance quote form above. Medical malpractice insurance is very different from other types of insurance that we buy on a regular basis so it is important for new practitioners to understand how these policies work. In contrast to the standard malpractice insurance, tail coverage insurance offers a physician protection for all malpractice claims reported after the doctor’s policy has expired or after its cancellation. Every insurance carrier has their own “tail factors” based on their underwriting guidelines and actuarial rules, so you may see a range in tail costs by carrier.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title tail malpractice insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information