Tail policy insurance information

Home » Trending » Tail policy insurance informationYour Tail policy insurance images are available in this site. Tail policy insurance are a topic that is being searched for and liked by netizens today. You can Download the Tail policy insurance files here. Download all royalty-free photos and vectors.

If you’re searching for tail policy insurance pictures information related to the tail policy insurance interest, you have visit the right blog. Our site frequently provides you with hints for downloading the maximum quality video and image content, please kindly surf and locate more enlightening video content and graphics that fit your interests.

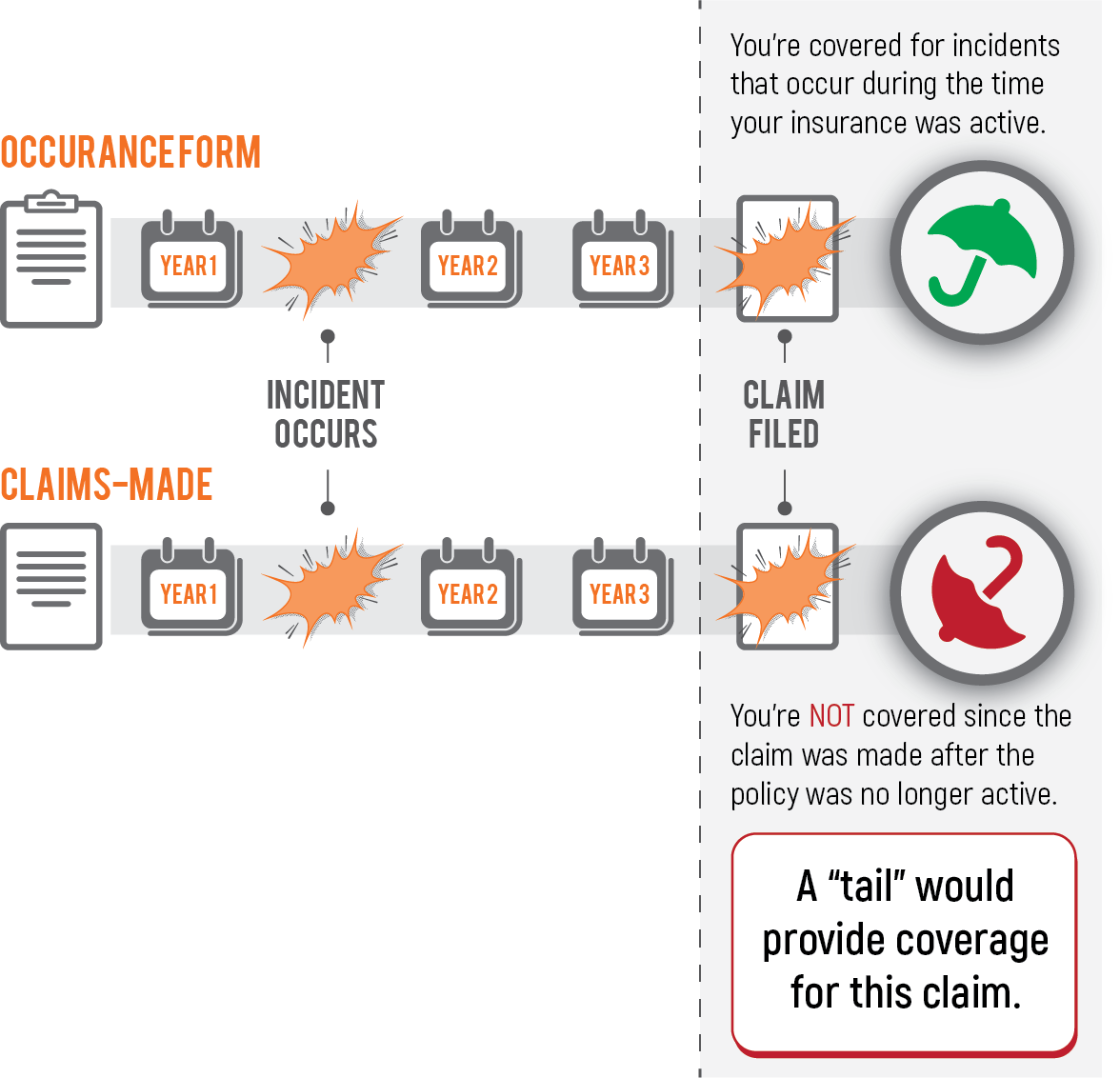

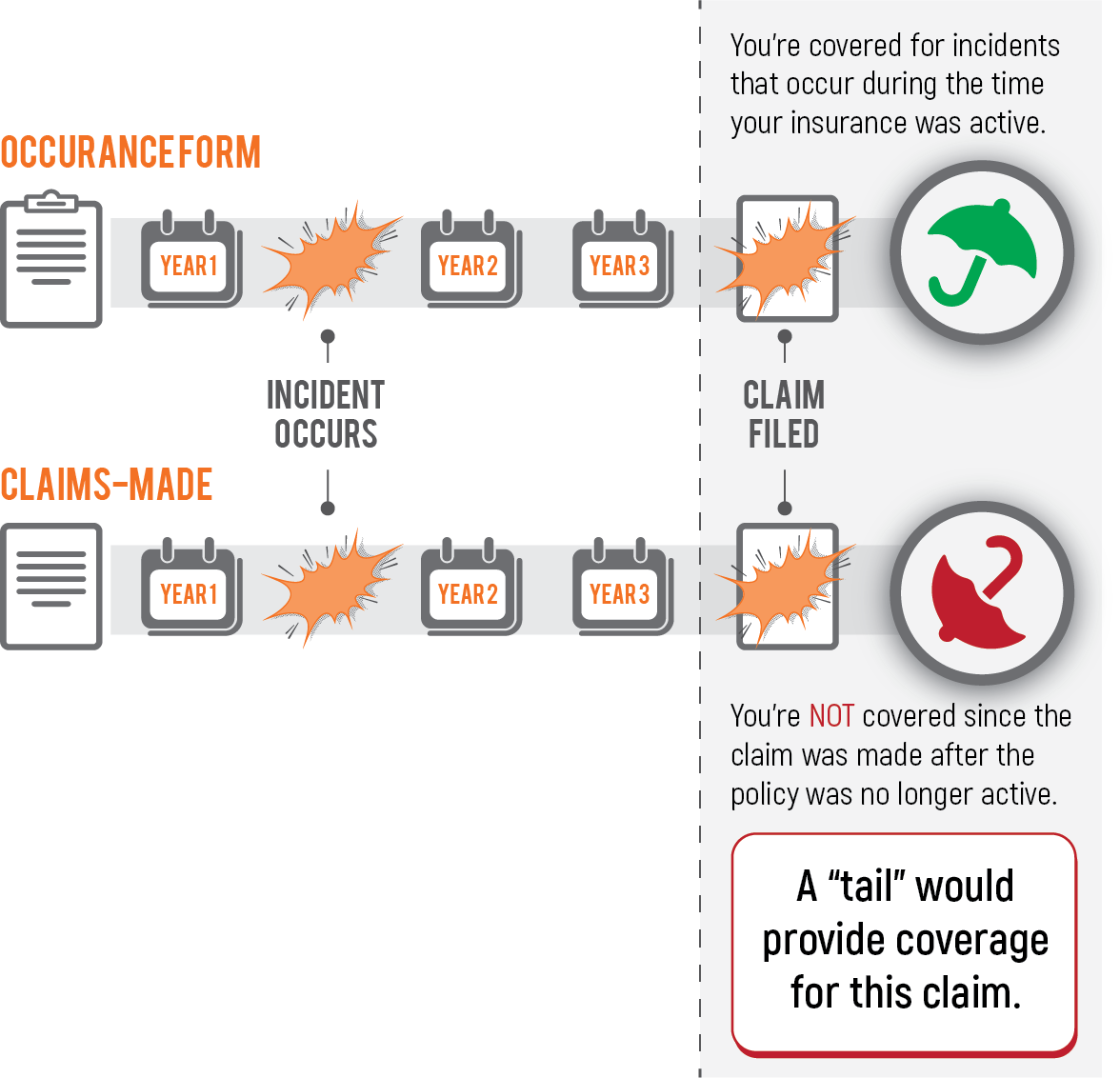

Tail Policy Insurance. That’s why it’s important to remember to pay attention to details like extended reporting provision (“erp”) or “tail” coverage options available in insurance policies that can protect the business going forward in the event of claims. An “occurrence” policy, on the other hand, focuses on when the incident that ends in a claim actually occurs, regardless of when the claim is filed. Tail policies should be considered and explored in both stock and asset purchases. What is a tail policy?

Keeping Up With Clinical Risk ManagementWho Needs From psfinc.com

Keeping Up With Clinical Risk ManagementWho Needs From psfinc.com

Tail coverage is an endorsement (or an addition) to your insurance that allows you to file a claim against your policy after it expired or was canceled. Tail coverage insurance is a provision within an insurance policy that allows the insured to make claims after a policy has expired for acts that occurred while the policy was still valid. It gives your business protection for claims that are reported after your insurance policy ends. An “occurrence” policy, on the other hand, focuses on when the incident that ends in a claim actually occurs, regardless of when the claim is filed. That’s why it’s important to remember to pay attention to details like extended reporting provision (“erp”) or “tail” coverage options available in insurance policies that can protect the business going forward in the event of claims. In this post, we mainly focus on d&o coverage and r&w policies.

It is critical to understand that this provision is not found on every insurance policy.

In m&a, the d&o insurance policy that responds to a claim is the policy that is in place at the time the claim is made. Tail coverage is meant to address this problem by providing coverage for medical malpractice claims made after an insurance policy has ended. “tail insurance policy” means that certain tail insurance policy relating to professional liability insurance purchased by sellers in connection with the transactions, providing coverage effective as of the closing date and through at least the third (3rd) anniversary of the closing date in the aggregate amount of ten million and no/100 dollars ($10,000,000.00), naming manager. Tail coverage insurance is a provision within an insurance policy that allows the insured to make claims after a policy has expired for acts that occurred while the policy was still valid. Tail coverage is usually offered by the insurance company your current policy is with. Most insurance policies cover claims made as long as the policy is in place.

Source: perronservices.com

Source: perronservices.com

Tail coverage is an endorsement (or an addition) to your insurance that allows you to file a claim against your policy after it expired or was canceled. Doctor a�s insurance policy is in effect from january 1, 2010 through december 31, 2020. It gives your business protection for claims that are reported after your insurance policy ends. Most insurance policies cover claims made as long as the policy is in place. The most common way to obtain tail coverage is to purchase it from the same carrier that issued the policy being cancelled or terminated.

Source: presidioinsurance.com

Source: presidioinsurance.com

In contrast to a standard policy, tail coverage provides protection for medical malpractice claims that are reported after the provider�s policy expired or was cancelled. These policies require the claim to be brought while the policy remains in effect. So, for example, if in 2020 a set of actions took place that is later challenged in 2021, it’s the 2021 policy that would respond, assuming you still have an active insurance policy in place. In m&a, the d&o insurance policy that responds to a claim is the policy that is in place at the time the claim is made. “tail insurance policy” means that certain tail insurance policy relating to professional liability insurance purchased by sellers in connection with the transactions, providing coverage effective as of the closing date and through at least the third (3rd) anniversary of the closing date in the aggregate amount of ten million and no/100 dollars ($10,000,000.00), naming manager.

Source: gallaghermalpractice.com

Source: gallaghermalpractice.com

(i) for a period of six (6) years from and after the closing date, the buyer shall purchase and maintain in effect policies of directors ’ and officers ’ liability insurance covering the indemnified persons and the buyer with respect to claims arising from facts or events that occurred on or. It allows the insured to report claims against a policy for a specified period after the policy has expired. An “occurrence” policy, on the other hand, focuses on when the incident that ends in a claim actually occurs, regardless of when the claim is filed. In m&a, the d&o insurance policy that responds to a claim is the policy that is in place at the time the claim is made. Tail policies should be considered and explored in both stock and asset purchases.

Source: gallaghermalpractice.com

Source: gallaghermalpractice.com

“tail insurance policy” means that certain tail insurance policy relating to professional liability insurance purchased by sellers in connection with the transactions, providing coverage effective as of the closing date and through at least the third (3rd) anniversary of the closing date in the aggregate amount of ten million and no/100 dollars ($10,000,000.00), naming manager. In this post, we mainly focus on d&o coverage and r&w policies. Typically, if you have an occurrence policy, you would not need tail coverage. Tail coverage is an endorsement (or an addition) to your insurance that allows you to file a claim against your policy after it expired or was canceled. Tail coverage requires that the insured pay additional premium.

Source: youtube.com

Source: youtube.com

It is critical to understand that this provision is not found on every insurance policy. It gives your business protection for claims that are reported after your insurance policy ends. In contrast to a standard policy, tail coverage provides protection for medical malpractice claims that are reported after the provider�s policy expired or was cancelled. Typically, if you have an occurrence policy, you would not need tail coverage. It is critical to understand that this provision is not found on every insurance policy.

Source: inspectorproinsurance.com

Source: inspectorproinsurance.com

It gives your business protection for claims that are reported after your insurance policy ends. It is critical to understand that this provision is not found on every insurance policy. What is a tail policy? (i) for a period of six (6) years from and after the closing date, the buyer shall purchase and maintain in effect policies of directors ’ and officers ’ liability insurance covering the indemnified persons and the buyer with respect to claims arising from facts or events that occurred on or. Tail policies should be considered and explored in both stock and asset purchases.

Source: perronservices.com

Source: perronservices.com

It allows the insured to report claims against a policy for a specified period after the policy has expired. The formal term for this type of coverage is extended reporting period (erp). “tail insurance policy” means that certain tail insurance policy relating to professional liability insurance purchased by sellers in connection with the transactions, providing coverage effective as of the closing date and through at least the third (3rd) anniversary of the closing date in the aggregate amount of ten million and no/100 dollars ($10,000,000.00), naming manager. Our tail end coverage insurance options, or extended reporting coverage, give our clients flexibility in their e&o and d&o policies. Doctor a�s insurance policy is in effect from january 1, 2010 through december 31, 2020.

Source: thehedgefundjournal.com

Source: thehedgefundjournal.com

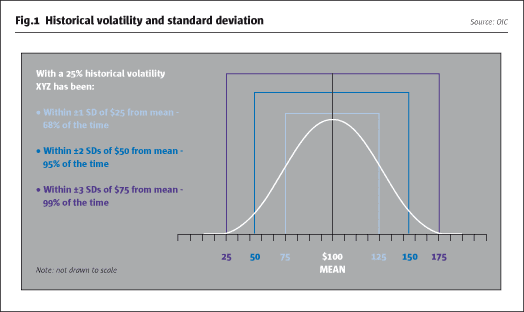

Greg doherty of poms & associates insurance. That’s why it’s important to remember to pay attention to details like extended reporting provision (“erp”) or “tail” coverage options available in insurance policies that can protect the business going forward in the event of claims. Tail policies should be considered and explored in both stock and asset purchases. Tail coverage requires that the insured pay additional premium. “tail insurance policy” means that certain tail insurance policy relating to professional liability insurance purchased by sellers in connection with the transactions, providing coverage effective as of the closing date and through at least the third (3rd) anniversary of the closing date in the aggregate amount of ten million and no/100 dollars ($10,000,000.00), naming manager.

Source: medresgrp.com

Source: medresgrp.com

It gives your business protection for claims that are reported after your insurance policy ends. Tail coverage is meant to address this problem by providing coverage for medical malpractice claims made after an insurance policy has ended. Tail coverage insurance is a provision within an insurance policy that allows the insured to make claims after a policy has expired for acts that occurred while the policy was still valid. Doctor a�s insurance policy is in effect from january 1, 2010 through december 31, 2020. In contrast to a standard policy, tail coverage provides protection for medical malpractice claims that are reported after the provider�s policy expired or was cancelled.

Source: demontinsurance.com

Source: demontinsurance.com

An “occurrence” policy, on the other hand, focuses on when the incident that ends in a claim actually occurs, regardless of when the claim is filed. “tail insurance policy” means that certain tail insurance policy relating to professional liability insurance purchased by sellers in connection with the transactions, providing coverage effective as of the closing date and through at least the third (3rd) anniversary of the closing date in the aggregate amount of ten million and no/100 dollars ($10,000,000.00), naming manager. What is a tail policy? Tail policies should be considered and explored in both stock and asset purchases. An “occurrence” policy, on the other hand, focuses on when the incident that ends in a claim actually occurs, regardless of when the claim is filed.

Source: prms.com

Source: prms.com

Typically, if you have an occurrence policy, you would not need tail coverage. Tail coverage is meant to address this problem by providing coverage for medical malpractice claims made after an insurance policy has ended. The formal term for this type of coverage is extended reporting period (erp). These policies require the claim to be brought while the policy remains in effect. An “occurrence” policy, on the other hand, focuses on when the incident that ends in a claim actually occurs, regardless of when the claim is filed.

Source: slideshare.net

Source: slideshare.net

Doctor a�s insurance policy is in effect from january 1, 2010 through december 31, 2020. It allows the insured to report claims against a policy for a specified period after the policy has expired. Tail coverage is usually offered by the insurance company your current policy is with. It protects physicians when a former patient claims malpractice that took place during the physician�s previous plan�s coverage period. Most insurance policies cover claims made as long as the policy is in place.

Source: psfinc.com

Source: psfinc.com

So, for example, if in 2020 a set of actions took place that is later challenged in 2021, it’s the 2021 policy that would respond, assuming you still have an active insurance policy in place. These policies require the claim to be brought while the policy remains in effect. So, for example, if in 2020 a set of actions took place that is later challenged in 2021, it’s the 2021 policy that would respond, assuming you still have an active insurance policy in place. Our tail end coverage insurance options, or extended reporting coverage, give our clients flexibility in their e&o and d&o policies. Tail coverage is usually offered by the insurance company your current policy is with.

Source: profrisk.com

Source: profrisk.com

An “occurrence” policy, on the other hand, focuses on when the incident that ends in a claim actually occurs, regardless of when the claim is filed. Tail coverage is usually offered by the insurance company your current policy is with. Typically, if you have an occurrence policy, you would not need tail coverage. An “occurrence” policy, on the other hand, focuses on when the incident that ends in a claim actually occurs, regardless of when the claim is filed. “tail insurance policy” means that certain tail insurance policy relating to professional liability insurance purchased by sellers in connection with the transactions, providing coverage effective as of the closing date and through at least the third (3rd) anniversary of the closing date in the aggregate amount of ten million and no/100 dollars ($10,000,000.00), naming manager.

Source: presidioinsurance.com

Source: presidioinsurance.com

“tail insurance policy” means that certain tail insurance policy relating to professional liability insurance purchased by sellers in connection with the transactions, providing coverage effective as of the closing date and through at least the third (3rd) anniversary of the closing date in the aggregate amount of ten million and no/100 dollars ($10,000,000.00), naming manager. These policies require the claim to be brought while the policy remains in effect. Tail coverage is an endorsement (or an addition) to your insurance that allows you to file a claim against your policy after it expired or was canceled. “tail insurance policy” means that certain tail insurance policy relating to professional liability insurance purchased by sellers in connection with the transactions, providing coverage effective as of the closing date and through at least the third (3rd) anniversary of the closing date in the aggregate amount of ten million and no/100 dollars ($10,000,000.00), naming manager. In m&a, the d&o insurance policy that responds to a claim is the policy that is in place at the time the claim is made.

Source: slideshare.net

Source: slideshare.net

Here is an example of how tail coverage works: Tail coverage requires that the insured pay additional premium. It protects physicians when a former patient claims malpractice that took place during the physician�s previous plan�s coverage period. “tail insurance policy” means that certain tail insurance policy relating to professional liability insurance purchased by sellers in connection with the transactions, providing coverage effective as of the closing date and through at least the third (3rd) anniversary of the closing date in the aggregate amount of ten million and no/100 dollars ($10,000,000.00), naming manager. In m&a, the d&o insurance policy that responds to a claim is the policy that is in place at the time the claim is made.

Source: teamais.net

Source: teamais.net

It gives your business protection for claims that are reported after your insurance policy ends. Most insurance policies cover claims made as long as the policy is in place. Tail coverage insurance is a provision within an insurance policy that allows the insured to make claims after a policy has expired for acts that occurred while the policy was still valid. Our tail end coverage insurance options, or extended reporting coverage, give our clients flexibility in their e&o and d&o policies. Tail coverage is meant to address this problem by providing coverage for medical malpractice claims made after an insurance policy has ended.

Source: slideserve.com

Source: slideserve.com

This coverage is also known as an extended reporting period. Greg doherty of poms & associates insurance. Occurrence policies are very common among healthcare professionals who buy malpractice insurance. That’s why it’s important to remember to pay attention to details like extended reporting provision (“erp”) or “tail” coverage options available in insurance policies that can protect the business going forward in the event of claims. In this post, we mainly focus on d&o coverage and r&w policies.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title tail policy insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information