Takaful vs insurance Idea

Home » Trending » Takaful vs insurance IdeaYour Takaful vs insurance images are available. Takaful vs insurance are a topic that is being searched for and liked by netizens today. You can Download the Takaful vs insurance files here. Get all free vectors.

If you’re searching for takaful vs insurance pictures information linked to the takaful vs insurance keyword, you have come to the ideal blog. Our site always gives you hints for viewing the maximum quality video and picture content, please kindly hunt and locate more enlightening video content and images that fit your interests.

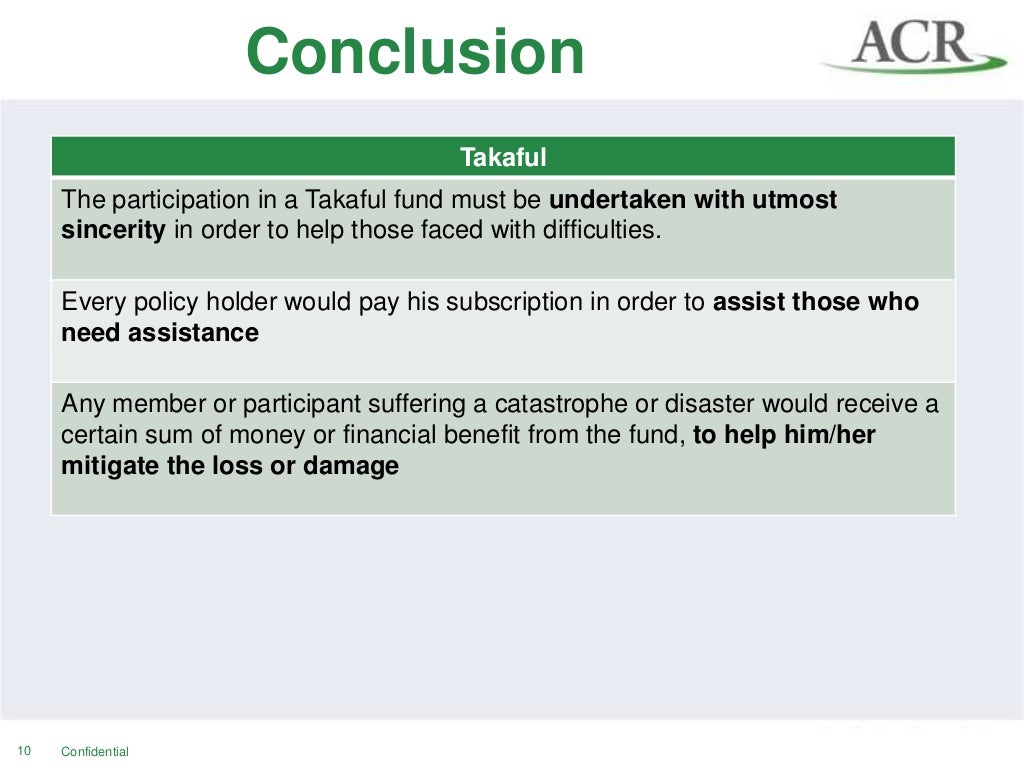

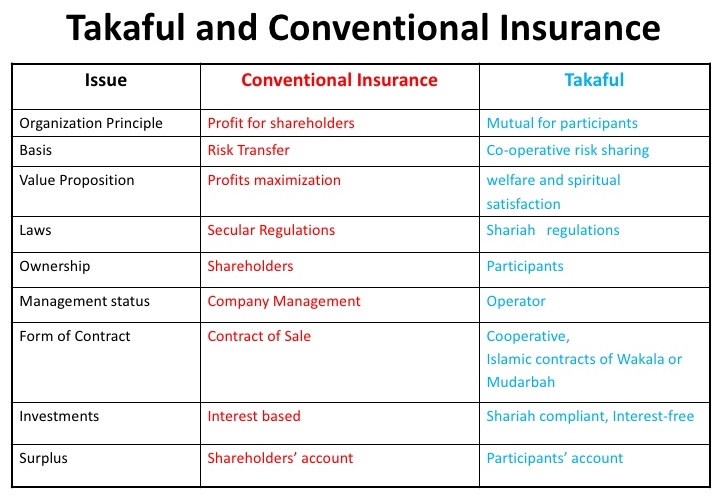

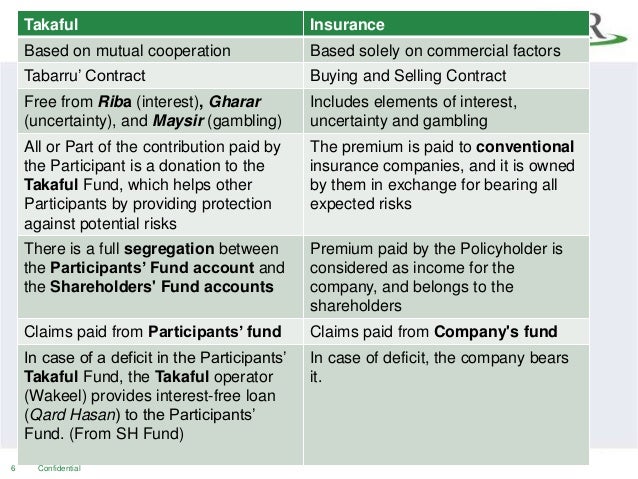

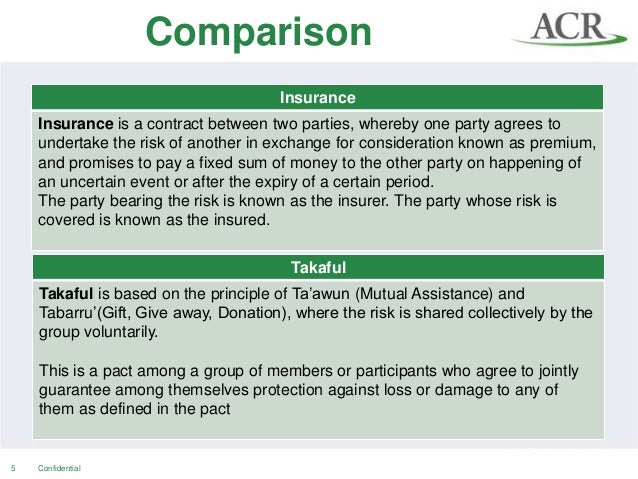

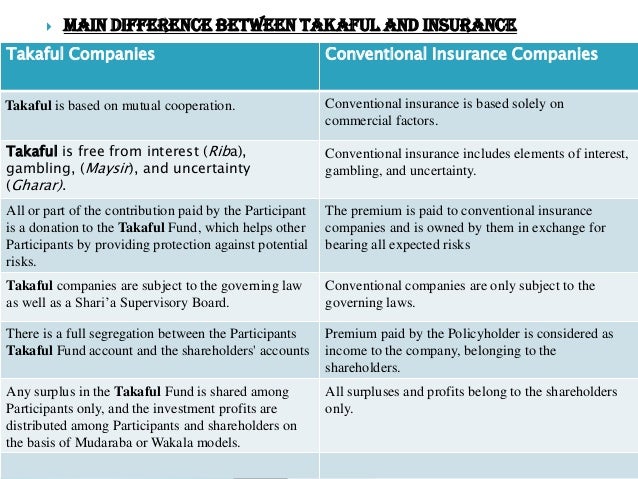

Takaful Vs Insurance. October 30, 2017 | no comments. In takaful, both parties will equally divide the burden whereas in insurance one party will take the risks for other. Takaful and conventional insurance companies share the same objective of providing protection to you, your loved ones and your valuable possessions. Is takaful or conventional insurance cheaper?

What difference between "Takaful vs Conventional From miadviser.com

What difference between "Takaful vs Conventional From miadviser.com

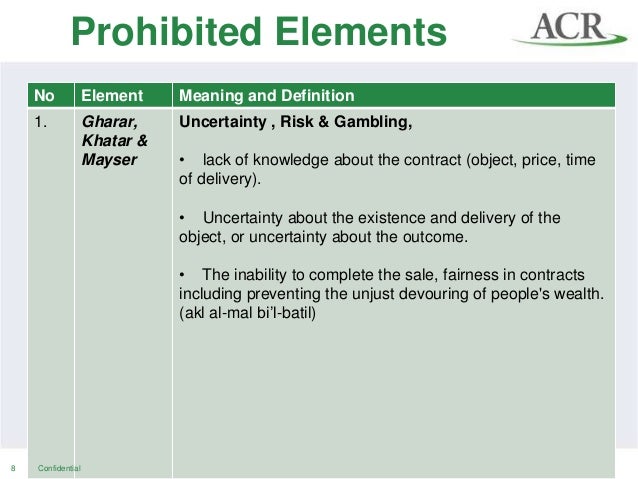

Both insurance policies and takaful cover the same range of products including house, car, life, personal accident, medical and more. This means that from the customer’s point of view, takaful is an inferior insurance product compared to conventional insurance! Conventional insurance involves the elements of excessive uncertainty (gharar) in the contract of insurance; (a) the takaful company exists for reasons other than to profits its stockholders • in conventional insurance, the insurance company exists to maximize profits, that the primary goal. This is because takaful fund rates are generally fixed and people deemed to carry extra risk aren’t typically charged more, unless in severe situations that would cause losses to the entire fund. Is takaful or conventional insurance cheaper?

Or • based on haram practices (eg.

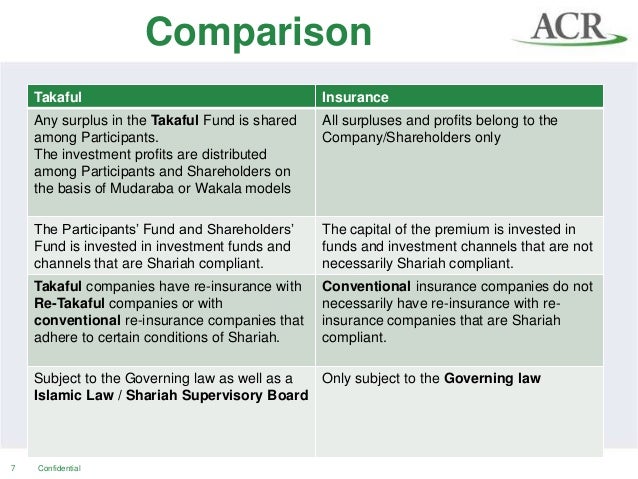

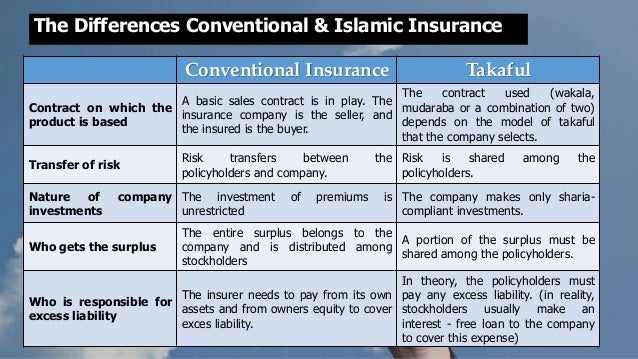

Although essentially both takaful and conventional life insurance serves the same purpose of providing coverage, there are major differences between the two as can be seen below: Bonds), as this violates the riba principle; The other difference between the two types of insurance is profit sharing. In takaful, both parties will equally divide the burden whereas in insurance one party will take the risks for other. Takaful is a cooperative, mutual, and solidarity product that can be used as a risk management tool. This is because when you purchase conventional insurance the amount of coverage you’re entitled to isn’t left to chance.

Source: malaycoco.blogspot.com

Source: malaycoco.blogspot.com

This paper chiefly focuses to study the conventional and takaful insurance comparatively to bring out the differences between them based on conceptual and operational framework. Other differences are the relationship between the operators and the participants. Although essentially both takaful and conventional life insurance serves the same purpose of providing coverage, there are major differences between the two as can be seen below: Investments made by insurance companies have failed in the past. Takaful, which is sometimes referred to as islamic insurance, is a.

Source: ifresource.com

Source: ifresource.com

What is the difference between takaful and conventional insurance Takaful is a type of islamic insurance wherein members contribute money into a pool system to guarantee each other. This means that from the customer’s point of view, takaful is an inferior insurance product compared to conventional insurance! This paper chiefly focuses to study the conventional and takaful insurance comparatively to bring out the differences between them based on conceptual and operational framework. In takaful, both parties will equally divide the burden whereas in insurance one party will take the risks for other.

Source: slideshare.net

Source: slideshare.net

The other difference between the two types of insurance is profit sharing. This does not eliminate the risk entirely. Takaful have other key features that set them apart from conventional insurance products: This is because takaful fund rates are generally fixed and people deemed to carry extra risk aren’t typically charged more, unless in severe situations that would cause losses to the entire fund. In a takaful policy, if you do not make a claim during that year, you are eligible for a certain percentage of profit sharing depending on the company’s profit.

Source: souqalmal.com

Source: souqalmal.com

The main different between conventional insurance and takaful is the way in which the risk is handled and assessed along with the management of the takaful fund. Although essentially both takaful and conventional life insurance serves the same purpose of providing coverage, there are major differences between the two as can be seen below: Takaful have other key features that set them apart from conventional insurance products: The takaful insurance on the other hand does not include such a benefit. This paper chiefly focuses to study the conventional and takaful insurance comparatively to bring out the differences between them based on conceptual and operational framework.

Source: ezytakaful.com

Source: ezytakaful.com

Although essentially both takaful and conventional life insurance serves the same purpose of providing coverage, there are major differences between the two as can be seen below: Takaful is void of any elements of gharar, maisir, or riba. Both insurance policies and takaful cover the same range of products including house, car, life, personal accident, medical and more. Three important differences distinguish conventional insurance from takaful: Takaful is a cooperative, mutual, and solidarity product that can be used as a risk management tool.

Source: slideshare.net

Source: slideshare.net

The only difference would be that a takaful plan may extend to include islamic obligations such as travel and medical coverage for hajj and umrah. In a takaful policy, if you do not make a claim during that year, you are eligible for a certain percentage of profit sharing depending on the company’s profit. The only difference would be that a takaful plan may extend to include islamic obligations such as travel and medical coverage for hajj and umrah. Insurance companies are generally thought of as being very safe as there are more contributions than there are depletions per year. The insurance company receives payment in the form of premium and will compensate policyholder in the event of covered losses or damages sustained by him/her.

Source: eztakaful.com.my

Source: eztakaful.com.my

Investments made by insurance companies have failed in the past. A prevailing misperception about takaful is that it is simply the islamic version of traditional insurance, and thus is confined to those of the religion. Takaful have other key features that set them apart from conventional insurance products: Both insurance policies and takaful cover the same range of products including house, car, life, personal accident, medical and more. What is takaful?takaful is a type of islamic insurance wherein members contribute money into a pool system to guarantee each other against loss or damage.

Source: baldwinyasmine.blogspot.com

Source: baldwinyasmine.blogspot.com

The most glaring difference between takaful and conventional insurance is takaful complies with sharia law. The takaful insurance on the other hand does not include such a benefit. Gambling (maysir) as the consequences of the presence of excessive uncertainty that rely on future outcomes Although both takaful and conventional insurance have similar basic principles that provide protection in the event of unforeseen events and contributions must be made to start the coverage, there are some major differences between both. The insurance company receives payment in the form of premium and will compensate policyholder in the event of covered losses or damages sustained by him/her.

Source: takafulbesideyou.blogspot.com

Source: takafulbesideyou.blogspot.com

Conventional insurance involves the elements of excessive uncertainty (gharar) in the contract of insurance; This does not eliminate the risk entirely. Takaful is a cooperative, mutual, and solidarity product that can be used as a risk management tool. Gambling (maysir) as the consequences of the presence of excessive uncertainty that rely on future outcomes A prevailing misperception about takaful is that it is simply the islamic version of traditional insurance, and thus is confined to those of the religion.

Source: burnprudential.blogspot.com

Source: burnprudential.blogspot.com

Investments made by insurance companies have failed in the past. (a) the takaful company exists for reasons other than to profits its stockholders • in conventional insurance, the insurance company exists to maximize profits, that the primary goal. This is a significant difference for muslim customers in malaysia as they might choose the shariah compliant plan as urged by their religious teaching. Takaful have other key features that set them apart from conventional insurance products: • have a guaranteedorminimumreturnontheinvestment,asthisviolates the risk/reward sharing principle;

Source: slideshare.net

Source: slideshare.net

This means that from the customer’s point of view, takaful is an inferior insurance product compared to conventional insurance! Takaful is a cooperative, mutual, and solidarity product that can be used as a risk management tool. Is takaful or conventional insurance cheaper? Or • based on haram practices (eg. The term takaful originated from the arabic word “kafl” denoting assurance or responsibility (jamil & akhter, 2016 ).

Source: ezytakaful.com

Source: ezytakaful.com

The takaful insurance on the other hand does not include such a benefit. Insurance companies are generally thought of as being very safe as there are more contributions than there are depletions per year. Other differences are the relationship between the operators and the participants. This paper chiefly focuses to study the conventional and takaful insurance comparatively to bring out the differences between them based on conceptual and operational framework. (a) the takaful company exists for reasons other than to profits its stockholders • in conventional insurance, the insurance company exists to maximize profits, that the primary goal.

Source: slideshare.net

Source: slideshare.net

A prevailing misperception about takaful is that it is simply the islamic version of traditional insurance, and thus is confined to those of the religion. Insurance companies are generally thought of as being very safe as there are more contributions than there are depletions per year. Takaful have other key features that set them apart from conventional insurance products: This paper chiefly focuses to study the conventional and takaful insurance comparatively to bring out the differences between them based on conceptual and operational framework. Bonds), as this violates the riba principle;

Source: slideshare.net

Source: slideshare.net

(a) the takaful company exists for reasons other than to profits its stockholders • in conventional insurance, the insurance company exists to maximize profits, that the primary goal. This is a significant difference for muslim customers in malaysia as they might choose the shariah compliant plan as urged by their religious teaching. The main different between conventional insurance and takaful is the way in which the risk is handled and assessed along with the management of the takaful fund. Conventional insurance involves the elements of excessive uncertainty (gharar) in the contract of insurance; What is takaful?takaful is a type of islamic insurance wherein members contribute money into a pool system to guarantee each other against loss or damage.

Source: researchgate.net

Source: researchgate.net

The main different between conventional insurance and takaful is the way in which the risk is handled and assessed along with the management of the takaful fund. Although essentially both takaful and conventional life insurance serves the same purpose of providing coverage, there are major differences between the two as can be seen below: In a takaful policy, if you do not make a claim during that year, you are eligible for a certain percentage of profit sharing depending on the company’s profit. This does not eliminate the risk entirely. The insurance company receives payment in the form of premium and will compensate policyholder in the event of covered losses or damages sustained by him/her.

Source: slideshare.net

Source: slideshare.net

Conventional insurance 141 • debt based (eg. The takaful insurance on the other hand does not include such a benefit. Is takaful or conventional insurance cheaper? With the recent growing interest in islamic finance, there are, however, Investments made by insurance companies have failed in the past.

Source: safwanamran.my

Source: safwanamran.my

In insurance, there is no guarantee that. Is takaful or conventional insurance cheaper? (a) the takaful company exists for reasons other than to profits its stockholders • in conventional insurance, the insurance company exists to maximize profits, that the primary goal. Other differences are the relationship between the operators and the participants. What is takaful?takaful is a type of islamic insurance wherein members contribute money into a pool system to guarantee each other against loss or damage.

Source: miadviser.com

Source: miadviser.com

This paper chiefly focuses to study the conventional and takaful insurance comparatively to bring out the differences between them based on conceptual and operational framework. Takaful and conventional insurance companies share the same objective of providing protection to you, your loved ones and your valuable possessions. Takaful is a relatively new insurance product that is marketed as an islamic alternative to conventional insurance and is often. In insurance, there is no guarantee that. What is the difference between takaful and conventional insurance

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title takaful vs insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information