Take out life insurance on parent information

Home » Trend » Take out life insurance on parent informationYour Take out life insurance on parent images are ready. Take out life insurance on parent are a topic that is being searched for and liked by netizens today. You can Get the Take out life insurance on parent files here. Find and Download all free images.

If you’re looking for take out life insurance on parent images information linked to the take out life insurance on parent topic, you have come to the ideal blog. Our website frequently provides you with hints for viewing the highest quality video and image content, please kindly surf and find more enlightening video articles and graphics that fit your interests.

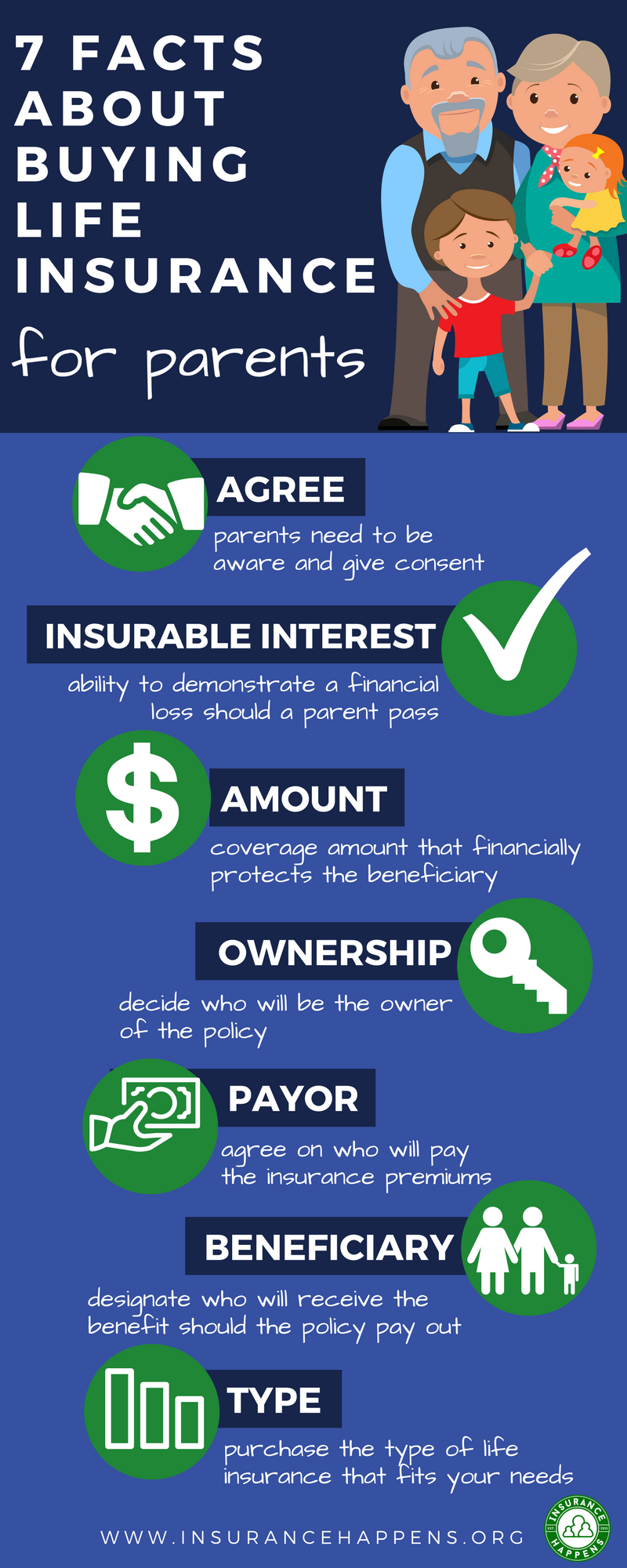

Take Out Life Insurance On Parent. In order to buy a policy on a parent, you will need their consent along with proof of insurable interest. From birth until the age of 14 parents or grandparents of the minor child can purchase life insurance and the child does not have to sign the application for insurance. An aarp survey published in january 2020 found that 42% of adults 40 to 64 years old expect to provide regular financial support to their. If you’re a parent or grandparent looking to purchase life insurance for your children or grandchildren, you may be able to take a policy without them knowing, because the child’s parents or guardian can.

How to Take Out a Life Insurance Policy on a Parent From livestrong.com

How to Take Out a Life Insurance Policy on a Parent From livestrong.com

You�ll need your parents� permission if you want to take out an insurance policy on their behalf. If you’re a parent or grandparent looking to purchase life insurance for your children or grandchildren, you may be able to take a policy without them knowing, because the child’s parents or guardian can. People might insure their parents because it will help with costs after their parents die. There are also some life insurance plans designed for children that you can take with you into adulthood. In most cases, prior to age 85, buying life insurance for elderly parents can be relatively affordable, depending on the type and amount of coverage, and the carrier you choose to purchase the coverage through. The life insurance could cover the remainder of payments on the house, make provision for you to continue studying or pay for estate taxes if your parents are wealthy and own expensive real estate.

Pay for funeral and burial expenses.

Ad compare & save on life insurance plans designed for expats & foreign citizens abroad. In order to buy a policy on a parent, you will need their consent along with proof of insurable interest. That means talking it over in advance and explaining the benefits of the policy. However, it can be difficult to take out a life insurance policy on someone other than yourself even if that person is related to you. However, parents can take out life insurance on their children without needing their children’s permission. Following your parent’s death, you (the child) will most likely be negatively affected financiall y in one way or another — this is recognized as insurable interest.

Source: noclutter.cloud

Source: noclutter.cloud

There are also some life insurance plans designed for children that you can take with you into adulthood. Death benefit proceeds can be used to help: However, parents can take out life insurance on their children without needing their children’s permission. There are also some life insurance plans designed for children that you can take with you into adulthood. That means talking it over in advance and explaining the benefits of the policy.

Source: lifeinsurancepost.com

Source: lifeinsurancepost.com

Yes, you can purchase life insurance for your parents. Death benefit proceeds can be used to help: If your parent consents, you can take out a life insurance policy on them if you’d suffer financially upon their death. Many parents purchase these plans for their children to ensure they are protected as they transition into adulthood. There are also some life insurance plans designed for children that you can take with you into adulthood.

Source: csc-financial.co.uk

Source: csc-financial.co.uk

Life insurance can be discussed with an insurance agent or a financial planner. Ad compare & save on life insurance plans designed for expats & foreign citizens abroad. Can you buy life insurance for your parents? However, parents can take out life insurance on their children without needing their children’s permission. Learn whether or not you can take out life insurance on a parent without their consent.

Source: iffa-yana.blogspot.com

Source: iffa-yana.blogspot.com

You will be the policy owner, responsible for paying the premiums. An aarp survey published in january 2020 found that 42% of adults 40 to 64 years old expect to provide regular financial support to their. Get the most accurate rates in 2 minutes or less. You can take out a life insurance policy on your parents providing there is a financial loss that would be passed onto you if they died. Yes, you can purchase life insurance for your parents to help cover their final expenses.

Source: noclutter.cloud

Source: noclutter.cloud

However, parents can take out life insurance on their children without needing their children’s permission. Some will even allow you to convert that term policy to permanent life insurance after a specific period of time. An aarp survey published in january 2020 found that 42% of adults 40 to 64 years old expect to provide regular financial support to their. If you purchase life insurance on one or both of your parents, you will need their consent to buy the policy. You can take out a life insurance policy on your parents providing there is a financial loss that would be passed onto you if they died.

![Buy Life Insurance For Your Parents [2020 Guide] PinnacleQuote Buy Life Insurance For Your Parents [2020 Guide] PinnacleQuote](https://www.pinnaclequote.com/wp-content/uploads/2019/09/pinnacle-quote-life-ins-for-parents-1024x341.png) Source: pinnaclequote.com

Source: pinnaclequote.com

Can you buy life insurance for your parents? An aarp survey published in january 2020 found that 42% of adults 40 to 64 years old expect to provide regular financial support to their. When buying life insurance on your parents, you will typically need to have their knowledge and their approval first and foremost. If your parent consents, you can take out a life insurance policy on them if you’d suffer financially upon their death. Death benefit proceeds can be used to help:

Source: iffa-yana.blogspot.com

Source: iffa-yana.blogspot.com

Pay for funeral and burial expenses. However, it can be difficult to take out a life insurance policy on someone other than yourself even if that person is related to you. Can you get life insurance for your parents? With an a+ (superior) financial strength rating from am best and a rating of 4.7 stars out of 5 from trustpilot, bestow is our top choice for. Get the most accurate rates in 2 minutes or less.

Source: theinsuranceproblog.com

Source: theinsuranceproblog.com

The life insurance could cover the remainder of payments on the house, make provision for you to continue studying or pay for estate taxes if your parents are wealthy and own expensive real estate. There are advantages and disadvantages to. If you’re a parent or grandparent looking to purchase life insurance for your children or grandchildren, you may be able to take a policy without them knowing, because the child’s parents or guardian can. Regardless of the type of policy they choose, you’ll receive a guaranteed death benefit when they pass away — as long as they keep up with their premiums. If your parent consents, you can take out a life insurance policy on them if you’d suffer financially upon their death.

Source: cliffordosborne.co.uk

Source: cliffordosborne.co.uk

Life insurance is part of an overall life plan. There are also some life insurance plans designed for children that you can take with you into adulthood. Life insurance is part of an overall life plan. Many parents purchase these plans for their children to ensure they are protected as they transition into adulthood. Yes, you can purchase life insurance for your parents.

Source: motherhoodtherealdeal.com

Source: motherhoodtherealdeal.com

In most cases, prior to age 85, buying life insurance for elderly parents can be relatively affordable, depending on the type and amount of coverage, and the carrier you choose to purchase the coverage through. Making a financial decision doesn’t have to. Just because a parent takes out a life insurance policy, doesn’t make their plans at all morbid. Instead of you taking out a policy on your parents, encourage them to manage the process and name you as a beneficiary. There are advantages and disadvantages to.

Source: iffa-yana.blogspot.com

Source: iffa-yana.blogspot.com

The life insurance could cover the remainder of payments on the house, make provision for you to continue studying or pay for estate taxes if your parents are wealthy and own expensive real estate. Just because a parent takes out a life insurance policy, doesn’t make their plans at all morbid. Ad compare & save on life insurance plans designed for expats & foreign citizens abroad. Life insurance is part of an overall life plan. Instead, it is a very responsible action that signals how much a parent cares for their child and wants to protect them at all costs.

Source: livestrong.com

Source: livestrong.com

Some will even allow you to convert that term policy to permanent life insurance after a specific period of time. There are also some life insurance plans designed for children that you can take with you into adulthood. An aarp survey published in january 2020 found that 42% of adults 40 to 64 years old expect to provide regular financial support to their. You must be eligible to take out a. Beyond the age of 14 the child must sign the application even if it is a printed name and the parent can s.

Source: howtoshopforlifeinsurancenensan.blogspot.com

Source: howtoshopforlifeinsurancenensan.blogspot.com

Regardless of the type of policy they choose, you’ll receive a guaranteed death benefit when they pass away — as long as they keep up with their premiums. You must be eligible to take out a. There are also some life insurance plans designed for children that you can take with you into adulthood. Regardless of the type of policy they choose, you’ll receive a guaranteed death benefit when they pass away — as long as they keep up with their premiums. There are advantages and disadvantages to.

Source: pinterest.com

Source: pinterest.com

By taking life insurance out on your parents, you can protect yourself against financial hardship should they pass away. Yes, you can purchase life insurance for your parents to help cover their final expenses. Ad compare & save on life insurance plans designed for expats & foreign citizens abroad. In most cases, prior to age 85, buying life insurance for elderly parents can be relatively affordable, depending on the type and amount of coverage, and the carrier you choose to purchase the coverage through. With an a+ (superior) financial strength rating from am best and a rating of 4.7 stars out of 5 from trustpilot, bestow is our top choice for.

Source: savings4savvymums.co.uk

Source: savings4savvymums.co.uk

Ask your parents to purchase life insurance coverage. Many parents purchase these plans for their children to ensure they are protected as they transition into adulthood. You must be eligible to take out a. There are also some life insurance plans designed for children that you can take with you into adulthood. Get the most accurate rates in 2 minutes or less.

Source: iffa-yana.blogspot.com

Source: iffa-yana.blogspot.com

You must be eligible to take out a. Yes, you can purchase life insurance for your parents to help cover their final expenses. If your parent consents, you can take out a life insurance policy on them if you’d suffer financially upon their death. Ad compare & save on life insurance plans designed for expats & foreign citizens abroad. Can you buy life insurance for your parents?

Source: iffa-yana.blogspot.com

Source: iffa-yana.blogspot.com

Instead, it is a very responsible action that signals how much a parent cares for their child and wants to protect them at all costs. Can you buy life insurance for your parents? However, parents can take out life insurance on their children without needing their children’s permission. Yes, you can purchase life insurance for your parents to help cover their final expenses. Get the most accurate rates in 2 minutes or less.

Source: stuff.co.nz

Source: stuff.co.nz

Following your parent’s death, you (the child) will most likely be negatively affected financiall y in one way or another — this is recognized as insurable interest. Life insurance can be discussed with an insurance agent or a financial planner. Premium rates are affordable compared to other types of life insurance. With an a+ (superior) financial strength rating from am best and a rating of 4.7 stars out of 5 from trustpilot, bestow is our top choice for. In most cases, prior to age 85, buying life insurance for elderly parents can be relatively affordable, depending on the type and amount of coverage, and the carrier you choose to purchase the coverage through.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title take out life insurance on parent by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information