Tax insurance Idea

Home » Trend » Tax insurance IdeaYour Tax insurance images are available. Tax insurance are a topic that is being searched for and liked by netizens now. You can Get the Tax insurance files here. Download all royalty-free vectors.

If you’re searching for tax insurance pictures information linked to the tax insurance interest, you have come to the ideal site. Our site frequently provides you with hints for viewing the maximum quality video and image content, please kindly hunt and locate more enlightening video content and graphics that fit your interests.

Tax Insurance. A tax preparer is a person who prepares tax returns for small businesses and other individuals. Where a transaction fails to qualify for its intended tax treatment; We give many options to find a insurance that fits your needs. There are two different insurance premium tax rates:

Is Life Insurance Taxable in Canada? CorporateOwned From smartwealthfinancial.ca

Is Life Insurance Taxable in Canada? CorporateOwned From smartwealthfinancial.ca

A tax preparer is a person who prepares tax returns for small businesses and other individuals. Life insurance benefits and settlements for home and car insurance claims are generally not considered to be taxable income. This tax and vat investigation insurance covers up to £100,000 of fees incurred in respect of tax enquiries by hmrc. We have more than 10 years of experience doing taxes and accounting services. Vehicle tax, mot and insurance popular services. Any amount of the estate that’s subject to state or federal estate taxes.

A higher rate of 20%;

Check if a vehicle is taxed; Exemptions from insurance premium tax We give many options to find a insurance that fits your needs. Tax preparer insurance policy information. Insurance companies pay corporate tax only in the state in which they are domiciled, but premium taxes are collected by every state in which premiums are written. Tax and vat investigation insurance cover quotes and cover available online.

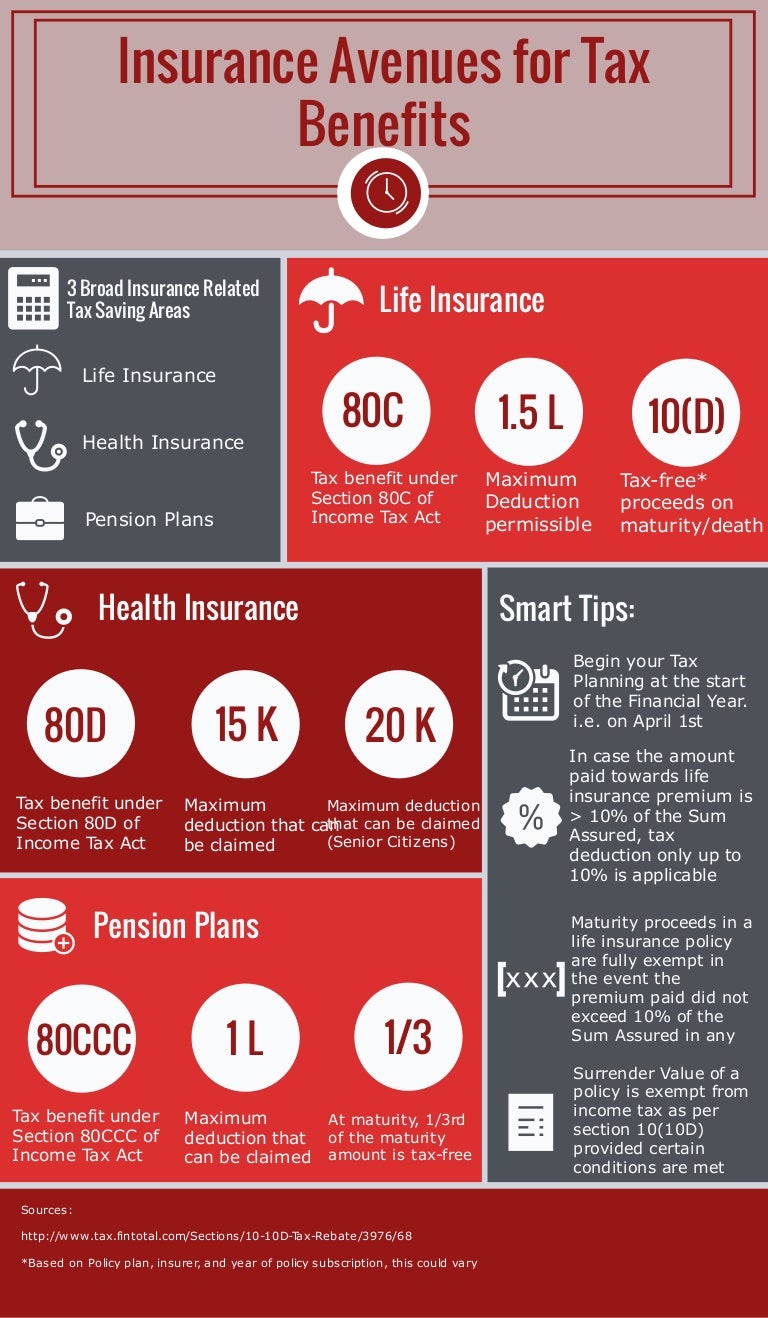

Source: slideshare.net

Source: slideshare.net

Insurance premium tax ( ipt) is a tax on general insurance premiums. A higher rate of 20%; Tax and vat investigation insurance cover quotes and cover available online. There are two different insurance premium tax rates: Insurance premium tax ( ipt) is a tax on general insurance premiums.

Source: investmentfrontier.com

Source: investmentfrontier.com

Under the b2v reform, the new vat rate may be higher than the original bt rate on the assumption that there will be input credits. Just call me now and make an appointment. After your insurance provider collects the premium from you, the tax is paid directly to the government. A higher rate of 20%; There are two different insurance premium tax rates:

Source: premiertaxsolutions.co.uk

Source: premiertaxsolutions.co.uk

Read the best of our blog articles here. We have more than 10 years of experience doing taxes and accounting services. Life insurance benefits and settlements for home and car insurance claims are generally not considered to be taxable income. Currently, there are two rates of ipt. Our insurance tax services include a single source solution for:

Source: moneycontrol.com

Source: moneycontrol.com

Thousands of individuals and businesses will face tax. Check the mot status of a vehicle A tax preparer is a person who prepares tax returns for small businesses and other individuals. Zion is a tax office with insurance services. The insurance premium tax rate is 21% on general insurance premium and 21% on the additional cost for services related to the insurance.

Source: maxlifeinsurance.com

Any amount of the estate that’s subject to state or federal estate taxes. Check the mot status of a vehicle Insurance premium tax (ipt) is a tax on insurers, like vat, that applies to most general uk insurance premiums 1 or potential premiums. Under the b2v reform, the new vat rate may be higher than the original bt rate on the assumption that there will be input credits. Any amount of the estate that’s subject to state or federal estate taxes.

Source: connect-insurance.uk

Source: connect-insurance.uk

A standard rate of 12%; Check if a vehicle is taxed; Tax and vat investigation insurance cover quotes and cover available online. Cancel your vehicle tax and get a refund; We are an expert in taxes.

Source: bankingtruths.com

Source: bankingtruths.com

Choosing where to do your tax is just as important as doing you tax. Tax preparer insurance policy information. (including insurance agents, brokers, intermediaries as well as real estate landlords) become subject to vat and charge vat on their invoices to the insurers. We are an expert in taxes. What is the insurance premium tax rate?

Source: sharrockinsurance.co.uk

Source: sharrockinsurance.co.uk

But as you might expect, there are certain cases where your state or the federal government may claim a share of the insurance. Insurance premium tax (ipt) is a tax on insurers, like vat, that applies to most general uk insurance premiums 1 or potential premiums. Check the mot status of a vehicle Currently, there are two rates of ipt. Insurance premium tax ( ipt) is a tax on general insurance premiums.

Source: insurancejournal.com

Source: insurancejournal.com

Where a transaction fails to qualify for its intended tax treatment; Everything you need to know about the latest in taxes and insurance straight from personal capital�s team of experts. A standard rate of 12%; We are an expert in taxes. Insurance companies pay corporate tax only in the state in which they are domiciled, but premium taxes are collected by every state in which premiums are written.

Source: coverfox.com

Source: coverfox.com

A standard rate of 12%; Insurance companies pay corporate tax only in the state in which they are domiciled, but premium taxes are collected by every state in which premiums are written. This premium tax is assessed at a rate equal to the greater of the tax rate in the domicile. Currently, there are two rates of ipt. They are used to make the job of filing taxes a lot easier for people who don�t know how or don�t have the time to do it.

Source: makesworth.co.uk

Source: makesworth.co.uk

Under the b2v reform, the new vat rate may be higher than the original bt rate on the assumption that there will be input credits. Insurance premium tax ( ipt) is a tax on general insurance premiums. We give many options to find a insurance that fits your needs. This tax and vat investigation insurance covers up to £100,000 of fees incurred in respect of tax enquiries by hmrc. Tax preparer insurance policy information.

Source: letsbegamechangers.com

Source: letsbegamechangers.com

Read the best of our blog articles here. Currently, there are two rates of ipt. The insurance premium tax rate is 21% on general insurance premium and 21% on the additional cost for services related to the insurance. If you got excess advance payments of the premium tax credit (aptc) for 2021, you’ll have to report the excess aptc on your 2021 tax return or file form 8962, premium tax credit (pdf, 110 kb). Insurance premium tax (ipt) is a tax on insurers, like vat, that applies to most general uk insurance premiums 1 or potential premiums.

Source: policybazaar.com

Source: policybazaar.com

Under the b2v reform, the new vat rate may be higher than the original bt rate on the assumption that there will be input credits. Currently, there are two rates of ipt. What is the insurance premium tax rate? Check if a vehicle is taxed; Our insurance tax services include a single source solution for:

Source: planmoneytax.com

Source: planmoneytax.com

If you got excess advance payments of the premium tax credit (aptc) for 2021, you’ll have to report the excess aptc on your 2021 tax return or file form 8962, premium tax credit (pdf, 110 kb). Insurance premium tax (ipt) is a tax on insurers, like vat, that applies to most general uk insurance premiums 1 or potential premiums. This tax and vat investigation insurance covers up to £100,000 of fees incurred in respect of tax enquiries by hmrc. We are an expert in taxes. What can qualify for tax deduction are mediclaim policies and critical illness policy.tax exemption on health insurance premium is relative to the year the premium is paid, this is called “payment basis”.tax deduction is applicable only if the premium is paid in other modes of payment other than cash.the value received on maturity is exempted from tax under critical illness.

Source: smartwealthfinancial.ca

Source: smartwealthfinancial.ca

Life insurance benefits and settlements for home and car insurance claims are generally not considered to be taxable income. Our insurance tax services include a single source solution for: Where a transaction fails to qualify for its intended tax treatment; Cancel your vehicle tax and get a refund; Vehicle tax, mot and insurance popular services.

Source: hdfclife.com

Source: hdfclife.com

Thousands of individuals and businesses will face tax. Check if a vehicle is taxed; Under the b2v reform, the new vat rate may be higher than the original bt rate on the assumption that there will be input credits. A standard rate of 12%; We are an expert in taxes.

Source: shardaassociates.in

Source: shardaassociates.in

We offer auto insurance, home insurance, business insurance, health insurance and more. Cancel your vehicle tax and get a refund; This tax and vat investigation insurance covers up to £100,000 of fees incurred in respect of tax enquiries by hmrc. Any amount of the estate that’s subject to state or federal estate taxes. For p&c insurers which are currently subject to 5% bt,

Source: turbotax.intuit.ca

Source: turbotax.intuit.ca

This tax and vat investigation insurance covers up to £100,000 of fees incurred in respect of tax enquiries by hmrc. (including insurance agents, brokers, intermediaries as well as real estate landlords) become subject to vat and charge vat on their invoices to the insurers. Where a transaction fails to qualify for its intended tax treatment; Family owned business medina tax & insurance is a very experienced insurance and tax preparer. A standard rate of 12%;

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title tax insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information