Tax insurance number uk Idea

Home » Trend » Tax insurance number uk IdeaYour Tax insurance number uk images are ready. Tax insurance number uk are a topic that is being searched for and liked by netizens now. You can Get the Tax insurance number uk files here. Get all royalty-free images.

If you’re searching for tax insurance number uk pictures information linked to the tax insurance number uk keyword, you have pay a visit to the right site. Our site frequently provides you with hints for downloading the maximum quality video and image content, please kindly search and find more informative video articles and graphics that match your interests.

Tax Insurance Number Uk. There is more general information about ninos in the tax basics section. What is a national insurance number? The number is sometimes referred to as a ni no or nino. The national insurance number may also be shown on a national insurance card and on letters issued by the department for work and pensions (dwp).

Link your Benefits and Council Tax Reduction account From wandsworth.gov.uk

Link your Benefits and Council Tax Reduction account From wandsworth.gov.uk

A tax identification number (tin) is an identification number that’s used for tax purposes. In basics terms the more money you earn the more tax you have to pay. How do i apply for a national insurance number? Although tax identification numbers are used by most countries, they are different in each. Most countries issue them to identify their taxpayers and to help with the administration of tax affairs. For example, in the uk, individuals have a national insurance (ni) number, and companies have a corporation tax.

Although tax identification numbers are used by most countries, they are different in each.

If you provide your national insurance number (nino), you can visit any tax office or call tax office number across uk to satisfy your tax query. Most countries issue them to identify their taxpayers and to help with the administration of tax affairs. The tin is the term used in international law, each nation refers to its own name for it. A tax identification number (tin) is an identification number that’s used for tax purposes. For jersey the identifier to be reported for individuals is a social security number. It also ensures that the national insurance contributions (nic) or taxes you pay are properly recorded on your hmrc record.

Source: ambiance-accountants.co.uk

Source: ambiance-accountants.co.uk

For example, in the uk, individuals have a national insurance (ni) number, and companies have a corporation tax. But for those newly arrived to the uk to live and work, it’s something you will need to apply for. National insurance number application helpline (england, scotland and wales) telephone: A tax identification number (tin) is an identifying number used for tax purposes. If you provide your national insurance number (nino), you can visit any tax office or call tax office number across uk to satisfy your tax query.

Source: pinterest.com

Source: pinterest.com

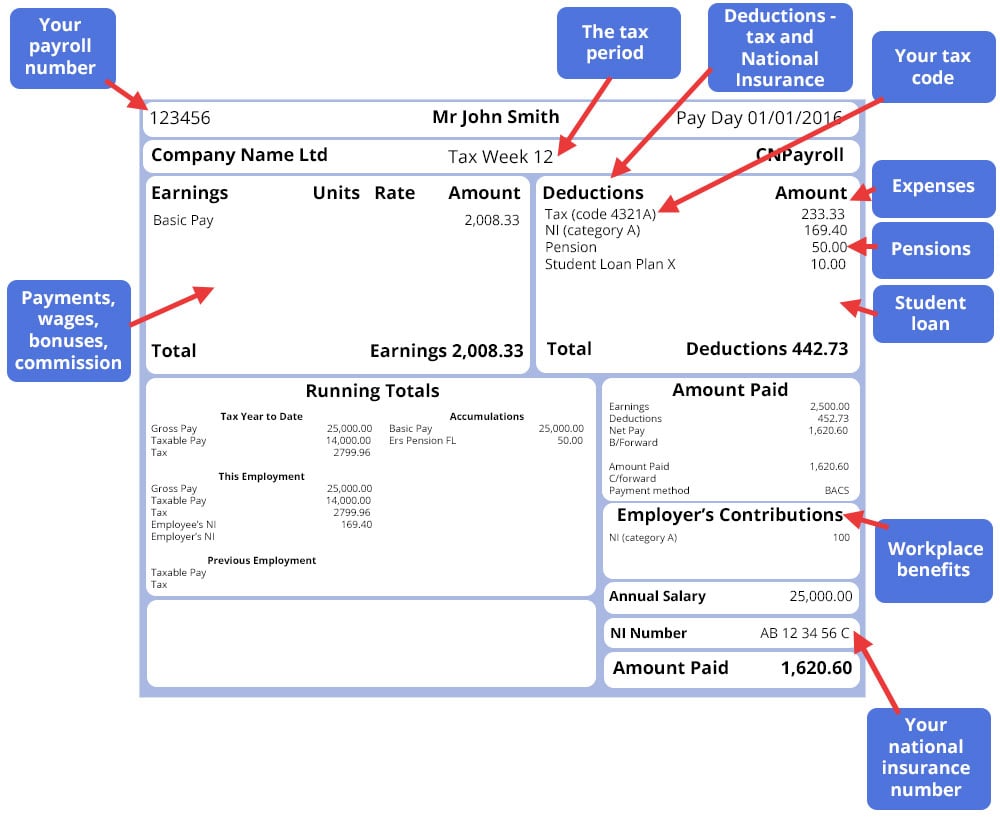

A national insurance number is a given to each and every working person in the uk. P60 is also provided by your employer. For example, in the uk, individuals have a national insurance (ni) number, and companies have a corporation tax. The national insurance number may also be shown on a national insurance card and on letters issued by the department for work and pensions (dwp). Phone hmrc to discuss your personal tax and get your questions answered.

Source: powerfulhollywood.weebly.com

Source: powerfulhollywood.weebly.com

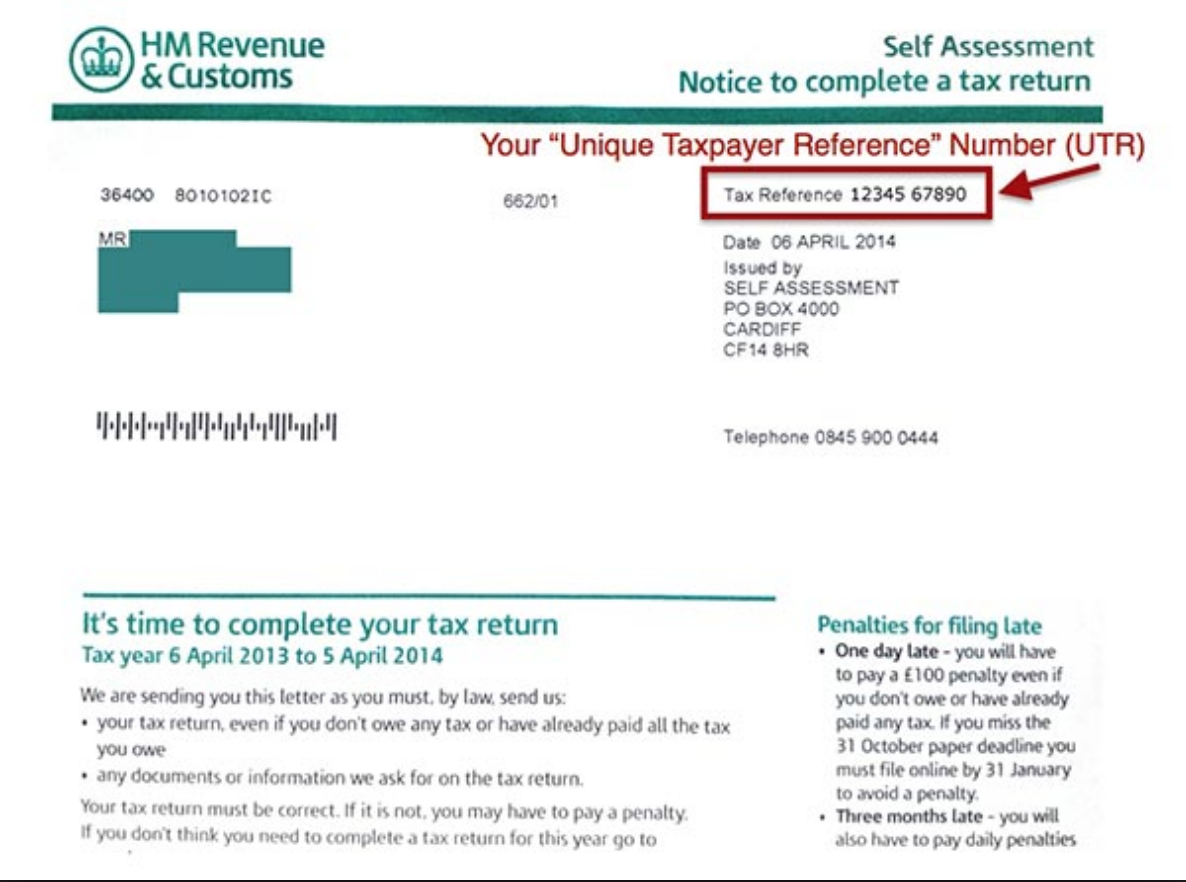

A utr number is your ‘unique taxpayer reference’ number. National insurance number (nino) hmrc issues coding notices to taxpayers. Although tax identification numbers are used by most countries, they are different in each. A tax identification number (tin) is an identification number that’s used for tax purposes. Hm revenue and customs (hmrc) is responsible for administering and collecting taxes in the uk.

Source: nationalinsurancenumber.org

Source: nationalinsurancenumber.org

What is a national insurance number? For jersey the identifier to be reported for individuals is a social security number. A tax identification number (tin) is an identification number that’s used for tax purposes. Most countries issue them to identify their taxpayers and to help with the administration of tax affairs. A national insurance number (nino) is used to uniquely identify you in the uk system.

Source: brighton-hove.gov.uk

Source: brighton-hove.gov.uk

For example, in the uk, individuals have a national insurance (ni) number, and companies have a corporation tax. Sometime it is a personal account number in uk. A utr number is your ‘unique taxpayer reference’ number. A tax identification number (tin) is an identifying number used for tax purposes. Tins are different in every country.

Source: taxrebates.co.uk

Source: taxrebates.co.uk

A tax identification number (tin) is an identification number that’s used for tax purposes. The number is sometimes referred to as a ni no or nino. Some countries use social security numbers, numbers from identity cards or passports or other national numbers. The heading of the notice contains the national insurance number as indicated in the example below: It also ensures that the national insurance contributions (nic) or taxes you pay are properly recorded on your hmrc record.

Source: limopowerup.weebly.com

Source: limopowerup.weebly.com

The number is sometimes referred to as a ni no or nino. National insurance number application helpline (england, scotland and wales) telephone: What is a national insurance number? If you don�t have a national insurance number printed on the back of your biometric residence permit (brp). In basics terms the more money you earn the more tax you have to pay.

Source: wandsworth.gov.uk

Source: wandsworth.gov.uk

Each country / jurisdiction will have its own structure (combinations of letters / numbers / symbols and digit length) and refer to. Many of these are progressive. A national insurance number is a given to each and every working person in the uk. For most individuals in the uk the tin will be their national insurance number. A tax identification number (tin) is an identification number that’s used for tax purposes.

Source: reed.co.uk

Source: reed.co.uk

The good news is there is something called a personal allowance. How to get help with income tax. A tax identification number (tin) is an identifying number used for tax purposes. If you’re working in other countri… We are not associated with hmrc.

Source: actionretail.co.uk

Source: actionretail.co.uk

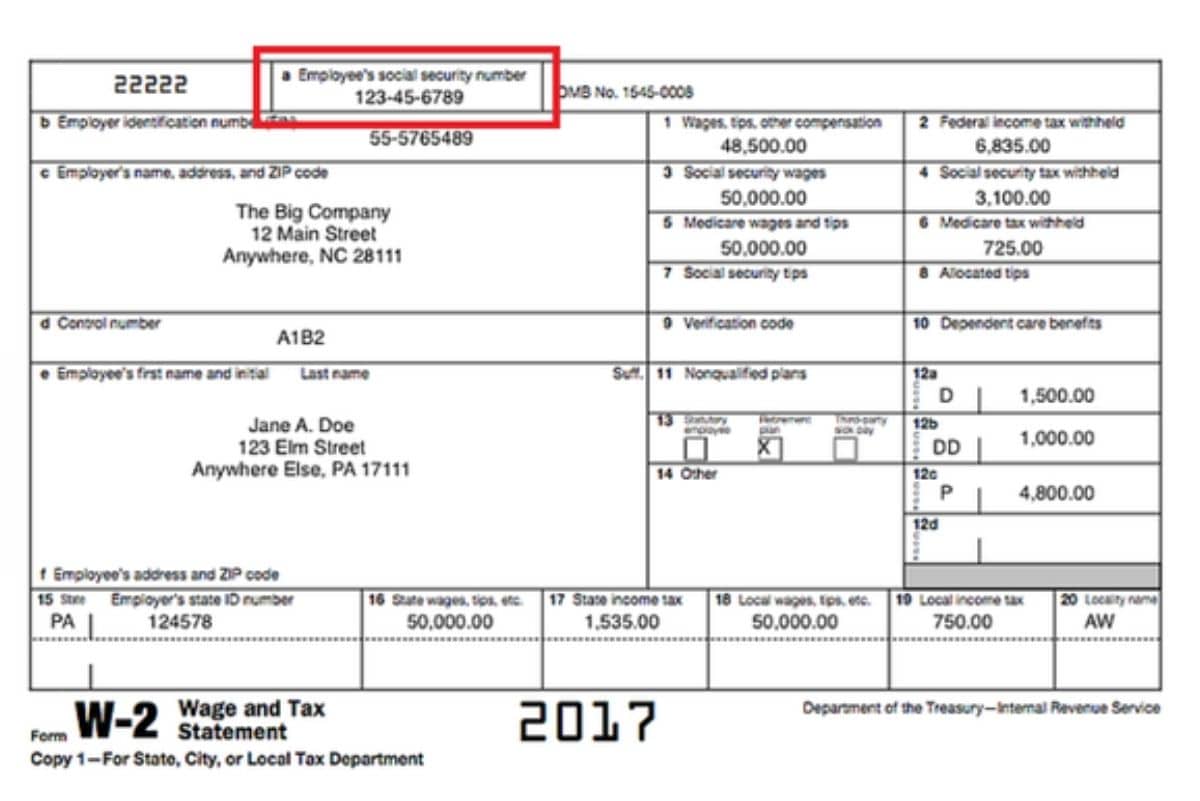

All utr numbers have 10 digits, and sometimes there�s a letter �k� at the end. Your national insurance number stays with you for life and helps hmrc ensure your tax and national insurance (ni) contributions are recorded against your name. Tax identification number you’re end of year certificate; A national insurance number is like a tax file number (for the australians), or an inland revenue department (ird number) for the new zealanders. A tax identification number (tin) is an identifying number used for tax purposes.

Source: certaxlondon.co.uk

Source: certaxlondon.co.uk

0800 141 2438 monday to friday, 8am to 5pm find out about call charges Tax receipts for the uk totaled approximately £584.5 billion in 2020/21, a decrease of 7.7% from the previous tax year. There is more general information about ninos in the tax basics section. In the uk ni number and universal tax code are examples. Call the connection service on:

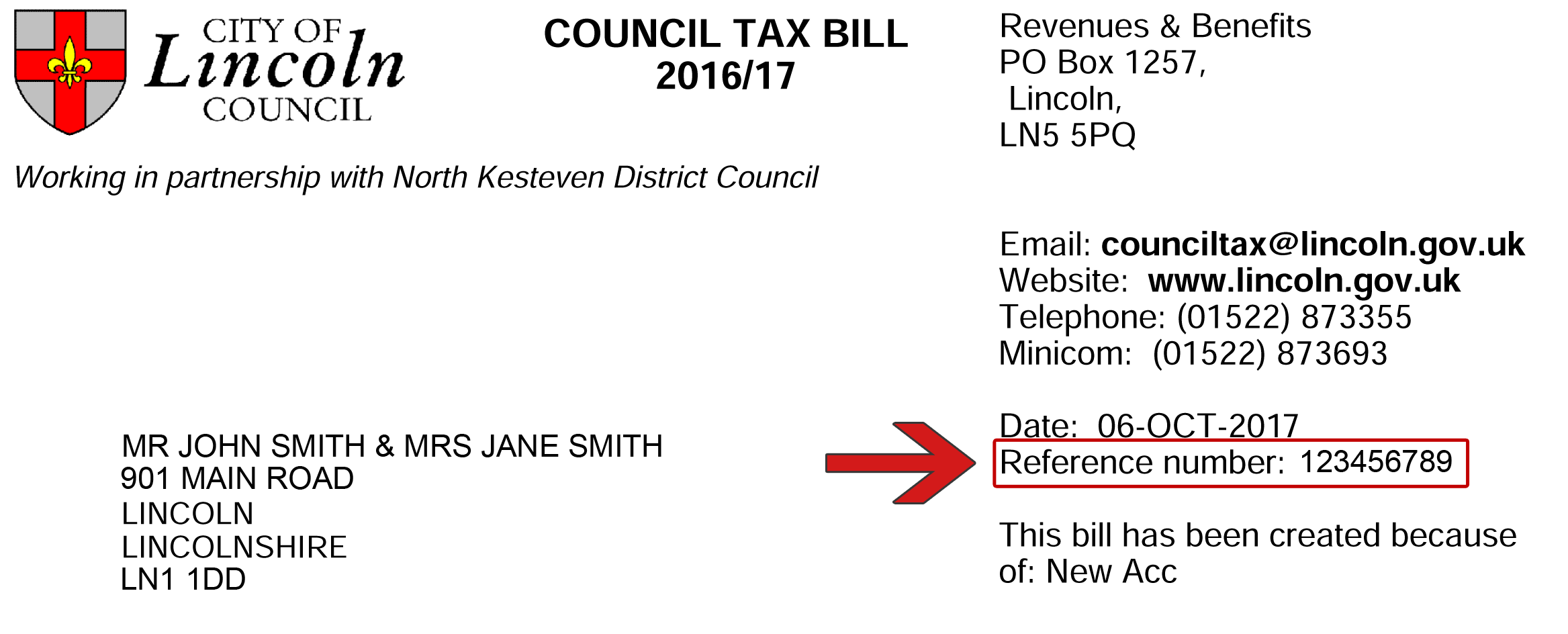

Source: lincoln.gov.uk

Source: lincoln.gov.uk

The national insurance number (nino) is a number in the administration of the social security system or national insurance used in the united kingdom. The amount you have to pay on your income depends on how much to earn. All utr numbers have 10 digits, and sometimes there�s a letter �k� at the end. I found this on the west bromwich building society site: Although tax identification numbers are used by most countries, they are different in each.

Source: onettechnologiesindia.com

Source: onettechnologiesindia.com

If you don�t have a national insurance number printed on the back of your biometric residence permit (brp). For most individuals in the uk the tin will be their national insurance number. What is a national insurance number? There are currently 3 different uk tax rates ranging from 20% to 45%. Sometime it is a personal account number in uk.

Source: invoiceberry.com

Source: invoiceberry.com

It also ensures that the national insurance contributions (nic) or taxes you pay are properly recorded on your hmrc record. A tax identification number (tin) is an identifying number used for tax purposes. Most countries issue them to identify their taxpayers and to help with the administration of tax affairs. The good news is there is something called a personal allowance. A tax identification number is a number used by the irs as a tracking number for tax purposes and is required information on all tax returns.

Source: restlessworld.com.au

Source: restlessworld.com.au

Phone hmrc to discuss your personal tax and get your questions answered. If you don’t have any of these documents and you’re struggling to find your national insurance number, you can call hmrc’s national insurance number helpline on 0300 200 3500. This is a call forwarding service which will connect your call directly to the official helpline where you can get help with all national insurance enquiries. Many of these are progressive. If you are calling from outside of the uk then you will need to use the number below:

Source: c1000stitches.co.uk

Source: c1000stitches.co.uk

Tax receipts for the uk totaled approximately £584.5 billion in 2020/21, a decrease of 7.7% from the previous tax year. In basics terms the more money you earn the more tax you have to pay. Although tax identification numbers are used by most countries, they are different in each. For jersey the identifier to be reported for individuals is a social security number. Tax receipts for the uk totaled approximately £584.5 billion in 2020/21, a decrease of 7.7% from the previous tax year.

Source: numberye.blogspot.com

Source: numberye.blogspot.com

In the uk you have to pay tax on your income. Many of these are progressive. How to get help with income tax. The tin is the term used in international law, each nation refers to its own name for it. But for those newly arrived to the uk to live and work, it’s something you will need to apply for.

Source: insurancenoon.com

Source: insurancenoon.com

Most countries issue them to identify their taxpayers and to help with the administration of tax affairs. Phone hmrc to discuss your personal tax and get your questions answered. Tax receipts for the uk totaled approximately £584.5 billion in 2020/21, a decrease of 7.7% from the previous tax year. A tax identification number (tin) is an identification number that’s used for tax purposes. Your national insurance number stays with you for life and helps hmrc ensure your tax and national insurance (ni) contributions are recorded against your name.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title tax insurance number uk by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information