Tax on life insurance payout ireland Idea

Home » Trend » Tax on life insurance payout ireland IdeaYour Tax on life insurance payout ireland images are ready in this website. Tax on life insurance payout ireland are a topic that is being searched for and liked by netizens today. You can Download the Tax on life insurance payout ireland files here. Download all free photos.

If you’re searching for tax on life insurance payout ireland images information connected with to the tax on life insurance payout ireland topic, you have pay a visit to the ideal site. Our website always provides you with hints for seeking the highest quality video and picture content, please kindly hunt and locate more enlightening video articles and images that match your interests.

Tax On Life Insurance Payout Ireland. More often than not, a life insurance claim is not taxable. This levy is payable four times per annum, within 25 days of the end of each quarter (i.e. Likewise, you may be entitled to a supplement to your pension in respect of a spouse/civil partner, but not in respect of a cohabitee. I�m a tax resident in ireland and have received a life insurance payout from a spanish grandmother.

Do You Have To Pay Tax On Life Insurance Payout From thismuchistrue-karen.blogspot.com

Do You Have To Pay Tax On Life Insurance Payout From thismuchistrue-karen.blogspot.com

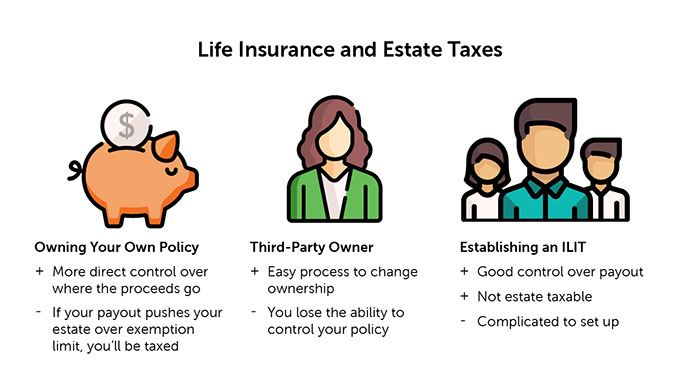

There are several strategies that you can undertake to avoid saddling your dependents with this cost. This applies to life insurance payouts, too. First, if your life insurance policy is in trust then it will be exempt from tax. Inheritance tax of 40% must be paid on the value of an estate above a threshold of £325,000 unless the entire estate is left to a spouse or civil partner. Here�s when a beneficiary can expect to not pay tax on a life insurance payout:. Most life insurance policies are excluded from the current uk income tax regime.

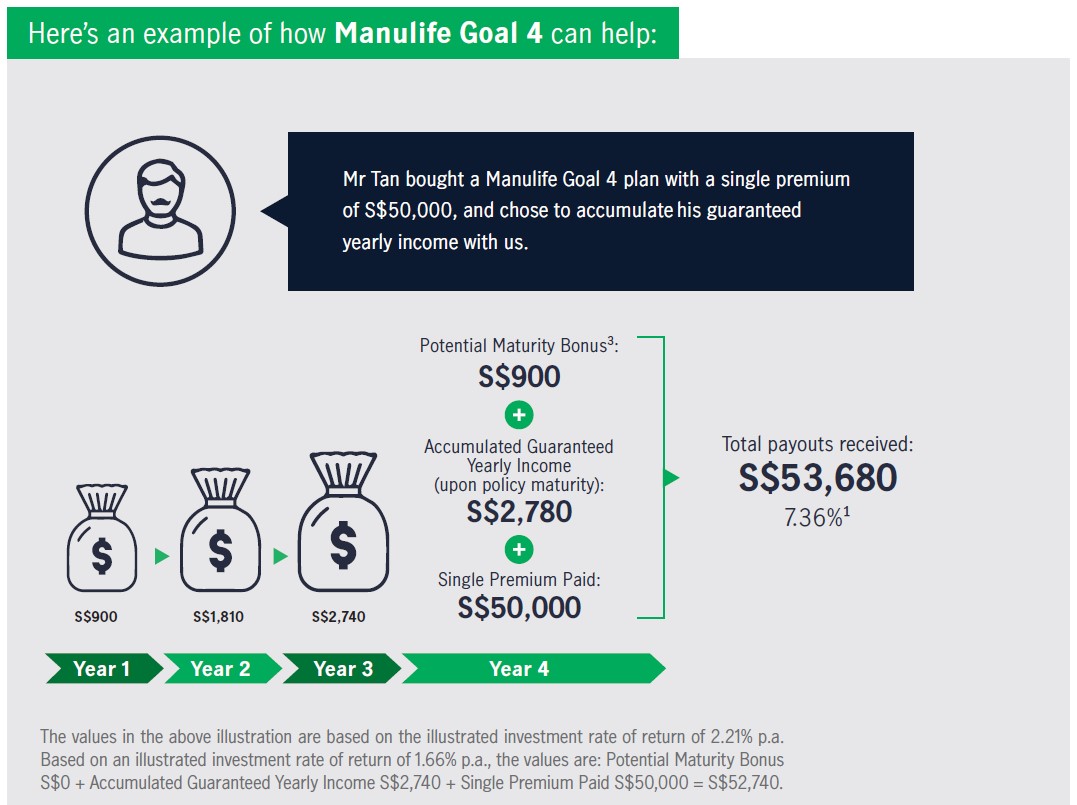

Yes, any gains on the investments of the proceeds of a life insurance policy are taxable at 41%.

If the person receiving this money is a spouse, then no tax is payable. If the person receiving this money is a spouse, then no tax is payable. The canadian revenue agency makes receiving life insurance proceeds simple for beneficiaries when it comes to tax reporting. Check with your insurer or the trustees of your pension if you want to be sure about the conditions of your particular policy. More often than not, a life insurance claim is not taxable. For instance, if your entire estate is worth £600,000 when you die, your beneficiaries will have to pay inheritance tax of 40% on £275,000, i.e.

Source: quotacy.com

Source: quotacy.com

Life insurance death benefits typically won’t be hit with income tax. Life insurance death benefits typically won’t be hit with income tax. Do you pay tax if you invest the payout of a life insurance policy? Generally, life insurance payouts to your spouse and children are not taxed. This levy is payable four times per annum, within 25 days of the end of each quarter (i.e.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

More often than not, a life insurance claim is not taxable. Life insurance death benefits typically won’t be hit with income tax. In other words, the person or people who receive the payout do not. The tool is designed for taxpayers who were u.s. This exit tax here in ireland has risen steadily since 2001:

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

Do you pay tax if you invest the payout of a life insurance policy? Check with your insurer or the trustees of your pension if you want to be sure about the conditions of your particular policy. Life cover premiums are sometimes tax deductible, depending on the type of cover and whether you�ve purchased it inside or outside of your super fund. Payment of key person insurance benefits (life insurance for key business personnel) benefits from these types of policies are sometimes taxable at rates of 30%, and with life insurance policies often worth six figures or more, it’s vital to know if a policy’s beneficiary will never even see a third of that money! Within 25 days from quarters ending 31 march, 30 june, 30 september, and 31 december).

Source: bestinsurancequotes.ie

Source: bestinsurancequotes.ie

Other beneficiaries depending on their relationship to the deceased may have to pay tax according. Inheritance tax of 40% must be paid on the value of an estate above a threshold of £325,000 unless the entire estate is left to a spouse or civil partner. For instance, if your entire estate is worth £600,000 when you die, your beneficiaries will have to pay inheritance tax of 40% on £275,000, i.e. Beneficiaries you�re not related to and who are more than 37.5 years younger than you. Bonus and sum assured, under a life insurance policy on maturity or surrender of the policy or on the death of the insured are not taxable i.e.

Source: taxwalls.blogspot.com

Source: taxwalls.blogspot.com

Inheritance tax of 40% must be paid on the value of an estate above a threshold of £325,000 unless the entire estate is left to a spouse or civil partner. First, if your life insurance policy is in trust then it will be exempt from tax. Any taxable elements of a life insurance payout above the iht threshold will be taxed at 40%, or the current iht rate. Do you pay tax if you invest the payout of a life insurance policy? Life insurance death benefits typically won’t be hit with income tax.

Source: theinsuranceproblog.com

Source: theinsuranceproblog.com

Are life insurance payouts taxable? Typically, beneficiaries on a life insurance policy will not be required to pay income tax when they receive a death benefit, but there are certain exceptions to this rule. For instance, if your entire estate is worth £600,000 when you die, your beneficiaries will have to pay inheritance tax of 40% on £275,000, i.e. To avoid this tax, consider setting up an irrevocable life insurance trust (ilit). Yes, any gains on the investments of the proceeds of a life insurance policy are taxable at 41%.

Source: varaklaw.com

Source: varaklaw.com

Here�s when a beneficiary can expect to not pay tax on a life insurance payout:. This applies to life insurance payouts, too. For instance, if your entire estate is worth £600,000 when you die, your beneficiaries will have to pay inheritance tax of 40% on £275,000, i.e. Estate taxes on life insurance payouts. Life cover premiums are sometimes tax deductible, depending on the type of cover and whether you�ve purchased it inside or outside of your super fund.

Source: lion.ie

Source: lion.ie

Do you pay tax if you invest the payout of a life insurance policy? Generally, life insurance payouts to your spouse and children are not taxed. The average property price outside of london is almost half of the tax threshold, with london properties being around the same value as the tax threshold. But if the value of the life insurance policy pushes you over the federal estate tax threshold ($11.70 million as of 2021), any money in your estate above that threshold will get hit with the estate tax upon your death. Bonus and sum assured, under a life insurance policy on maturity or surrender of the policy or on the death of the insured are not taxable i.e.

Source: chill.ie

Source: chill.ie

But if the value of the life insurance policy pushes you over the federal estate tax threshold ($11.70 million as of 2021), any money in your estate above that threshold will get hit with the estate tax upon your death. This applies to life insurance payouts, too. Any taxable elements of a life insurance payout above the iht threshold will be taxed at 40%, or the current iht rate. Other beneficiaries depending on their relationship to the deceased may have to pay tax according. How the estate tax affects a life insurance payout.

Source: pontren-almanar.blogspot.com

Beneficiaries you�re not related to and who are more than 37.5 years younger than you. Are life insurance payouts taxable? Premiums for personal life insurance are not tax deductible, but in the event of a valid claim the cash sum will not be subject to income tax. For instance, if your entire estate is worth £600,000 when you die, your beneficiaries will have to pay inheritance tax of 40% on £275,000, i.e. Likewise, you may be entitled to a supplement to your pension in respect of a spouse/civil partner, but not in respect of a cohabitee.

Source: taxwalls.blogspot.com

Source: taxwalls.blogspot.com

Within 25 days from quarters ending 31 march, 30 june, 30 september, and 31 december). Are life insurance payouts taxable? Any taxable elements of a life insurance payout above the iht threshold will be taxed at 40%, or the current iht rate. However, if the total value of your estate is more than £325,000, inheritance tax (iht) will be deducted from your insurance payout at a rate 40%. Life insurance payouts usually aren�t taxed if they go to financial dependants.

Source: investopedia.com

Source: investopedia.com

A levy of 1% of gross premiums received by insurers applies in relation to certain classes of life insurance policies relating to risks located in ireland. Typically, beneficiaries on a life insurance policy will not be required to pay income tax when they receive a death benefit, but there are certain exceptions to this rule. If there are interest earnings, the insurance company will send the beneficiary a t5 slip. According to the irs, any money received from a life insurance policy is not required to be declared as gross income and does not need to be reported on your tax return. I�m a tax resident in ireland and have received a life insurance payout from a spanish grandmother.

Source: moneywise.com

Source: moneywise.com

Check with your insurer or the trustees of your pension if you want to be sure about the conditions of your particular policy. But your payout could be subject to taxation if your designated beneficiary isn�t a relative. If there are interest earnings, the insurance company will send the beneficiary a t5 slip. Other beneficiaries depending on their relationship to the deceased may have to pay tax according. However, if the total value of your estate is more than £325,000, inheritance tax (iht) will be deducted from your insurance payout at a rate 40%.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

A levy of 1% of gross premiums received by insurers applies in relation to certain classes of life insurance policies relating to risks located in ireland. Bonus and sum assured, under a life insurance policy on maturity or surrender of the policy or on the death of the insured are not taxable i.e. However, if the total value of your estate is more than £325,000, inheritance tax (iht) will be deducted from your insurance payout at a rate 40%. According to the irs, any money received from a life insurance policy is not required to be declared as gross income and does not need to be reported on your tax return. If the person receiving this money is a spouse, then no tax is payable.

Source: express.co.uk

Source: express.co.uk

Premiums for personal life insurance are not tax deductible, but in the event of a valid claim the cash sum will not be subject to income tax. Yes, any gains on the investments of the proceeds of a life insurance policy are taxable at 41%. Within 25 days from quarters ending 31 march, 30 june, 30 september, and 31 december). Other beneficiaries depending on their relationship to the deceased may have to pay tax according. The tool is designed for taxpayers who were u.s.

Source: insurancenoon.com

Source: insurancenoon.com

There are several strategies that you can undertake to avoid saddling your dependents with this cost. Citizens or resident aliens for the entire tax year for which. I�m a tax resident in ireland and have received a life insurance payout from a spanish grandmother. Premiums for personal life insurance are not tax deductible, but in the event of a valid claim the cash sum will not be subject to income tax. Other beneficiaries depending on their relationship to the deceased may have to pay tax according.

Source: miwaylife.co.za

Source: miwaylife.co.za

Estate taxes on life insurance payouts. Generally, life insurance payouts to your spouse and children are not taxed. The tool is designed for taxpayers who were u.s. If the person receiving this money is a spouse, then no tax is payable. If there are interest earnings, the insurance company will send the beneficiary a t5 slip.

Source: thismuchistrue-karen.blogspot.com

Source: thismuchistrue-karen.blogspot.com

Unless tax is due on interest earnings, these amounts don’t have to be reported as taxable income on a tax return. The average property price outside of london is almost half of the tax threshold, with london properties being around the same value as the tax threshold. This exit tax here in ireland has risen steadily since 2001: Secondly, calculate what your estate is worth and see if you will have to pay tax. Check with your insurer or the trustees of your pension if you want to be sure about the conditions of your particular policy.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title tax on life insurance payout ireland by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information