Tax treatment of surrendered life insurance policy information

Home » Trend » Tax treatment of surrendered life insurance policy informationYour Tax treatment of surrendered life insurance policy images are available. Tax treatment of surrendered life insurance policy are a topic that is being searched for and liked by netizens today. You can Get the Tax treatment of surrendered life insurance policy files here. Get all royalty-free photos and vectors.

If you’re looking for tax treatment of surrendered life insurance policy images information connected with to the tax treatment of surrendered life insurance policy topic, you have visit the ideal blog. Our site always gives you suggestions for viewing the maximum quality video and picture content, please kindly surf and find more enlightening video articles and images that fit your interests.

Tax Treatment Of Surrendered Life Insurance Policy. Selling a whole life insurance policy in a life settlement is a strategy to get far greater returns than a surrender. However, remember that for every $100,000 in coverage, only an average of $460 is received in surrender benefits. For a life insurance policy, your premiums are the deposit. There are no tax consequences if the policy has no cash surrender value (csv) — in other words, no proceeds — or the policy’s acb is greater than the csv.

Source: vn-parco.com

Source: vn-parco.com

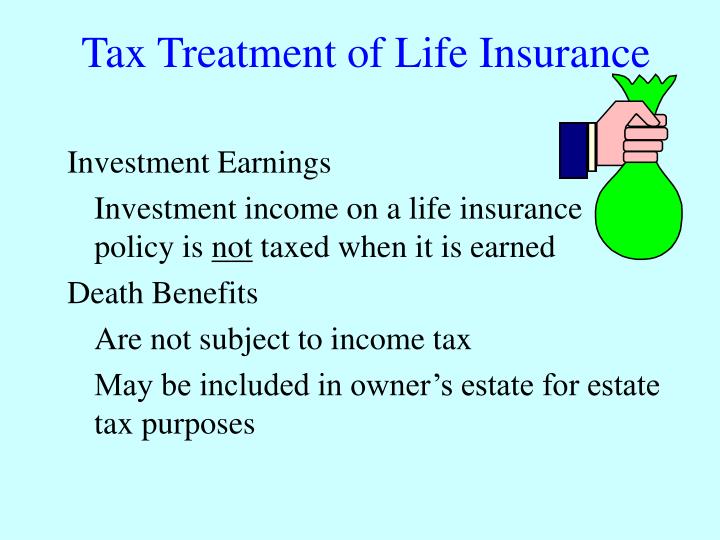

This means even a $1 million whole life. If the event is a death or the maturity, sale or surrender of the whole of a policy, the gain is treated as income of the tax year in which the death, maturity, sale or surrender occurs. One beneficial tax treatment of life insurance is the first in first out ( fifo) accounting principle. Whoever inherits your estate does not have to pay tax on it. However, if there is a partial surrender or sale, then it is the tax year in which the last day of the policy’s insurance year falls.

Source: keijgoeskorea.blogspot.com

Source: keijgoeskorea.blogspot.com

If a loan is still outstanding when a policy is surrendered or allowed to lapse, the borrowed amount becomes taxable at. Gain or loss on surrender or sale of a life insurance policy is discussed in detail in section 19.1, subdivision d. 3,00,000 and total income apart from surrender value is rs. If you surrender a policy in exchange for cash, this will be treated as income by hmrc, so you will need to report and pay tax on it at your usual rate. Where the policy’s csv exceeds the acb, the insurance company issues a t5 to the policyholder for the difference.

Source: prudentiallifeinsurancesurrenderforms.blogspot.com

Source: prudentiallifeinsurancesurrenderforms.blogspot.com

Like individuals, a corporation that is the beneficiary of a life insurance policy will receive the death benefit free of tax. However, if there is a partial surrender or sale, then it is the tax year in which the last day of the policy’s insurance year falls. The amount you deposit is yours and you can take it back tax free. One beneficial tax treatment of life insurance is the first in first out ( fifo) accounting principle. Gain or loss on surrender or sale of a life insurance policy is discussed in detail in section 19.1, subdivision d.

Source: pasivinco.blogspot.com

Source: pasivinco.blogspot.com

Calculating the tax on the cash surrender value of a life insurance policy think of your life insurance policy like a savings account that you can withdraw money from. If you surrender a policy in exchange for cash, this will be treated as income by hmrc, so you will need to report and pay tax on it at your usual rate. Rarely is there a deductible loss. The tax rules on surrendering the life insurance depend on the type of plan you hold. Fifo life insurance withdrawal example

The surrender or sale of a life insurance policy, can result in a gain or loss to the policyowner. A common type of disposition is the cancellation or surrender of a policy. If the event is a death or the maturity, sale or surrender of the whole of a policy, the gain is treated as income of the tax year in which the death, maturity, sale or surrender occurs. However, if there is a partial surrender or sale, then it is the tax year in which the last day of the policy’s insurance year falls. However, the agency requires your representative to file a.

Source: slideserve.com

Source: slideserve.com

However, remember that for every $100,000 in coverage, only an average of $460 is received in surrender benefits. If the policy was purchased after 1 st april 2012, the minimum sum assured should be 10 times of the premium. One notable exception is term assurance policies. Calculating the tax on the cash surrender value of a life insurance policy think of your life insurance policy like a savings account that you can withdraw money from. Where the policy’s csv exceeds the acb, the insurance company issues a t5 to the policyholder for the difference.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

Gain or loss on surrender or sale of a life insurance policy is discussed in detail in section 19.1, subdivision d. The surrender value shall be taxed in the year in which it has surrendered. Gain or loss on surrender or sale of a life insurance policy is discussed in detail in section 19.1, subdivision d. The interest is income and is taxed. To allow for proper tax integration, canadian private corporations can use a notional account called the capital dividend

Source: prudentiallifeinsurancesurrenderforms.blogspot.com

Source: prudentiallifeinsurancesurrenderforms.blogspot.com

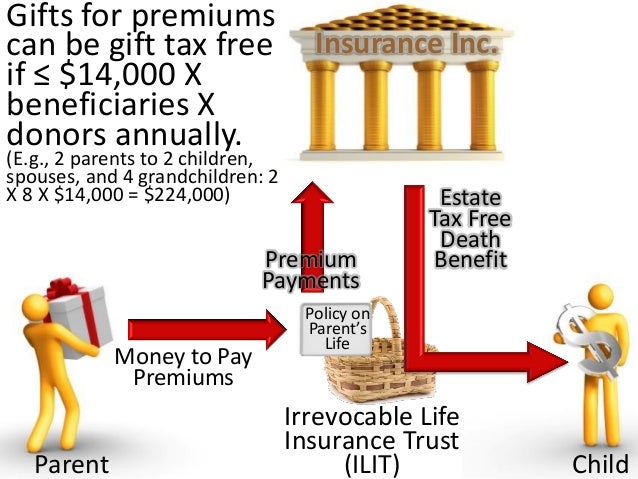

Generally, any gain is taxable as ordinary income. If you have a life insurance policy, you can ensure it is used to cover your final taxes so your heirs can inherit as much as possible. The surrender or sale of a life insurance policy, can result in a gain or loss to the policyowner. Selling a whole life insurance policy in a life settlement is a strategy to get far greater returns than a surrender. To allow for proper tax integration, canadian private corporations can use a notional account called the capital dividend

Source: prudentiallifeinsurancesurrenderforms.blogspot.com

Source: prudentiallifeinsurancesurrenderforms.blogspot.com

If the event is a death or the maturity, sale or surrender of the whole of a policy, the gain is treated as income of the tax year in which the death, maturity, sale or surrender occurs. A common type of disposition is the cancellation or surrender of a policy. 3,00,000 and total income apart from surrender value is rs. 15,00,000, the total income will be rs. Let’s take the previous example as mentioned above, if surrender value of ulip is rs.

Source: prudentiallifeinsurancesurrenderforms.blogspot.com

Source: prudentiallifeinsurancesurrenderforms.blogspot.com

However, if there is a partial surrender or sale, then it is the tax year in which the last day of the policy’s insurance year falls. If you surrender a policy in exchange for cash, this will be treated as income by hmrc, so you will need to report and pay tax on it at your usual rate. Only the amount you receive over the cash basis will be taxed as regular income, at your top tax rate. On may 1, 2009 the internal revenue service issued two revenue rulings to clarify the proper income tax treatment relating to the surrender, sale, and purchase of life insurance policies. If the event is a death or the maturity, sale or surrender of the whole of a policy, the gain is treated as income of the tax year in which the death, maturity, sale or surrender occurs.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

The amount you deposit is yours and you can take it back tax free. The tax rules on surrendering the life insurance depend on the type of plan you hold. If the event is a death or the maturity, sale or surrender of the whole of a policy, the gain is treated as income of the tax year in which the death, maturity, sale or surrender occurs. For a life insurance policy, your premiums are the deposit. Only the amount you receive over the cash basis will be taxed as regular income, at your top tax rate.

Source: prudentiallifeinsurancesurrenderforms.blogspot.com

Source: prudentiallifeinsurancesurrenderforms.blogspot.com

There are no tax consequences if the policy has no cash surrender value (csv) — in other words, no proceeds — or the policy’s acb is greater than the csv. However, the agency requires your representative to file a. Gain or loss on surrender or sale of a life insurance policy is discussed in detail in section 19.1, subdivision d. If you surrender a policy in exchange for cash, this will be treated as income by hmrc, so you will need to report and pay tax on it at your usual rate. Life insurance ‘surrender’ is the relatively rare act of giving up your life policy in exchange for a cash lump sum.

Source: igniter.buzz

Source: igniter.buzz

If a loan is still outstanding when a policy is surrendered or allowed to lapse, the borrowed amount becomes taxable at. To allow for proper tax integration, canadian private corporations can use a notional account called the capital dividend If the policy was purchased after 1 st april 2012, the minimum sum assured should be 10 times of the premium. 3,00,000 and total income apart from surrender value is rs. The surrender value shall be taxed in the year in which it has surrendered.

Source: k2financialpartners.com

Source: k2financialpartners.com

One notable exception is term assurance policies. The taxation of life insurance policy loans. A common type of disposition is the cancellation or surrender of a policy. On average,every $100,000 in life insurance policy value will only gain back $460 in surrender value. However, the agency requires your representative to file a.

Source: kangrohman-agusmunawar.blogspot.com

Source: kangrohman-agusmunawar.blogspot.com

Whoever inherits your estate does not have to pay tax on it. 3,00,000 and total income apart from surrender value is rs. Only the amount you receive over the cash basis will be taxed as regular income, at your top tax rate. Whoever inherits your estate does not have to pay tax on it. The surrender value is exempted from tax only on the fulfilment of the following conditions.

Source: livemint.com

Source: livemint.com

In particular, the rulings address the determination of the owner’s basis in a policy and whether any part of the gain on a surrender or sale of the policy is a capital gain. 3,00,000 and total income apart from surrender value is rs. Selling a whole life insurance policy in a life settlement is a strategy to get far greater returns than a surrender. The pension policy does not come under this purview. The taxation of life insurance policy loans.

Source: prudentiallifeinsurancesurrenderforms.blogspot.com

Source: prudentiallifeinsurancesurrenderforms.blogspot.com

Whoever inherits your estate does not have to pay tax on it. If a loan is still outstanding when a policy is surrendered or allowed to lapse, the borrowed amount becomes taxable at. There are no tax consequences if the policy has no cash surrender value (csv) — in other words, no proceeds — or the policy’s acb is greater than the csv. Selling a whole life insurance policy in a life settlement is a strategy to get far greater returns than a surrender. If you have a life insurance policy, you can ensure it is used to cover your final taxes so your heirs can inherit as much as possible.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title tax treatment of surrendered life insurance policy by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information