Taxation of insurance companies information

Home » Trend » Taxation of insurance companies informationYour Taxation of insurance companies images are ready in this website. Taxation of insurance companies are a topic that is being searched for and liked by netizens today. You can Download the Taxation of insurance companies files here. Find and Download all royalty-free photos and vectors.

If you’re looking for taxation of insurance companies images information related to the taxation of insurance companies interest, you have pay a visit to the ideal blog. Our website always provides you with suggestions for seeing the highest quality video and picture content, please kindly search and find more informative video articles and images that fit your interests.

Taxation Of Insurance Companies. 3 calculation of investment return Withholding tax reclaims based on double tax treaties function just like standardized reimbursements and happen within six to. General insurance companies are taxed under division 321 of the itaa1997, which takes into account their business model. View taxation of insurance companies.pdf from accounting abbq/00801 at technical university of mombasa.

RCT121C Fillin Gross Premiums Tax Foreign Casualty or From formsbirds.com

RCT121C Fillin Gross Premiums Tax Foreign Casualty or From formsbirds.com

Highlights of the new fourth edition include:. Ebook indiana taxation of insurance companies tuebl download online. Loss reserve discounting is projected to raise $13.2 billion from 2018 through 2027 The maximum state premium tax is 4%, while the most common percentage is 2.5%. However, some municipalities may also impose a premium tax, which would be added to the state tax. Were american health & life insurance company (34.0%), cmfg life insurance company (24.0%), minnesota life insurance company (14.7%), pekin life insurance company (11.0%), central states health and life company of omaha (8.4%), and american republic insurance company (4.6%).

The domestic tax rate is higher in most of the cases, especially for dividends, leading to reimbursement possibilities for insurance companies.

The government is seeking information and comments from interested parties on the tax impacts of implementing the new accounting standard for insurance contracts (aasb17) which will apply mandatorily for annual reporting periods beginning on or after 1 january 2021. These instructions will help you complete the life insurance companies taxation schedule 2021. The following is a list of various book titles based on search results using the keyword indiana taxation of insurance companies. Taxing insurance companies this study examines the difficult task of applying income taxation to the life and property and casualty insurance industries. Taxation of insurance companies an insurance company is a body corporate and is therefore Loss reserve discounting is projected to raise $13.2 billion from 2018 through 2027

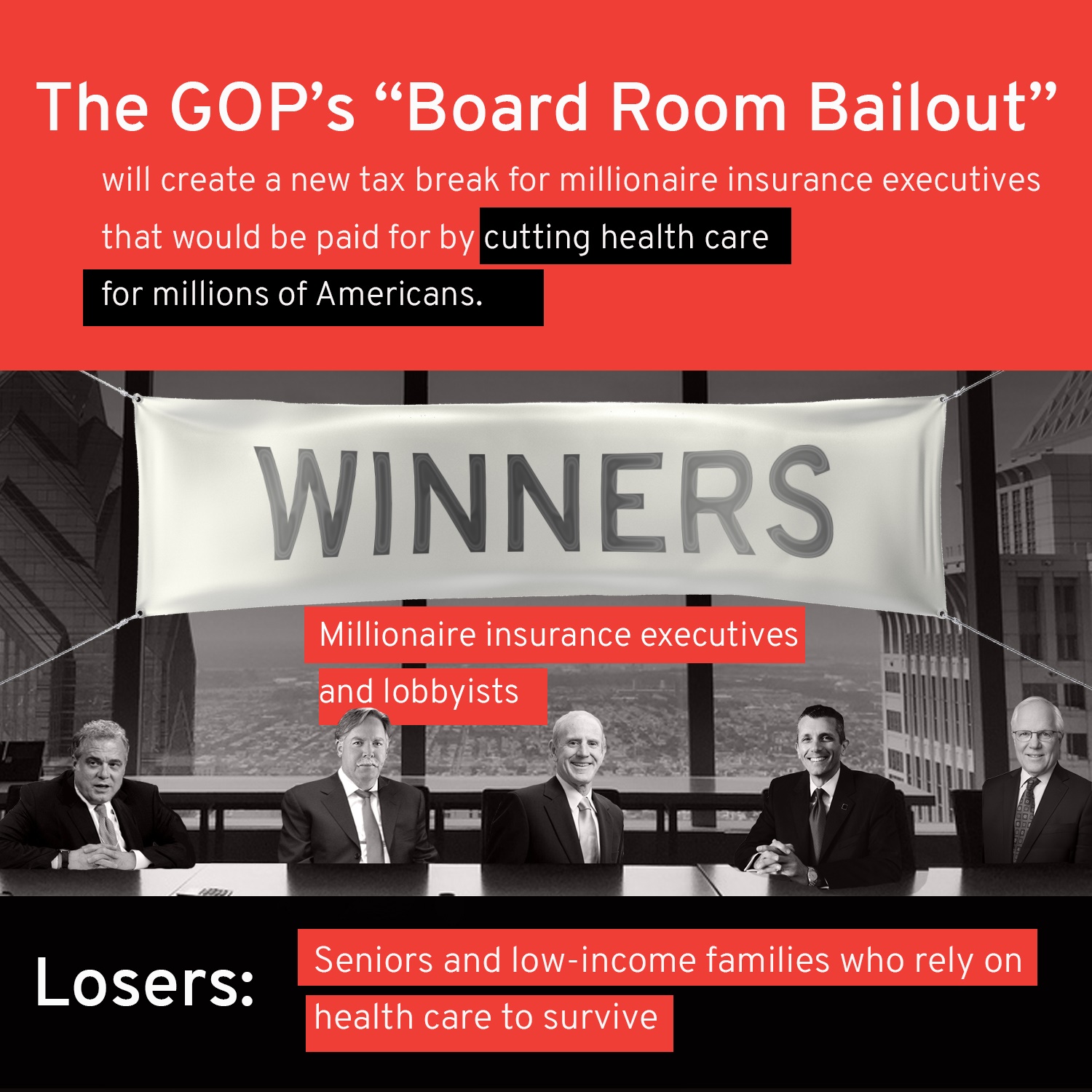

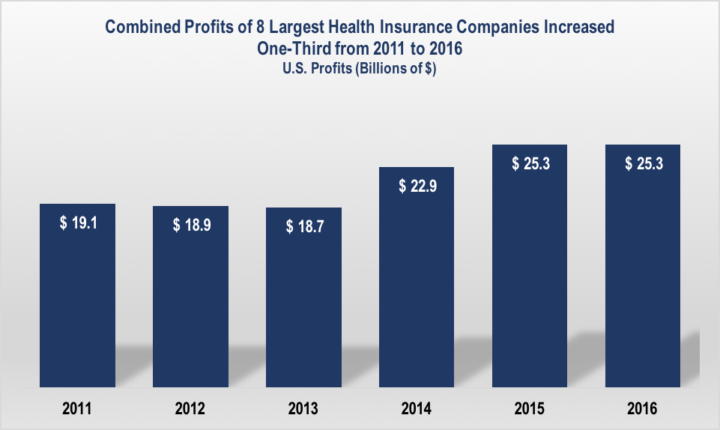

Source: aflcio.org

Source: aflcio.org

Highlights of the new fourth edition include:. This will inform the government’s consideration of whether and what changes may be. Tax practitioners who are new to insurance company taxation and students can use it as introduction to this field. Loss reserve discounting is projected to raise $13.2 billion from 2018 through 2027 Particularly in the case of life insurance, oecd countries have pursued a variety of methods to.

Source: bdblaw.com.ph

Federal income taxation of insurance companies, fourth edition, provides a comprehensive analysis of life and nonlife insurance company taxation in the united states, including corporate tax issues, the taxation of captive insurance arrangements, and provisions related to special health insurance providers. Taxation life insurance companies are taxed on a ‘total income’ basis including overall profit from underwriting and investment income. They are not a guide to income tax law. General insurance companies are taxed under division 321 of the itaa1997, which takes into account their business model. Annuity policies are related to

Source: formsbank.com

Source: formsbank.com

Insurance companies pay corporate tax only in the state in which they are domiciled, but premium taxes are collected by every state in which premiums are written. Federal income taxation of insurance companies, second edition, provides a comprehensive analysis of insurance company taxation, including corporate tax issues specific to insurance companies. Summary of changes impacting all corporations. View taxation of insurance companies.pdf from accounting abbq/00801 at technical university of mombasa. The maximum state premium tax is 4%, while the most common percentage is 2.5%.

Source: store.lexisnexis.com

Source: store.lexisnexis.com

Taxation of insurance companies and gains/profit arising from insurance company for taxation purposes as well as general insurance for businesses tutorial by Summary of changes impacting all corporations. Taxation of insurance companies a number of issues arise relating to the tax treatment of insurance companies. Withholding tax reclaims based on double tax treaties function just like standardized reimbursements and happen within six to. Taxation of insurance companies and gains/profit arising from insurance company for taxation purposes as well as general insurance for businesses tutorial by

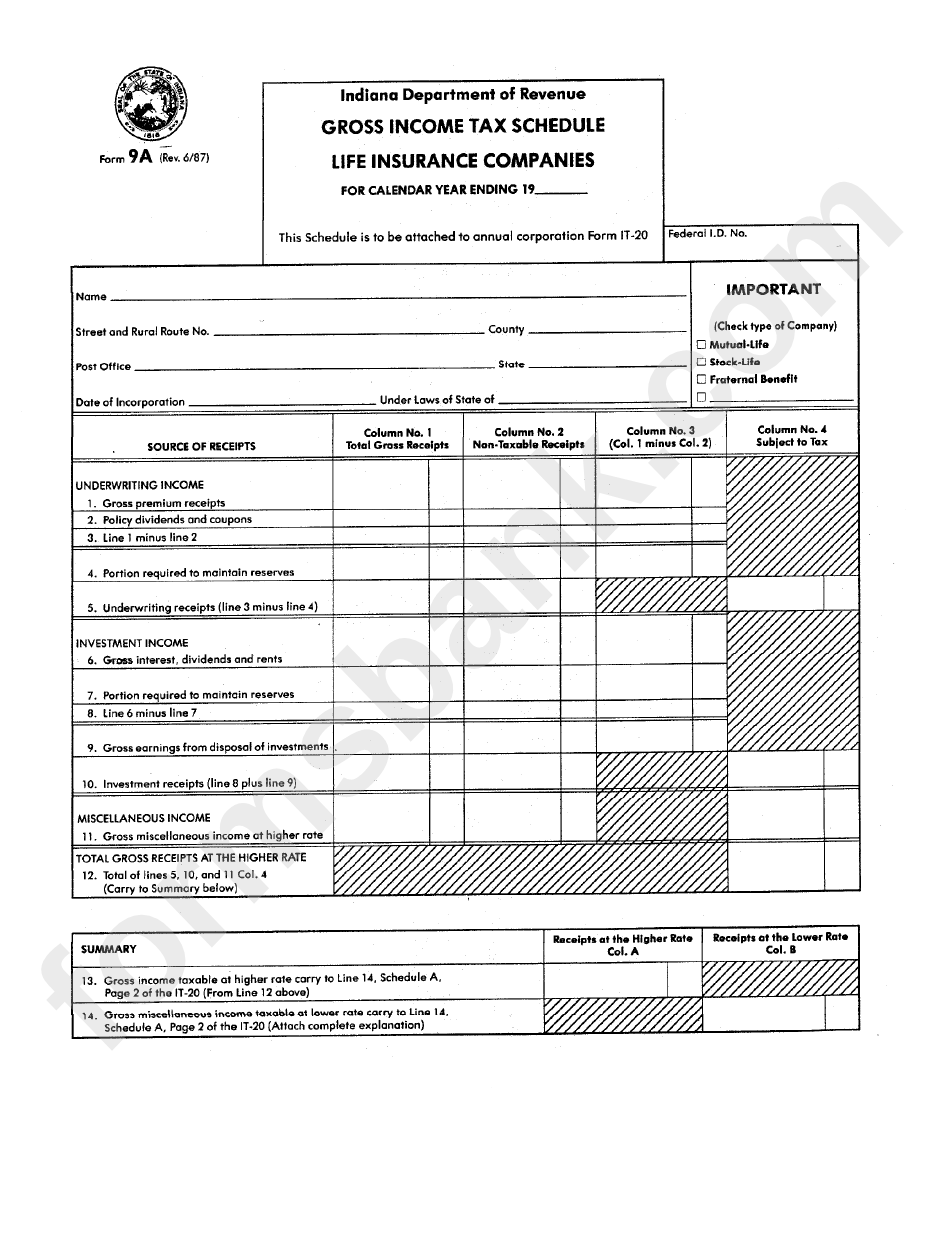

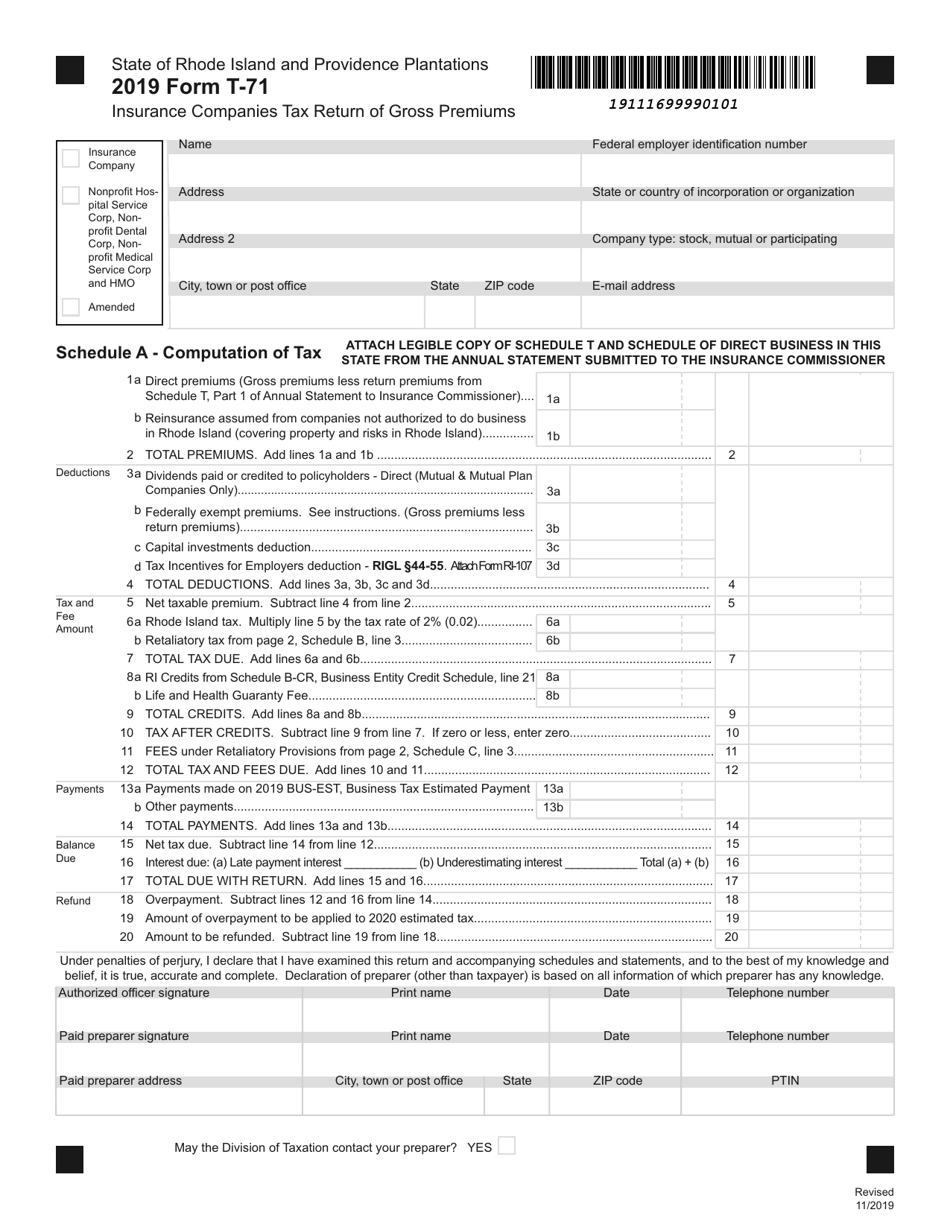

Source: formsbank.com

Source: formsbank.com

The government is seeking information and comments from interested parties on the tax impacts of implementing the new accounting standard for insurance contracts (aasb17) which will apply mandatorily for annual reporting periods beginning on or after 1 january 2021. In this article, the author gives a. Taxation life insurance companies are taxed on a ‘total income’ basis including overall profit from underwriting and investment income. They are not a guide to income tax law. 1.1 the taxation of life insurance business in india is currently governed by section 115 b, section 44 and the first schedule of the income tax act, 1961.

Source: americansfortaxfairness.org

Source: americansfortaxfairness.org

The new life company tax regimesupports the government�s policy of making the tax system simpler by bringing the taxation of life companies more in line with other companies, and aligning it more closely with the commercial realities of life insurance business. Highlights of the new fourth edition include:. Taxation of insurance companies an insurance company is a body corporate and is therefore Taxation life insurance companies are taxed on a ‘total income’ basis including overall profit from underwriting and investment income. Summary of changes impacting all corporations.

Source: formsbank.com

Source: formsbank.com

Ebook indiana taxation of insurance companies tuebl download online. The maximum state premium tax is 4%, while the most common percentage is 2.5%. The government is seeking information and comments from interested parties on the tax impacts of implementing the new accounting standard for insurance contracts (aasb17) which will apply mandatorily for annual reporting periods beginning on or after 1 january 2021. Click get book on the book you want. Loss reserve discounting is projected to raise $13.2 billion from 2018 through 2027

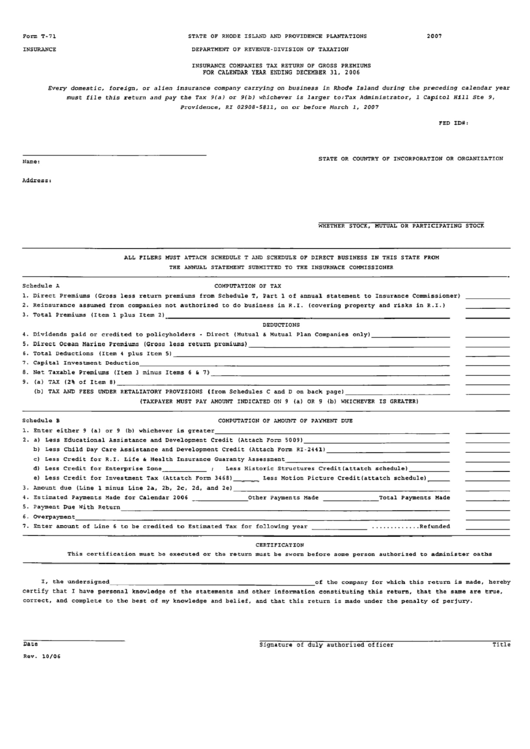

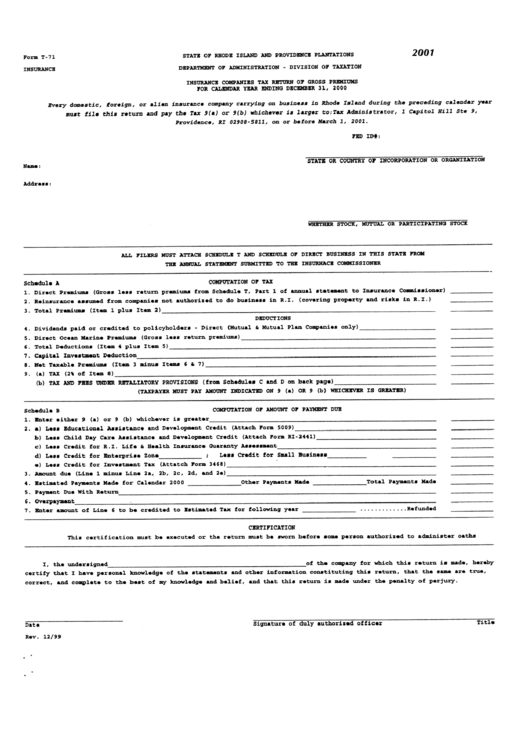

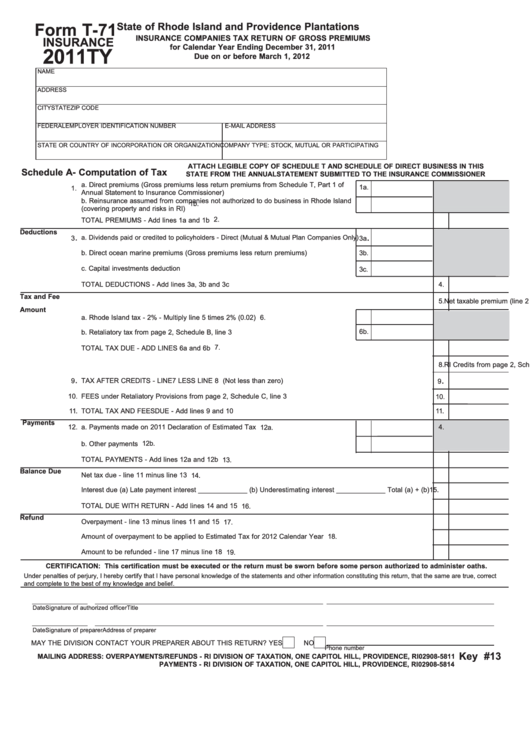

Source: templateroller.com

Source: templateroller.com

Taxation life insurance companies are taxed on a ‘total income’ basis including overall profit from underwriting and investment income. Ebook indiana taxation of insurance companies tuebl download online. However, some municipalities may also impose a premium tax, which would be added to the state tax. In this article, the author gives a. The schedule is to be completed by:

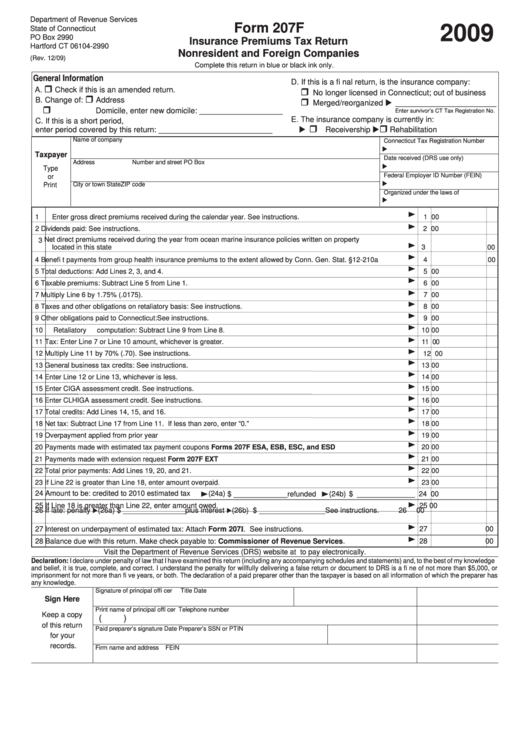

Source: formsbirds.com

Source: formsbirds.com

Loss reserve discounting is projected to raise $13.2 billion from 2018 through 2027 In this article, the author gives a. The texts of these are reproduced herein for ready reference. The head company of a consolidated group that includes at least one member that is a life insurance company. Click get book on the book you want.

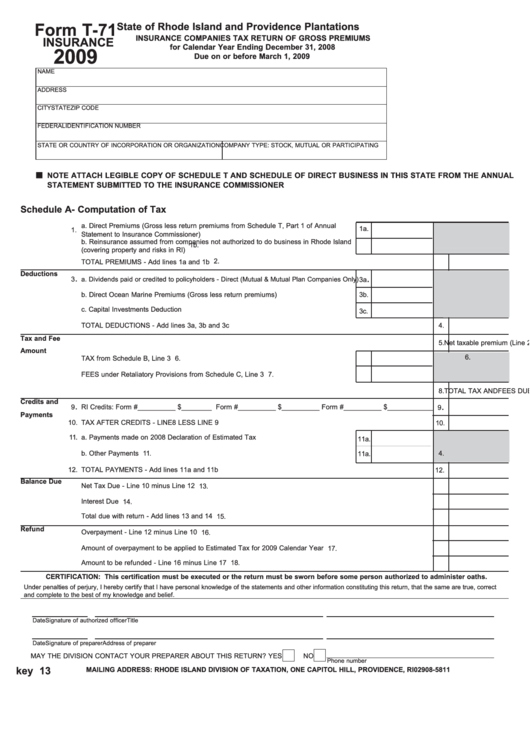

Source: formsbirds.com

Source: formsbirds.com

A life insurance company, or. Were american health & life insurance company (34.0%), cmfg life insurance company (24.0%), minnesota life insurance company (14.7%), pekin life insurance company (11.0%), central states health and life company of omaha (8.4%), and american republic insurance company (4.6%). Life assurance the tax treatment of life assurance companies varies depending on when the life assurance business was contracted. Federal income taxation of insurance companies, second edition, provides a comprehensive analysis of insurance company taxation, including corporate tax issues specific to insurance companies. The following is a list of various book titles based on search results using the keyword indiana taxation of insurance companies.

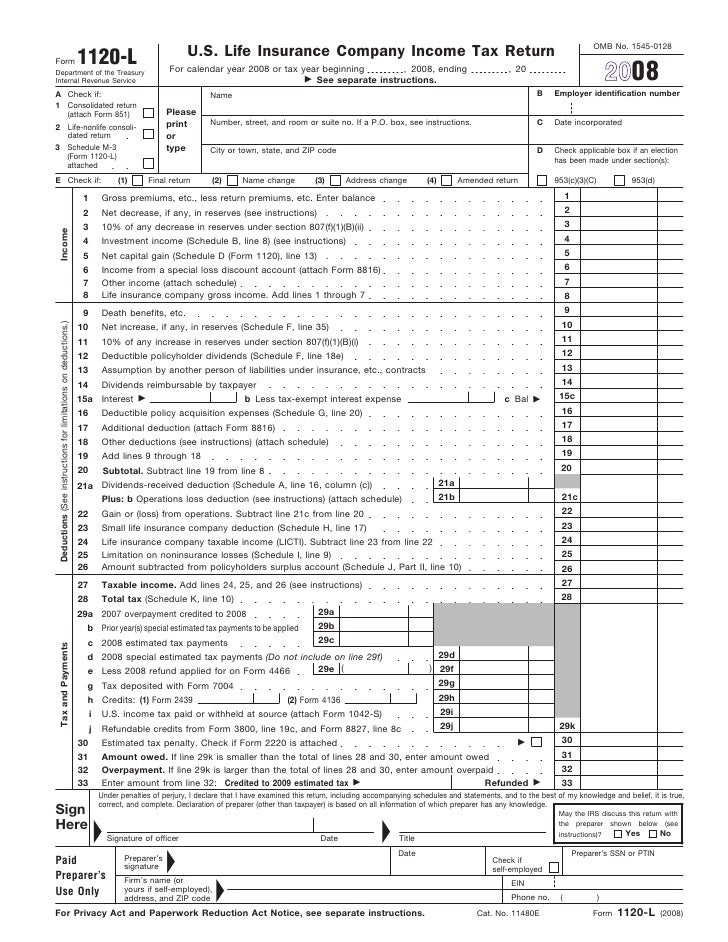

Source: slideshare.net

Source: slideshare.net

Insurance companies pay corporate tax only in the state in which they are domiciled, but premium taxes are collected by every state in which premiums are written. View taxation of insurance companies.pdf from accounting abbq/00801 at technical university of mombasa. Annuity policies are related to The schedule is to be completed by: The texts of these are reproduced herein for ready reference.

Source: formsbank.com

Source: formsbank.com

The following is a list of various book titles based on search results using the keyword indiana taxation of insurance companies. The head company of a consolidated group that includes at least one member that is a life insurance company. Summary of changes impacting all corporations. This will inform the government’s consideration of whether and what changes may be. The government is seeking information and comments from interested parties on the tax impacts of implementing the new accounting standard for insurance contracts (aasb17) which will apply mandatorily for annual reporting periods beginning on or after 1 january 2021.

Source: formsbank.com

Source: formsbank.com

The new life company tax regimesupports the government�s policy of making the tax system simpler by bringing the taxation of life companies more in line with other companies, and aligning it more closely with the commercial realities of life insurance business. Rates range from.5% to 4.35% per recent e&y study, converts to a net income tax rate of nearly 20% • rates can differ by product line within the state life insurance health insurance property/casualty fire 1)49 states and dc have a retaliatory tax Highlights of the new fourth edition include:. Business contracted on or after 1 january 2001 is The schedule is to be completed by:

Source: pinterest.com

Source: pinterest.com

This will inform the government’s consideration of whether and what changes may be. However, some municipalities may also impose a premium tax, which would be added to the state tax. Business contracted on or after 1 january 2001 is Taxing insurance companies this study examines the difficult task of applying income taxation to the life and property and casualty insurance industries. Loss reserve discounting is projected to raise $13.2 billion from 2018 through 2027

Source: formsbank.com

Source: formsbank.com

Business contracted on or after 1 january 2001 is Tax practitioners who are new to insurance company taxation and students can use it as introduction to this field. The domestic tax rate is higher in most of the cases, especially for dividends, leading to reimbursement possibilities for insurance companies. Taxation of insurance companies a number of issues arise relating to the tax treatment of insurance companies. Rates range from.5% to 4.35% per recent e&y study, converts to a net income tax rate of nearly 20% • rates can differ by product line within the state life insurance health insurance property/casualty fire 1)49 states and dc have a retaliatory tax

Source: in.pinterest.com

Source: in.pinterest.com

Taxation of insurance companies an insurance company is a body corporate and is therefore Annuity policies are related to The schedule is to be completed by: Insurance companies pay corporate tax only in the state in which they are domiciled, but premium taxes are collected by every state in which premiums are written. This will inform the government’s consideration of whether and what changes may be.

Source: revisi.net

Source: revisi.net

The domestic tax rate is higher in most of the cases, especially for dividends, leading to reimbursement possibilities for insurance companies. Taxation of insurance companies and gains/profit arising from insurance company for taxation purposes as well as general insurance for businesses tutorial by Annuity policies are related to Withholding tax reclaims based on double tax treaties function just like standardized reimbursements and happen within six to. The texts of these are reproduced herein for ready reference.

Source: captivatingthinking.com

Source: captivatingthinking.com

A life insurance company, or. Annuity policies are related to Were american health & life insurance company (34.0%), cmfg life insurance company (24.0%), minnesota life insurance company (14.7%), pekin life insurance company (11.0%), central states health and life company of omaha (8.4%), and american republic insurance company (4.6%). A life insurance company, or. Rates range from.5% to 4.35% per recent e&y study, converts to a net income tax rate of nearly 20% • rates can differ by product line within the state life insurance health insurance property/casualty fire 1)49 states and dc have a retaliatory tax

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title taxation of insurance companies by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information