Tds on medical insurance premium Idea

Home » Trending » Tds on medical insurance premium IdeaYour Tds on medical insurance premium images are available. Tds on medical insurance premium are a topic that is being searched for and liked by netizens today. You can Download the Tds on medical insurance premium files here. Download all free photos and vectors.

If you’re looking for tds on medical insurance premium images information related to the tds on medical insurance premium interest, you have pay a visit to the ideal site. Our site always gives you hints for viewing the maximum quality video and picture content, please kindly surf and locate more informative video articles and images that match your interests.

Tds On Medical Insurance Premium. Individual, to effect or keep in force an insurance on his health or health of. This section allows you to receive tax deductions on premiums made for medical insurance for yourself and on behalf of your family. Tds is a form of income tax whereby the relevant tax amount is deducted directly from the full amount, before the resulting income is provided to a person. Tds provisions are exhaustive provisions.

DEDUCTION FOR MEDICAL INSURANCE PREMIUMPREVENTIVE HEALTH From simpletaxindia.net

DEDUCTION FOR MEDICAL INSURANCE PREMIUMPREVENTIVE HEALTH From simpletaxindia.net

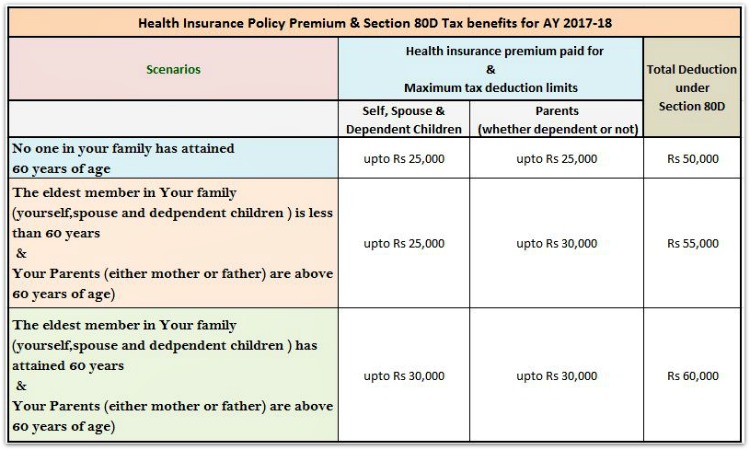

An individual can claim a deduction of rs 25,000 for insurance premium paid for self, spouse and dependent children. Tds is typically applicable on salaries, professional fees, interests and commissions. Deduction in respect of medical insurance premium [section 80d] as per section 80d, an individual or a huf can claim deduction in respect of the following payments: Medical insurance premium paid by assessee, being individual/huf by any mode other than cash. They just provide the nature of incomes on which tds is required to be deducted. Aggregate of point (a) and (b) cannot be more than rs.

Ca hemant t dewani (expert) follow 24 march 2009 tds is not deducted on medical insurance.

Medical insurance premium paid by assessee, being individual/huf by any mode other than cash. There is no tds on any kind of insurance payments. 25000 for resident tax payers aged less than 60 years and rs. This tax deduction is available over and above the deduction of rs. 30 march 2012 tds is not applicable on insurance premium paid to an insurance company. Group health insurance › is tds applicable on health insurance premium paid by employer

Source: oliverjean-alittlelovefromyou.blogspot.com

Source: oliverjean-alittlelovefromyou.blogspot.com

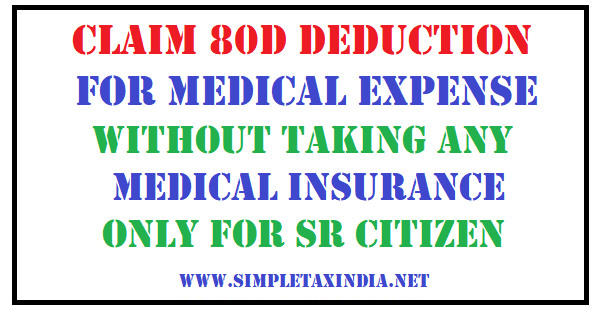

There is no tds on any kind of insurance payments. (b) medical expenditure for a very senior citizen: This section allows you to receive tax deductions on premiums made for medical insurance for yourself and on behalf of your family. 28 july 2020 no, you are not required to deduct tds, though government organization. Under section 80d, you are allowed to claim a tax deduction of up to rs 25,000 per financial year on medical insurance premiums.

Source: aegonlife.com

Source: aegonlife.com

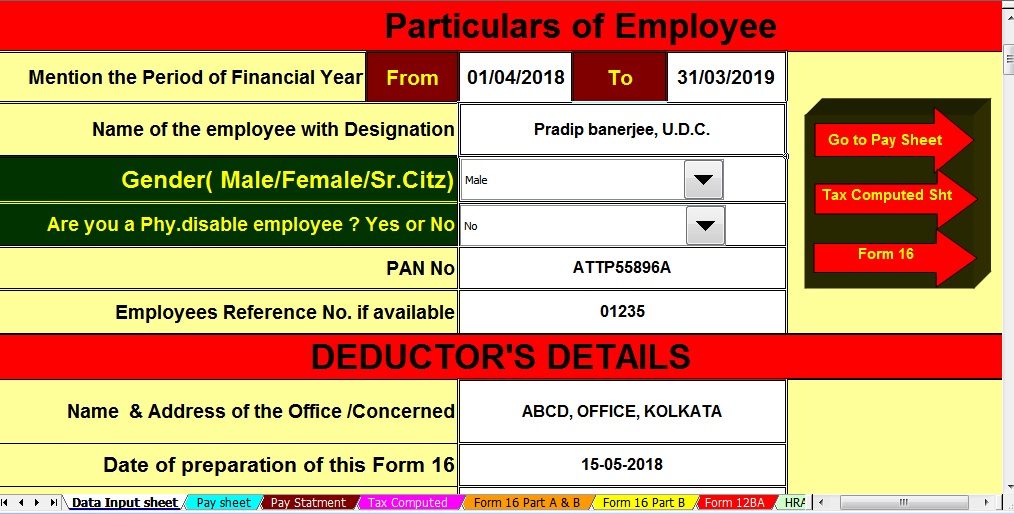

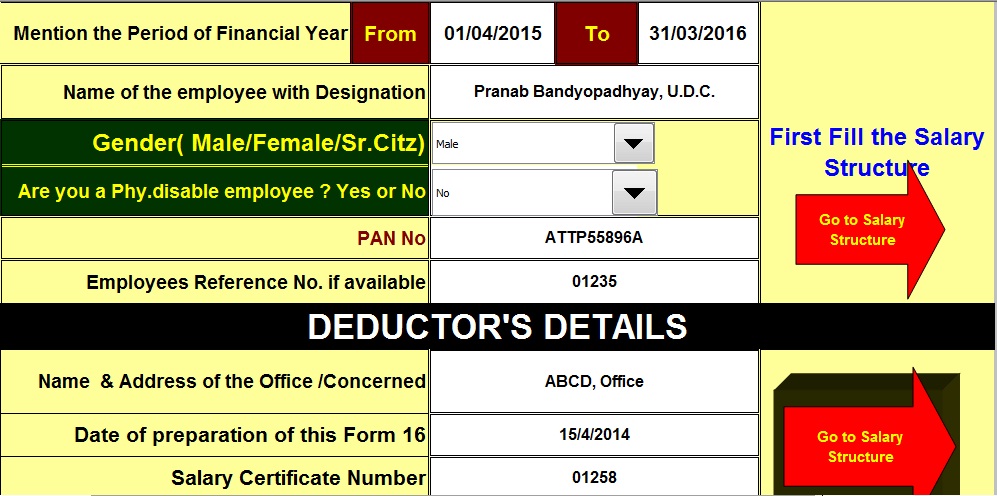

25,000 can be claimed for insurance of self, spouse and dependent children. This limit applies to the premium paid towards health insurance purchased for you, your spouse, and your dependent children. This tax deduction is available over and above the deduction of rs. Under section 80d, you are allowed to claim a tax deduction of up to rs 25,000 per financial year on medical insurance premiums. Average income tax rate = income tax payable (computed through slab.

Source: amac.us

Source: amac.us

Tds provisions are exhaustive provisions. This tax deduction is available over and above the deduction of rs. Aggregate of point (a) and (b) cannot be more than rs. There is no tds on any kind of insurance payments. Deduction in respect of medical insurance premium [section 80d] as per section 80d, an individual or a huf can claim deduction in respect of the following payments:

Source: simpletaxindia.net

Source: simpletaxindia.net

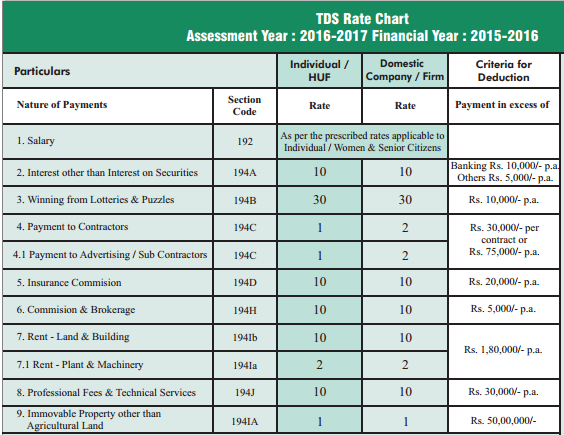

The rate of deduction is 5% if the payee’s pan is provided. This section lets you receive tax deductions on premiums made for medical insurance to secure yourself and your family members. Payment of insurance premium is an investment and not an expenditure for the person who is paying. If provisions of section 194d get attracted, the deductor is required to deduct tds @ 10% in case of domestic company and @ 5% in any other case. The section 80d of the income tax act, 1961 deals with tax deductions on medical insurance.

Source: facelesscompliance.com

Source: facelesscompliance.com

30 march 2012 tds is not applicable on insurance premium paid to an insurance company. 5,000 is allowed for the medical insurance premium paid for senior citizen or very senior citizen. Group health insurance › is tds applicable on health insurance premium paid by employer They just provide the nature of incomes on which tds is required to be deducted. The section 80d of the income tax act, 1961 deals with tax deductions on medical insurance.

Source: pinterest.com

Source: pinterest.com

5,000 is allowed for the medical insurance premium paid for senior citizen or very senior citizen. Deduction in respect of medical insurance premium [section 80d] as per section 80d, an individual or a huf can claim deduction in respect of the following payments: This tax deduction is available over and above the deduction of rs. Tds provisions are exhaustive provisions. 5,000 is allowed for the medical insurance premium paid for senior citizen or very senior citizen.

Source: itaxsoftware.blogspot.com

Source: itaxsoftware.blogspot.com

The section 80d of the income tax act, 1961 deals with tax deductions on medical insurance. Medical insurance premium paid by assessee, being individual/huf by any mode other than cash. Section 80d provides for tax deduction from the total taxable income for the payment (by any mode other than cash) of medical insurance premium paid by an individual or a huf. Tds calculation formula with example (as per new regime) typically, the employer deducts tds from his employee’s salary at the ‘average rate’ of his income tax. The deducted amount is eventually deposited with the government.

Source: taxexcel.blogspot.com

Source: taxexcel.blogspot.com

As per section 194d, any person making payment to a resident as the insurance commission or any other remuneration / reward is required to deduct tds. The section 80d of the income tax act, 1961 deals with tax deductions on medical insurance. There is no tds on any kind of insurance payments. 5,000 is allowed for the medical insurance premium paid for senior citizen or very senior citizen. Therefore there is no tds liability of payment of insurance premium.

Source: indiantaxationupdatess.blogspot.com

Source: indiantaxationupdatess.blogspot.com

Showing replies 1 to 1 of 1 records. Q.2 what percentage of tds is deducted? Tds is a form of income tax whereby the relevant tax amount is deducted directly from the full amount, before the resulting income is provided to a person. Any contribution made by assessee, being individual to central government health scheme or such other. This tax deduction is available over and above the deduction of rs.

Source: simpletaxindia.net

Source: simpletaxindia.net

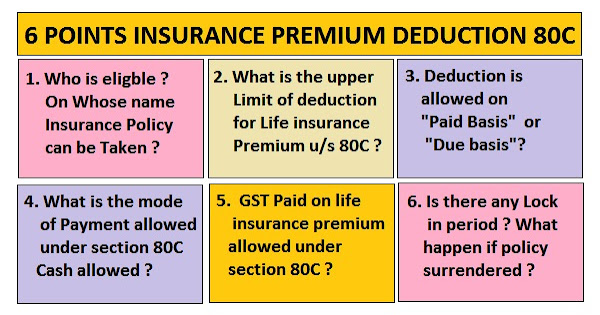

Q.2 what percentage of tds is deducted? Deduction for premium paid for medical insurance. Tds on life insurance policies Tds is a form of income tax whereby the relevant tax amount is deducted directly from the full amount, before the resulting income is provided to a person. Tds provisions are exhaustive provisions.

Source: indiantaxationupdatess.blogspot.com

Source: indiantaxationupdatess.blogspot.com

This section lets you receive tax deductions on premiums made for medical insurance to secure yourself and your family members. This limit applies to the premium paid towards health insurance purchased for you, your spouse, and your dependent children. Under section 194da, tds is applicable on all taxable payments made under life insurance policies. The section 80d of the income tax act, 1961 deals with tax deductions on medical insurance. Section 80d of the income tax act, 1961 relates to the tax deductions on medical insurance.

Source: bemoneyaware.com

Source: bemoneyaware.com

Tds is required to be deducted by the payee, if it is paid as expense. 30 march 2012 tds is not applicable on insurance premium paid to an insurance company. As per section 194d, any person making payment to a resident as the insurance commission or any other remuneration / reward is required to deduct tds. Tds on life insurance policies Deduction under this section is available to an individual or a huf.

Source: simpletaxindia.net

Source: simpletaxindia.net

Payment of insurance premium is an investment and not an expenditure for the person who is paying. Deduction in respect of medical insurance premium [section 80d] as per section 80d, an individual or a huf can claim deduction in respect of the following payments: The rate of deduction is 5% if the payee’s pan is provided. Q.2 what percentage of tds is deducted? Tds is required to be deducted by the payee, if it is paid as expense.

Source: taxationwealth.com

Source: taxationwealth.com

Showing replies 1 to 1 of 1 records. An individual can claim a deduction of rs 25,000 for insurance premium paid for self, spouse and dependent children. Any contribution made by assessee, being individual to central government health scheme or such other. The deducted amount is eventually deposited with the government. For entities other than individual & huf however, the tds rate is 10% if pan is provided.

Source: asianage.com

Source: asianage.com

Payment of insurance premium is an investment and not an expenditure for the person who is paying. Tds calculation formula with example (as per new regime) typically, the employer deducts tds from his employee’s salary at the ‘average rate’ of his income tax. There is no tds on any kind of insurance payments. In budget 2016, the rate of tax deducted at source (tds) on life insurance policies where maturity proceeds are taxable has been halved from 2% to 1%. 30 march 2012 tds is not applicable on insurance premium paid to an insurance company.

Source: taxexcel.blogspot.com

Source: taxexcel.blogspot.com

Group health insurance › is tds applicable on health insurance premium paid by employer Group health insurance › is tds applicable on health insurance premium paid by employer There is no tds on any kind of insurance payments. Deduction under this section is available to an individual or a huf. 30 march 2012 tds is not applicable on insurance premium paid to an insurance company.

Source: ateacher.in

Source: ateacher.in

Section 80d of the income tax act provides tax deduction for health insurance premium paid by individuals. The provisions of tds do not have a negative list (tds is not applicable on this & this). Payment of insurance premium is an investment and not an expenditure for the person who is paying. Medical insurance premium paid by assessee, being individual/huf by any mode other than cash. 25,000 can be claimed for insurance of self, spouse and dependent children.

Source: cagmc.com

Source: cagmc.com

Follow 24 march 2009 a company is paying medical insurance premiun to insurance company on behalf of it�s empoyees. They just provide the nature of incomes on which tds is required to be deducted. (b) medical expenditure for a very senior citizen: Tds is typically applicable on salaries, professional fees, interests and commissions. The provisions of tds do not have a negative list (tds is not applicable on this & this).

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title tds on medical insurance premium by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information