Tech e o insurance information

Home » Trend » Tech e o insurance informationYour Tech e o insurance images are ready in this website. Tech e o insurance are a topic that is being searched for and liked by netizens now. You can Get the Tech e o insurance files here. Get all free vectors.

If you’re looking for tech e o insurance images information linked to the tech e o insurance topic, you have visit the ideal blog. Our site always provides you with hints for viewing the maximum quality video and picture content, please kindly hunt and locate more enlightening video content and graphics that fit your interests.

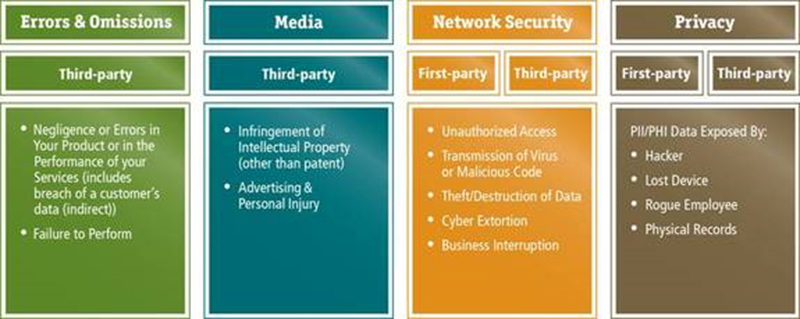

Tech E O Insurance. Nevertheless, cyber and privacy insurance policies do offer a number of the same insuring agreements as tech e&o policies. Technology errors and omissions insurance and cyber liability insurance both address cyber risk, but from different perspectives. In contrast to tech e&o coverage, cyber and privacy insurance is intended to protect consumers of technology products and services. Errors and omissions insurance solutions with general & professional liability tech general liability |.

Small Business Insurance Kuzneski Insurance Group From kuzneski.com

However, they both differ from data breach and cyber liability insurance. Nevertheless, cyber and privacy insurance policies do offer a number of the same insuring agreements as tech e&o policies. Tech e&o covers unintentional breach of contract. Errors and omissions insurance solutions with general & professional liability tech general liability |. Provide immediate risk assessments and rate, quote, and bind in under 2 minutes to win more business. These errors can range from missing project deadlines to recommending inappropriate technology.

These are both the same insurance and provide coverage for errors, omissions, mistakes, and negligence in technology services or products provided.

In contrast to tech e&o coverage, cyber and privacy insurance is intended to protect consumers of technology products and services. Technology e&o insurance is a form of small business insurance that protects policyholders from losses accrued from the failure of technology products or services they sell to their customers. Provide immediate risk assessments and rate, quote, and bind in under 2 minutes to win more business. Axis technology errors & omissions insurance provides coverage for liability exposures arising from software products, security breaches, content dissemination and the performance of professional services. Who is tech e&o insurance for? Risk management experts who specialize in providing the right coverage for technology companies commonly cite tech errors & omissions as one of the most important policies and an essential piece of the puzzle when putting together a good tech startup insurance package.

Source: kuzneski.com

Technology e&o is an insurance bundle designed specifically for tech companies. Tech e&o policies are a type of professional liability policy that covers providers of technology services or products for financial losses to their customers that result from errors or omissions on the part of the tech company. Techguard® provides a range of coverage options with flexibility to fit your clients� unique needs. Provide immediate risk assessments and rate, quote, and bind in under 2 minutes to win more business. It is likely that a technology provider will, by contract, need to supply evidence of e&o coverage.

Source: eperils.com

Source: eperils.com

Tech e&o designed to move at the speed of technology. Technology e&o insurance applies when a company makes a mistake or is negligent in providing their tech service, which causes financial harm to a customer. Specifically, tech e&o insurance covers financial loss to a company’s client due to failure of the company’s. Technology professional liability insurance is commonly referred to as technology e&o insurance. Tech e&o insurance is often confused with cyber and privacy insurance.

Source: thefoleyinsurancegroup.com

Source: thefoleyinsurancegroup.com

Technology errors and omissions insurance cost. These errors can range from missing project deadlines to recommending inappropriate technology. It is likely that a technology provider will, by contract, need to supply evidence of e&o coverage. Understanding how these insurances work will help you ensure that your client is getting the most from each type, and,. Nevertheless, cyber and privacy insurance policies do offer a number of the same insuring agreements as tech e&o policies.

Source: harrylevineinsurance.com

Source: harrylevineinsurance.com

Axis technology errors & omissions insurance provides coverage for liability exposures arising from software products, security breaches, content dissemination and the performance of professional services. However, they both differ from data breach and cyber liability insurance. On average, e&o coverage costs about $500 to $1,000 per year, per employee. Technology errors and omissions insurance. Technology errors and omissions insurance and cyber liability insurance both address cyber risk, but from different perspectives.

In contrast to tech e&o coverage, cyber and privacy insurance is intended to protect consumers of technology products and services. Provide immediate risk assessments and rate, quote, and bind in under 2 minutes to win more business. It includes smart cyber insurance coverage with a dynamic loss prevention™ report that provides detailed it security recommendations, access to our risk. Technology errors and omissions insurance (tech e&o) is a type of professional liability insurance designed to cover specific exposures faced by providers of technology services or products. Network asset protection covers system failures, operational mistakes, and acts of cyber terrorism or other cyber attacks.

Source: blog.coverwallet.com

Source: blog.coverwallet.com

Technology professional liability insurance is commonly referred to as technology e&o insurance. Tech e&o is a subset of miscellaneous professional liability specifically tailored to address the unique exposures presented by technology companies. E&o insurance for the technology based business general liability. We decided to write an article about the differences between tech e&o vs. When a client sues to recover losses, technology e&o insurance will pay for a firm’s legal expenses, including:

Source: at-bay.com

Source: at-bay.com

Tech e&o covers unintentional breach of contract. Technology errors and omissions insurance (tech e&o) is a type of professional liability insurance designed to cover specific exposures faced by providers of technology services or products. Techguard® provides a range of coverage options with flexibility to fit your clients� unique needs. Technology e&o is an insurance bundle designed specifically for tech companies. Tech e&o insurance is intended to cover two basic risks :

Source: kirkwoodinsurance.net

Source: kirkwoodinsurance.net

*insurance products may be underwritten by north american capacity insurance company, north american specialty insurance company, or an affiliated company, which are members of swiss re corporate solutions. Tech e&o insurance is often confused with cyber and privacy insurance. Tech e&o insurance was created to specifically protect technology companies by covering risks associated with financial losses suffered by clients related to a technology product or service’s failure to perform as intended or losses arising from acts, errors, or inadequate, negligent work committed by the tech company in the course of its. Technology e&o insurance protects a company that makes a mistake or forgets to do a critical task that hurts a client financially. Don’t settle for e&o coverage by endorsement.

Source: withlayr.com

Source: withlayr.com

Tech e&o policies are a type of professional liability policy that covers providers of technology services or products for financial losses to their customers that result from errors or omissions on the part of the tech company. On average, e&o coverage costs about $500 to $1,000 per year, per employee. Technology e&o insurance is a form of small business insurance that protects policyholders from losses accrued from the failure of technology products or services they sell to their customers. Who is tech e&o insurance for? Specifically, tech e&o insurance covers financial loss to a company’s client due to failure of the company’s.

Source: insurancebusinessmag.com

Source: insurancebusinessmag.com

Tech e&o policies are a type of professional liability policy that covers providers of technology services or products for financial losses to their customers that result from errors or omissions on the part of the tech company. It is likely that a technology provider will, by contract, need to supply evidence of e&o coverage. Understanding how these insurances work will help you ensure that your client is getting the most from each type, and,. Technology e&o insurance was created to provide coverage for. Technology e&o is an insurance bundle designed specifically for tech companies.

Source: databreachinsurancequote.com

Source: databreachinsurancequote.com

(1) financial loss of a third party arising from failure of the insured’s product to perform as intended or expected, and (2) financial loss of a third party arising from an act, error, or omission committed in the course of the insured’s performance of services for another. We take a proactive approach to our cyber solutions by helping demystify the cyber risk landscape and deliver production innovation. *insurance products may be underwritten by north american capacity insurance company, north american specialty insurance company, or an affiliated company, which are members of swiss re corporate solutions. Technology errors and omissions insurance cost. In contrast to tech e&o coverage, cyber and privacy insurance is intended to protect consumers of technology products and services.

Source: generalliabilityshop.com

Source: generalliabilityshop.com

It includes errors and omissions insurance and cyber liability insurance policies, and. Don’t settle for e&o coverage by endorsement. Tech e&o insurance is often confused with cyber and privacy insurance. These are both the same insurance and provide coverage for errors, omissions, mistakes, and negligence in technology services or products provided. In contrast to tech e&o coverage, cyber and privacy insurance is intended to protect consumers of technology products and services.

Source: at-bay.com

Source: at-bay.com

It is likely that a technology provider will, by contract, need to supply evidence of e&o coverage. It includes errors and omissions insurance and cyber liability insurance policies, and. In contrast to tech e&o coverage, cyber and privacy insurance is intended to protect consumers of technology products and services. When a client sues to recover losses, technology e&o insurance will pay for a firm’s legal expenses, including: We decided to write an article about the differences between tech e&o vs.

Source: hub.clements.com

Source: hub.clements.com

These mistakes can range from recommending inappropriate technology to failing to meet project deadlines. When a client sues to recover losses, technology e&o insurance will pay for a firm’s legal expenses, including: Errors and omissions insurance solutions with general & professional liability tech general liability |. Technology consultants, system integrators, application. Technology errors and omissions insurance and cyber liability insurance both address cyber risk, but from different perspectives.

Source: liabilitycover.ca

Source: liabilitycover.ca

Risk management experts who specialize in providing the right coverage for technology companies commonly cite tech errors & omissions as one of the most important policies and an essential piece of the puzzle when putting together a good tech startup insurance package. Don’t settle for e&o coverage by endorsement. In contrast to tech e&o coverage, cyber and privacy insurance is intended to protect consumers of technology products and services. Technology e&o insurance protects a company that makes a mistake or forgets to do a critical task that hurts a client financially. On average, e&o coverage costs about $500 to $1,000 per year, per employee.

Source: embroker.com

Source: embroker.com

Technology errors and omissions insurance cost. When a client sues to recover losses, technology e&o insurance will pay for a firm’s legal expenses, including: However, they both differ from data breach and cyber liability insurance. Tech e&o insurance is often confused with cyber and privacy insurance. Tech e&o covers unintentional breach of contract.

Source: jobearn.in

Source: jobearn.in

Nevertheless, cyber and privacy insurance policies do offer a number of the same insuring agreements as tech e&o policies. Technology e&o insurance applies when a company makes a mistake or is negligent in providing their tech service, which causes financial harm to a customer. Technology errors and omissions insurance. In contrast to tech e&o coverage, cyber and privacy insurance is intended to protect consumers of technology products and services. Tech e&o insurance was created to specifically protect technology companies by covering risks associated with financial losses suffered by clients related to a technology product or service’s failure to perform as intended or losses arising from acts, errors, or inadequate, negligent work committed by the tech company in the course of its.

Source: embroker.com

Source: embroker.com

Errors and omissions insurance solutions with general & professional liability tech general liability |. Types of businesses that can be covered by tech e&o insurance include, but aren’t limited to: Network asset protection covers system failures, operational mistakes, and acts of cyber terrorism or other cyber attacks. Technology e&o insurance applies when a company makes a mistake or is negligent in providing their tech service, which causes financial harm to a customer. Technology e&o insurance was created to provide coverage for.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title tech e o insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information