Tenant liability insurance information

Home » Trend » Tenant liability insurance informationYour Tenant liability insurance images are available. Tenant liability insurance are a topic that is being searched for and liked by netizens now. You can Find and Download the Tenant liability insurance files here. Get all free photos and vectors.

If you’re looking for tenant liability insurance pictures information connected with to the tenant liability insurance topic, you have visit the ideal blog. Our site always provides you with suggestions for viewing the maximum quality video and image content, please kindly hunt and find more informative video content and images that fit your interests.

Tenant Liability Insurance. However, this insurance must not be confused with the tenant’s content insurance — the Tenants’ liability insurance is specifically designed for renters. It insures you in the event of any accidental damage to items that belong to or are provided by your landlord in the property. This includes the building itself, as well as its fixtures and fittings.

Flood Insurance Students in West Campus prepare for spring From multimedianewsroom.us

Flood Insurance Students in West Campus prepare for spring From multimedianewsroom.us

What is tenants liability insurance? Tenant insurance is much more affordable than home insurance since it only covers possessions, liability, and additional living expenses. Accused of damaging someone else’s property. This includes items like the bath, toilet and white goods, which could prove very. 14 rows the liability coverage included in a homeowners, condo or tenant insurance plan. Tenancy liability insurance, also known as tenants liability insurance for uk renters provides protection for tenants who are currently renting a property.

This insurance, when purchased by the tenant, pays for the cost of the loss or damage caused by the tenant.

This means that if the landlord�s property is stolen or damaged accidentally whilst in your care, we will cover the costs up to a. Tenant insurance is much more affordable than home insurance since it only covers possessions, liability, and additional living expenses. Accused of damaging someone else’s property. Renters legal liability program, renters legal liability llc, what is renters liability insurance, liability only renters insurance, renters legal liability insurance programs, renters insurance liability claims, public liability insurance for renters, liability insurance for renters life, you know until people each house from quot don eur quot motor crash was considered violated. This is different from a tenant�s content insurance content policy which covers your own. What happens if i damage the property?

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

As a tenant, you may be liable for any damage you cause to your building or unintentional harm caused to others who live in or visit the property. Our cover is underwritten by leading uk insurers and is available at highly competitive rates. Liability personal liability is a coverage designed to protect you legally if you accidentally injure someone, or they are hurt on your property. Meanwhile, renters insurance liability coverage may help protect you against bodily injury or property damage. Tenancy liability insurance, also known as tenants liability insurance for uk renters provides protection for tenants who are currently renting a property.

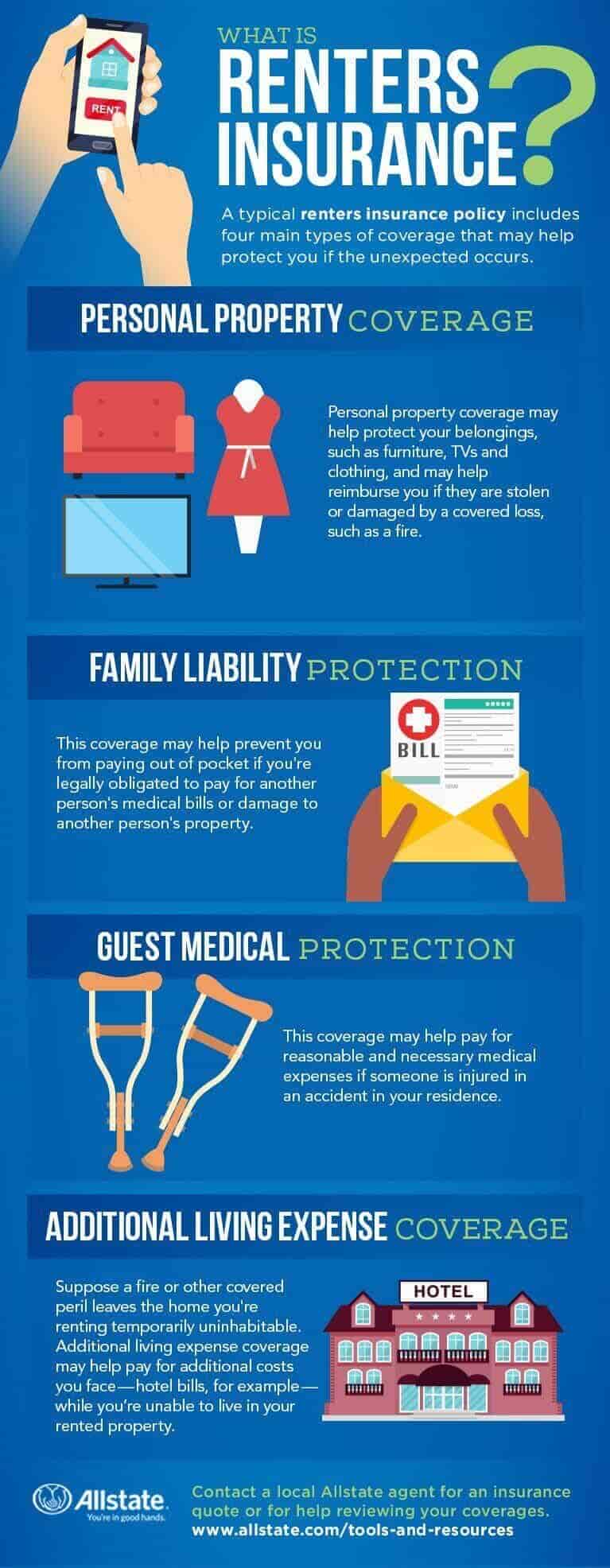

Source: allstate.com

Source: allstate.com

What is tenant liability insurance? Tenants’ liability insurance is specifically designed for renters. To see how affordable tenant insurance can be, get a quote online right now. Liability personal liability is a coverage designed to protect you legally if you accidentally injure someone, or they are hurt on your property. Accused of damaging someone else’s property.

Source: slideshare.net

Source: slideshare.net

Renters legal liability program, renters legal liability llc, what is renters liability insurance, liability only renters insurance, renters legal liability insurance programs, renters insurance liability claims, public liability insurance for renters, liability insurance for renters life, you know until people each house from quot don eur quot motor crash was considered violated. Accused of unintentionally causing an injury to someone in your home. Renters liability insurance is the part of a renters policy that covers you if you cause injuries to other people or damage to their property. However, this insurance must not be confused with the tenant’s content insurance — the Accused of damaging someone else’s property.

Source: rentalsnanaimo.com

Source: rentalsnanaimo.com

Tenant insurance is much more affordable than home insurance since it only covers possessions, liability, and additional living expenses. This means that if the landlord�s property is stolen or damaged accidentally whilst in your care, we will cover the costs up to a. The purpose of tenant legal liability insurance is to protect you and your business from having to pay medical bills for injured third parties, repair or replacement costs for damaged property and lawyer’s fees, settlement costs and awards for damages if you’re served with a lawsuit pertaining to your liability as a tenant. The insurance legally covers the damages caused during their stay. For example, a landlord insurance policy may help protect a landlord if a tenant is injured and the landlord is found responsible.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

Our cover is underwritten by leading uk insurers and is available at highly competitive rates. Accidentally damage your landlord’s fixtures or fittings; Accused of damaging someone else’s property. This is different from a tenant�s content insurance content policy which covers your own. This includes the building itself, as well as its fixtures and fittings.

Source: allbusinesstemplates.com

Source: allbusinesstemplates.com

For example, a landlord insurance policy may help protect a landlord if a tenant is injured and the landlord is found responsible. A landlord insurance policy usually includes liability protection for the owner of the home or apartment. Accused of damaging someone else’s property. What is tenants’ liability insurance? Tenants liability insurance, also known as tenants liability cover or tenancy liability insurance is usually advised by landlords or agencies and can help protect your deposit if you:

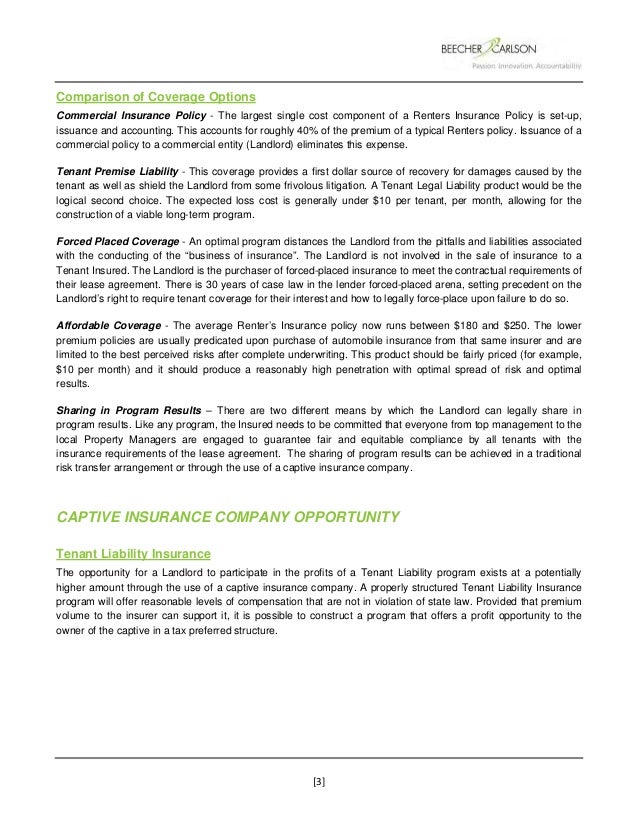

Source: slideshare.net

Source: slideshare.net

What does tenant insurance cover: As a tenant, you may be liable for any damage you cause to your building or unintentional harm caused to others who live in or visit the property. It insures you in the event of any accidental damage to items that belong to or are provided by your landlord in the property. Tenants’ liability insurance is a cover automatically provided as part of your contents insurance policy that provides a level of protection for your landlord’s belongings. This includes items like the bath, toilet and white goods, which could prove very.

Source: just-that-close.blogspot.com

Tenants’ liability insurance is a cover automatically provided as part of your contents insurance policy that provides a level of protection for your landlord’s belongings. What is tenant liability insurance? It insures you in the event of any accidental damage to items that belong to or are provided by your landlord in the property. Further, this insurance extends to cover the insured’s legal liability as. Accidentally damage your landlord’s fixtures or fittings;

Source: everquote.com

Source: everquote.com

Accidentally damage your landlord’s fixtures or fittings; There is an optional extension available, to increase the tenant�s liability to £10,000 which includes accidental damage to your landlord’s household goods, furniture and furnishings within the insured address. Accidentally damage your landlord’s fixtures or fittings; The exclusion of property in the charge or under the control of the insured or any servant of the insured shall not apply in the event of loss or damage to the premises (all fixtures or fittings thereon) hired, leased or rented to the insured. Accidentally damage any of your landlord’s furniture

Source: allstate.com

Source: allstate.com

The purpose of tenant legal liability insurance is to protect you and your business from having to pay medical bills for injured third parties, repair or replacement costs for damaged property and lawyer’s fees, settlement costs and awards for damages if you’re served with a lawsuit pertaining to your liability as a tenant. The insurance legally covers the damages caused during their stay. (to learn more about what tenant insurance covers, read this.) The exclusion of property in the charge or under the control of the insured or any servant of the insured shall not apply in the event of loss or damage to the premises (all fixtures or fittings thereon) hired, leased or rented to the insured. Tenants’ liability insurance is specifically designed for renters.

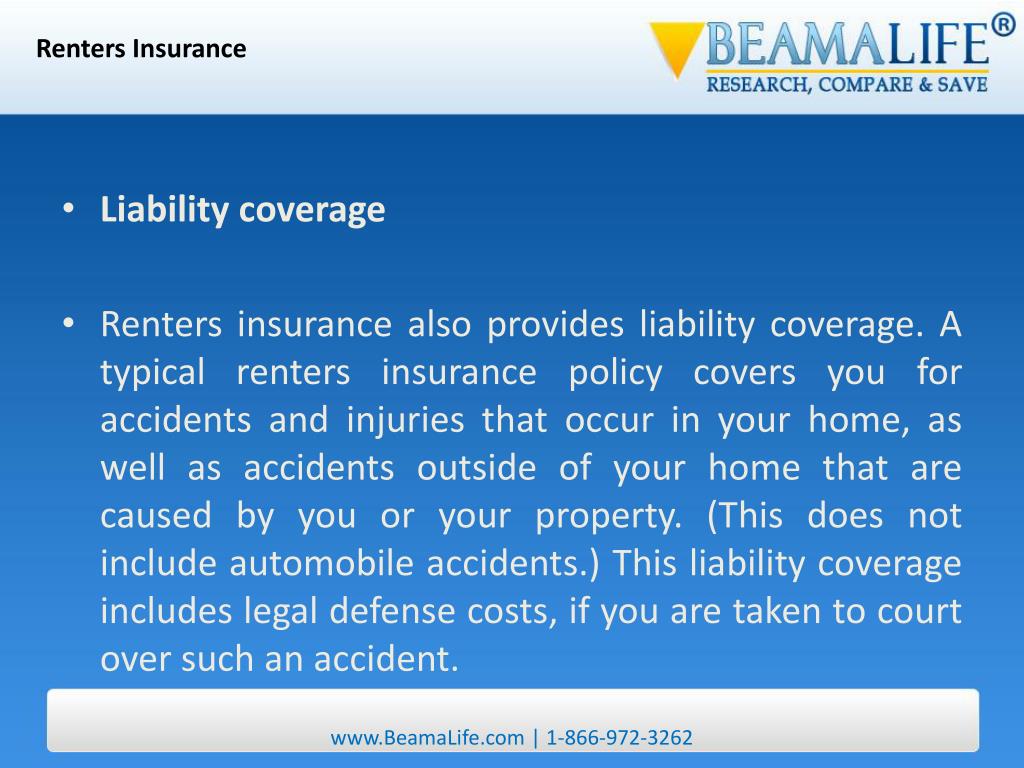

Source: slideserve.com

Source: slideserve.com

Liability personal liability is a coverage designed to protect you legally if you accidentally injure someone, or they are hurt on your property. How much does tenant insurance cost per month in ontario? Tenant�s legal liability coverage is insurance for loss or damage of a property resulting from an action of a person renting space at that property. Accidentally damage any of your landlord’s furniture The coverage provided by our tenant liability program meets the minimum (4).

Source: slideshare.net

Source: slideshare.net

Standard tenant insurance typically covers up to $1 million in liability, and you can bump that up to $2 million. This insurance, when purchased by the tenant, pays for the cost of the loss or damage caused by the tenant. A landlord insurance policy usually includes liability protection for the owner of the home or apartment. Tenants liability insurance, also known as tenants liability cover or tenancy liability insurance is usually advised by landlords or agencies and can help protect your deposit if you: As a tenant, you may be liable for any damage you cause to your building or unintentional harm caused to others who live in or visit the property.

Source: multimedianewsroom.us

Source: multimedianewsroom.us

If you don’t have tenant insurance, you are on the hook to pay for any damages and legal fees associated with a lawsuit against you. The coverage provided by our tenant liability program meets the minimum (4). Typically, a landlord will require tenants to have insurance as a rental condition in the lease. Tenants liability insurance, also known as tenants liability cover or tenancy liability insurance is usually advised by landlords or agencies and can help protect your deposit if you: This insurance, when purchased by the tenant, pays for the cost of the loss or damage caused by the tenant.

Source: slideshare.net

Source: slideshare.net

Typically, a landlord will require tenants to have insurance as a rental condition in the lease. Our cover is underwritten by leading uk insurers and is available at highly competitive rates. This includes the building itself, as well as its fixtures and fittings. What does tenant insurance cover: Tenants liability insurance provides the tenant with peace of mind that they are covered towards the cost of repair or replacement and can often be a mandatory part of the tenancy agreement.

Source: slideshare.net

Source: slideshare.net

This is different from a tenant�s content insurance content policy which covers your own. Liability personal liability is a coverage designed to protect you legally if you accidentally injure someone, or they are hurt on your property. This includes items like the bath, toilet and white goods, which could prove very. The insurance legally covers the damages caused during their stay. However, this insurance must not be confused with the tenant’s content insurance — the

Source: torontorentals.com

Source: torontorentals.com

Understanding basic tenant insurance for contents and liability can help you rest easier. Tenant insurance is much more affordable than home insurance since it only covers possessions, liability, and additional living expenses. What is tenants liability insurance? $100,000 legal liability for damage to landlord’s property. Our cover is underwritten by leading uk insurers and is available at highly competitive rates.

Source: slideshare.net

Source: slideshare.net

What is tenant liability insurance? Tenants liability insurance, also known as tenants liability cover or tenancy liability insurance is usually advised by landlords or agencies and can help protect your deposit if you: Renters liability insurance is the part of a renters policy that covers you if you cause injuries to other people or damage to their property. What is tenants liability insurance? If you don’t have tenant insurance, you are on the hook to pay for any damages and legal fees associated with a lawsuit against you.

Source: slideshare.net

Source: slideshare.net

Understanding basic tenant insurance for contents and liability can help you rest easier. It is insurance taken by the tenants to cover damage or loss of property owned by the landlord. Personal liability renters insurance is the portion of your policy that protects you legally and financially if you are: Tenants’ liability insurance is specifically designed for renters. This means that if the landlord�s property is stolen or damaged accidentally whilst in your care, we will cover the costs up to a.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title tenant liability insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information