Tenants insurance vs contents insurance information

Home » Trend » Tenants insurance vs contents insurance informationYour Tenants insurance vs contents insurance images are available. Tenants insurance vs contents insurance are a topic that is being searched for and liked by netizens today. You can Get the Tenants insurance vs contents insurance files here. Download all free photos.

If you’re looking for tenants insurance vs contents insurance pictures information connected with to the tenants insurance vs contents insurance keyword, you have visit the right site. Our site frequently gives you suggestions for seeing the maximum quality video and picture content, please kindly hunt and find more informative video content and images that fit your interests.

Tenants Insurance Vs Contents Insurance. Homeowners insurance, on the other hand, is a type of property insurance that covers the structure of the home and any belongings owned by the homeowner inside of the property. Tenant insurance is typically very affordable, but it depends on the size and location of your home and the value of your personal property. The average cost of contents insurance for tenants between january and june 2019 was £59, but the actual amount you’ll pay will depend on a number of factors: Does everybody need contents insurance?

Learn more in our guide below. Either way, it’s worth the measly monthly cost. If it doesn’t include tenants’ liability, it won’t cover any damage to your landlord’s belongings. Contents insurance can also be taken out by homeowners. It can either cover specific types of loss or provide coverage against all causes. Typically content coverage is for people with valuable assets (original artwork, jewelry, etc) in excess of what standard liability and property coverage would be needed.

What is tenants content insurance?

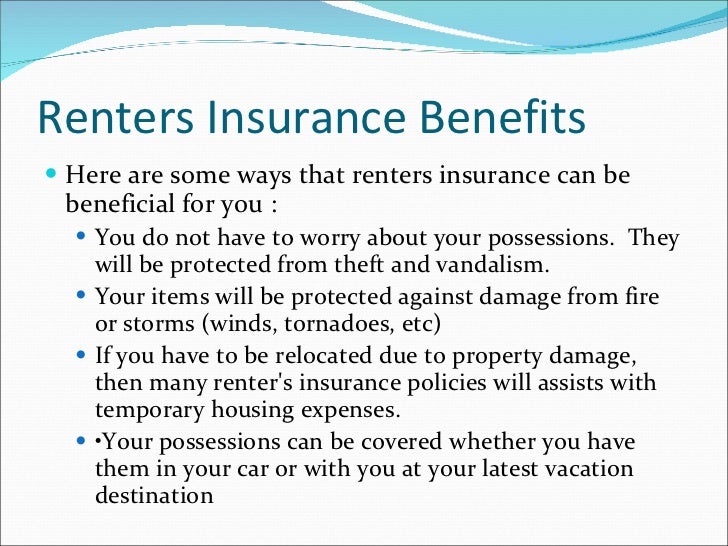

If you damage your own belongings, it won’t affect the deposit return on your rental. In fact, your policy may even cover the contents of your freezer. This type of insurance protects the value of the contents of an apartment, office, or other rental property against common forms of loss. Tenancy liability covers accidental damage to your landlord�s contents and items they provide for you to use, whereas tenants contents insurance covers your personal possessions in case of fire, theft, accidental damage or other insured risk. Technically speaking, it works exactly. Renters insurance only covers the personal belongings and home contents and not any actual structures or buildings.

Learn more in our guide below. Renter’s insurance requires you to add additional policy measure to cover theft outside your premises, while contents insurance can be readily claimed if such incidents happen. On a 100k policy in the us typically the difference between renters and content coverage is less than $20 a year. Typically, your possessions are protected against theft, damage due to fire, flood, storms, malicious damage, burst pipes and water leak. This could include furniture, appliances, and personal things such as jewellery if they are stolen or broken.

Source: fsogradstudentchronicles.blogspot.com

Source: fsogradstudentchronicles.blogspot.com

Admiral tenants insurance protects your valuables from. On a 100k policy in the us typically the difference between renters and content coverage is less than $20 a year. Tenants contents insurance is a policy which covers your personal possessions in your rental property. In addition to providing cover for your personal belongings, the policy also includes tenants’ liability insurance which means you are also protected should you need to cover the cost of any accidental damage to the landlord’s fixtures and fittings. For this reason, tenant insurance is referred to as various different terms such as home renters’ insurance and tenants’ contents insurance to name a few.

Source: availsupermarket.co.uk

Source: availsupermarket.co.uk

This type of insurance can sometimes be referred as �tenants insurance�, �tenants contents insurance� or just �contents insurance�. For this reason, tenant insurance is referred to as various different terms such as home renters’ insurance and tenants’ contents insurance to name a few. It’s usually better value to buy a home contents insurance policy, with tenants liability cover included. Does everybody need contents insurance? If you damage your own belongings, it won’t affect the deposit return on your rental.

Source: currentinsurance.ca

Source: currentinsurance.ca

Does everybody need contents insurance? This could include furniture, appliances, and personal things such as jewellery if they are stolen or broken. Learn more in our guide below. With endsleigh you�d need to make sure your contents insurance is covered up to £17,000 as the tenants liability is limited to 30%, so 30% of £17,000 is abuot £5000. A renter’s insurance policy with apolloinsurancestarts at $17/month, whereas squareoneinsuranceoffers tenant insurance quotes as low as $12/month.

Source: moneyunder30.com

Source: moneyunder30.com

Renters insurance only covers the personal belongings and home contents and not any actual structures or buildings. Contents insurance contents insurance is one component of a tenant�s insurance policy. This could include furniture, appliances, and personal things such as jewellery if they are stolen or broken. What is tenants content insurance? A tenant is someone who occupies land or property which is rented from a landlord.

Source: iastl.com

Source: iastl.com

There are two main types of tenant insurance cover: In fact, your policy may even cover the contents of your freezer. There are two main types of tenant insurance cover: Tenancy liability and tenants contents insurance. Typical loss categories include theft, fire, and flood.

Source: pinterest.com

Source: pinterest.com

On a 100k policy in the us typically the difference between renters and content coverage is less than $20 a year. If you’re wondering how tenants’ insurance in the uk differs with contents insurance, it doesn’t!. Tenancy liability covers accidental damage to your landlord�s contents and items they provide for you to use, whereas tenants contents insurance covers your personal possessions in case of fire, theft, accidental damage or other insured risk. As the name suggests, contents insurance covers the belongings you keep in your property. Homeowners insurance, on the other hand, is a type of property insurance that covers the structure of the home and any belongings owned by the homeowner inside of the property.

Source: bramleys.com

Source: bramleys.com

It can either cover specific types of loss or provide coverage against all causes. Learn more in our guide below. While both provide insurance for your personal belongings, renters insurance is designed specifically for tenants. Tenant insurance for renters explained we often think of home insurance as protecting against the loss or damage of the big stuff—like pipes, appliances, and the physical structure of a home or building. Endsleigh seem to include it at standard:

Source: amjcampbell.com

Source: amjcampbell.com

Homeowners insurance, on the other hand, is a type of property insurance that covers the structure of the home and any belongings owned by the homeowner inside of the property. Typically, your possessions are protected against theft, damage due to fire, flood, storms, malicious damage, burst pipes and water leak. Renters insurance only covers the personal belongings and home contents and not any actual structures or buildings. Tenants’ insurance vs contents insurance. Renters insurance provides you with peace of mind as it protects.

In a shared living situation insurance sonetimes requires that your room has its own lock that your housemates don�t have a key to, so check that before you buy. The biggest difference between home contents insurance vs. The main difference is that contents insurance covers your belongings. Renter’s insurance requires you to add additional policy measure to cover theft outside your premises, while contents insurance can be readily claimed if such incidents happen. Homeowners insurance, on the other hand, is a type of property insurance that covers the structure of the home and any belongings owned by the homeowner inside of the property.

Source: einsurance.com

Source: einsurance.com

Either way, it’s worth the measly monthly cost. Renters insurance provides you with peace of mind as it protects. Technically speaking, it works exactly. It also covers additional living expenses if you need to move out of your space. Does everybody need contents insurance?

Source: intel26.blogspot.com

Source: intel26.blogspot.com

Either way, it’s worth the measly monthly cost. The average cost of contents insurance for tenants between january and june 2019 was £59, but the actual amount you’ll pay will depend on a number of factors: Contents insurance can also be taken out by homeowners. As some landlords require their tenants to have some form of insurance, renters cover is an ideal solution for a tenant looking for contents insurance. With endsleigh you�d need to make sure your contents insurance is covered up to £17,000 as the tenants liability is limited to 30%, so 30% of £17,000 is abuot £5000.

Source: intel26.blogspot.com

Source: intel26.blogspot.com

Typical loss categories include theft, fire, and flood. In a shared living situation insurance sonetimes requires that your room has its own lock that your housemates don�t have a key to, so check that before you buy. As the name suggests, contents insurance covers the belongings you keep in your property. Premiums tend to be higher in locations at a high risk of flooding or criminal activity, while properties in london almost always carry higher insurance costs If you, your partner or family rent the entire home, simply buy standard contents insurance let�s be clear:

Source: domansresidential.co.uk

Source: domansresidential.co.uk

Renters insurance only covers the personal belongings and home contents and not any actual structures or buildings. A renter’s insurance policy with apolloinsurancestarts at $17/month, whereas squareoneinsuranceoffers tenant insurance quotes as low as $12/month. Tenancy liability covers accidental damage to your landlord�s contents and items they provide for you to use, whereas tenants contents insurance covers your personal possessions in case of fire, theft, accidental damage or other insured risk. If you damage your own belongings, it won’t affect the deposit return on your rental. Renters insurance provides you with peace of mind as it protects.

Source: pinterest.com

Source: pinterest.com

It�s usually called contents insurance for tenants or tenants contents insurance or something like that. Tenancy liability and tenants contents insurance. Premiums tend to be higher in locations at a high risk of flooding or criminal activity, while properties in london almost always carry higher insurance costs Homeowners insurance, on the other hand, is a type of property insurance that covers the structure of the home and any belongings owned by the homeowner inside of the property. If it doesn’t include tenants’ liability, it won’t cover any damage to your landlord’s belongings.

Source: ahainsurance.ca

Source: ahainsurance.ca

It can either cover specific types of loss or provide coverage against all causes. Tenant insurance for renters explained we often think of home insurance as protecting against the loss or damage of the big stuff—like pipes, appliances, and the physical structure of a home or building. The biggest difference between home contents insurance vs. In a shared living situation insurance sonetimes requires that your room has its own lock that your housemates don�t have a key to, so check that before you buy. It does not cover the building since they do not own the building.

Source: effectivecoverage.com

Source: effectivecoverage.com

The main difference is that contents insurance covers your belongings. Tenant insurance also includes third party liability insurance protecting you, the tenant, in case someone injures themselves inside your space. It’s usually better value to buy a home contents insurance policy, with tenants liability cover included. Either way, it’s worth the measly monthly cost. Does everybody need contents insurance?

Source: fsogradstudentchronicles.blogspot.com

Source: fsogradstudentchronicles.blogspot.com

Your landlord should have landlord�s insurance for the building. Of course, you also get. In a shared living situation insurance sonetimes requires that your room has its own lock that your housemates don�t have a key to, so check that before you buy. Tips for getting a tenants contents insurance policy; Renters insurance only covers the personal belongings and home contents and not any actual structures or buildings.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title tenants insurance vs contents insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information