Term insurance comes under which section information

Home » Trend » Term insurance comes under which section informationYour Term insurance comes under which section images are available. Term insurance comes under which section are a topic that is being searched for and liked by netizens today. You can Download the Term insurance comes under which section files here. Download all royalty-free photos and vectors.

If you’re looking for term insurance comes under which section images information related to the term insurance comes under which section topic, you have come to the ideal site. Our website frequently gives you suggestions for downloading the highest quality video and picture content, please kindly surf and find more informative video content and graphics that match your interests.

Term Insurance Comes Under Which Section. If you choose the deferred annuity mode, the deduction would be allowed under section 80c. The interest you accrue through this scheme is eligible for tax deductions under section 80c of the income tax act. If, however, an immediate annuity policy is bought, the deduction would be. Term insurance is a product that offers complete protection for a given term as long as the life insured pays the required premiums.the premiums paid towards a term insurance policy are eligible for tax benefits under section 80d.

How much a term life insurance policy cost at the age of 30? From livemint.com

How much a term life insurance policy cost at the age of 30? From livemint.com

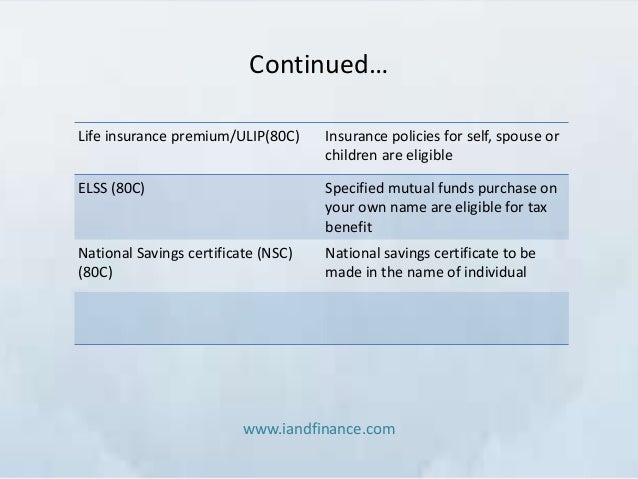

Unit linked insurance plans (ulips): Term insurance tax benefits under section 80c and 10(10d) choosing term insurance gives you tax benefits under section 80 c and 10(10d) of the income tax act 1961 (the act), subject to provisions stated therein. Term insurance tax benefitsunder sections 80c and 10 (10d) with your term insurance policy, you can maximise your tax savings under section 80c of the income tax act, 1961. But, who can avail this benefit? A term insurance plan provides tax benefits under section 80c and section 10(10d) of the income tax act 1961. Here, you can claim deductions of up to inr 1,50,000 per year for the premiums you pay towards the upkeep of your life insurance policy.

There are two tax benefits available:

It is necessary that such funds need to. How is term insurance covered under section 80d? As a taxpayer, both section 80c and section 10 (10d) of the income tax act of 1961 work towards your benefit when you buy term insurance. You can get deductions of up to ₹ 1.5 lakh under section 80c There are two tax benefits available: All life insurance policies are eligible for tax exemption under section 80c of the income tax act, 1961.

Source: fascynacjedorotheahh.blogspot.com

Source: fascynacjedorotheahh.blogspot.com

You can either claim the tax advantage for yourself, your husband or wife or your children. So, you must explore these benefits as they allow some tax deductions while you compute your annual income. If you choose the deferred annuity mode, the deduction would be allowed under section 80c. If the exemption under section 10(10d) is not available, then the net maturity proceeds taxable under the other sources, and the slab tax rate is applicable on the same. Term insurance tax benefits under section 80c and 10(10d) choosing term insurance gives you tax benefits under section 80 c and 10(10d) of the income tax act 1961 (the act), subject to provisions stated therein.

Source: coverfox.com

Term insurance tax benefits under section 80c and 10(10d) choosing term insurance gives you tax benefits under section 80 c and 10(10d) of the income tax act 1961 (the act), subject to provisions stated therein. On the other hand, you can also enjoy term insurance tax benefits under section 80c and section 10 (10d) as per the income tax act 1961. As mentioned above, there are several term insurance tax benefits^ that you can avail of. You get life insurance premium tax benefit on a life insurance policy, endowment plan, whole life insurance plans, money back policies, term insurances, as well as unit linked insurance plans (ulips). You can either claim the tax advantage for yourself, your husband or wife or your children.

Source: slideshare.net

Source: slideshare.net

What are the tax benefits of term insurance? There are two tax benefits available: If you choose the deferred annuity mode, the deduction would be allowed under section 80c. On the other hand, you can also enjoy term insurance tax benefits under section 80c and section 10 (10d) as per the income tax act 1961. You can avail tax benefits.

Source: livemint.com

Source: livemint.com

Term insurance tax benefits under section 80c the simplest and basic term insurance tax benefit that any indian taxpayer can opt for falls under the purview of section 80c of the ita, 1961. What are the tax benefits of term insurance? Under section 80c of the income tax act, 1961, the life insurance premiums you pay during any financial year are exempted from your taxable income up to a. You will have to pay less tax if you show your premium of the term insurance while computing your income. Following are a few of them:

Source: comparepolicy.com

Source: comparepolicy.com

You will have to pay less tax if you show your premium of the term insurance while computing your income. Under section 80c, you can claim a deduction of up to rs 1.5 lakh annually on the premiums you have paid. But, who can avail this benefit? As per section 80c, the premium that you pay for your term insurance plan can be deducted from your total income. Following are a few of them:

Source: indiawest.com

Source: indiawest.com

There are two tax benefits available: If the insurance policy is surrendered before paying the premium of the first two years (traditional plan) or, completion of two years (single premium plan) or, five years (ulip). The interest you accrue through this scheme is eligible for tax deductions under section 80c of the income tax act. Following are a few of them: As per section 80c, the premium that you pay for your term insurance plan can be deducted from your total income.

Source: tax2win.in

Source: tax2win.in

How is term insurance covered under section 80d? Under section 80c of the income tax act, 1961, the life insurance premiums you pay during any financial year are exempted from your taxable income up to a. You can claim an additional amount of inr 25,000 under section 80d of the income tax act for premiums paid towards the upkeep of your term plan. So, you must explore these benefits as they allow some tax deductions while you compute your annual income. How is term insurance covered under section 80d?

Source: myowngreenlittleworld.blogspot.com

Source: myowngreenlittleworld.blogspot.com

Money spent on maintaining a health insurance policy can be claimed under section 80d. It is necessary that such funds need to. If you choose the deferred annuity mode, the deduction would be allowed under section 80c. So, you must explore these benefits as they allow some tax deductions while you compute your annual income. You will have to pay less tax if you show your premium of the term insurance while computing your income.

Source: trucompare.in

Source: trucompare.in

You get life insurance premium tax benefit on a life insurance policy, endowment plan, whole life insurance plans, money back policies, term insurances, as well as unit linked insurance plans (ulips). You can either claim the tax advantage for yourself, your husband or wife or your children. It is common knowledge how you can save tax by buying term insurance. 4 rows there are term insurance premium tax benefits available under both section 80d and section. Under section 80c of the income tax act, 1961, the life insurance premiums you pay during any financial year are exempted from your taxable income up to a.

Source: fascynacjedorotheahh.blogspot.com

Source: fascynacjedorotheahh.blogspot.com

You can either claim the tax advantage for yourself, your husband or wife or your children. You can avail tax benefits. What are the tax benefits of term insurance? All life insurance policies are eligible for tax exemption under section 80c of the income tax act, 1961. Term insurance tax benefits under section 80c and 10(10d) choosing term insurance gives you tax benefits under section 80 c and 10(10d) of the income tax act 1961 (the act), subject to provisions stated therein.

Source: myinvestmentideas.com

Source: myinvestmentideas.com

Under sec 80 c (2) of the it act, any amount paid to an insurer for a life insurance policy, can be claimed as a deduction from gross total income of the policyholder. Here, you can claim deductions of up to inr 1,50,000 per year for the premiums you pay towards the upkeep of your life insurance policy. It is necessary that such funds need to. So, you must explore these benefits as they allow some tax deductions while you compute your annual income. How is term insurance covered under section 80d?

Source: fascynacjedorotheahh.blogspot.com

Source: fascynacjedorotheahh.blogspot.com

If you choose the deferred annuity mode, the deduction would be allowed under section 80c. Unit linked insurance plans (ulips): Since term plans today also offer some health cover, you can also enjoy term plan tax benefits under this section. How is term insurance covered under section 80d? They will often ask questions like term insurance comes under which section as per the income tax act.

Source: lifeinsurance.satukara.com

Source: lifeinsurance.satukara.com

Term insurance is a product that offers complete protection for a given term as long as the life insured pays the required premiums.the premiums paid towards a term insurance policy are eligible for tax benefits under section 80d. It is necessary that such funds need to. What are the tax benefits of term insurance? How is term insurance covered under section 80d? Money spent on maintaining a health insurance policy can be claimed under section 80d.

Source: businesstoday.in

Source: businesstoday.in

What are the tax benefits of term insurance? Unit linked insurance plans (ulips): Following are a few of them: You can claim an additional amount of inr 25,000 under section 80d of the income tax act for premiums paid towards the upkeep of your term plan. You get life insurance premium tax benefit on a life insurance policy, endowment plan, whole life insurance plans, money back policies, term insurances, as well as unit linked insurance plans (ulips).

Source: thespuzz.com

Source: thespuzz.com

Money spent on maintaining a health insurance policy can be claimed under section 80d. The interest you accrue through this scheme is eligible for tax deductions under section 80c of the income tax act. You get life insurance premium tax benefit on a life insurance policy, endowment plan, whole life insurance plans, money back policies, term insurances, as well as unit linked insurance plans (ulips). As a taxpayer, both section 80c and section 10 (10d) of the income tax act of 1961 work towards your benefit when you buy term insurance. Section 80ccc of the income tax act allows for income tax deductions that taxpayers can claim for purchasing certain annuity plans or pension funds offered by public insurance companies.

Source: bajajallianzlife.com

Source: bajajallianzlife.com

Money spent on maintaining a health insurance policy can be claimed under section 80d. 4 rows there are term insurance premium tax benefits available under both section 80d and section. Term insurance tax benefits under section 80c the simplest and basic term insurance tax benefit that any indian taxpayer can opt for falls under the purview of section 80c of the ita, 1961. All life insurance policies are eligible for tax exemption under section 80c of the income tax act, 1961. The amount is limited by the age of the insured under the plan.

Source: moneymint.com

Source: moneymint.com

As mentioned above, there are several term insurance tax benefits^ that you can avail of. Term insurance tax benefitsunder sections 80c and 10 (10d) with your term insurance policy, you can maximise your tax savings under section 80c of the income tax act, 1961. Term insurance is a product that offers complete protection for a given term as long as the life insured pays the required premiums.the premiums paid towards a term insurance policy are eligible for tax benefits under section 80d. You will have to pay less tax if you show your premium of the term insurance while computing your income. There are two tax benefits available:

Source: rediff.com

Source: rediff.com

A term insurance plan provides tax benefits under section 80c and section 10(10d) of the income tax act 1961. As per section 80c, the premium that you pay for your term insurance plan can be deducted from your total income. Here, you can claim deductions of up to inr 1,50,000 per year for the premiums you pay towards the upkeep of your life insurance policy. These restrictions apply to people (insured under the policy) aged below 80 years : Term insurance policy is a type of life insurance policy.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title term insurance comes under which section by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information