Term insurance has which of the following characteristics information

Home » Trending » Term insurance has which of the following characteristics informationYour Term insurance has which of the following characteristics images are available in this site. Term insurance has which of the following characteristics are a topic that is being searched for and liked by netizens today. You can Get the Term insurance has which of the following characteristics files here. Download all free vectors.

If you’re searching for term insurance has which of the following characteristics pictures information connected with to the term insurance has which of the following characteristics interest, you have pay a visit to the ideal blog. Our site always gives you suggestions for seeing the highest quality video and image content, please kindly surf and locate more enlightening video content and graphics that match your interests.

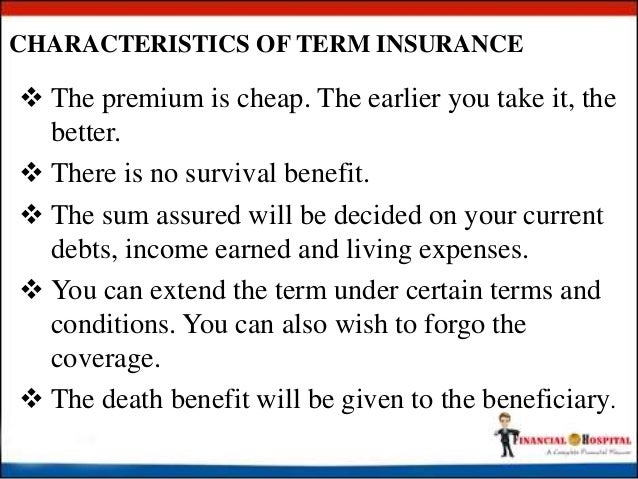

Term Insurance Has Which Of The Following Characteristics. A) the item to be insured presents no hardship to the owner should it be lost or damaged. The attained age is the insured�s age upon purchase of the term life insurance policy. C) the item to be insured presents a market value that is difficult to determine. Sequential easy first hard first.

How to choose the right term insurance for you? From holisticinvestment.in

How to choose the right term insurance for you? From holisticinvestment.in

Pays benefits to the insured when the insured reaches age 65 b. Which of the following characteristics does not describe convertible term life insurance policies? The original age is the insured�s age upon purchase of the term life insurance policy. The most common of these features are listed here: C this is the date on which the contract between the person and insurance company will come to an end. This is the date on which the contract between the person and insurance company will come to an end.

Costs more than other types of life insurance d.

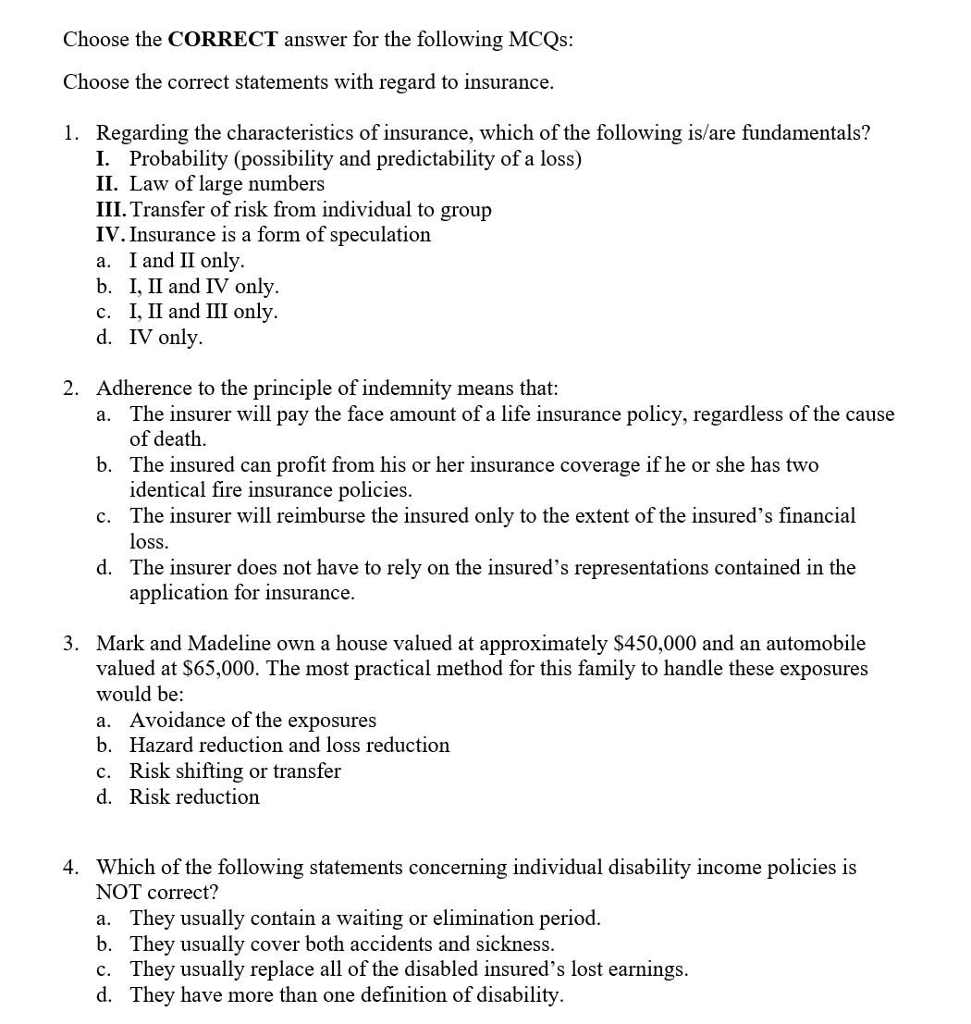

Which of the following characteristics would not stop an insurance company from accepting an insurance risk? Which of the following characteristics does not describe convertible term life insurance policies? Term life insurance provides benefits to a named beneficiary for a specific term from the initiation of the policy. Term insurance has which of the following characteristics? The attained age is the insured�s age upon purchase of the term life insurance policy. Which of the following characteristics would not stop an insurance company from accepting an insurance risk?

Source: slideserve.com

Source: slideserve.com

All of the following are distinguishing characteristics of group life insurance except. The original age is the insured�s age upon purchase of the term life insurance policy. The owner of the policy pays premiums until the end of the term. Term insurance has two features that make it attractive: Sequential easy first hard first.

Source: youtube.com

Source: youtube.com

The insured must die for any benefits to be paid and, by definition, the contract expires. The insured must die for any benefits to be paid and, by definition, the contract expires. The owner of the policy pays premiums until the end of the term. These days, almost everyone buys level term insurance. An employee under a group insurance policy has the right to name a beneficiary and the right to.

Source: insurance-companies.co

Source: insurance-companies.co

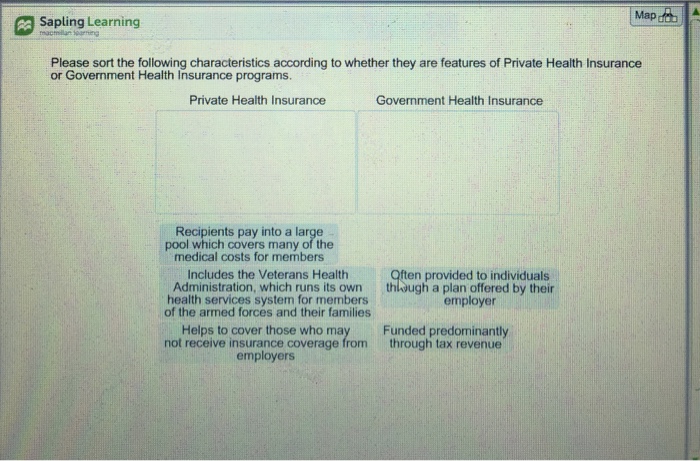

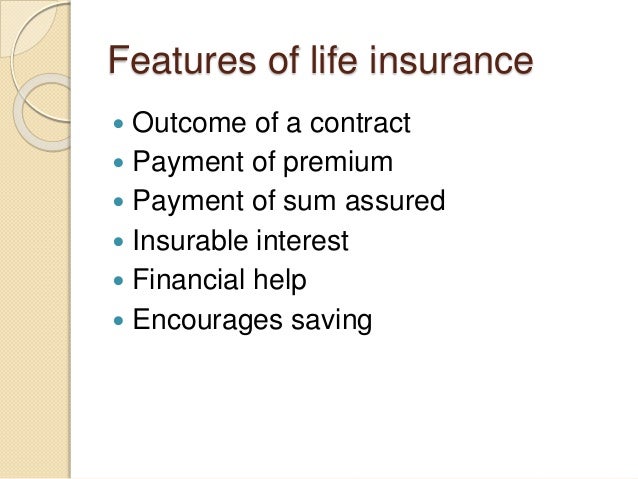

Though all contracts share fundamental concepts and basic elements, insurance contracts typically possess a number of characteristics not widely found in other types of contractual agreements. B) the insured is part of a large group of homogeneous exposure units. An employee under a group insurance policy has the right to name a beneficiary and the right to. All of the following are distinguishing characteristics of group life insurance except. The most common of these features are listed here:

The attained age is the insured�s age upon purchase of the term life insurance policy. The owner of the policy pays premiums until the end of the term. These days, almost everyone buys level term insurance. The attained age is the insured�s age upon purchase of the term life insurance policy. If one party to a contract might receive considerably more in value than he or.

Source: chegg.com

Source: chegg.com

This can be a positive or negative feature depending on individual circumstances. A guarantee on the premium and survivor benefit for a defined amount of years, depending on the company, age of the insured, and other. Joan appleton has purchased a new car, and when registering her vehicle, she is told that she must provide proof of. Term insurance has two features that make it attractive: At the end of the term, if the insured is alive, the policy ends and no longer offers benefits.

Source: holisticinvestment.in

Source: holisticinvestment.in

Term life insurance provides benefits to a named beneficiary for a specific term from the initiation of the policy. A) the item to be insured presents no hardship to the owner should it be lost or damaged. Term insurance has which of the following characteristics? Which of the following characteristics does not describe convertible term life insurance policies? All of the following are distinguishing characteristics of group life insurance except.

Source: slideserve.com

Source: slideserve.com

Term life insurance, also known as pure life insurance, is a type of life insurance that guarantees payment of a stated death benefit if the covered person dies during a. Relieve the insured of premium payments following an initial waiting period after the insured becomes totally disabled. Which of the following is characteristic of term life insurance? A life insurance policy�s waiver of premium rider has the ability to. The attained age is the insured�s age upon purchase of the term life insurance policy.

Source: youtube.com

Source: youtube.com

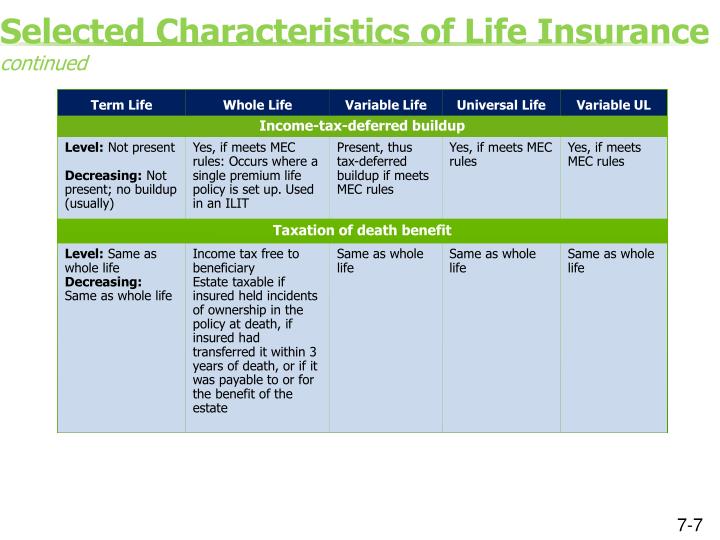

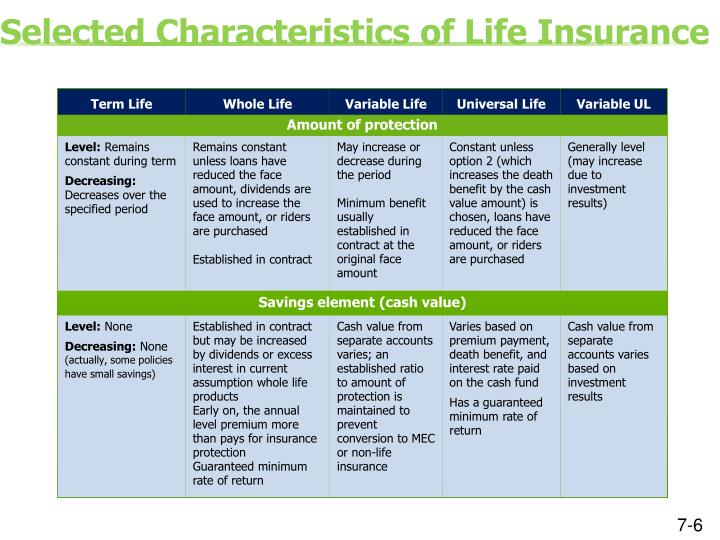

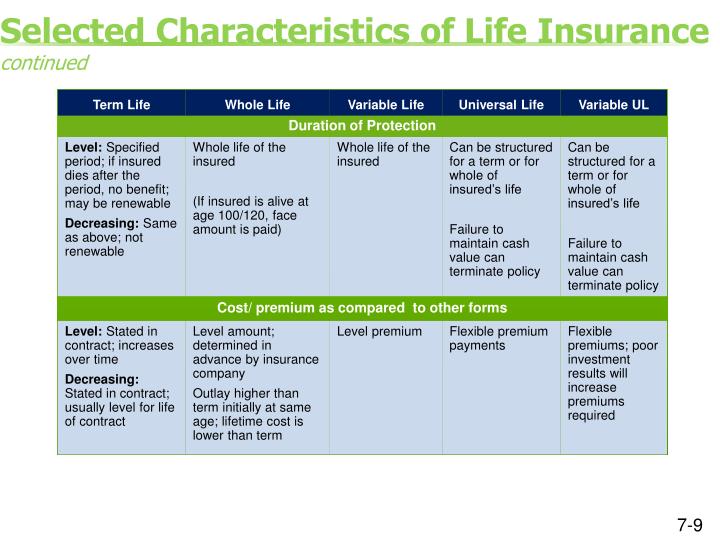

The terms “level” and “decreasing” refer to the death benefit amount during the term of the policy. The original age is the insured�s age upon purchase of the term life insurance policy. Which of the following characteristics does not describe convertible term life insurance policies? Provide a policy loan to cover the premium payments in the event. Waive the premium payments in the event the insured becomes financially insolvent.

Source: smartfinance.tips

Source: smartfinance.tips

This can be a positive or negative feature depending on individual circumstances. Unlike other types of life insurance, a term policy eventually expires. Which of the following is characteristic of term life insurance? The owner of the policy pays premiums until the end of the term. Which of the following characteristics would not stop an insurance company from accepting an insurance risk?

Source: fbsbenefits.com

Source: fbsbenefits.com

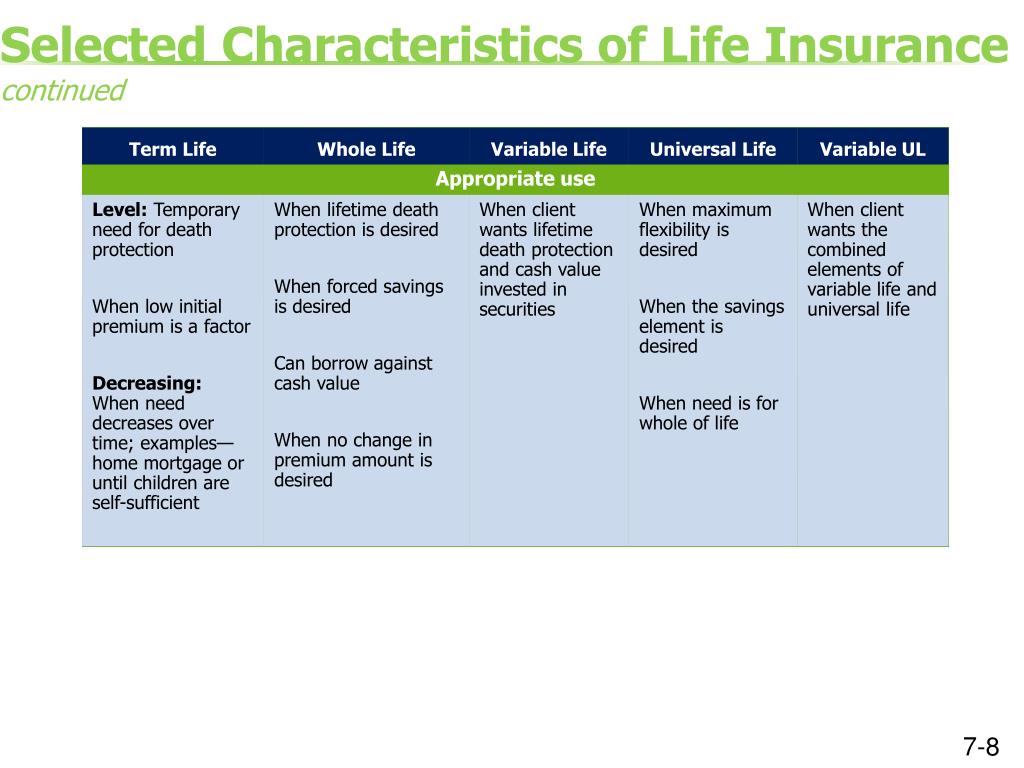

These days, almost everyone buys level term insurance. A) the item to be insured presents no hardship to the owner should it be lost or damaged. The owner of the policy pays premiums until the end of the term. The two principal characteristics of term insurance are: The original age is the insured�s age upon purchase of the term life insurance policy.

Source: chegg.com

Source: chegg.com

A guarantee on the premium and survivor benefit for a defined amount of years, depending on the company, age of the insured, and other. Term life insurance is a type of life insurance that provides a death benefit to the beneficiary only if the insured dies during a specified period. Which of the following is characteristic of term life insurance? The two principal characteristics of term insurance are: Unlike other types of life insurance, a term policy eventually expires.

Source: mesadesignworks.blogspot.com

Source: mesadesignworks.blogspot.com

A) the item to be insured presents no hardship to the owner should it be lost or damaged. A guarantee on the premium and survivor benefit for a defined amount of years, depending on the company, age of the insured, and other. B) the insured is part of a large group of homogeneous exposure units. An employee under a group insurance policy has the right to name a beneficiary and the right to. Term life insurance is a type of life insurance that provides a death benefit to the beneficiary only if the insured dies during a specified period.

Source: slideshare.net

Source: slideshare.net

If one party to a contract might receive considerably more in value than he or. Waive the premium payments in the event the insured becomes financially insolvent. Which of the following characteristics does not describe convertible term life insurance policies? A) the item to be insured presents no hardship to the owner should it be lost or damaged. The original age is the insured�s age upon purchase of the term life insurance policy.

Source: insurance-companies.co

Source: insurance-companies.co

Term life insurance provides benefits to a named beneficiary for a specific term from the initiation of the policy. Term life insurance provides benefits to a named beneficiary for a specific term from the initiation of the policy. The original age is the insured�s age upon purchase of the term life insurance policy. This is the date on which the contract between the person and insurance company will come to an end. Though all contracts share fundamental concepts and basic elements, insurance contracts typically possess a number of characteristics not widely found in other types of contractual agreements.

Source: slideserve.com

Source: slideserve.com

The premiums for the policy are generally locked in for the entire term. A guarantee on the premium and survivor benefit for a defined amount of years, depending on the company, age of the insured, and other. Which of the following is characteristic of term life insurance? Convert to an individual policy in the event of employment termination. All of the following are distinguishing characteristics of group life insurance except.

Source: slideshare.net

Source: slideshare.net

The attained age is the insured�s age upon purchase of the term life insurance policy. Provide a policy loan to cover the premium payments in the event. If the policyholder survives until the end of the period, or term, the insurance coverage ceases without value. The most common of these features are listed here: At the end of the term, if the insured is alive, the policy ends and no longer offers benefits.

Source: quora.com

Unlike other types of life insurance, a term policy eventually expires. This can be a positive or negative feature depending on individual circumstances. Joan appleton has purchased a new car, and when registering her vehicle, she is told that she must provide proof of. Provide a policy loan to cover the premium payments in the event. The insured must die for any benefits to be paid and, by definition, the contract expires.

Source: slideserve.com

Source: slideserve.com

The insured must die for any benefits to be paid and, by definition, the contract expires. A) the item to be insured presents no hardship to the owner should it be lost or damaged. The terms “level” and “decreasing” refer to the death benefit amount during the term of the policy. At the end of the term, if the insured is alive, the policy ends and no longer offers benefits. Unlike other types of life insurance, a term policy eventually expires.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title term insurance has which of the following characteristics by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information