Term insurance with living benefits Idea

Home » Trend » Term insurance with living benefits IdeaYour Term insurance with living benefits images are available. Term insurance with living benefits are a topic that is being searched for and liked by netizens today. You can Get the Term insurance with living benefits files here. Download all royalty-free photos.

If you’re looking for term insurance with living benefits pictures information related to the term insurance with living benefits topic, you have visit the ideal blog. Our website always provides you with suggestions for seeing the maximum quality video and image content, please kindly hunt and find more informative video articles and graphics that fit your interests.

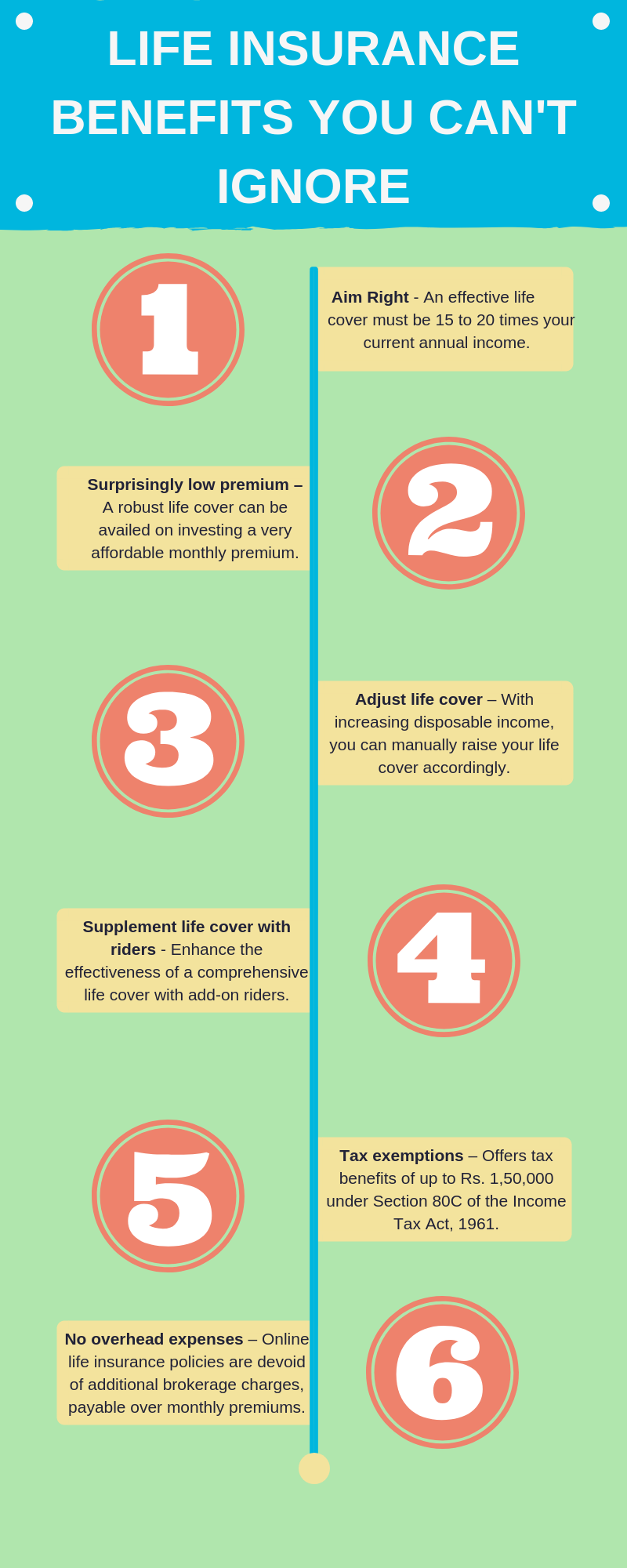

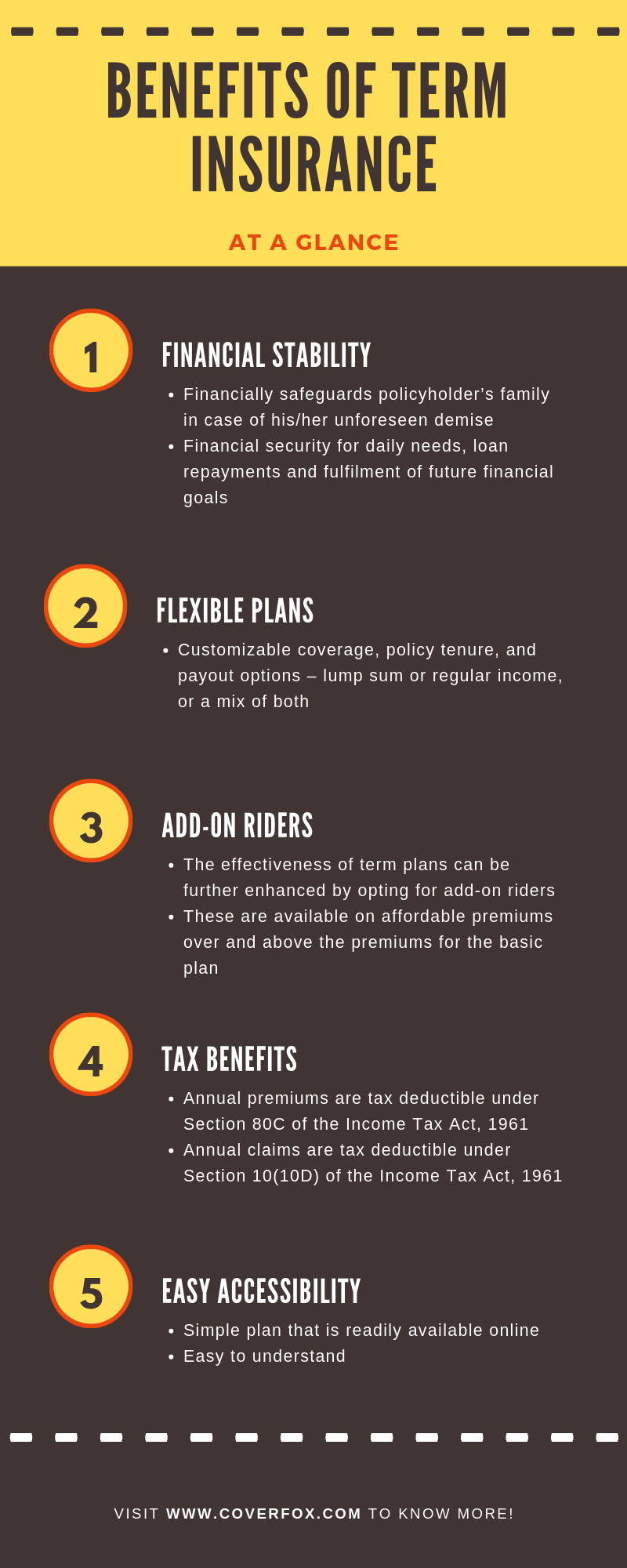

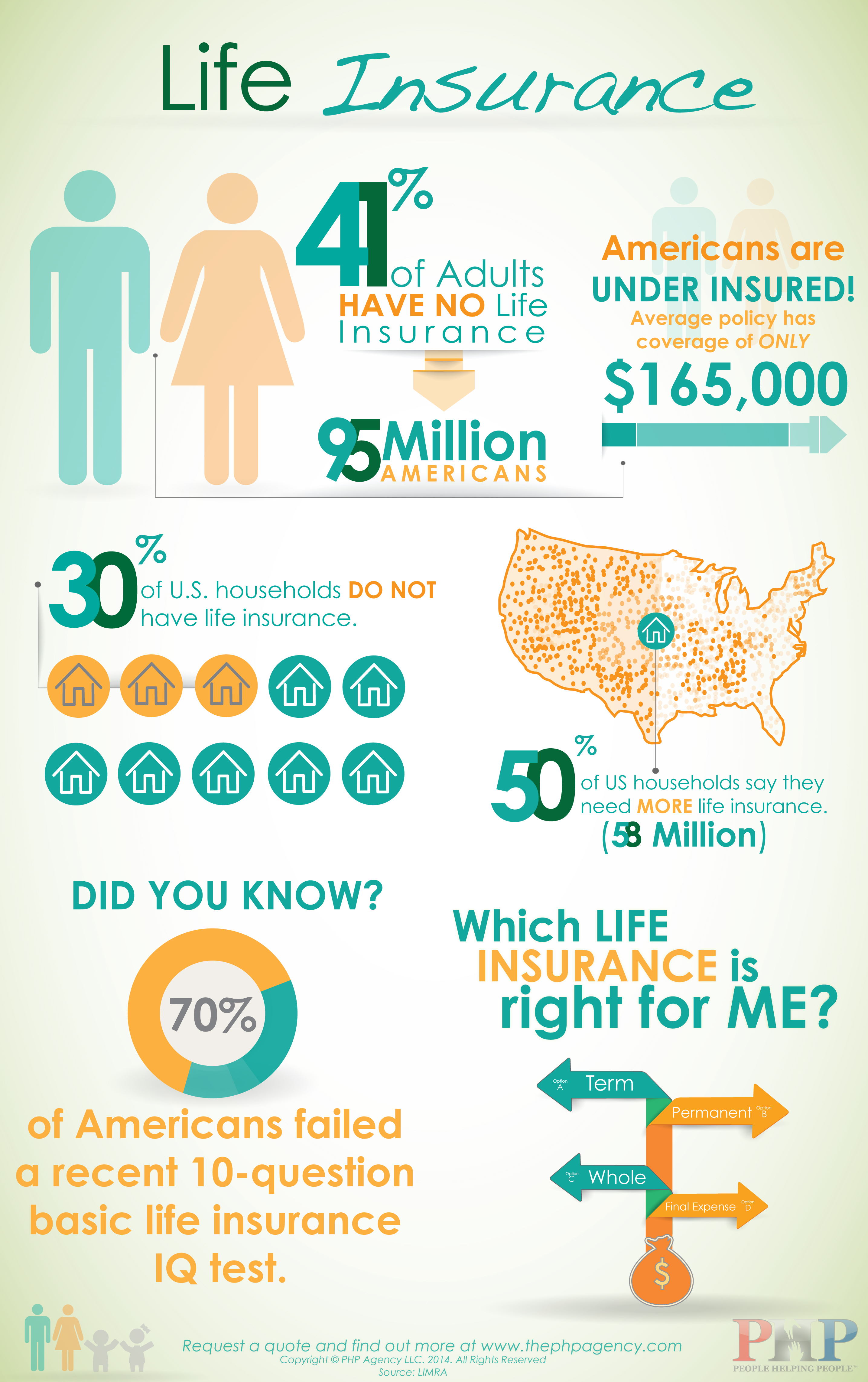

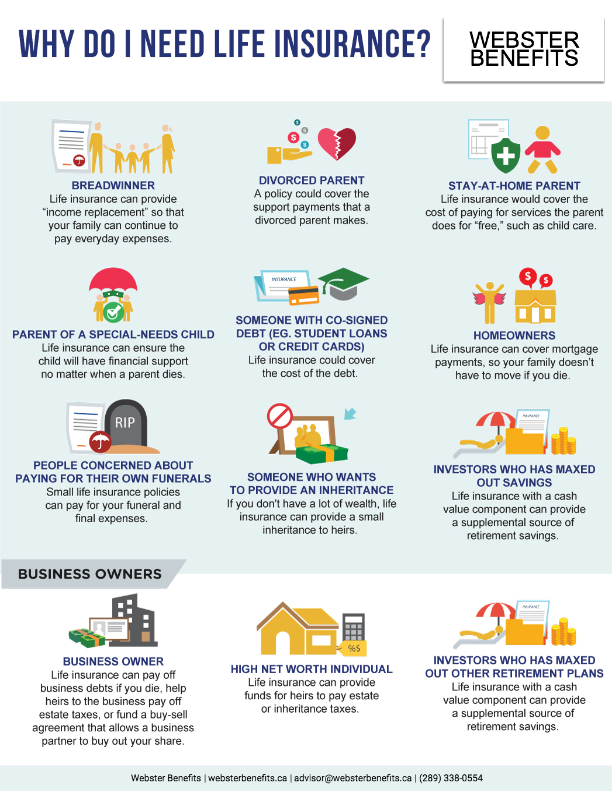

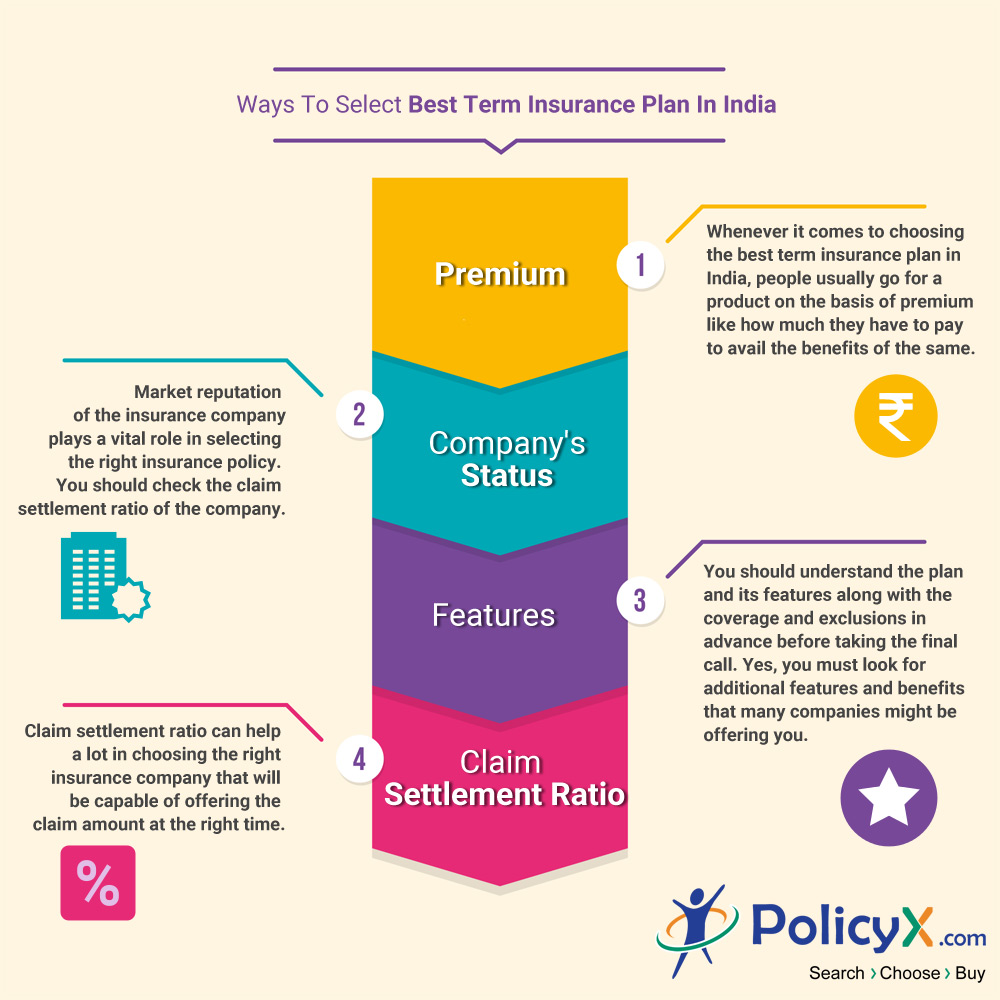

Term Insurance With Living Benefits. Here’s what you need to know. Typically, term life insurance provides a cash payout to help support your family financially after you die. Although term insurance is not always the most. Haven life offers two life insurance policies with living benefits, haven term and haven simple, and you can apply online or by phone.

Benefits of Life Insurance Need for Life Insurance From iciciprulife.com

Benefits of Life Insurance Need for Life Insurance From iciciprulife.com

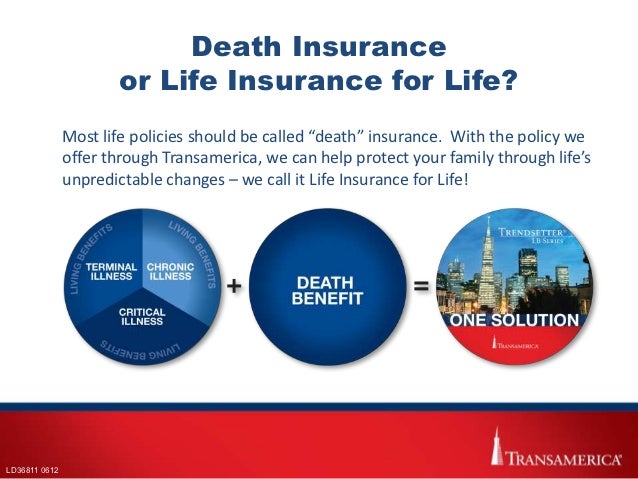

Term insurance plans are very simple to understan. What are the benefits of term insurance? If you encounter any of the below. Term life insurance is a pure life cover that focuses on offering your dependents the sum assured in case you were to die. Policyholders with qualifying chronic, critical, and terminal illnesses or conditions may be able to advance the payment of their policy�s death benefit, which can help to cover the costs of medical expenses or recoup lost income. All life insurance policies come with what is known as a death benefit.

These are accelerated benefit riders.

Typically, term life insurance provides a cash payout to help support your family financially after you die. Riders, such as the living benefits riders discussed above, can. Term insurance plans are very simple to understan. Haven life offers two life insurance policies with living benefits, haven term and haven simple, and you can apply online or by phone. Typically, term life insurance provides a cash payout to help support your family financially after you die. The living benefits offered by term insurance policies have to do with illness.

Source: pinterest.com

Source: pinterest.com

Although term insurance is not always the most. Ad compare & save on life insurance plans designed for expats & foreign citizens abroad. Additionally, if you buy a term life insurance policy you will often pay less than if you buy a permanent policy. The policy may need to be in force. Term insurance offers multiple benefits to customers.

Source: quora.com

Term insurance with living benefits.but even term life insurance policies can be purchased with one or more accelerated benefits riders , which will pay you money while you’re still alive—under circumstances you, frankly, hope you never find yourself in. All you need to ensure that the premium is paid on time. They are benefits paid from the term life policy while you are living. Although term insurance is not always the most. What is term life insurance with living benefits?

Source: coverfox.com

Source: coverfox.com

If you encounter any of the below. If you encounter any of the below. Here’s what you need to know. Living benefits may be provided by optional accelerated benefits riders. Recently there has been an uptick in the number of companies that are offering policy benefits that would pay out while you are still living;

Source: coverfox.com

Source: coverfox.com

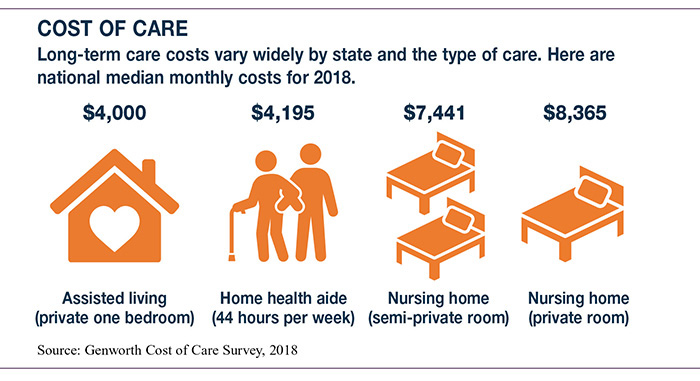

The plan offers guaranteed maturity benefit which is 110% of the total premium paid. An option for a $500,000 20 year term with a standard rate for him would run $42.23. They are benefits paid from the term life policy while you are living. Ad compare & save on life insurance plans designed for expats & foreign citizens abroad. Term life insurance is among the devices that people should consider when they want to provide an immediate estate for loved ones after their death.

Source: iciciprulife.com

Source: iciciprulife.com

Ad compare & save on life insurance plans designed for expats & foreign citizens abroad. Riders are supplemental benefits that can be added to a life insurance policy and are not suitable unless you also have a need for life insurance. The plan offers guaranteed maturity benefit which is 110% of the total premium paid. They don’t affect how much is paid. Term insurance plans are very simple to understan.

Source: financialsavingspro.com

Source: financialsavingspro.com

4 rows term life insurance with living benefits is usually offered as an optional rider. An option for a $500,000 20 year term with a standard rate for him would run $42.23. They don’t affect how much is paid. Living benefits are exactly what the name implies. Term insurance offers multiple benefits to customers.

Source: slideshare.net

Source: slideshare.net

Term insurance with living benefits.but even term life insurance policies can be purchased with one or more accelerated benefits riders , which will pay you money while you’re still alive—under circumstances you, frankly, hope you never find yourself in. For the team at haven life, that seemed like a missed opportunity. Some life insurance policies can even provide you with benefits while you’re still alive. Term life insurance is a pure life cover that focuses on offering your dependents the sum assured in case you were to die. Insurance is term life insurance that has living benefits baked into the policy.

Source: pacificinsurancegroup.com

Source: pacificinsurancegroup.com

Did you notice what it is? More commonly, they are known as accelerated death benefits. Did you notice what it is? Term insurance plans are very simple to understan. Riders, such as the living benefits riders discussed above, can.

Source: annuityadvantage.com

Source: annuityadvantage.com

Here’s what you need to know. Term insurance offers multiple benefits to customers. The policy may need to be in force. Term life insurance is among the devices that people should consider when they want to provide an immediate estate for loved ones after their death. Term insurance plans are very simple to understan.

Source: youtube.com

Source: youtube.com

Life insurance with living benefits can provide you and your family with essential resources should you become terminally ill or die. Here’s what you need to know. Living benefit options for term life include: The policy may need to be in force. Your loved ones can use this payout to pay bills and debt, save for the future, or cover any other needs.

Source: slideteam.net

Source: slideteam.net

Term life insurance is a pure life cover that focuses on offering your dependents the sum assured in case you were to die. Here are a few you should be aware of: Term insurance offers multiple benefits to customers. Think about those times when life surprises you and having an extra source of income would come in handy. Term insurance with living benefits.but even term life insurance policies can be purchased with one or more accelerated benefits riders , which will pay you money while you’re still alive—under circumstances you, frankly, hope you never find yourself in.

Source: pacificinsurancegroup.com

Source: pacificinsurancegroup.com

Life insurance with living benefits can provide you and your family with essential resources should you become terminally ill or die. What is term life insurance with living benefits? Living benefits riders that make life less hard with term life insurance, the interaction that most people have with their life insurance company is a monthly bill for 10 to 30 years. Living benefit options for term life include: You pay your monthly premiums and hope your family will never have to use it.

Source: quickquote.com

Source: quickquote.com

An option for a $500,000 20 year term with a standard rate for him would run $42.23. Riders, such as the living benefits riders discussed above, can. Riders are optional, may require additional premium and may not be available in all states or on all products. Just look at the image below: What is term life insurance with living benefits?

Source: websterbenefits.ca

Source: websterbenefits.ca

Just look at the image below: They are benefits paid from the term life policy while you are living. Living benefits riders that make life less hard with term life insurance, the interaction that most people have with their life insurance company is a monthly bill for 10 to 30 years. Simplicity is one of the reasons for the growing popularity of term insurance. Think about those times when life surprises you and having an extra source of income would come in handy.

Source: paisabazaar.com

Source: paisabazaar.com

Term life insurance is a pure life cover that focuses on offering your dependents the sum assured in case you were to die. Typically, term life insurance provides a cash payout to help support your family financially after you die. This is $1.40 more per month to have living benefits included!! Your loved ones can use this payout to pay bills and debt, save for the future, or cover any other needs. Term insurance plans are very simple to understan.

Source: topquotelifeinsurance.com

Source: topquotelifeinsurance.com

The death benefit in a life insurance policy will only pay out upon the death of the insured. An option for a $500,000 20 year term with a standard rate for him would run $42.23. More commonly, they are known as accelerated death benefits. Living benefits are exactly what the name implies. Policyholders with qualifying chronic, critical, and terminal illnesses or conditions may be able to advance the payment of their policy�s death benefit, which can help to cover the costs of medical expenses or recoup lost income.

Source: effortlessinsurance.com

Source: effortlessinsurance.com

With these benefits, the life insurance company pays or advances a portion of the policy’s death benefit to you to pay for care or treatment. Additionally, if you buy a term life insurance policy you will often pay less than if you buy a permanent policy. Riders are supplemental benefits that can be added to a life insurance policy and are not suitable unless you also have a need for life insurance. Riders, such as the living benefits riders discussed above, can. Your loved ones can use this payout to pay bills and debt, save for the future, or cover any other needs.

Source: policyx.com

Source: policyx.com

The plan offers guaranteed maturity benefit which is 110% of the total premium paid. You pay your monthly premiums and hope your family will never have to use it. Living benefit options for term life include: Term life insurance is a pure life cover that focuses on offering your dependents the sum assured in case you were to die. They don’t affect how much is paid.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title term insurance with living benefits by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information