Term life insurance with living benefits information

Home » Trending » Term life insurance with living benefits informationYour Term life insurance with living benefits images are ready in this website. Term life insurance with living benefits are a topic that is being searched for and liked by netizens now. You can Find and Download the Term life insurance with living benefits files here. Find and Download all free images.

If you’re looking for term life insurance with living benefits pictures information connected with to the term life insurance with living benefits keyword, you have visit the ideal site. Our website always provides you with hints for seeking the maximum quality video and picture content, please kindly hunt and find more enlightening video content and images that match your interests.

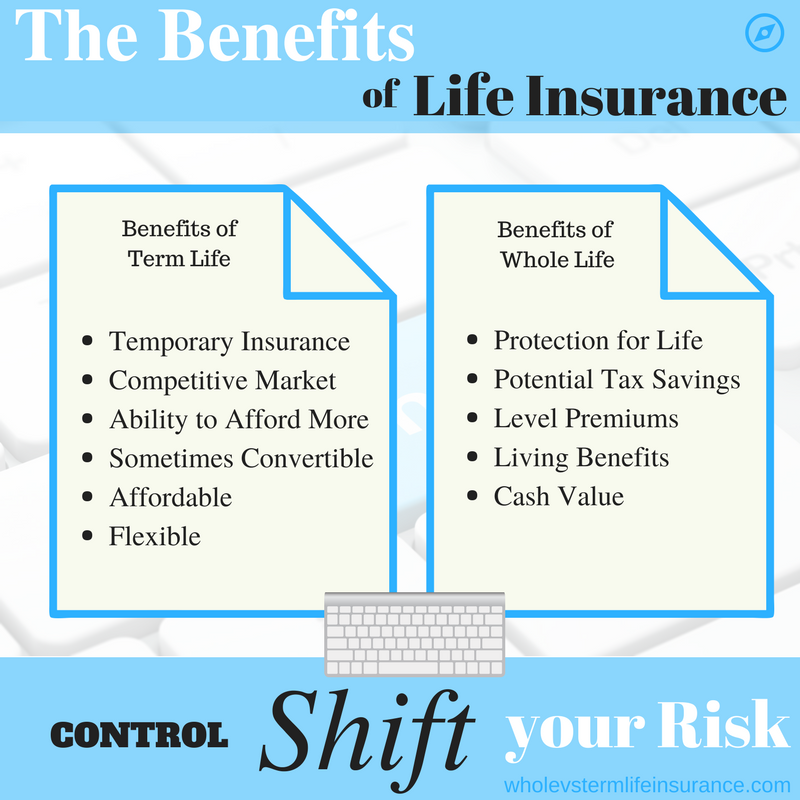

Term Life Insurance With Living Benefits. Living benefits are most often associated with permanent (cash value) life insurance. Life insurance allows you, the policy owner, to build cash value through your life insurance policy that accumulates over your lifetime. Living benefits of a life insurance policy are benefits provided to and obtained by those insured, while still alive. But even term life insurance policies can be purchased with one or more accelerated benefits riders , which will pay you money while you’re still alive—under circumstances you, frankly, hope you never find yourself in.

Term Life Insurance with Accelerated Living Benefits From pacificinsurancegroup.com

Term Life Insurance with Accelerated Living Benefits From pacificinsurancegroup.com

Are you prepared for an unexpected illness? Does term life insurance have living benefits? The death benefit in a life insurance policy will only pay out upon the death of the insured. All life insurance policies come with what is known as a death benefit. Many people think of life insurance only in terms of protecting loved ones. A term life insurance that specifically covers your remaining mortgage and associated costs.

However, those additional protections often mean higher premiums.

Living benefit options for term life include: Living benefits are most often associated with permanent (cash value) life insurance. Term life insurance with living benefits (the hybrid product series) watch later. Term life insurance with living benefits can often be included in your policy for a small increase in cost. Insurance is term life insurance that has living benefits baked into the policy. Renewable after 10 to 20 years with age related pricing and without providing proof of health.

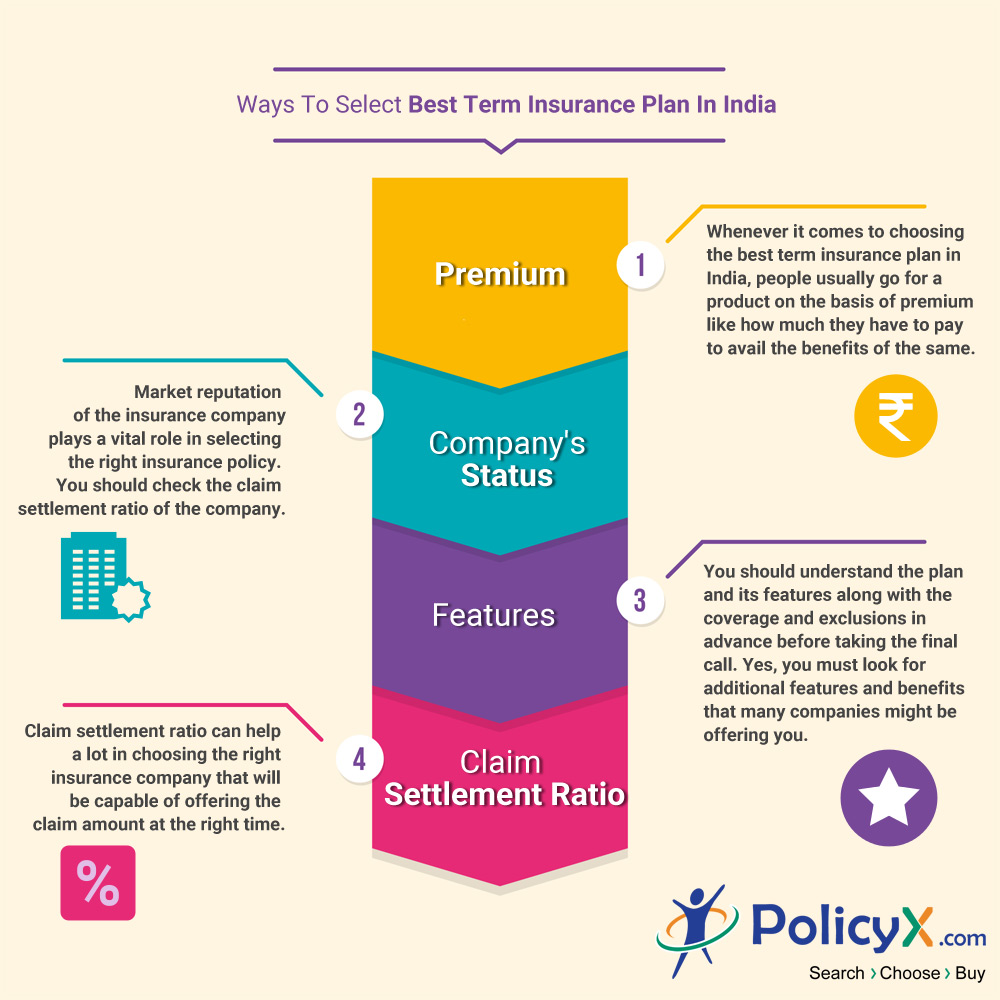

Source: policyx.com

Source: policyx.com

It provides funds to your beneficiary (or beneficiaries) if you pass away during that time. Based on the product, living benefits can provide benefits should a qualifying terminal, chronic or critical illness or critical injury occur 1 , or if your desire is to have an income that you cannot outlive. Critical, chronic and terminal coverage are important riders that can be added to most life insurance policies. Recently there has been an uptick in the number of companies that are offering policy benefits that would pay out while you are still living; This living benefit pays out a portion of your term life policy if you ever face a terminal illness.

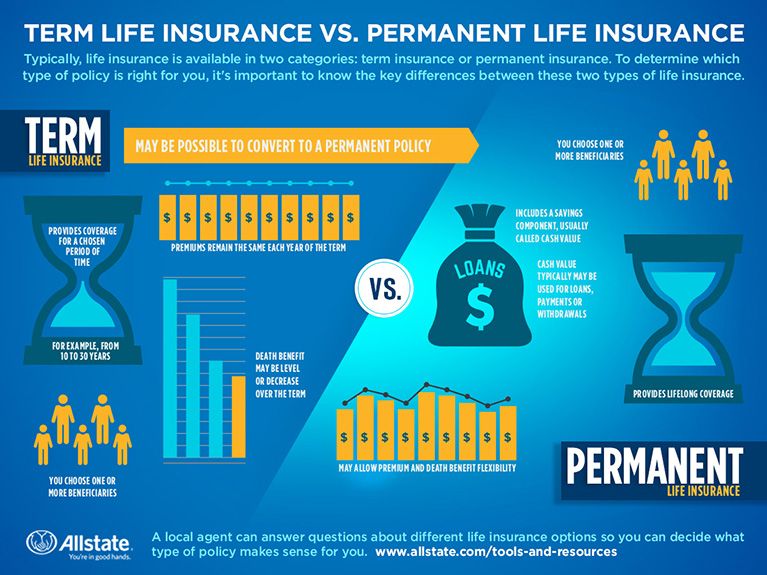

Source: allstate.com

Source: allstate.com

This is considered a living benefit of life insurance because, in contrast to a death benefit that pays out when you pass away, you can use the money while you’re still alive. Life insurance with living benefits can provide you and your family with essential resources should you become terminally ill or die. After all, it’s called “life” insurance for a reason. Here’s what you need to know about living benefits and how they might help. It means you can access the benefits of your insurance plan before you die, instead of waiting for a payout on the policy after the insured person dies.

Source: pinterest.com

Source: pinterest.com

Term life insurance with living benefits can often be included in your policy for a small increase in cost. Renewable after 10 to 20 years with age related pricing and without providing proof of health. Life insurance allows you, the policy owner, to build cash value through your life insurance policy that accumulates over your lifetime. Best for term life insurance: If you encounter any of the below.

Source: effortlessinsurance.com

Source: effortlessinsurance.com

What does living benefits of life insurance mean? This living benefit pays out a portion of your term life policy if you ever face a terminal illness. Term life insurance with living benefits can often be included in your policy for a small increase in cost. All life insurance policies come with what is known as a death benefit. As your life changes, term insurance also provides the option to convert to permanent insurance before age 65 or 70 (depending on your conversion options).

Source: blog.policyadvisor.com

Source: blog.policyadvisor.com

Term life insurance with living benefits is often referred to as accelerated death benefits. This could happen in 2 scenarios: What is cash value in life. What does living benefits of life insurance mean? Living benefits of a life insurance policy are benefits provided to and obtained by those insured, while still alive.

Source: theinvestmentmania.com

Source: theinvestmentmania.com

Insurance is term life insurance that has living benefits baked into the policy. It means you can access the benefits of your insurance plan before you die, instead of waiting for a payout on the policy after the insured person dies. Living benefits are most often associated with permanent (cash value) life insurance. Are you prepared for an unexpected illness? * purchase life insurance with living benefits.

Source: fbsbenefits.com

Source: fbsbenefits.com

Based on the product, living benefits can provide benefits should a qualifying terminal, chronic or critical illness or critical injury occur 1 , or if your desire is to have an income that you cannot outlive. Covers you for a set amount of time, or term. Are you prepared for an unexpected illness? The insured does not have to die to use the policy. All life insurance policies come with what is known as a death benefit.

Source: makeittosimple.blogspot.com

Source: makeittosimple.blogspot.com

Does term life insurance have living benefits? Some life insurance policies can even provide you with benefits while you’re still alive. But even term life insurance policies can be purchased with one or more accelerated benefits riders , which will pay you money while you’re still alive—under circumstances you, frankly, hope you never find yourself in. This is considered a living benefit of life insurance because, in contrast to a death benefit that pays out when you pass away, you can use the money while you’re still alive. With more life insurance living benefits, you and your loved ones will have more options to use the policy while you are living.

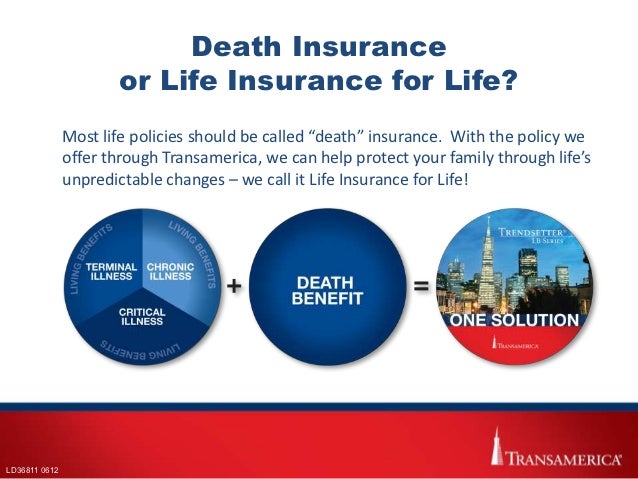

Source: slideteam.net

Source: slideteam.net

It provides funds to your beneficiary (or beneficiaries) if you pass away during that time. Based on the product, living benefits can provide benefits should a qualifying terminal, chronic or critical illness or critical injury occur 1 , or if your desire is to have an income that you cannot outlive. Living benefit options for term life include: Living benefits are most often associated with permanent (cash value) life insurance. This is considered a living benefit of life insurance because, in contrast to a death benefit that pays out when you pass away, you can use the money while you’re still alive.

![10 Year Term Life Insurance [Top 10 Companies and Tips] 10 Year Term Life Insurance [Top 10 Companies and Tips]](https://www.lifeinsuranceblog.net/wp-content/uploads/2017/01/Term-Life-Insurance.png) Source: lifeinsuranceblog.net

Source: lifeinsuranceblog.net

Life insurance allows you, the policy owner, to build cash value through your life insurance policy that accumulates over your lifetime. Living benefits are most often associated with permanent (cash value) life insurance. This living benefit pays out a portion of your term life policy if you ever face a terminal illness. Living promise whole life insurance level benefit policy form: Meets your immediate protection needs with the lowest initial cost.

Source: pacificinsurancegroup.com

Source: pacificinsurancegroup.com

This could happen in 2 scenarios: With more life insurance living benefits, you and your loved ones will have more options to use the policy while you are living. Meets your immediate protection needs with the lowest initial cost. * purchase life insurance with living benefits. The insured does not have to die to use the policy.

Source: nextgen-life-insurance.com

Source: nextgen-life-insurance.com

A term life insurance that specifically covers your remaining mortgage and associated costs. Term life insurance with living benefits (the hybrid product series) watch later. Covers you for a set amount of time, or term. Life insurance allows you, the policy owner, to build cash value through your life insurance policy that accumulates over your lifetime. The 6 best life insurance with living benefits of 2022 best overall:

Source: slideshare.net

Source: slideshare.net

However, those additional protections often mean higher premiums. Many people think of life insurance only in terms of protecting loved ones. Simply put, the living benefits of life insurance is the option for the insured to use his or her life insurance policy while still alive. Affordable life insurance quotes online | fidelity life Best for whole life insurance:

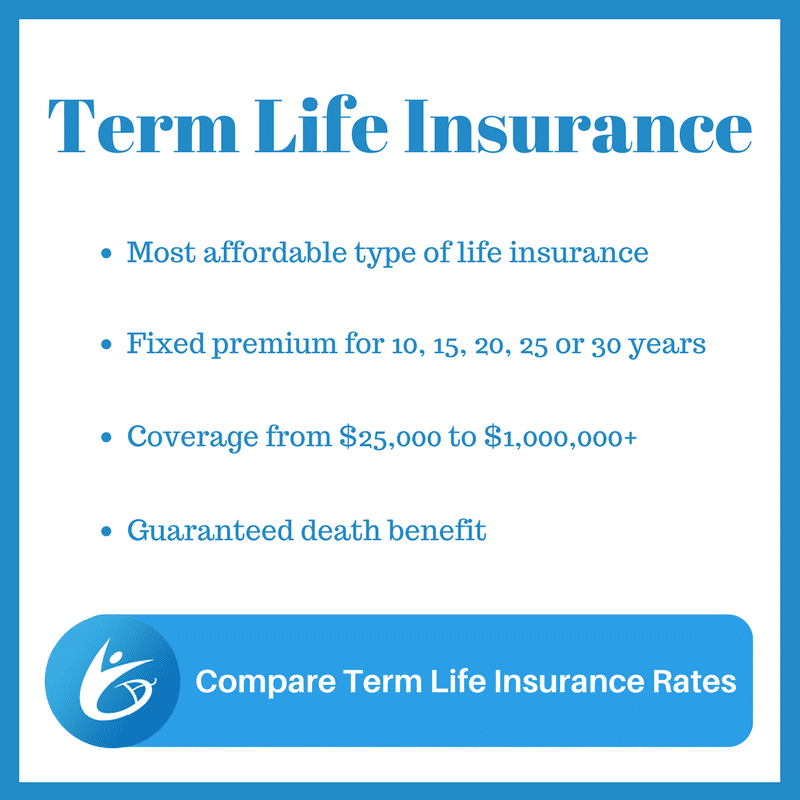

Source: topquotelifeinsurance.com

Source: topquotelifeinsurance.com

- purchase a policy that builds up cash value. Critical, chronic and terminal coverage are important riders that can be added to most life insurance policies. As your life changes, term insurance also provides the option to convert to permanent insurance before age 65 or 70 (depending on your conversion options). * purchase a policy that builds up cash value. Many people think of life insurance only in terms of protecting loved ones.

Source: wholevstermlifeinsurance.com

Source: wholevstermlifeinsurance.com

Term life insurance with living benefits can often be included in your policy for a small increase in cost. Based on the product, living benefits can provide benefits should a qualifying terminal, chronic or critical illness or critical injury occur 1 , or if your desire is to have an income that you cannot outlive. What is cash value in life. Are you prepared for an unexpected illness? It means you can access the benefits of your insurance plan before you die, instead of waiting for a payout on the policy after the insured person dies.

Source: annuityadvantage.com

Source: annuityadvantage.com

After all, it’s called “life” insurance for a reason. Here’s what you need to know about living benefits and how they might help. If you encounter any of the below. Life insurance with living benefits can provide you and your family with essential resources should you become terminally ill or die. All life insurance policies come with what is known as a death benefit.

Source: coverfox.com

Source: coverfox.com

It means you can access the benefits of your insurance plan before you die, instead of waiting for a payout on the policy after the insured person dies. A term life insurance that specifically covers your remaining mortgage and associated costs. It means you can access the benefits of your insurance plan before you die, instead of waiting for a payout on the policy after the insured person dies. * purchase a policy that builds up cash value. What is cash value in life.

Source: pacificinsurancegroup.com

Source: pacificinsurancegroup.com

As your life changes, term insurance also provides the option to convert to permanent insurance before age 65 or 70 (depending on your conversion options). Best for whole life insurance: Some life insurance policies can even provide you with benefits while you’re still alive. Life insurance with living benefits can provide you and your family with essential resources should you become terminally ill or die. Insurance is term life insurance that has living benefits baked into the policy.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title term life insurance with living benefits by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information