Term vs whole life insurance suze orman Idea

Home » Trending » Term vs whole life insurance suze orman IdeaYour Term vs whole life insurance suze orman images are available in this site. Term vs whole life insurance suze orman are a topic that is being searched for and liked by netizens today. You can Download the Term vs whole life insurance suze orman files here. Find and Download all free images.

If you’re searching for term vs whole life insurance suze orman images information related to the term vs whole life insurance suze orman keyword, you have pay a visit to the ideal blog. Our site always provides you with hints for viewing the highest quality video and picture content, please kindly surf and locate more informative video content and graphics that match your interests.

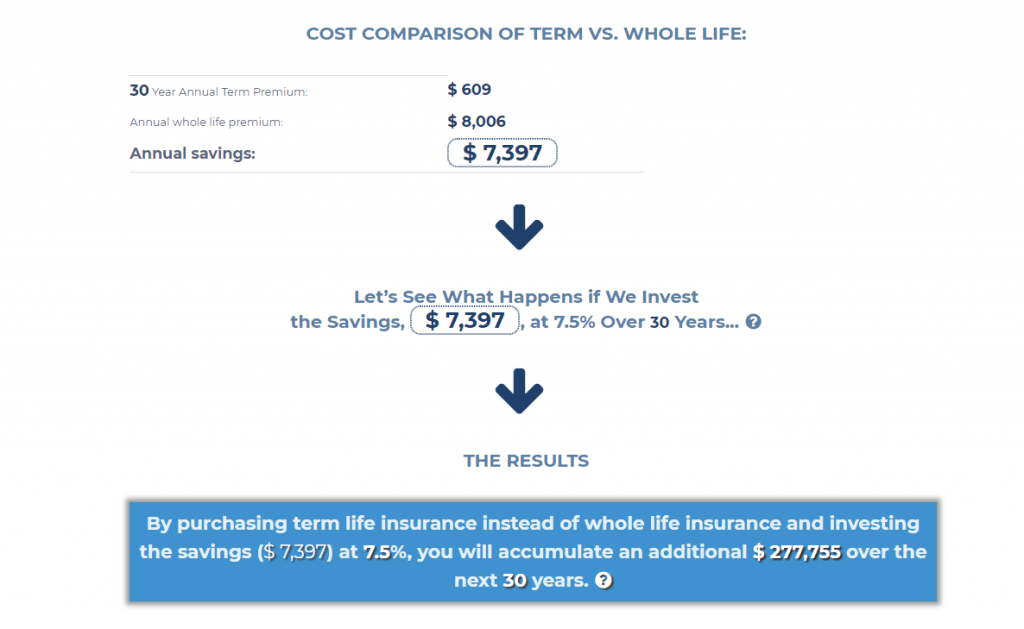

Term Vs Whole Life Insurance Suze Orman. Suze orman is a big supporter of term life insurance policies, and she firmly believes that those types of policies are the best ones to have. $500,000 worth of term coverage = $300 per year Dave ramsey and suze orman with their term life insurance arguments, do have sound thoughts, but they are operating from an assumption that people. The annual premium is $14,000 for $500,000 of whole life coverage.

Suze Orman On Whole Life Insurance kangsantri008 From kangsantri008.blogspot.com

Suze Orman On Whole Life Insurance kangsantri008 From kangsantri008.blogspot.com

For example, if you are 35 years old and make $37,000 a year, your policy should be worth at around $750,000. That is the life insurance consumer who buys a whole life policy vs a term life insurance policy. But when one considers the risk and taxation on those types of investments, plus the fact. A term life insurance policy provides a death benefit when the insured dies. Thankfully, educated experts like suze orman can make the. Suze orman is a personal financial guru that generally believes that term life insurance is the best use of life insurance for most americans.

A term life insurance policy provides a death benefit when the insured dies.

Term life insurance is incredibly affordable. You can quickly compare life insurance quotes across companies here. Stick to term life insurance. Suze orman recommends that you stick to term life insurance to cover your needs. Suze orman is against whole life insurance because she feels that people can do better by buying term life insurance and investing the rest. 2019 whole life insurance vs term (suze orman) term life is renting insurance for a specific number of years.

Source: lifeinsuranceira401kinvestments.com

Source: lifeinsuranceira401kinvestments.com

Suze orman explaining life insurance in general life insurance. And here’s some really good news: That is the life insurance consumer who buys a whole life policy vs a term life insurance policy. According to multiple public remarks on the subject she believes that unless you have a permanent need for life insurance—such as a special needs child—term insurance is the better deal for you. First because her life story is very encouraging (you should google it), and second because she pretty much goes straight to the point.

Source: newyorklifeinsurancecompanyreviewswoy.blogspot.com

Source: newyorklifeinsurancecompanyreviewswoy.blogspot.com

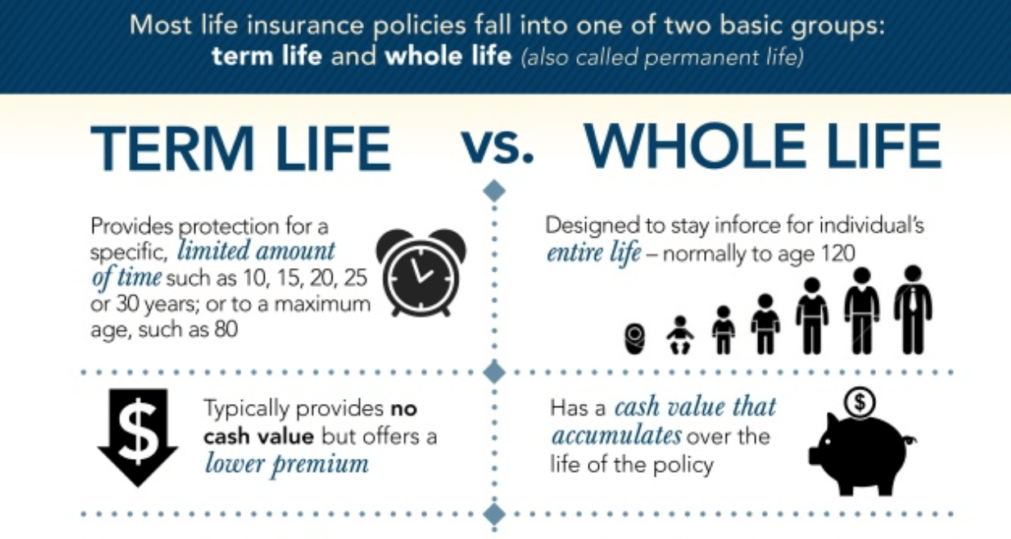

A term life insurance policy provides a death benefit when the insured dies. Term life insurance is incredibly affordable. You can quickly compare life insurance quotes across companies here. With term coverage there is no investment portion. Term life insurance lasts only for a specific period of time, usually 10 to 35 years, while whole or universal life insurance covers you for your entire life.

Source: lifeinsuranceguideline.com

Source: lifeinsuranceguideline.com

A sweet 30 something woman asked her i am married with two young children. What is the difference between term life insurance vs whole life insurance? Term life insurance lasts only for a specific period of time, usually 10 to 35 years, while whole or universal life insurance covers you for your entire life. When to consider whole life insurance $500,000 worth of whole life coverage = $14,000 per year;

Source: kangsantri008.blogspot.com

Source: kangsantri008.blogspot.com

But as it turns out, he’d have gotten the same level of protection with term insurance, having have made about $21, 000 from investing the difference. $500,000 worth of whole life coverage = $14,000 per year; It is “term” because policies come in different time terms: With term coverage there is no investment portion. Whole life is life coverage for the rest of your life plus an investment portion held by the life insurance company.

Source: kangsantri008.blogspot.com

Source: kangsantri008.blogspot.com

$500,000 worth of whole life coverage = $14,000 per year; Term insurance is for a set term or time period from 1 year and usually up to 30 years. You are going to be amazed at how little it costs to buy yourself peace of mind. She insists that term life insurance policies are cheaper than whole and/or universal life insurance policies and that they just make sound financial sense. You can quickly compare life insurance quotes across companies here.

Source: kangsantri008.blogspot.com

Source: kangsantri008.blogspot.com

$500,000 worth of term coverage = $300 per year That is the life insurance consumer who buys a whole life policy vs a term life insurance policy. $500,000 worth of whole life coverage = $14,000 per year; Suze orman recommends that you stick to term life insurance to cover your needs. Suze orman does not like whole insurance (also known as variable life insurance / permanent life / universal life)?

Source: consolidate-a-student-lo-1c8e.blogspot.com

Source: consolidate-a-student-lo-1c8e.blogspot.com

Whole life is life coverage for the rest of your life plus an investment portion held by the life insurance company. Whole life premiums are higher than term life premiums for. Pretty soon, you’ll see why and probably be agreeing with her (and us). Purchasing life insurance is a difficult process that often requires a bit of research. Suze orman explaining life insurance in general life insurance.

Source: policygenius.com

Source: policygenius.com

A term life insurance policy provides a death benefit when the insured dies. Term insurance is for a set term or time period from 1 year and usually up to 30 years. You can quickly compare life insurance quotes across companies here. · a term life insurance policy provides a death (5). Do not let anybody tell you that your life insurance policy is a good way to build extra savings.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

Here is a conversation with a guest calling in which will shed some light on her thoughts on term life insurance vs whole life. Suze orman explaining life insurance. Whole life insurance is a. Suze orman does not like whole insurance (also known as variable life insurance / permanent life / universal life)? Term insurance is for a set term or time period from 1 year and usually up to 30 years.

Source: youtube.com

Source: youtube.com

Fall for that and you will end up wasting thousands of dollars over the life of the policy. A term life insurance policy provides a death benefit when the insured dies. Dave ramsey and suze orman with their term life insurance arguments, do have sound thoughts, but they are operating from an assumption that people. 2019 whole life insurance vs term (suze orman) · term life is renting insurance for a specific number of years. Suze orman is a personal financial guru that generally believes that term life insurance is the best use of life insurance for most americans.

Source: my-horse-maira.blogspot.com

Source: my-horse-maira.blogspot.com

Suze orman does not like whole insurance (also known as variable life insurance / permanent life / universal life)? · a term life insurance policy provides a death (5). Do not let anybody tell you that your life insurance policy is a good way to build extra savings. Suze orman is a big supporter of term life insurance policies, and she firmly believes that those types of policies are the best ones to have. What does suze orman say about whole life insurance?

Source: youtube.com

Source: youtube.com

Do not let anybody tell you that your life insurance policy is a good way to build extra savings. Thankfully, educated experts like suze orman can make the. $500,000 worth of term coverage = $300 per year It is more profitable for ramsey and orman There are three main reasons why suze orman gives out so much advice on term life insurance rather than whole life insurance.

Source: insuranceblogbychris.com

Source: insuranceblogbychris.com

But throughout life, whole life insurance costs much less than term life. And here’s some really good news: Stick to term life insurance. That is the life insurance consumer who buys a whole life policy vs a term life insurance policy. · a term life insurance policy provides a death (5).

Source: policygenius.com

Source: policygenius.com

Suze orman does not like whole insurance (also known as variable life insurance / permanent life / universal life)? Suze orman recommends that you stick to term life insurance to cover your needs. 2019 whole life insurance vs term (suze orman) · term life is renting insurance for a specific number of years. A term life insurance policy provides a death benefit when the insured dies. That is the life insurance consumer who buys a whole life policy vs a term life insurance policy.

Source: wholesalerforknockoffhandbags.blogspot.com

Source: wholesalerforknockoffhandbags.blogspot.com

And here’s some really good news: $500,000 worth of term coverage = $300 per year Stick to term life insurance. It is more profitable for ramsey and orman Suze orman does not like whole insurance (also known as variable life insurance / permanent life / universal life)?

Source: insuranceblogbychris.com

Source: insuranceblogbychris.com

A term life insurance policy provides a death benefit when the insured dies. But throughout life, whole life insurance costs much less than term life. A term life insurance policy provides a death benefit when the insured dies. Here is a conversation with a guest calling in which will shed some light on her thoughts on term life insurance vs whole life. What does suze orman say about whole life insurance?

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

Thankfully, educated experts like suze orman can make the. When to consider whole life insurance Stick to term life insurance. Whole life premiums are higher than term life premiums for. Annual renewable term, 20 year decreasing term, 30 year level term, etc.

Source: dailymotion.com

Suze orman is a big supporter of term life insurance policies, and she firmly believes that those types of policies are the best ones to have. A caller has phoned in asking suze�s advice on whether to purchase a whole life policy recommended by a friend. She insists that term life insurance policies are cheaper than whole and/or universal life insurance policies and that they just make sound financial sense. First because her life story is very encouraging (you should google it), and second because she pretty much goes straight to the point. The annual premium is $14,000 for $500,000 of whole life coverage.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title term vs whole life insurance suze orman by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information