Terrorism insurance Idea

Home » Trend » Terrorism insurance IdeaYour Terrorism insurance images are ready. Terrorism insurance are a topic that is being searched for and liked by netizens today. You can Download the Terrorism insurance files here. Get all free photos and vectors.

If you’re searching for terrorism insurance pictures information linked to the terrorism insurance keyword, you have come to the ideal site. Our website frequently provides you with hints for seeing the maximum quality video and picture content, please kindly surf and locate more informative video content and images that fit your interests.

Terrorism Insurance. However, the financial losses can also be significant. However, it is not required to purchase. We can quote large portfolios with a individual value up to £100m or €120m (larger limits available on request) and both commercial and residential property including selecting parts of portfolio�s in higher. Terrorism/strikes, riots, civil commotion, malicious damage/war, and political violence.

Do I really need terrorism insurance? Watkin Davies From watkindavies.com

Do I really need terrorism insurance? Watkin Davies From watkindavies.com

An act, including the use of force or violence, of any person or group(s) of persons, whether acting alone or on behalf of or in connection with any organization(s), committed for political, religious, or ideological purposes, including the intention to influence any government and/or to put the public in fear. Axa xl offers worldwide insurance for assets that are exposed to war, terrorism and political violence attacks. Prior to 9/11, standard commercial insurance policies included terrorism coverage, effectively free of charge. The program was envisioned as a temporary federal program to provide public and private compensation for certain insured losses resulting from a. However, it is not required to purchase. Unless endorsed to exclude loss due to terrorism, commercial insurance policies issued in the united states (for example, commercial property policies, commercial general liability (cgl) policies, and commercial auto policies) generally provide terrorism insurance coverage.

The terrorism risk insurance act (tria) was originally enacted in 2002 in response to the inability of insurance markets to predict, price and offer terrorism risk coverage to commercial policyholders.

You are hereby notified that under the federal terrorism risk insurance act, as amended (the act), you have a right to purchase insurance coverage for losses arising out of acts of terrorism, as defined in section 102(1) of the act: Prior to 9/11, standard commercial insurance policies included terrorism coverage, effectively free of charge. However, the financial losses can also be significant. The loss of human life is an obvious and sad outcome of terrorist attacks. Beazley leads the market in creative insurance solutions for assets that are exposed to terrorist and politically motivated attacks. Over the last several years the need for terrorism insurance has increased.

Source: contractorsinsurancecompany.com

Source: contractorsinsurancecompany.com

However, the financial losses can also be significant. Our policy offers incident response and crisis management services, provides victim compensation and support and also covers legal. The terrorism risk insurance act (tria) was originally enacted in 2002 in response to the inability of insurance markets to predict, price and offer terrorism risk coverage to commercial policyholders. Most businesses and landlords have either rejected this coverage in the past or have purchased a different form of this coverage known as tria. Standalone policy offering cover for damage to premises, restriction of access to property and utilities and loss of income as a result of an act of terrorism or sabotage.

Source: einsurance.com

Source: einsurance.com

Axa xl offers worldwide insurance for assets that are exposed to war, terrorism and political violence attacks. The insurance information institute (iii) estimates that the 9/11 attacks cost the insurance industry $47 billion (in 2019 dollars) in losses, making it the most expensive terrorist incident in u.s. The term act of terrorism means any act that is certified by the secretary of. The act provides a temporary program. A standard business policy alone will not cover losses caused by terrorism.

Source: today.cofc.edu

Source: today.cofc.edu

Consulting & modelling at no additional cost for insurance clients. The broadest terrorism insurance cover in the market today. Terrorism insurance typically covers equipment, furnishings, inventory, and buildings damaged or destroyed by terrorist acts and protects businesses against liability claims. You are hereby notified that under the federal terrorism risk insurance act, as amended (the act), you have a right to purchase insurance coverage for losses arising out of acts of terrorism, as defined in section 102(1) of the act: Terrorism insurance — insurance covering loss due to acts of terrorism.

Source: slideserve.com

Source: slideserve.com

Prior to 9/11, standard commercial insurance policies included terrorism coverage, effectively free of charge. Terrorism/strikes, riots, civil commotion, malicious damage/war, and political violence. We can offer cover on company or lloyd�s paper, maximum line size available: Axa xl offers worldwide insurance for assets that are exposed to war, terrorism and political violence attacks. For specialist advice on how to anticipate and respond to terrorism.

Source: poolre.co.uk

Source: poolre.co.uk

The insurance information institute (iii) estimates that the 9/11 attacks cost the insurance industry $47 billion (in 2019 dollars) in losses, making it the most expensive terrorist incident in u.s. The loss of human life is an obvious and sad outcome of terrorist attacks. Terrorism is a grave risk that is being faced by the entire world. Political violence insurance as above, this policy provides cover against loss or damage to insured property and the ensuing loss of income caused by acts of terrorism and sabotage, with certain extensions. Our policy offers incident response and crisis management services, provides victim compensation and support and also covers legal.

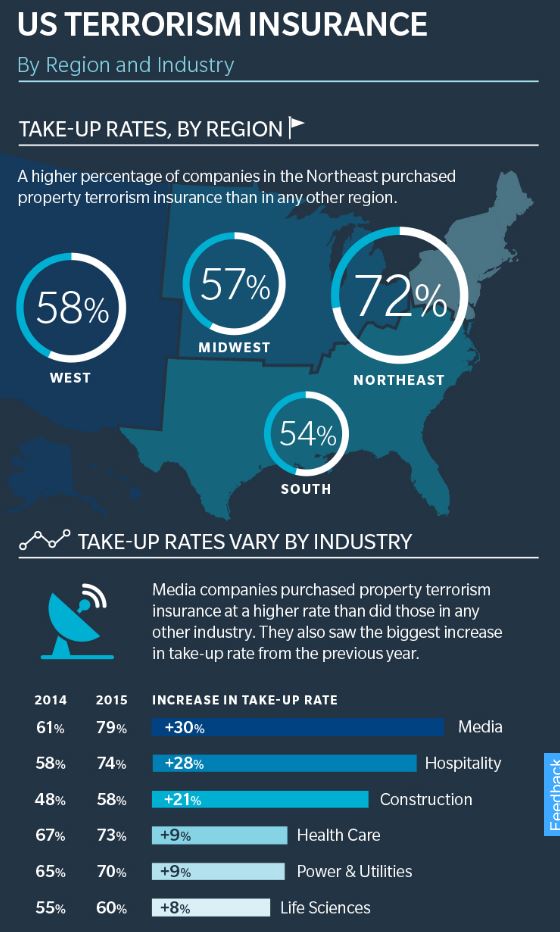

Source: riskmanagementmonitor.com

Source: riskmanagementmonitor.com

The act provides a temporary program. The loss of human life is an obvious and sad outcome of terrorist attacks. The term act of terrorism means any act that is certified by the secretary of. Terrorism insurance the changing nature of attacks and why terrorism insurance is important to businesses. Political violence insurance as above, this policy provides cover against loss or damage to insured property and the ensuing loss of income caused by acts of terrorism and sabotage, with certain extensions.

Source: natlawreview.com

Source: natlawreview.com

Terrorisminsure.com was born in 2015 to offer wider scope, 100% lloyds capacity and a more flexible approach to this class of business. An act, including the use of force or violence, of any person or group(s) of persons, whether acting alone or on behalf of or in connection with any organization(s), committed for political, religious, or ideological purposes, including the intention to influence any government and/or to put the public in fear. Over the last several years the need for terrorism insurance has increased. History, as well as one of the largest single insured loss events in history. Terrorism insurance — insurance covering loss due to acts of terrorism.

Source: tribune.com.pk

Source: tribune.com.pk

An act, including the use of force or violence, of any person or group(s) of persons, whether acting alone or on behalf of or in connection with any organization(s), committed for political, religious, or ideological purposes, including the intention to influence any government and/or to put the public in fear. We can offer cover on company or lloyd�s paper, maximum line size available: Standalone policy offering cover for damage to premises, restriction of access to property and utilities and loss of income as a result of an act of terrorism or sabotage. Prior to 9/11, standard commercial insurance policies included terrorism coverage, effectively free of charge. Our policy offers incident response and crisis management services, provides victim compensation and support and also covers legal.

Source: insurancejournal.com

Source: insurancejournal.com

Terrorism insurance is offered separately or as a special addition—called an “endorsement” or “rider”—to your standard commercial property insurance policy. Prior to 9/11, standard commercial insurance policies included terrorism coverage, effectively free of charge. Consulting & modelling at no additional cost for insurance clients. Covers against loss or damage to insured property and the ensuing loss of income caused by acts of terrorism and sabotage. The term act of terrorism means any act that is certified by the secretary of.

![]() Source: businessinsurance.com

Source: businessinsurance.com

When an event related to terrorism occurs, the losses faced by certain individuals or groups of individuals are catastrophic. A standard business policy alone will not cover losses caused by terrorism. Axa xl offers worldwide insurance for assets that are exposed to war, terrorism and political violence attacks. The term act of terrorism means any act that is certified by the secretary of. We can quote large portfolios with a individual value up to £100m or €120m (larger limits available on request) and both commercial and residential property including selecting parts of portfolio�s in higher.

Source: obierisk.com

Source: obierisk.com

However, the financial losses can also be significant. You are hereby notified that under the federal terrorism risk insurance act, as amended (the act), you have a right to purchase insurance coverage for losses arising out of acts of terrorism, as defined in section 102(1) of the act: Political violence insurance as above, this policy provides cover against loss or damage to insured property and the ensuing loss of income caused by acts of terrorism and sabotage, with certain extensions. Terrorism is a grave risk that is being faced by the entire world. Terrorism insurance — insurance covering loss due to acts of terrorism.

Source: insure24-7.co.uk

Source: insure24-7.co.uk

The terrorism risk insurance act (tria) was originally enacted in 2002 in response to the inability of insurance markets to predict, price and offer terrorism risk coverage to commercial policyholders. Our policy offers incident response and crisis management services, provides victim compensation and support and also covers legal. The insurance information institute (iii) estimates that the 9/11 attacks cost the insurance industry $47 billion (in 2019 dollars) in losses, making it the most expensive terrorist incident in u.s. History, as well as one of the largest single insured loss events in history. When evaluating the value of terrorism insurance to your business, make sure to consider the following:

Source: greshamonline.taskerinsurancegroup.co.uk

Source: greshamonline.taskerinsurancegroup.co.uk

Most businesses and landlords have either rejected this coverage in the past or have purchased a different form of this coverage known as tria. The loss of human life is an obvious and sad outcome of terrorist attacks. Terrorism insurance typically covers equipment, furnishings, inventory, and buildings damaged or destroyed by terrorist acts and protects businesses against liability claims. Terrorism/strikes, riots, civil commotion, malicious damage/war, and political violence. Unless endorsed to exclude loss due to terrorism, commercial insurance policies issued in the united states (for example, commercial property policies, commercial general liability (cgl) policies, and commercial auto policies) generally provide terrorism insurance coverage.

Source: theriskfactor.com

Source: theriskfactor.com

Standalone policy offering cover for damage to premises, restriction of access to property and utilities and loss of income as a result of an act of terrorism or sabotage. Our policy offers incident response and crisis management services, provides victim compensation and support and also covers legal. Standalone policy offering cover for damage to premises, restriction of access to property and utilities and loss of income as a result of an act of terrorism or sabotage. Consulting & modelling at no additional cost for insurance clients. The act provides a temporary program.

Source: murraygrp.com

Source: murraygrp.com

Consulting & modelling at no additional cost for insurance clients. Covers against loss or damage to insured property and the ensuing loss of income caused by acts of terrorism and sabotage. Over the last several years the need for terrorism insurance has increased. Consulting & modelling at no additional cost for insurance clients. Terrorisminsure.com was born in 2015 to offer wider scope, 100% lloyds capacity and a more flexible approach to this class of business.

The insurance information institute (iii) estimates that the 9/11 attacks cost the insurance industry $47 billion (in 2019 dollars) in losses, making it the most expensive terrorist incident in u.s. We can offer cover on company or lloyd�s paper, maximum line size available: You are hereby notified that under the federal terrorism risk insurance act, as amended (the act), you have a right to purchase insurance coverage for losses arising out of acts of terrorism, as defined in section 102(1) of the act: For specialist advice on how to anticipate and respond to terrorism. Terrorisminsure.com was born in 2015 to offer wider scope, 100% lloyds capacity and a more flexible approach to this class of business.

Source: watkindavies.com

Source: watkindavies.com

Disclosure notice of terrorism insurance coverage. A standard business policy alone will not cover losses caused by terrorism. Terrorism insurance the changing nature of attacks and why terrorism insurance is important to businesses. Political violence insurance as above, this policy provides cover against loss or damage to insured property and the ensuing loss of income caused by acts of terrorism and sabotage, with certain extensions. In the insurance context, an act of terrorism is often defined as:

Source: ff.org

Source: ff.org

Unless endorsed to exclude loss due to terrorism, commercial insurance policies issued in the united states (for example, commercial property policies, commercial general liability (cgl) policies, and commercial auto policies) generally provide terrorism insurance coverage. Over the last several years the need for terrorism insurance has increased. However, the financial losses can also be significant. Terrorism insurance — insurance covering loss due to acts of terrorism. In the insurance context, an act of terrorism is often defined as:

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title terrorism insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information