Texas homeowners insurance laws Idea

Home » Trend » Texas homeowners insurance laws IdeaYour Texas homeowners insurance laws images are ready in this website. Texas homeowners insurance laws are a topic that is being searched for and liked by netizens today. You can Download the Texas homeowners insurance laws files here. Get all royalty-free photos.

If you’re looking for texas homeowners insurance laws images information connected with to the texas homeowners insurance laws keyword, you have come to the ideal blog. Our site always gives you suggestions for refferencing the highest quality video and picture content, please kindly surf and find more enlightening video articles and images that fit your interests.

Texas Homeowners Insurance Laws. Texas law gives you certain rights as an insurance consumer. Chapter 81 applies to most condominiums with declarations recorded prior to 1994. When signing up for a texas homeowner’s insurance policy, it is very important to have a thorough understanding of the outlined terms and conditions. See homeowners� guide to hoa laws for a list of all applicable laws.

Texas Homeowners Insurance Rate Increase at Insurance From revisi.net

Texas Homeowners Insurance Rate Increase at Insurance From revisi.net

This means that they are business entities formally created under texas law and registered with the secretary of state. Compliant contractors need not worry; Texas law states that while your bank lender can require homeowners insurance on your mortgaged home, the lender cannot request coverage that exceeds the value of the replacing the dwelling and your personal possessions, regardless of the total mortgage loan amount. Texas law requires a person insured under a property insurance policy to pay any deductible applicable to a claim made under the policy. Texas has a consumer bill of rights for homeowners and renters insurance. Not only for peace of mind, but to protect you and your family’s assets.

In texas, there are certain caveats to that particular law, including a stipulation that the dog in question cannot have had any incidents of questionable or aggressive behavior.

Not only for peace of mind, but to protect you and your family’s assets. Texas homeowners association insurance protects your hoa from lawsuits with rates as low as $57/mo. Your insurance company will give you a copy of the bill of rights when you get or renew a policy. Texas law requires a person insured under a property insurance policy to pay any deductible applicable to a claim made under the policy. Although home insurance is not legally required in the state of texas, its surely a good idea to have it. The texas department of insurance (“tdi”) created a consumer bill of rights (“bor”) for homeowners and renters that gives you the basic knowledge you need.

Source: xpcourse.com

Source: xpcourse.com

2.20.1 authority to levy assessments. The average cost of home insurance in texas is $3,429, making texas the fifth most expensive state in the country for home insurance. Its average cost is $1,124, or 49%, more than the national average of $2,305, for the coverage level of: The texas department of housing and community affairs (tdhca) is in the process of creating a distribution plan. The texas department of insurance (“tdi”) created a consumer bill of rights (“bor”) for homeowners and renters that gives you the basic knowledge you need.

Source: lawinfo.com

Source: lawinfo.com

Property insurance law is a highly complex and specialized area of law and our firm represents policyholders when claims are denied, delayed or underpaid. Most texas homeowners insurance policies require coverage for the following five categories: Texas law requires a person insured under a property insurance policy to pay any deductible applicable to a claim made under the policy. Title 11 of the tpc includes numerous provisions governing the formation, management, powers, and operation of residential homeowners’ associations (hoas) (usually called property owners associations in the statute) in texas. The average cost of home insurance in texas is $3,429, making texas the fifth most expensive state in the country for home insurance.

Source: moore-firm.com

Source: moore-firm.com

Texas homeowners association law is the essential legal guidebook for texas hoas and homeowners and is written specifically for directors, officers and homeowners. Texas law gives you certain rights as an insurance consumer. For more information, you can contact tdhca at: It is a violation of this texas law for a person or business paid wholly or partly from proceeds of a property insurance claim to knowingly allow the insured person to fail to pay. 2.20.1 authority to levy assessments.

Source: newinsurancetime.com

Source: newinsurancetime.com

In addition, under texas insurance code chapter 542, up to 18 percent interest per year is available on the amount of the claim. Families count on it to protect themselves from catastrophic financial damages in the event of storm damage or a loss to their property. This means that they are business entities formally created under texas law and registered with the secretary of state. Get a fast quote and your certificate of insurance now. Title 11 of the tpc includes numerous provisions governing the formation, management, powers, and operation of residential homeowners’ associations (hoas) (usually called property owners associations in the statute) in texas.

Source: einsurance.com

Source: einsurance.com

For this reason, when asked questions about the functions of an hoa, our librarians often refer people to the texas law on nonprofit corporations. Title 11 of the tpc includes numerous provisions governing the formation, management, powers, and operation of residential homeowners’ associations (hoas) (usually called property owners associations in the statute) in texas. What is the average cost of homeowners insurance in texas? The consumer bill of rights for homeowners, dwelling, and renters insurance outlines many of those important rights. Under section 707.003 texas insurance commission is entrusted with the responsibility of initiating consumer awareness on the new law.

Source: insurancenewshubb.com

Source: insurancenewshubb.com

Funds from the haf may be used for mortgage payments, homeowner’s insurance, utility payments, and other specified purposes such as homeowner and condominium association fees. In addition, under texas insurance code chapter 542, up to 18 percent interest per year is available on the amount of the claim. Texas property code (tpc), tex. Title 11 of the tpc includes numerous provisions governing the formation, management, powers, and operation of residential homeowners’ associations (hoas) (usually called property owners associations in the statute) in texas. Families count on it to protect themselves from catastrophic financial damages in the event of storm damage or a loss to their property.

Source: revisi.net

Source: revisi.net

Your insurance company will give you a copy of the bill of rights when you get or renew a policy. The texas department of housing and community affairs (tdhca) is in the process of creating a distribution plan. Most texas homeowners insurance policies require coverage for the following five categories: If you’re unsure of whether or not your situation warrants filing a claim against your homeowners insurance company,. Average cost of homeowners insurance in texas.

Source: musicaccoustic.com

Source: musicaccoustic.com

Potential in texas, certain dog breeds that have been deemed to have the potential to be dangerous will have higher insurance premiums and might also require certain. Texas law gives you certain rights as an insurance consumer. Texas homeowners insurance requirements 🏠 nov 2021. 2.20.1 authority to levy assessments. Compliant contractors need not worry;

Source: freshstartwithmichaela.blogspot.com

When signing up for a texas homeowner’s insurance policy, it is very important to have a thorough understanding of the outlined terms and conditions. Property insurance law is a highly complex and specialized area of law and our firm represents policyholders when claims are denied, delayed or underpaid. Many property owners� associations in texas are formed as nonprofit corporations. Texas homeowners association law is the essential legal guidebook for texas hoas and homeowners and is written specifically for directors, officers and homeowners. Texas law requires a person insured under a property insurance policy to pay any deductible applicable to a claim made under the policy.

Source: npa1.org

Source: npa1.org

It is a violation of this texas law for a person or business paid wholly or partly from proceeds of a property insurance claim to knowingly allow the insured person to fail to pay. The consumer bill of rights for homeowners, dwelling, and renters insurance outlines many of those important rights. Common elements, insurance, and records retention in texas. Texas has a consumer bill of rights for homeowners and renters insurance. The texas department of housing and community affairs (tdhca) is in the process of creating a distribution plan.

Source: dicklawfirm.com

Source: dicklawfirm.com

Homeowners insurance is getting more expensive. Many property owners� associations in texas are formed as nonprofit corporations. The average cost of home insurance in texas is $3,429, making texas the fifth most expensive state in the country for home insurance. Although home insurance is not legally required in the state of texas, its surely a good idea to have it. This means that they are business entities formally created under texas law and registered with the secretary of state.

Source: progressivelegalgroup.com

Source: progressivelegalgroup.com

Most texas homeowners insurance policies require coverage for the following five categories: It’s in the texas administrative code at: The texas department of housing and community affairs (tdhca) is in the process of creating a distribution plan. 2.20 authority to levy assessments and establishment of an assessment lien. The two laws govern, among other things, condominium formation, management, operation, and powers;

Source: moore-firm.com

Source: moore-firm.com

Its average cost is $1,124, or 49%, more than the national average of $2,305, for the coverage level of: It’s in the texas administrative code at: The two laws govern, among other things, condominium formation, management, operation, and powers; Texas homeowners association law is the essential legal guidebook for texas hoas and homeowners and is written specifically for directors, officers and homeowners. Common elements, insurance, and records retention in texas.

Source: vector-works.org

Source: vector-works.org

The average cost of home insurance in texas is $3,429, making texas the fifth most expensive state in the country for home insurance. Homeowner claims disputes litigation for policyholders throughout texas. It’s in the texas administrative code at: Funds from the haf may be used for mortgage payments, homeowner’s insurance, utility payments, and other specified purposes such as homeowner and condominium association fees. Most texas homeowners insurance policies require coverage for the following five categories:

Source: iffa-yana.blogspot.com

Source: iffa-yana.blogspot.com

The average cost of home insurance in texas is $3,429, making texas the fifth most expensive state in the country for home insurance. Funds from the haf may be used for mortgage payments, homeowner’s insurance, utility payments, and other specified purposes such as homeowner and condominium association fees. Homeowners insurance is getting more expensive. The two laws govern, among other things, condominium formation, management, operation, and powers; Your insurance company will give you a copy of the bill of rights when you get or renew a policy.

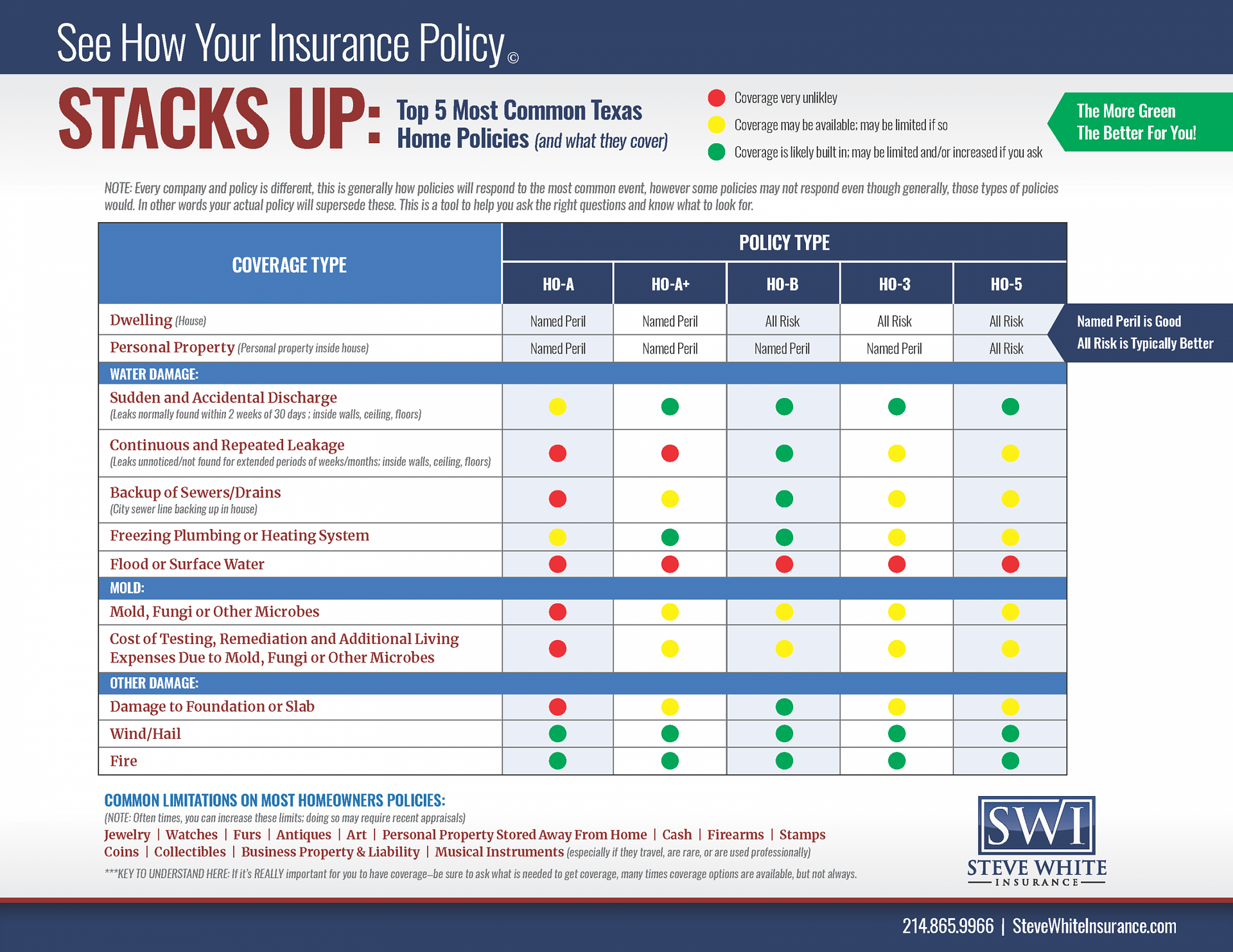

Source: stevewhiteinsurance.com

Source: stevewhiteinsurance.com

The consumer bill of rights for homeowners, dwelling, and renters insurance outlines many of those important rights. This means that they are business entities formally created under texas law and registered with the secretary of state. Your insurance company will give you a copy of the bill of rights when you get or renew a policy. Homeowners insurance protects you financially if your home or property is damaged or destroyed by something your policy covers, like a fire or storm. Texas law states that while your bank lender can require homeowners insurance on your mortgaged home, the lender cannot request coverage that exceeds the value of the replacing the dwelling and your personal possessions, regardless of the total mortgage loan amount.

Source: iffa-yana.blogspot.com

Source: iffa-yana.blogspot.com

The texas department of insurance (“tdi”) created a consumer bill of rights (“bor”) for homeowners and renters that gives you the basic knowledge you need. Texas homeowners association insurance protects your hoa from lawsuits with rates as low as $57/mo. Average cost of homeowners insurance in texas. Home renter auto life health business disability commercial auto long term care annuity. Compliant contractors need not worry;

Source: propertyinsurancecoveragelaw.com

Source: propertyinsurancecoveragelaw.com

Title 11 of the tpc includes numerous provisions governing the formation, management, powers, and operation of residential homeowners’ associations (hoas) (usually called property owners associations in the statute) in texas. 2.20 authority to levy assessments and establishment of an assessment lien. Potential in texas, certain dog breeds that have been deemed to have the potential to be dangerous will have higher insurance premiums and might also require certain. Property insurance law is a highly complex and specialized area of law and our firm represents policyholders when claims are denied, delayed or underpaid. Funds from the haf may be used for mortgage payments, homeowner’s insurance, utility payments, and other specified purposes such as homeowner and condominium association fees.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title texas homeowners insurance laws by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information