Texas homeowners insurance rate increase information

Home » Trending » Texas homeowners insurance rate increase informationYour Texas homeowners insurance rate increase images are ready in this website. Texas homeowners insurance rate increase are a topic that is being searched for and liked by netizens now. You can Download the Texas homeowners insurance rate increase files here. Download all free images.

If you’re looking for texas homeowners insurance rate increase images information linked to the texas homeowners insurance rate increase keyword, you have come to the ideal blog. Our site frequently provides you with hints for viewing the highest quality video and picture content, please kindly hunt and find more enlightening video articles and images that match your interests.

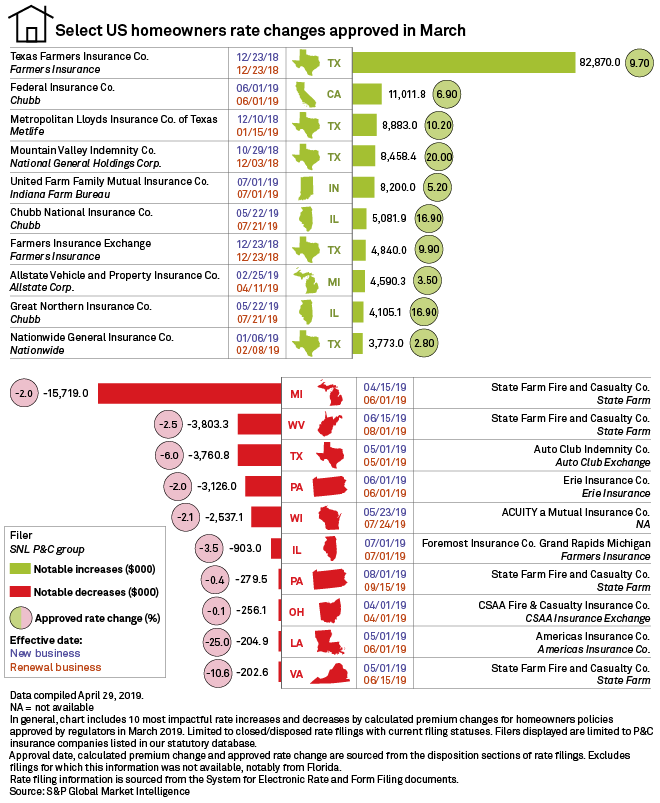

Texas Homeowners Insurance Rate Increase. In 2018, homeowners insurance premiums saw a 3.1 percent increase nationwide, according to a january 2021 study by the naic. But price is only one factor of homeowners. As it stands now, state farm insures over one million texas homeowners, capturing 30 percent of the market. Insurance companies that sell homeowners insurance in texas have been filing for rate increases with the state regulators over the last couple of years and jim gavin, information services specialist at the independent insurance.

Texas Homeowners Insurance Rate Increase at Insurance From revisi.net

Texas Homeowners Insurance Rate Increase at Insurance From revisi.net

Texas’s rates went up 18% during that time frame, and. 6 rows the texas department of insurance (tdi) has approved the fair plan’s rate changes. That’s $94 more than the national monthly average of $192. The state has not been hit by a major hurricane in six years. New customers will see rates increase as of november 1, but those already insured with state farm won’t see increases until december 1. As it stands now, state farm insures over one million texas homeowners, capturing 30 percent of the market.

The head of a national consumer advocacy organization predicted this week insurance companies will raise already high homeowners insurance premiums in texas after frigid temperatures and brutal storms caused as much as $50 billion in damage across much of the state.

These new and higher rates are going to be going into effect for new and renewal policies. By shopping for home insurance, you could save more than $1,000 each year. Homeowners insurance costs more in texas than nearly every other state. In 2018, homeowners insurance premiums saw a 3.1 percent increase nationwide, according to a january 2021 study by the naic. 6 rows the texas department of insurance (tdi) has approved the fair plan’s rate changes. Farmers seeks 15 percent rate increase for texans� homeowners insurance homeowners covered by farmers insurance will see their second premium increase this year, the company told state regulators friday, planning to boost the cost of.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

Texas homeowners’ premiums likely to increase after historic weather. Homeowners insurers have been filing for rate increases in the state over the past couple of years and that’s going to continue, according to jim gavin, information services specialist at the. Farmers seeks 15 percent rate increase for texans� homeowners insurance homeowners covered by farmers insurance will see their second premium increase this year, the company told state regulators friday, planning to boost the cost of. Texas’s rates went up 18% during that time frame, and. Texas homeowners’ premiums likely to increase after historic weather.

Source: listalternatives.com

Source: listalternatives.com

New customers will see rates increase as of november 1, but those already insured with state farm won’t see increases until december 1. The head of a national consumer advocacy organization predicted this week insurance companies will raise already high homeowners insurance premiums in texas after frigid temperatures and brutal storms caused as much as $50 billion in damage across much of the state. Texas homeowners could be seeing a premium hike or increase in deductibles this year according to a recent insurance journal article. Farmers seeks 15 percent rate increase for texans� homeowners insurance homeowners covered by farmers insurance will see their second premium increase this year, the company told state regulators friday, planning to boost the cost of. Insurance coverage is becoming more expensive because of natural disasters in the past homeowners insurance rates are on the rise in texas,.

Source: intel26.blogspot.com

Insurance coverage is becoming more expensive because of natural disasters in the past homeowners insurance rates are on the rise in texas,. We don’t approve rates in advance, but if we find that an insurance company’s rates are too high, we can require it to pay refunds to the people it overcharged. Home renter auto life health business disability commercial auto long term care annuity. The state has not been hit by a major hurricane in six years. The cheapest home insurance in texas is texas farmers with an average rate of $2,690.

Source: nbcdfw.com

Source: nbcdfw.com

Insurance companies may appeal our decisions. About 450,000 homeowners covered by allstate. New customers will see rates increase as of november 1, but those already insured with state farm won’t see increases until december 1. Texas sees significant homeowners rate hikes in april. Insurance coverage is becoming more expensive because of natural disasters in the past homeowners insurance rates are on the rise in texas,.

Source: homeinsuranceking.com

Source: homeinsuranceking.com

The head of a national consumer advocacy organization predicts insurance companies will raise already high homeowners insurance premiums in texas after frigid temperatures and brutal storms caused. The state has not been hit by a major hurricane in six years. So, it’s vital that you shop around and get quotes from home insurance companies to get the best rate for your home. Texas’s rates went up 18% during that time frame, and. About 450,000 homeowners covered by allstate.

Source: revisi.net

Source: revisi.net

The head of a national consumer advocacy organization predicted this week insurance companies will raise already high homeowners insurance premiums in texas after frigid temperatures and brutal storms caused as much as $50 billion in damage across much of the state. The head of a national consumer advocacy organization predicts insurance companies will raise already high homeowners insurance premiums in texas after frigid temperatures and brutal storms caused. In 2018, homeowners insurance premiums saw a 3.1 percent increase nationwide, according to a january 2021 study by the naic. Three texas homeowners insurance companies have announced that they will be increasing the premiums that they charge for providing coverage for the properties of the residents of the state. Texas homeowners’ premiums likely to increase after historic weather.

Source: insureinfoq.com

Source: insureinfoq.com

The cheapest home insurance in texas is texas farmers with an average rate of $2,690. By shopping for home insurance, you could save more than $1,000 each year. Rates for the estimated 175,000 homeowners covered by allstate texas fire and casualty will increase 9.7 percent, according to documents filed with. Texas’s rates went up 18% during that time frame, and. But price is only one factor of homeowners.

Source: intel26.blogspot.com

So, it’s vital that you shop around and get quotes from home insurance companies to get the best rate for your home. Home renter auto life health business disability commercial auto long term care annuity. The average home insurance cost per month in texas is $286, based on an insurance.com rate analysis. In 2018, homeowners insurance premiums saw a 3.1 percent increase nationwide, according to a january 2021 study by the naic. New customers will see rates increase as of november 1, but those already insured with state farm won’t see increases until december 1.

Source: vector-works.org

Source: vector-works.org

Homeowners insurance rates are on the rise in texas, and natural disasters may be the cause. Take a look at some of the reasons auto insurance rates have gone up. Texas law requires insurance companies to charge rates that are fair, reasonable, and adequate for the risks they cover. We don’t approve rates in advance, but if we find that an insurance company’s rates are too high, we can require it to pay refunds to the people it overcharged. Homeowners insurance costs more in texas than nearly every other state.

Source: intel26.blogspot.com

Source: intel26.blogspot.com

The cheapest home insurance in texas is texas farmers with an average rate of $2,690. Take a look at some of the reasons auto insurance rates have gone up. Farmers seeks 15 percent rate increase for texans� homeowners insurance homeowners covered by farmers insurance will see their second premium increase this year, the company told state regulators friday, planning to boost the cost of. Homeowners insurance costs more in texas than nearly every other state. These new and higher rates are going to be going into effect for new and renewal policies.

Source: intel26.blogspot.com

Source: intel26.blogspot.com

Know which companies offer the cheapest homeowners insurance in texas. Texas homeowners could be seeing a premium hike or increase in deductibles this year according to a recent insurance journal article. Three texas homeowners insurance companies have announced that they will be increasing the premiums that they charge for providing coverage for the properties of the residents of the state. Texas’s rates went up 18% during that time frame, and. 6 rows the texas department of insurance (tdi) has approved the fair plan’s rate changes.

Source: reviews.com

Source: reviews.com

Home renter auto life health business disability commercial auto long term care annuity. That’s $94 more than the national monthly average of $192. Texas’s rates went up 18% during that time frame, and. The cheapest home insurance in texas is texas farmers with an average rate of $2,690. Homeowners insurance costs more in texas than nearly every other state.

Source: revisi.net

Source: revisi.net

Texas homeowners insurance rate increase 🏠 feb 2022. 6 rows the texas department of insurance (tdi) has approved the fair plan’s rate changes. Texas homeowners’ premiums likely to increase after historic weather. There were 14 rate increases in the lone star state during the month, which could lead to an additional $110.2 million in premiums. The head of a national consumer advocacy organization predicts insurance companies will raise already high homeowners insurance premiums in texas after frigid temperatures and brutal storms caused.

Source: listalternatives.com

Source: listalternatives.com

Texas law requires insurance companies to charge rates that are fair, reasonable, and adequate for the risks they cover. Vos insurance agency makes large insurance companies compete for your business. The state has not been hit by a major hurricane in six years. On average, texas home insurance costs $1,863 per year for $250,000 in dwelling coverage, based on bankrate’s 2021 study of quoted annual premiums. The average home insurance cost per month in texas is $286, based on an insurance.com rate analysis.

Source: revisi.net

Source: revisi.net

Homeowners insurance rates are on the rise in texas, and natural disasters may be the cause. Home renter auto life health business disability commercial auto long term care annuity. Farmers seeks 15 percent rate increase for texans� homeowners insurance homeowners covered by farmers insurance will see their second premium increase this year, the company told state regulators friday, planning to boost the cost of. On average, texas home insurance costs $1,863 per year for $250,000 in dwelling coverage, based on bankrate’s 2021 study of quoted annual premiums. Insurance companies that sell homeowners insurance in texas have been filing for rate increases with the state regulators over the last couple of years and jim gavin, information services specialist at the independent insurance.

Source: demandmore.us

Source: demandmore.us

The head of a national consumer advocacy organization predicted this week insurance companies will raise already high homeowners insurance premiums in texas after frigid temperatures and brutal storms caused as much as $50 billion in damage across much of the state. Insurance companies that sell homeowners insurance in texas have been filing for rate increases with the state regulators over the last couple of years and jim gavin, information services specialist at the independent insurance. Homeowners insurers have been filing for rate increases in the state over the past couple of years and that’s going to continue, according to jim gavin, information services specialist at the. There were 14 rate increases in the lone star state during the month, which could lead to an additional $110.2 million in premiums. Insurance coverage is becoming more expensive because of natural disasters in the past homeowners insurance rates are on the rise in texas,.

Source: styrowing.com

Source: styrowing.com

We don’t approve rates in advance, but if we find that an insurance company’s rates are too high, we can require it to pay refunds to the people it overcharged. The state has not been hit by a major hurricane in six years. Texas is the fifth most expensive state in the country for home insurance with an average cost of $3,429. Texas homeowners could be seeing a premium hike or increase in deductibles this year according to a recent insurance journal article. Homeowners insurance costs more in texas than nearly every other state.

Source: revisi.net

Source: revisi.net

Farmers seeks 15 percent rate increase for texans� homeowners insurance homeowners covered by farmers insurance will see their second premium increase this year, the company told state regulators friday, planning to boost the cost of. Farmers seeks 15 percent rate increase for texans� homeowners insurance homeowners covered by farmers insurance will see their second premium increase this year, the company told state regulators friday, planning to boost the cost of. Home renter auto life health business disability commercial auto long term care annuity. Insurance companies may appeal our decisions. Rates for the estimated 175,000 homeowners covered by allstate texas fire and casualty will increase 9.7 percent, according to documents filed with.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title texas homeowners insurance rate increase by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information