Texas no fault insurance state Idea

Home » Trending » Texas no fault insurance state IdeaYour Texas no fault insurance state images are ready. Texas no fault insurance state are a topic that is being searched for and liked by netizens today. You can Find and Download the Texas no fault insurance state files here. Download all free photos and vectors.

If you’re looking for texas no fault insurance state images information linked to the texas no fault insurance state interest, you have visit the ideal blog. Our site always gives you hints for seeking the maximum quality video and image content, please kindly surf and find more enlightening video articles and images that fit your interests.

Texas No Fault Insurance State. It is an at fault state ↓ find out what that means for your car accident injury claim. The guide below explains these personal injury laws in more depth. In texas, however, this is not the case. Under this system, you must prove that the other driver was at fault before their insurance will cover your injuries and vehicle damage.

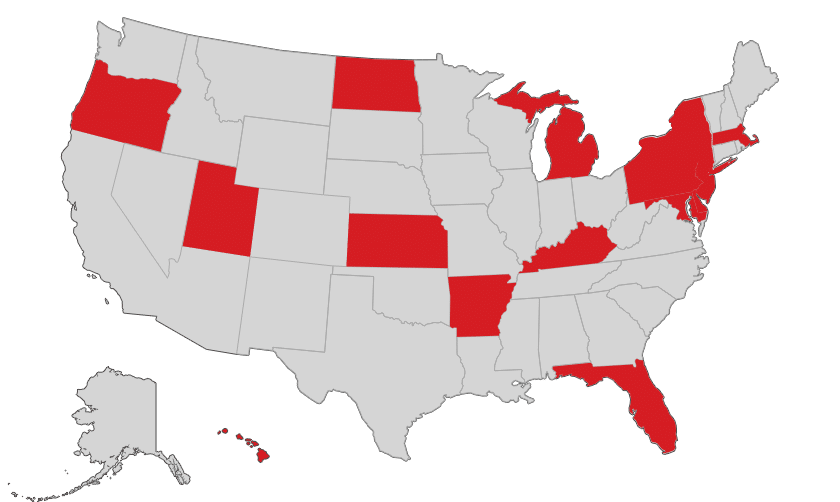

States With NoFault Auto Insurance Infogram From infogram.com

States With NoFault Auto Insurance Infogram From infogram.com

In the u.s., laws and regulations can vary from one jurisdiction to another, and insurance law is no exception. Texas follows something called the 30/60/25 coverage guideline. In texas, there is a fault insurance requirement for every licensed driver in the state. Remember, in texas it is mandatory to have auto insurance, if you still don�t have it be prepared to pay a fine. What is texas’s fault law? The state of texas does not require no fault insurance.

What is no fault insurance?

No fault insurance requires your own car insurance company to pay all or a portion of medical bills and lost wages for you (the driver) and any passengers in the event of an accident where any of you are injured. In texas, every driver is required to carry liability auto insurance to cover expenses for the other driver in the unfortunate event of a motor vehicle accident. Texas follows something called the 30/60/25 coverage guideline. Each state requires drivers to carry a minimum amount of car insurance. What is texas’s fault law? The guide below explains these personal injury laws in more depth.

Source: daileylawyers.com

Source: daileylawyers.com

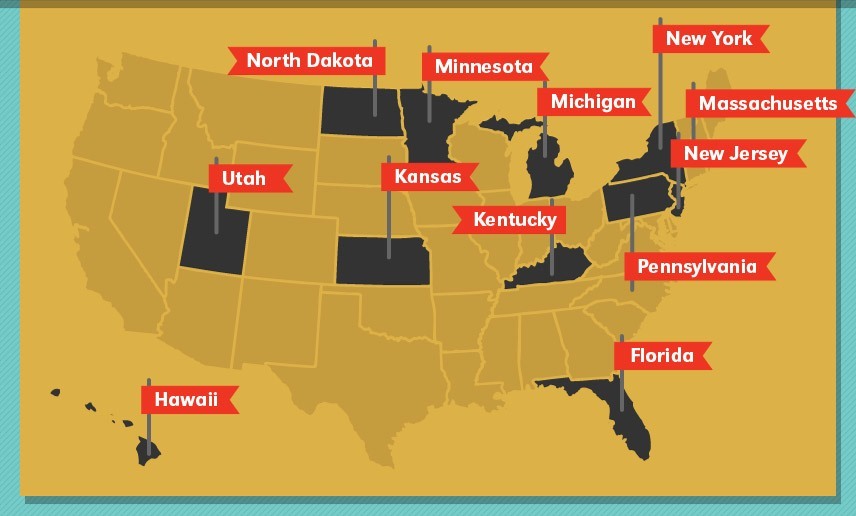

Every driver in the state of texas must carry a minimum amount of car insurance. Texas’s fault insurance claims system. Along with 12 other states, it follows fault rules, and as such, you should be prepared. Florida, hawaii, kansas, kentucky, massachusetts, michigan, minnesota, new jersey, new york, north dakota, pennsylvania, and utah. A fault state uses a car insurance system that centers on fault for the accident.

Source: blog.honestpolicy.com

Source: blog.honestpolicy.com

As a general matter, auto insurance. Texas liability laws the law requires every driver in texas to carry minimum amounts of insurance. Texas follows something called the 30/60/25 coverage guideline. What is no fault insurance? Remember, in texas it is mandatory to have auto insurance, if you still don�t have it be prepared to pay a fine.

Source: thezlawfirm.com

Source: thezlawfirm.com

Both drivers are financially protected by automobile insurance. In texas, there is a fault insurance requirement for every licensed driver in the state. A fault state uses a car insurance system that centers on fault for the accident. The guide below explains these personal injury laws in more depth. Texas’s fault insurance claims system.

Source: halloweenpics.me

Source: halloweenpics.me

Along with 12 other states, it follows fault rules, and as such, you should be prepared. The best option is a coverage amount that protects you such as comprehensives and collision. Texas is an at fault state. The state of texas does not require no fault insurance. It is an at fault state ↓ find out what that means for your car accident injury claim.

Source: chelsiegarzalaw.com

Source: chelsiegarzalaw.com

Every driver in the state of texas must carry a minimum amount of car insurance. Per the texas department of insurance, this is so that drivers must pay for the accidents they cause. In the u.s., laws and regulations can vary from one jurisdiction to another, and insurance law is no exception. What is texas’s fault law? This essentially means that you must have bodily injury.

Source: quora.com

Every driver in the state of texas must carry a minimum amount of car insurance. Uninsured/underinsured motorist coverage (um/uim) medical payments coverage (med pay) Texas liability laws the law requires every driver in texas to carry minimum amounts of insurance. No fault insurance requires your own car insurance company to pay all or a portion of medical bills and lost wages for you (the driver) and any passengers in the event of an accident where any of you are injured. It is an at fault state ↓ find out what that means for your car accident injury claim.

Source: sutliffstout.com

Source: sutliffstout.com

In texas, however, this is not the case. These amounts include $30,000 per person in bodily injury insurance, $60,000 per accident and $25,000 for property damage repairs. Every driver in the state of texas must carry a minimum amount of car insurance. It is a fault state. Each state requires drivers to carry a minimum amount of car insurance.

Source: cheapfullcoverageautoinsurance.com

Source: cheapfullcoverageautoinsurance.com

Getting familiar with insurance is a. Texas is not a no fault state. No fault insurance requires your own car insurance company to pay all or a portion of medical bills and lost wages for you (the driver) and any passengers in the event of an accident where any of you are injured. A fault state uses a car insurance system that centers on fault for the accident. Under this system, you must prove that the other driver was at fault before their insurance will cover your injuries and vehicle damage.

Source: insurancecartoronto.ca

Source: insurancecartoronto.ca

Texas follows something called the 30/60/25 coverage guideline. As of 2019, the minimum amount required in texas is $30,000 in bodily injury coverage per person, $60,000 in bodily injury coverage per accident, and $25,000 of coverage for property damage. In texas, every driver is required to carry liability auto insurance to cover expenses for the other driver in the unfortunate event of a motor vehicle accident. Texas follows something called the 30/60/25 coverage guideline. Florida, hawaii, kansas, kentucky, massachusetts, michigan, minnesota, new jersey, new york, north dakota, pennsylvania, and utah.

Source: ihlaw.com

Source: ihlaw.com

Texas’s fault insurance claims system. How are compensation claims handled in texas auto accidents? Florida, hawaii, kansas, kentucky, massachusetts, michigan, minnesota, new jersey, new york, north dakota, pennsylvania, and utah. In texas, however, this is not the case. The guide below explains these personal injury laws in more depth.

Source: ourinjurylawyers.com

Source: ourinjurylawyers.com

Texas follows something called the 30/60/25 coverage guideline. Each state requires drivers to carry a minimum amount of car insurance. The guide below explains these personal injury laws in more depth. Texas liability laws the law requires every driver in texas to carry minimum amounts of insurance. Florida, hawaii, kansas, kentucky, massachusetts, michigan, minnesota, new jersey, new york, north dakota, pennsylvania, and utah.

Source: michiganautolaw.com

Source: michiganautolaw.com

It is a fault state. Florida, hawaii, kansas, kentucky, massachusetts, michigan, minnesota, new jersey, new york, north dakota, pennsylvania, and utah. Read to know the list of states with no. This essentially means that you must have bodily injury. Under this system, you must prove that the other driver was at fault before their insurance will cover your injuries and vehicle damage.

Source: ratesforinsurance.com

Source: ratesforinsurance.com

Texas liability laws the law requires every driver in texas to carry minimum amounts of insurance. The guide below explains these personal injury laws in more depth. The state of texas does not require no fault insurance. Each state requires drivers to carry a minimum amount of car insurance. Along with 12 other states, it follows fault rules, and as such, you should be prepared.

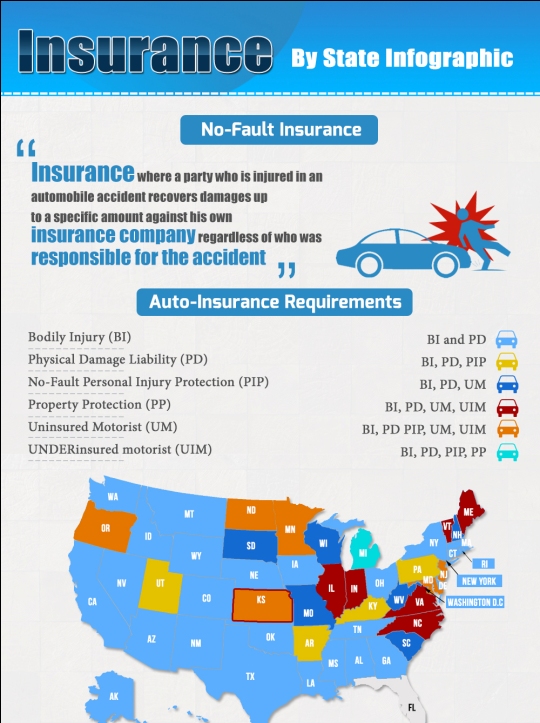

Source: infographicszone.com

Source: infographicszone.com

Texas liability laws the law requires every driver in texas to carry minimum amounts of insurance. A fault state uses a car insurance system that centers on fault for the accident. The state of texas does not require no fault insurance. Under this system, you must prove that the other driver was at fault before their insurance will cover your injuries and vehicle damage. What does being a fault state mean?

Source: gta-law.com

Source: gta-law.com

Texas’s fault insurance claims system. Getting familiar with insurance is a. This essentially means that you must have bodily injury. Remember, in texas it is mandatory to have auto insurance, if you still don�t have it be prepared to pay a fine. Texas follows something called the 30/60/25 coverage guideline.

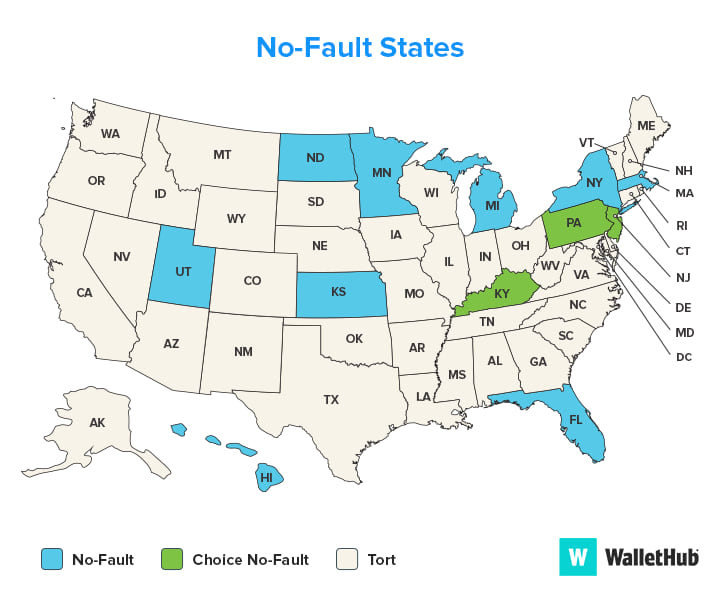

Source: wallethub.com

Source: wallethub.com

Florida, hawaii, kansas, kentucky, massachusetts, michigan, minnesota, new jersey, new york, north dakota, pennsylvania, and utah. In texas, there is a fault insurance requirement for every licensed driver in the state. No fault insurance requires your own car insurance company to pay all or a portion of medical bills and lost wages for you (the driver) and any passengers in the event of an accident where any of you are injured. Along with 12 other states, it follows fault rules, and as such, you should be prepared. The state of texas does not require no fault insurance.

Source: infogram.com

Source: infogram.com

What is no fault insurance? Per the texas department of insurance, this is so that drivers must pay for the accidents they cause. In texas, every driver is required to carry liability auto insurance to cover expenses for the other driver in the unfortunate event of a motor vehicle accident. It is an at fault state ↓ find out what that means for your car accident injury claim. A fault state uses a car insurance system that centers on fault for the accident.

Source: buyautoinsurance.com

Source: buyautoinsurance.com

How are compensation claims handled in texas auto accidents? It is a fault state. Texas’s fault insurance claims system. In texas, there is a fault insurance requirement for every licensed driver in the state. The state of texas does not require no fault insurance.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title texas no fault insurance state by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information