The agreement in a life insurance contract that states information

Home » Trend » The agreement in a life insurance contract that states informationYour The agreement in a life insurance contract that states images are ready in this website. The agreement in a life insurance contract that states are a topic that is being searched for and liked by netizens today. You can Get the The agreement in a life insurance contract that states files here. Find and Download all royalty-free images.

If you’re searching for the agreement in a life insurance contract that states pictures information related to the the agreement in a life insurance contract that states interest, you have come to the ideal blog. Our site always gives you suggestions for downloading the highest quality video and picture content, please kindly surf and find more informative video content and graphics that fit your interests.

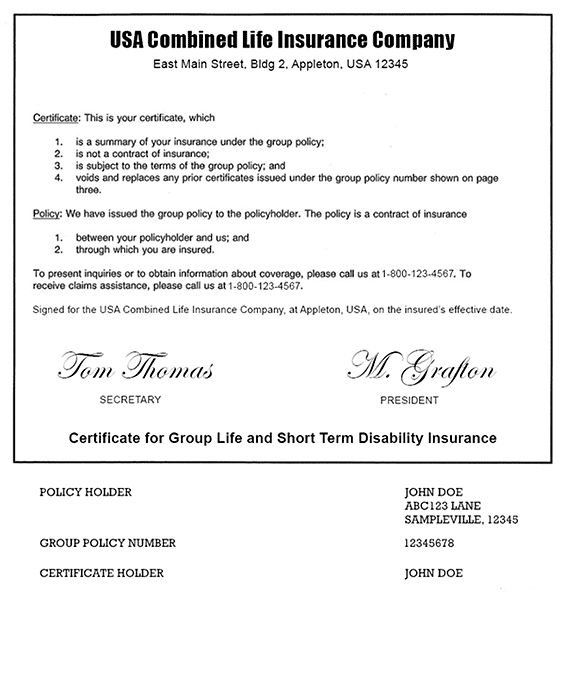

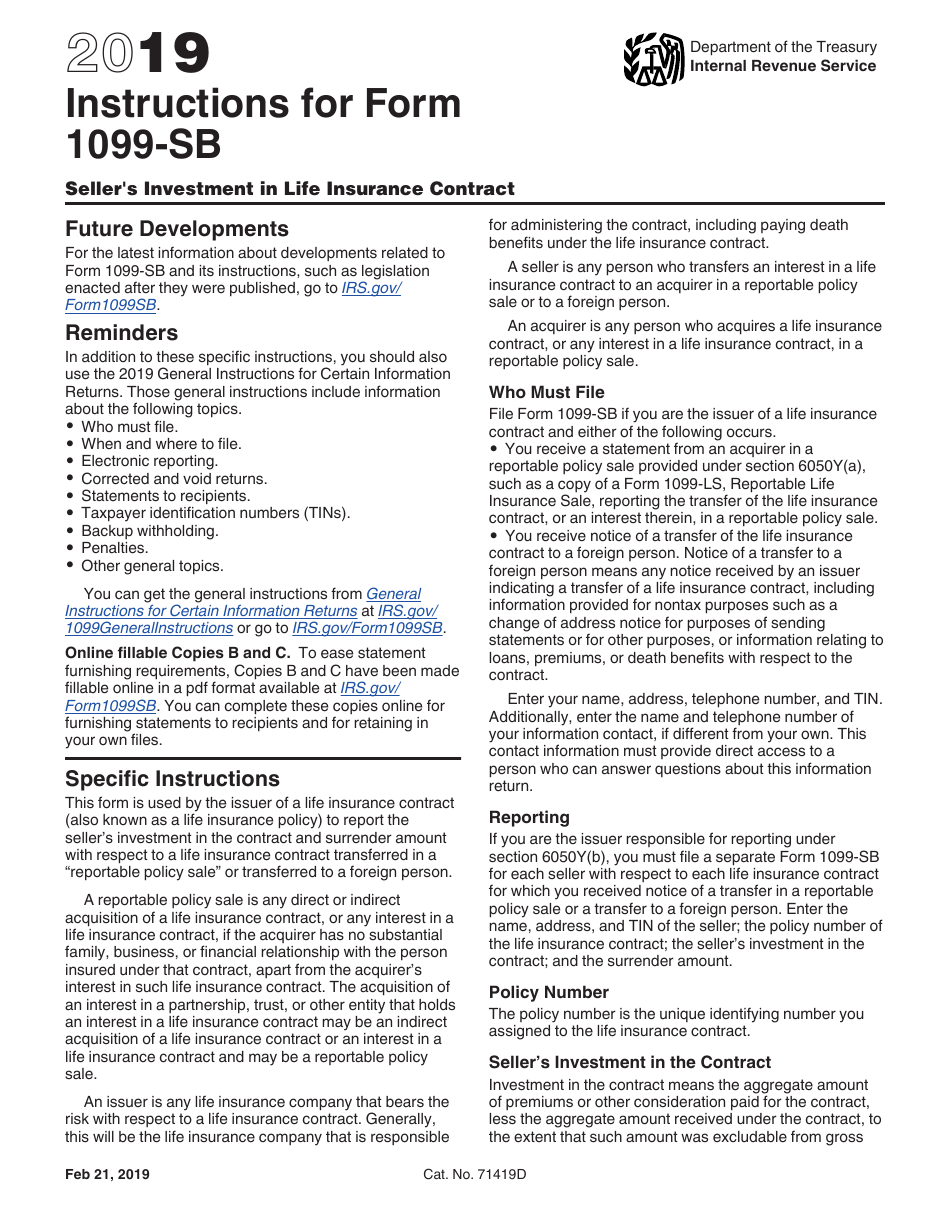

The Agreement In A Life Insurance Contract That States. In terms of insurance, these are the fundamental conditions of the insurance contract that bind both parties, validate the policy, and make it enforceable by law. Like any consensual contract, the contract of insurance is formed by the agreement of the parties, even verbal. The policy is a life insurance contract under the law of state and was designed to qualify as a life insurance contract under § 7702 by meeting the guideline premium requirements of The insuring agreement details what is to be covered by the insurance company.

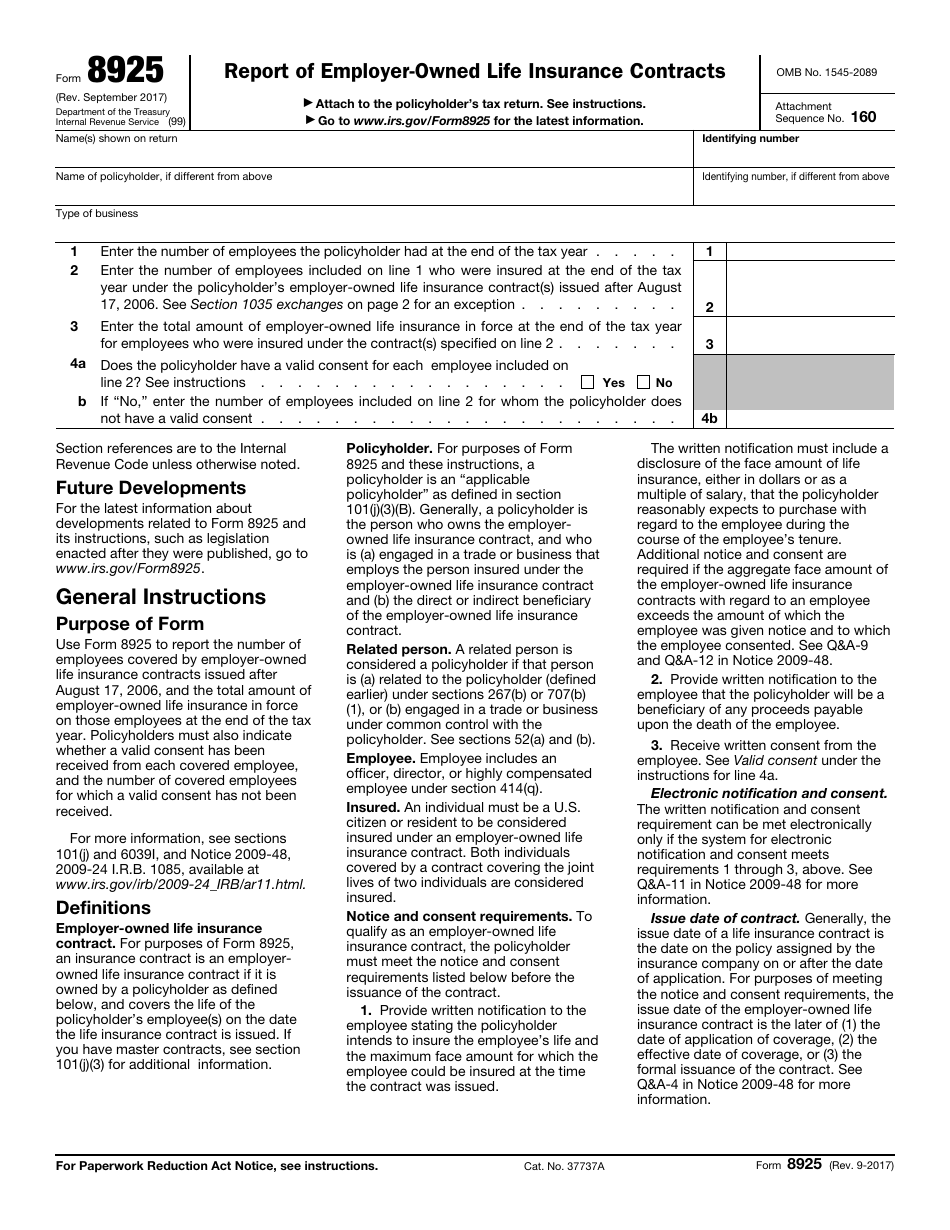

insurance contract template Seven Things To Avoid In From albanord.com

insurance contract template Seven Things To Avoid In From albanord.com

Year, ic issued a policy in state with a rider that provides term life insurance coverage on the life of a family member of the individual insured by the policy. Nevertheless, in practice, contract formation is contractually subject to a formality such as the signing of the policy. The essentials of any insurance contract are discussed as under with reference to the life insurance only. This means that you’re going to need a document that provides all of the information. The insurance, thus, is a contract whereby. Practice of life insurance notes 25 insurance documents diploma in insurance services 2.3.2 policy contract policy document is a detailed document and it is the evidence of the insurance contract which mentions all the terms and conditions of the insurance.

Insurance contracts are legally binding agreements in which the insurer agrees to indemnify the insured in case he or she incurs losses due to an unforeseen future event specified in the policy.3 min read.

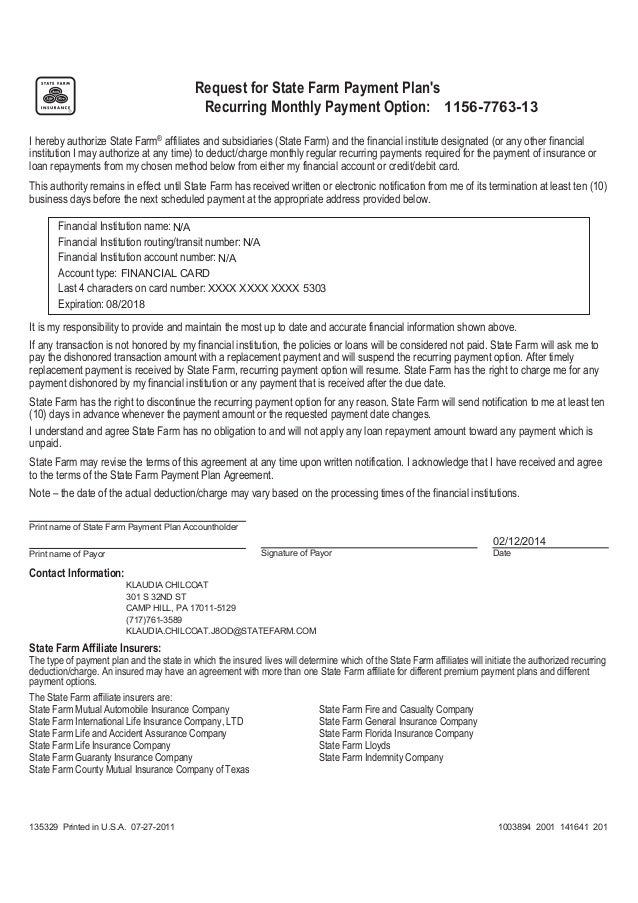

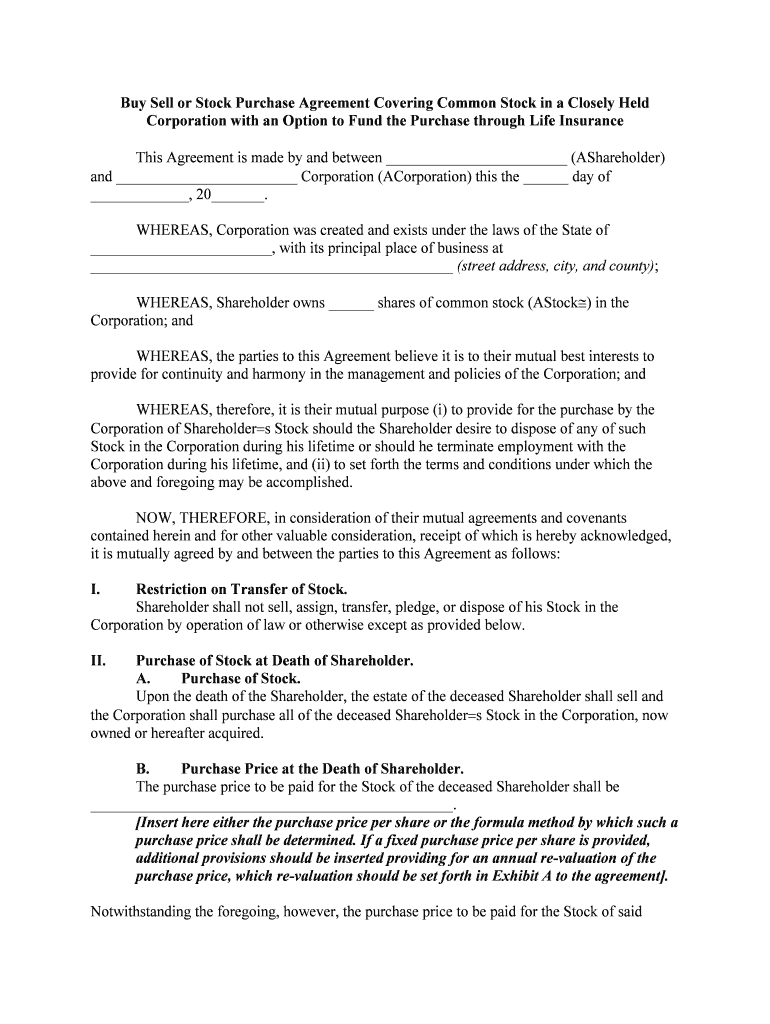

A temporary insurance agreement, or tia, acts as a binding contract, issued by a life insurance agent, between a life insurance company and an applicant. Life insurance company (individually, an “insurance company”, collectively, the. General features of an insurance contract. Called premium, is charged in consideration. The policy is a life insurance contract under the law of state and was designed to qualify as a life insurance contract under § 7702 by meeting the guideline premium requirements of What does the insuring agreement in a life insurance contract establish?

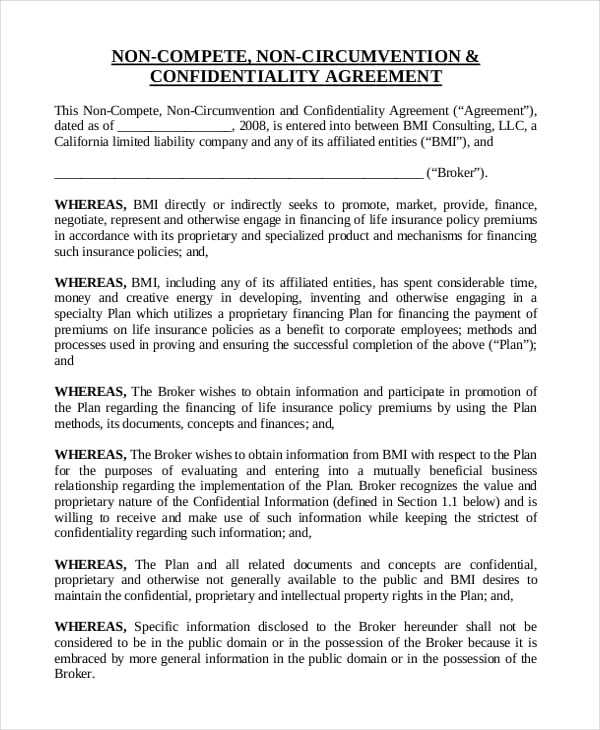

Source: axley.com

Source: axley.com

The policy is a life insurance contract under the law of state and was designed to qualify as a life insurance contract under § 7702 by meeting the guideline premium requirements of However, one cannot just acquire insurance unless all of the necessary agreements have been made and that all of the paperwork has been properly done. The essentials of any insurance contract are discussed as under with reference to the life insurance only. Life insurance study guide by kyleb00 includes 120 questions covering vocabulary, terms and more. Your policy may automatically reject all or a portion of any premium amount if it would result in the policy becoming a modified endowment contract or being disqualified as life insurance.

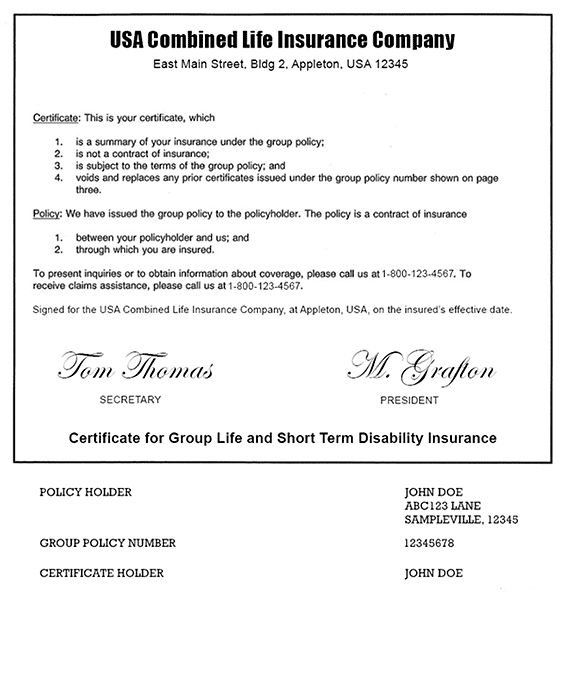

Source: slideshare.net

Source: slideshare.net

Practice of life insurance notes 25 insurance documents diploma in insurance services 2.3.2 policy contract policy document is a detailed document and it is the evidence of the insurance contract which mentions all the terms and conditions of the insurance. Your policy may automatically reject all or a portion of any premium amount if it would result in the policy becoming a modified endowment contract or being disqualified as life insurance. Distribution agreement (version 4/08) the parties to this insurance products distribution agreement (“agreement”) are: Agency agreement or agency contract. Year, ic issued a policy in state with a rider that provides term life insurance coverage on the life of a family member of the individual insured by the policy.

Source: templateroller.com

Source: templateroller.com

The insuring agreement details what is to be covered by the insurance company. Insurance contracts are legally binding agreements in which the insurer agrees to indemnify the insured in case he or she incurs losses due to an unforeseen future event specified in the policy.3 min read. Insurance may be defined as a contract between two parties whereby one party called insurer undertakes, in exchange for a fixed sum called premiums, to pay the other party called insured a fixed amount of money on the happening of a certain event. The insurance contract agreement is a contract whereby if certain defined events occur, the insurer promises to pay benefits to the insured or to a third party on his behalf. Practice of life insurance notes 25 insurance documents diploma in insurance services 2.3.2 policy contract policy document is a detailed document and it is the evidence of the insurance contract which mentions all the terms and conditions of the insurance.

Source: printablelegaldoc.com

Source: printablelegaldoc.com

These provisions are commonly the subjects of litigation. Insurance contracts are legally binding agreements in which the insurer agrees to indemnify the insured in case he or she incurs losses due to an unforeseen future event specified in the policy.3 min read. The agreement exposes the insurer to some degree of risk because the tia offers temporary coverage for an applicant during the evaluation or underwriting process while the applicant is. Insurance contracts are usually personal agreements between the insurance company and the insured individual, and are not transferable to another person without the insurer�s consent. Charged with regulating the insurance industry in his/her state by enforcing the insurance laws.

Source: printablelegaldoc.com

Source: printablelegaldoc.com

Like any consensual contract, the contract of insurance is formed by the agreement of the parties, even verbal. The policy is a life insurance contract under the law of state and was designed to qualify as a life insurance contract under § 7702 by meeting the guideline premium requirements of Your policy may automatically reject all or a portion of any premium amount if it would result in the policy becoming a modified endowment contract or being disqualified as life insurance. These provisions are commonly the subjects of litigation. The event must be uncertain subject to the “principle of fortuitousness.” the instability can be either as to when the incident will occur (for example, in a life insurance.

Source: dreamstime.com

Source: dreamstime.com

However, one cannot just acquire insurance unless all of the necessary agreements have been made and that all of the paperwork has been properly done. Insurance may be defined as a contract between two parties whereby one party called insurer undertakes, in exchange for a fixed sum called premiums, to pay the other party called insured a fixed amount of money on the happening of a certain event. Charged with regulating the insurance industry in his/her state by enforcing the insurance laws. Massachusetts mutual life insurance company, mml bay state life insurance company, and c.m. This means that you’re going to need a document that provides all of the information.

Source: slideshare.net

Source: slideshare.net

Year, ic issued a policy in state with a rider that provides term life insurance coverage on the life of a family member of the individual insured by the policy. Nevertheless, in practice, contract formation is contractually subject to a formality such as the signing of the policy. The event must be uncertain subject to the “principle of fortuitousness.” the instability can be either as to when the incident will occur (for example, in a life insurance. The elements of an insurance contract are the standard conditions that must be satisfied or agreed upon by both parties of the contract (the insured and the insurance company). Insurance contracts are legally binding agreements in which the insurer agrees to indemnify the insured in case he or she incurs losses due to an unforeseen future event specified in the policy.3 min read.

Source: bpicustomprinting.com

Source: bpicustomprinting.com

Charged with regulating the insurance industry in his/her state by enforcing the insurance laws. In terms of insurance, these are the fundamental conditions of the insurance contract that bind both parties, validate the policy, and make it enforceable by law. Your policy may automatically reject all or a portion of any premium amount if it would result in the policy becoming a modified endowment contract or being disqualified as life insurance. However, one cannot just acquire insurance unless all of the necessary agreements have been made and that all of the paperwork has been properly done. Year, ic issued a policy in state with a rider that provides term life insurance coverage on the life of a family member of the individual insured by the policy.

Year, ic issued a policy in state with a rider that provides term life insurance coverage on the life of a family member of the individual insured by the policy. The insurance contract agreement is a contract whereby if certain defined events occur, the insurer promises to pay benefits to the insured or to a third party on his behalf. The essentials of any insurance contract are discussed as under with reference to the life insurance only. State law requires that insurance contracts contain certain provisions protecting the rights of the insured against the insurer. You may purchase a life insurance policy of $1 million, but that does not imply that your life.

Source: sellmyforms.com

Source: sellmyforms.com

The policy is a life insurance contract under the law of state and was designed to qualify as a life insurance contract under § 7702 by meeting the guideline premium requirements of The essentials of any insurance contract are discussed as under with reference to the life insurance only. There are two main types of insuring agreements: The agreement exposes the insurer to some degree of risk because the tia offers temporary coverage for an applicant during the evaluation or underwriting process while the applicant is. Like any consensual contract, the contract of insurance is formed by the agreement of the parties, even verbal.

Source: templateroller.com

Source: templateroller.com

These provisions are commonly the subjects of litigation. Insurance contracts are usually personal agreements between the insurance company and the insured individual, and are not transferable to another person without the insurer�s consent. Life insurance company (individually, an “insurance company”, collectively, the. The essentials of any insurance contract are discussed as under with reference to the life insurance only. In life insurance an offer can be made either by the insurance company or the applicant (proposer) & the acceptance will follow.

Source: dreamstime.com

Source: dreamstime.com

E.g., subsequently (a) an offer made by the insurance company to proposer that An insured is past due on his life insurance premium, but is still within the grace period. Life insurance company (individually, an “insurance company”, collectively, the. This means that you’re going to need a document that provides all of the information. E.g., subsequently (a) an offer made by the insurance company to proposer that

Source: template.net

Source: template.net

Insurance contracts are legally binding agreements in which the insurer agrees to indemnify the insured in case he or she incurs losses due to an unforeseen future event specified in the policy.3 min read. The essentials of any insurance contract are discussed as under with reference to the life insurance only. In terms of insurance, these are the fundamental conditions of the insurance contract that bind both parties, validate the policy, and make it enforceable by law. The insuring agreement details what is to be covered by the insurance company. Called premium, is charged in consideration.

Source: albanord.com

Source: albanord.com

E.g., subsequently (a) an offer made by the insurance company to proposer that Distribution agreement (version 4/08) the parties to this insurance products distribution agreement (“agreement”) are: Your policy may automatically reject all or a portion of any premium amount if it would result in the policy becoming a modified endowment contract or being disqualified as life insurance. (life insurance and some maritime insurance policies are notable exceptions to this standard.) as an illustration, if the owner of a car sells. The agreement exposes the insurer to some degree of risk because the tia offers temporary coverage for an applicant during the evaluation or underwriting process while the applicant is.

Source: researchgate.net

Source: researchgate.net

(life insurance and some maritime insurance policies are notable exceptions to this standard.) as an illustration, if the owner of a car sells. Like any consensual contract, the contract of insurance is formed by the agreement of the parties, even verbal. The insured buys not the policy contract, but the right to the sum of money and its. You may purchase a life insurance policy of $1 million, but that does not imply that your life. The policy is a life insurance contract under the law of state and was designed to qualify as a life insurance contract under § 7702 by meeting the guideline premium requirements of

Source: dexform.com

Source: dexform.com

Insurance contracts are legally binding agreements in which the insurer agrees to indemnify the insured in case he or she incurs losses due to an unforeseen future event specified in the policy.3 min read. Nevertheless, in practice, contract formation is contractually subject to a formality such as the signing of the policy. The essentials of any insurance contract are discussed as under with reference to the life insurance only. What provision in a life insurance policy states that the application is considered part of the contract? Charged with regulating the insurance industry in his/her state by enforcing the insurance laws.

Source: formupack.com

Source: formupack.com

The insuring agreement details what is to be covered by the insurance company. The insuring agreement details what is to be covered by the insurance company. There are two main types of insuring agreements: However, one cannot just acquire insurance unless all of the necessary agreements have been made and that all of the paperwork has been properly done. Called premium, is charged in consideration.

Source: slideshare.net

Source: slideshare.net

The insurance, thus, is a contract whereby. Called premium, is charged in consideration. What does the insuring agreement in a life insurance contract establish? Massachusetts mutual life insurance company, mml bay state life insurance company, and c.m. An insured is past due on his life insurance premium, but is still within the grace period.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title the agreement in a life insurance contract that states by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information