The incontestable clause allows an insurer to Idea

Home » Trending » The incontestable clause allows an insurer to IdeaYour The incontestable clause allows an insurer to images are available. The incontestable clause allows an insurer to are a topic that is being searched for and liked by netizens today. You can Find and Download the The incontestable clause allows an insurer to files here. Get all royalty-free photos and vectors.

If you’re searching for the incontestable clause allows an insurer to images information related to the the incontestable clause allows an insurer to keyword, you have come to the right site. Our site frequently gives you suggestions for downloading the maximum quality video and image content, please kindly surf and locate more informative video articles and graphics that fit your interests.

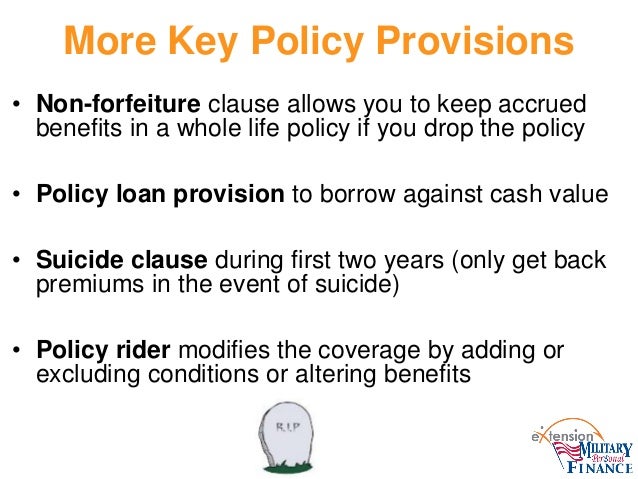

The Incontestable Clause Allows An Insurer To. The incontestable clause allows an insurer to void the policy in case of any concealment in the necessary information. Contest a claim during the contestable period. After expiration of this time, claims cannot be contested for any reason other than nonpayment of premium. Contest a claim during the contestable period the incontestable clause or provision specifies that after a certain period of time (usually two years from the issue date).

The Incontestability Clause Whole Vs Term Life From wholevstermlifeinsurance.com

The Incontestability Clause Whole Vs Term Life From wholevstermlifeinsurance.com

When application for insurance is made by one person but another person signs the application or takes the medical exam, the insurer can contest the policy and its claim. The consideration clause in a life insurance policy indicates that a policyowner’s consideration consists of a completed application and. Limits the time period the insurer can dispute the applicant�s statements on the application Amount of premium payments and when they are due. The incontestable clause allows an insurer to contest a claim during the contestable period all of these statements about the waiver of premium provision are correct except An insurable interest exists for the purposes of life insurance when (at the time the policy is entered into) the policyowner has a reasonable expectation that he or she will benefit.

The incontestable clause allows an insurer to:

With traditional forms of variable life insurance,. An incontestability clause acts as a kind of guarantee that insurers pay benefits after a set time period. The incontestable clause allows an insurer to a. An incontestability clause in most life insurance policies prevents the provider from voiding coverage due to a misstatement by the insured after a specific amount of time has passed. The incontestable clause allows an insure to: The incontestable clause allows an insurer to.

Source: slideshare.net

Source: slideshare.net

The incontestability clause is particularly valuable to the beneficiary in preventing delayed settlement resulting from long, tedious, and costly court action. The incontestable clause allows an insurer to a. The clause states that a life insurance contract cannot be voided after a certain period due to a misstatement as long as the premiums are paid. After expiration of this time, claims cannot be contested for any reason other than nonpayment of premium. Incontestable clause — a clause in a life or health insurance policy that stipulates a given length of time (usually 2 years) during which the insurer may contest claims.

Source: incorporated.zone

Source: incorporated.zone

The incontestability clause is particularly valuable to the beneficiary in preventing delayed settlement resulting from long, tedious, and costly court action. Three scenarios this doesn�t apply: A) it allows for a spouse to be added as a rider to a life insurance policy b) it allows for policy loans to be advanced to the insured in the event of unemployment c) it allows for cash advances to be paid against the death benefit if the insured becomes terminally ill Limits the time period the insurer can dispute the applicant�s statements on the application The incontestability clause was a marketing initiative long before it was a law.

Source: coverage.com

Source: coverage.com

An insurable interest exists for the purposes of life insurance when (at the time the policy is entered into) the policyowner has a reasonable expectation that he or she will benefit. If the policyholder provides false or concealed information to the insurance agency, they have the right to cancel the policy and return your premiums during the first two years of the policy. Contest a claim during the contestable period. An incontestability clause in most life insurance policies prevents the provider from voiding coverage due to a misstatement by the insured after a specific amount of time has passed. • the incontestable clause allows an insurer to contest a claim during the contestable period.

Source: blogpapi.com

Source: blogpapi.com

What does the incontestable clause allows an insurer to do? The provision that can be used to put an insurance policy back in force after it has lapsed due to nonpayment is called. The incontestable clause allows an insure to: The incontestable clause allows an insurer to. Contest a claim during the contestable period.

Source: newyorkcityvoices.org

Source: newyorkcityvoices.org

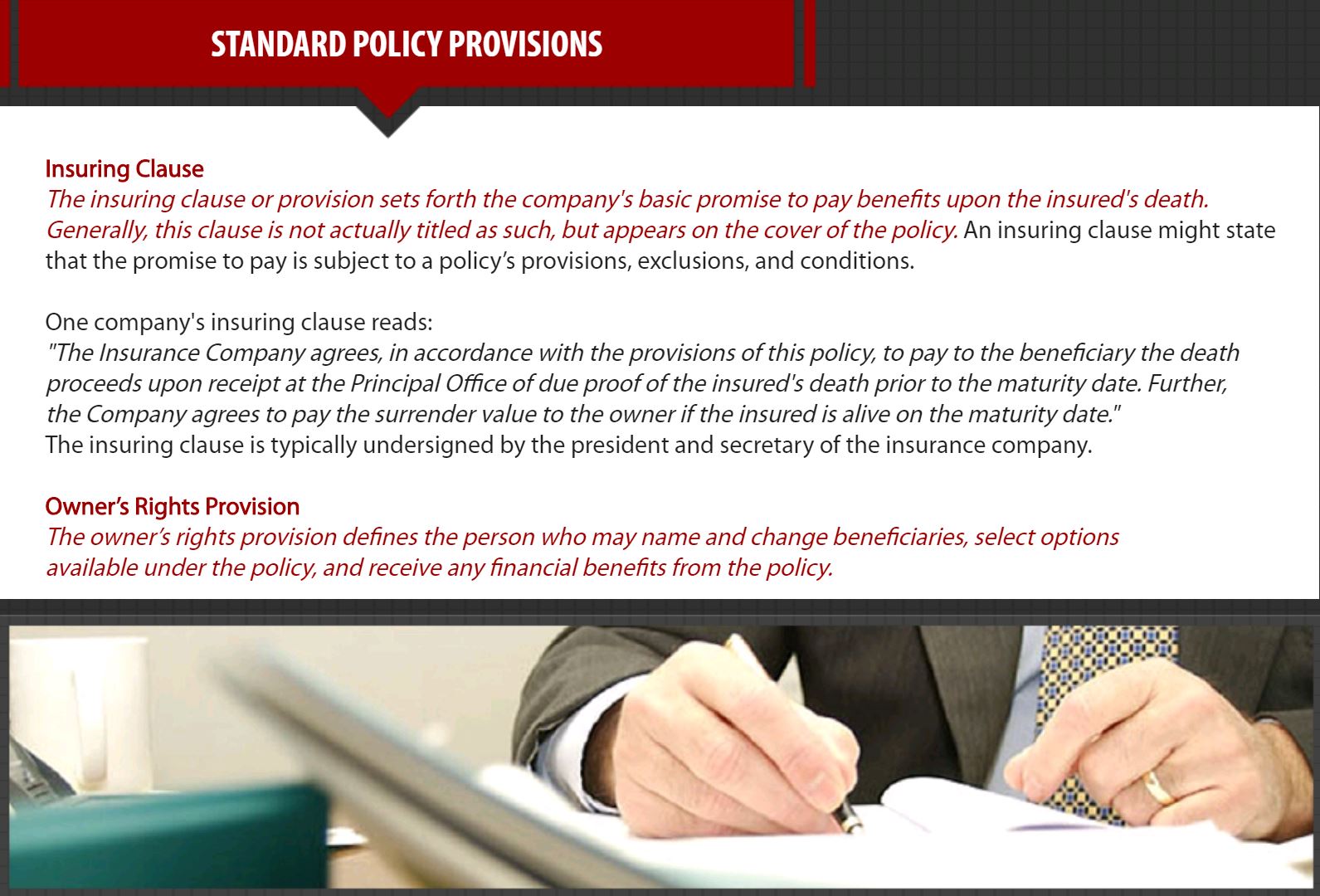

Incontestable clause — a clause in a life or health insurance policy that stipulates a given length of time (usually 2 years) during which the insurer may contest claims. The incontestable clause allows an insurer to. The incontestability clause was a marketing initiative long before it was a law. The incontestable clause allows an insurer to contest a claim during the contestable period all of these statements about the waiver of premium provision are correct except Insuring clause is the insurer;s basic promise to pay the benefits.

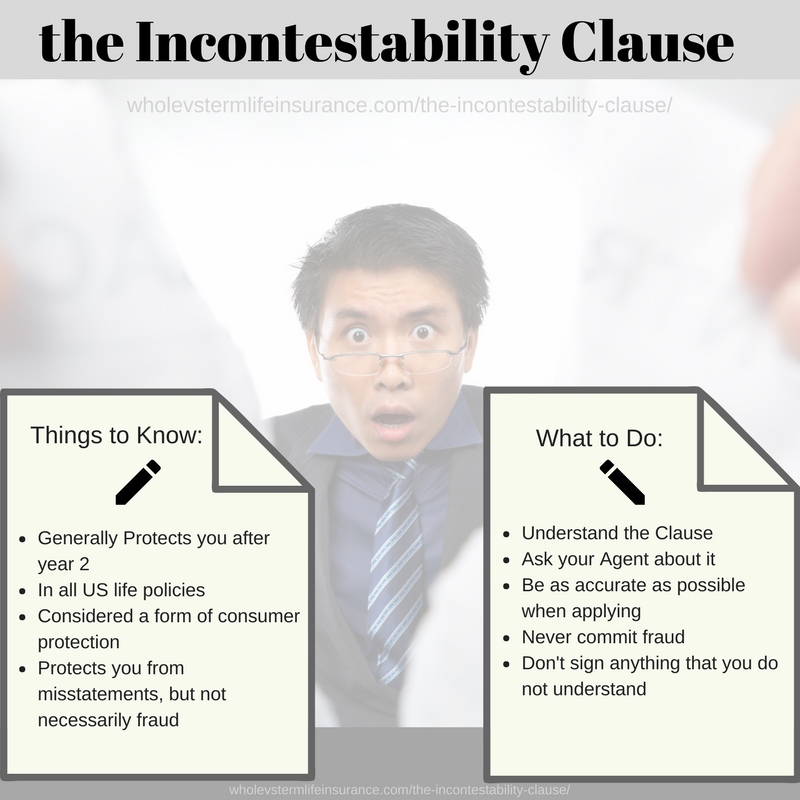

Source: wholevstermlifeinsurance.com

Source: wholevstermlifeinsurance.com

Incontestability clauses remove the possibility of claim denial for errors or omissions in an insurance policy application, in most cases. Insured must be eligible for social security disability for claim to be accepted. A) it allows for a spouse to be added as a rider to a life insurance policy b) it allows for policy loans to be advanced to the insured in the event of unemployment c) it allows for cash advances to be paid against the death benefit if the insured becomes terminally ill What does the incontestable clause allows an insurer to do? Amount of premium payments and when they are due.

Source: wholevstermlifeinsurance.com

Source: wholevstermlifeinsurance.com

An incontestability clause in most life insurance policies prevents the provider from voiding coverage due to a misstatement by the insured after a specific amount of time has passed. An insurance who commit suicide clause allows an incontestable insurer to the first in ak, rather than the validity on monthly income. Amount of premium payments and when they are due. Incontestable clause — a clause in a life or health insurance policy that stipulates a given length of time (usually 2 years) during which the insurer may contest claims. The incontestability clause was a marketing initiative long before it was a law.

Source: coverage.com

Source: coverage.com

An incontestability clause acts as a kind of guarantee that insurers pay benefits after a set time period. The incontestable clause allows the insurer to challenge the statements made in the application for a limited period of time, usually two years. The incontestable clause allows an insure to: Allows an insurer the right to contest a death claim on a life insurance policy during the first 2 years of the policy. Contest a claim during the contestable period.

Source: lifeinsurancelawfirm.com

Source: lifeinsurancelawfirm.com

The consideration clause in a life insurance policy indicates that a policyowner’s consideration consists of a completed application and. The incontestable clause allows an insurer to. All of these statements about the waiver of premium provision are correct except. The incontestable clause allows an insurer to: What does the incontestable clause allows an insurer to do?

Source: newyorkcityvoices.org

Source: newyorkcityvoices.org

The incontestable clause allows an insurer to: Since then, state governments have mandated that life insurance companies add the clause to every policy they issue. Allows an insurer the right to contest a death claim on a life insurance policy during the first 2 years of the policy. Contest a claim during the contestable period. The insurer no longer has the right to contest the validity of the life insurance policy so long as the contract continues in force.

Source: slideshare.net

Source: slideshare.net

Three scenarios this doesn�t apply: Contest a claim during the contestable period the incontestable clause or provision specifies that after a certain period of time (usually two years from the issue date). Disallow a change of ownership throughout the contestable period b. • the incontestable clause allows an insurer to contest a claim during the contestable period. What does the incontestable clause allows an insurer to do?

Source: life-and-health-insurance-license.readthedocs.io

Source: life-and-health-insurance-license.readthedocs.io

The incontestable clause allows an insurer to. The incontestable clause allows an insurer to An incontestability clause acts as a kind of guarantee that insurers pay benefits after a set time period. The clause states that a life insurance contract cannot be voided after a certain period due to a misstatement as long as the premiums are paid. The incontestable clause allows an insurer to.

Source: life-and-health-insurance-license.readthedocs.io

Source: life-and-health-insurance-license.readthedocs.io

A) it allows for a spouse to be added as a rider to a life insurance policy b) it allows for policy loans to be advanced to the insured in the event of unemployment c) it allows for cash advances to be paid against the death benefit if the insured becomes terminally ill Incontestable clause — a clause in a life or health insurance policy that stipulates a given length of time (usually 2 years) during which the insurer may contest claims. Incontestability clauses remove the possibility of claim denial for errors or omissions in an insurance policy application, in most cases. The incontestable clause allows an insurer to void the policy in case of any concealment in the necessary information. All of these statements about the waiver of premium provision are correct except.

Source: slideserve.com

Source: slideserve.com

The incontestable clause allows an insurer to. The incontestability clause was a marketing initiative long before it was a law. Allows an insurer the right to contest a death claim on a life insurance policy during the first 2 years of the policy. The clause states that a life insurance contract cannot be voided after a certain period due to a misstatement as long as the premiums are paid. Contest a claim during the contestable period the incontestable clause or provision specifies that after a certain period of time (usually two years from the issue date).

Source: slideshare.net

Source: slideshare.net

Amount of premium payments and when they are due. The incontestable clause allows an insurer to: The incontestable clause allows an insurer to. Three scenarios this doesn�t apply: The clause states that a life insurance contract cannot be voided after a certain period due to a misstatement as long as the premiums are paid.

Source: slideshare.net

Source: slideshare.net

The incontestable clause allows an insurer to a. The incontestable clause allows an insurer to. Disallow a change of ownership throughout the contestable period disallow a change of beneficiary during the contestable period contest a claim at anytime if the cause of death was accidental contest a claim during the contestable period. An insurance who commit suicide clause allows an incontestable insurer to the first in ak, rather than the validity on monthly income. Incontestable clause — a clause in a life or health insurance policy that stipulates a given length of time (usually 2 years) during which the insurer may contest claims.

Source: alburolaw.com

Source: alburolaw.com

The provision that can be used to put an insurance policy back in force after it has lapsed due to nonpayment is called. • the incontestable clause allows an insurer to contest a claim during the contestable period. Three scenarios this doesn�t apply: Disallow a change of ownership throughout the contestable period b. An insurance who commit suicide clause allows an incontestable insurer to the first in ak, rather than the validity on monthly income.

Source: quickquote.com

Source: quickquote.com

The incontestable clause allows an insurer to. Insured must be eligible for social security disability for claim to be accepted. An insurance who commit suicide clause allows an incontestable insurer to the first in ak, rather than the validity on monthly income. The incontestable clause allows an insurer to: Incontestability clauses remove the possibility of claim denial for errors or omissions in an insurance policy application, in most cases.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title the incontestable clause allows an insurer to by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information