The insurance act 1938 with important provisions Idea

Home » Trend » The insurance act 1938 with important provisions IdeaYour The insurance act 1938 with important provisions images are available in this site. The insurance act 1938 with important provisions are a topic that is being searched for and liked by netizens now. You can Get the The insurance act 1938 with important provisions files here. Download all free images.

If you’re looking for the insurance act 1938 with important provisions pictures information related to the the insurance act 1938 with important provisions interest, you have visit the ideal blog. Our site always gives you suggestions for seeking the maximum quality video and image content, please kindly search and locate more informative video articles and images that fit your interests.

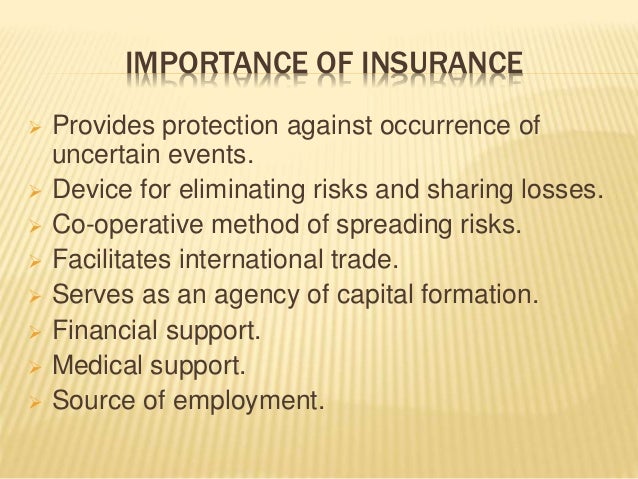

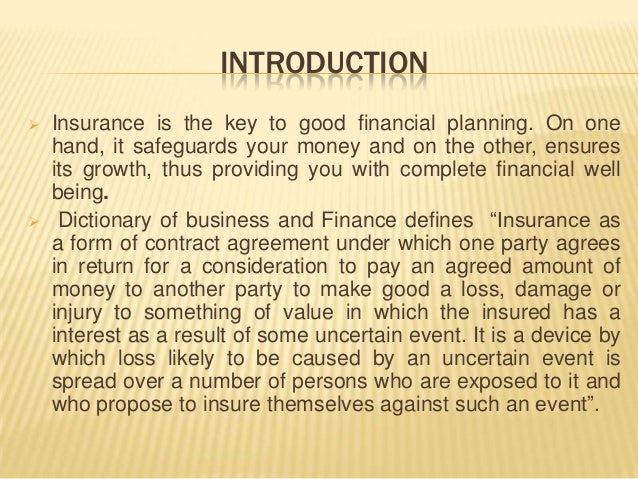

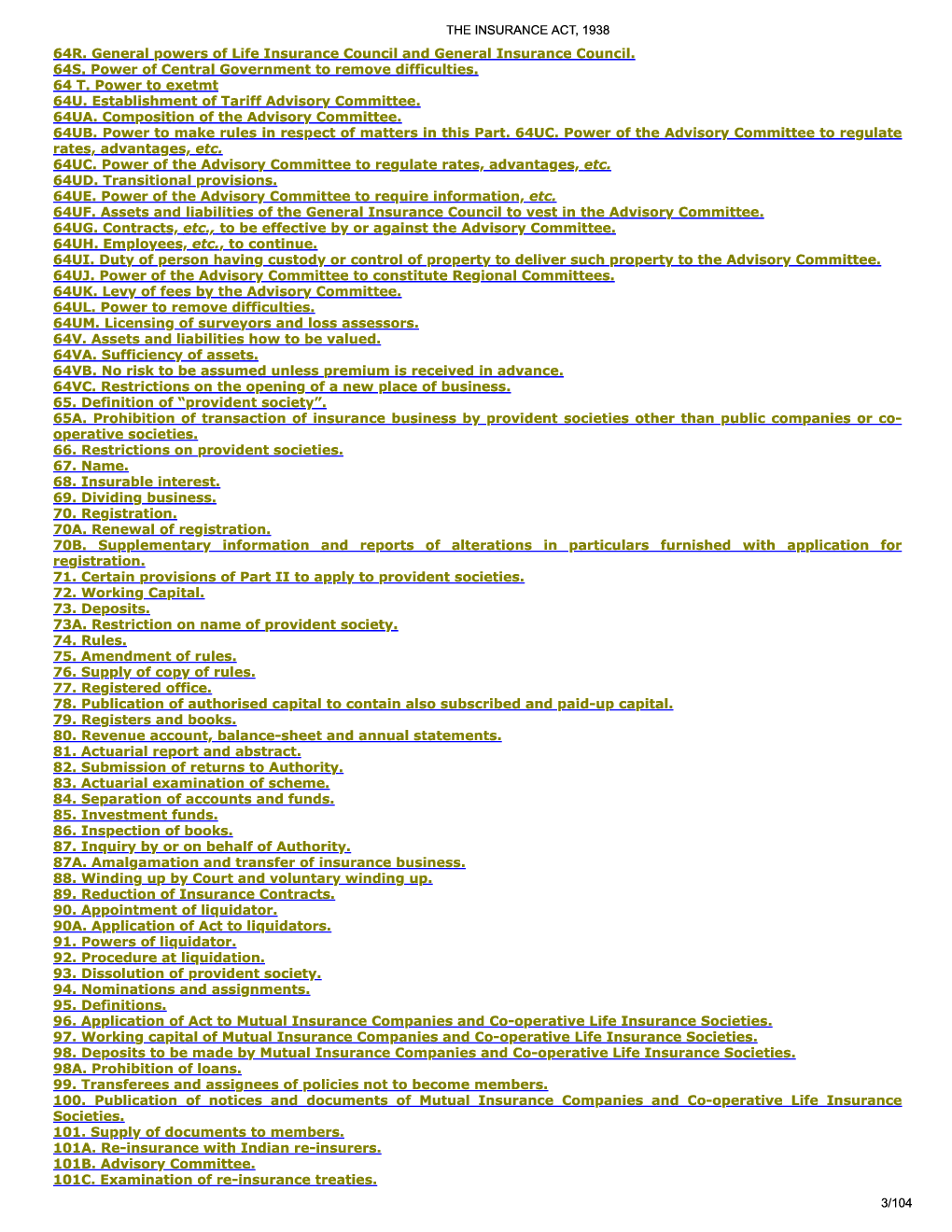

The Insurance Act 1938 With Important Provisions. Whereas it is expedient to consolidate and amend the law relating to the business of insurance ; — part i preliminary 1. An act to consolidate and amend the law relating to the business of insurance. Will introduce students with the insurance act, 1938 in which they will learn about importance and salient features of insurance act.

Insurance act 1938 From slideshare.net

Insurance act 1938 From slideshare.net

The act was amended several times in the years 1950, 1968, 1988, 1999. The registration should be renewed annually. This article will discuss the act highlighting some important points such as its history and features it holds. 63 (d) accounts, audit and actuarial reports and abstract. Will introduce students with the insurance act, 1938 in which they will learn about importance and salient features of insurance act. What is the insurance act 1938 and its history?

Unit five again deals with the insurance act, 1938 and will help students in knowing applicability of important provisions of the act.

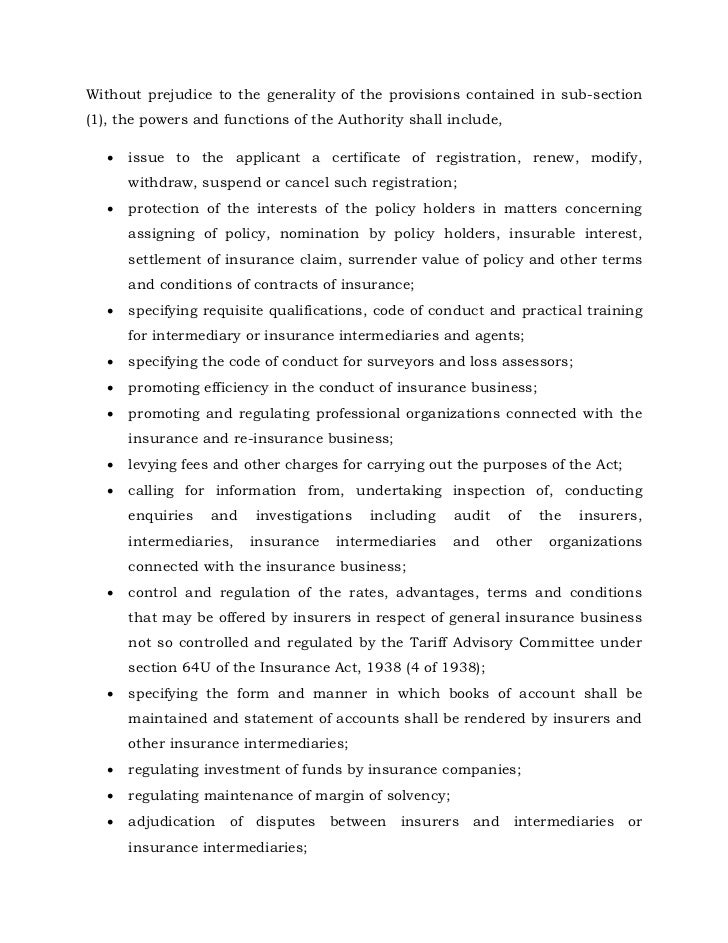

In 1956, life insurance corporation act was passed to nationalize the life insurance division. Appointment of controller of insurance: The insurance act, 1938 : In doing so, it took cognizance of the principles relating to investments enunciated by iais (appendix 3 to this report), existing provisions in the insurance act, 1938 and other principles such as corporate governance mechanism and robust independent mechanism for avoiding conflict of interest. The insurance act was introduced to regulate the activities of insurance companies. The all above said functions were performed by the controller of insurance earlier as per the insurance act, 1938.

Source: slideshare.net

Source: slideshare.net

Framework under the insurance act, 1938. This article will discuss the act highlighting some important points such as its history and features it holds. An act to consolidate and amend the law relating to the business of insurance. However, it empowered insurers with a right to repudiate the claim, in case they had evidences that policy was taken by misrepresenting/suppression of facts. *the insurance act, 1938 act no.

Source: slideshare.net

Source: slideshare.net

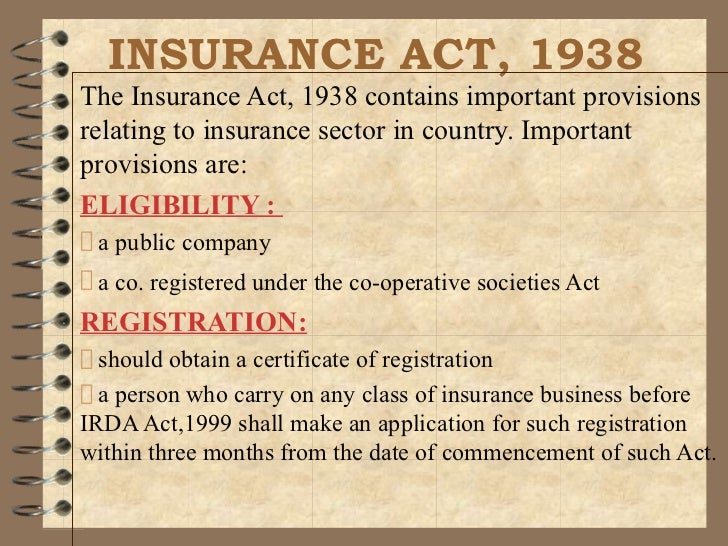

Framework under the insurance act, 1938. This act was passed in 1938 and was brought into force from 1st july, 1939. 4 of 1938 1 [26 th february, 1938.] an act to consolidate and amend the law relating to the business of insurance. 63 (d) accounts, audit and actuarial reports and abstract. Prohibition of transaction of insurance business by certain persons:

Source: slideshare.net

Source: slideshare.net

The all above said functions were performed by the controller of insurance earlier as per the insurance act, 1938. The insurance act, 1938 is a law originally passed in 1938 in british india to regulate the insurance sector. The act of 1938 along with various amendments over the years continues till date t o be the definitive piece of legislation on insurance and controls both lif e. An act further to amend the insurance act, 1938 and the general insurance business (nationalisation) act, 1972 and to amend the insurance regulatory and development authority act, 1999. 63 (e) provisions relating to invwstments.

Source: slideshare.net

Source: slideshare.net

The indian insurance act 1938 161. This act was passed in 1938 and was brought into force from 1st july, 1939. This act applies to the gic and the four subsidiaries. Prohibition of transaction of insurance business by certain persons: The insurance act was introduced to regulate the activities of insurance companies.

Source: slideshare.net

Source: slideshare.net

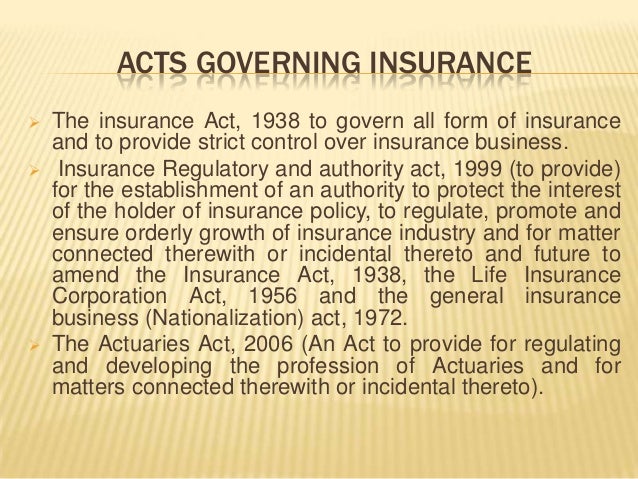

The registration should be renewed annually. The act was amended several times in the years 1950, 1968, 1988, 1999. Acts governing insurance the insurance act, 1938 to govern all form of insurance and to provide strict control over insurance business. The act was amended several times in the years 1950, 1968, 1988, 1999. Insurance regulatory and authority act, 1999 (to provide) for the establishment of an authority to protect the interest of the holder of insurance policy, to regulate, promote and ensure orderly growth of insurance industry and for matter.

Source: revisi.net

Source: revisi.net

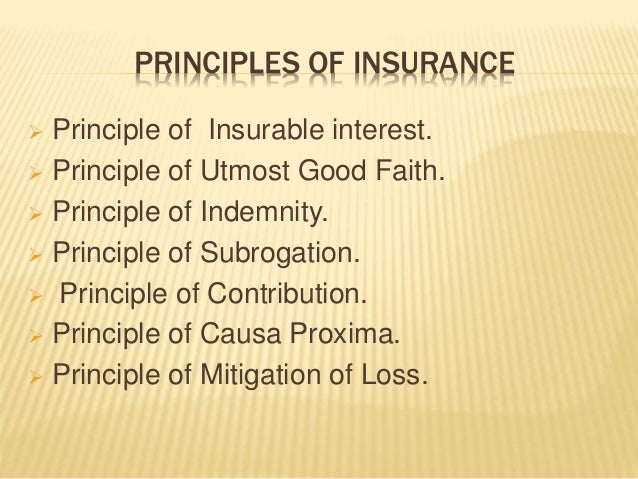

However, it empowered insurers with a right to repudiate the claim, in case they had evidences that policy was taken by misrepresenting/suppression of facts. 60 important provisions of insurance act (a) incorporation of insurance companies. Unit six will explain students about the life insurance act, 1956. 62 (c) deposits with rbi. Fourth will be so invested before the expiry of one year, not less.

Source: slideshare.net

Source: slideshare.net

63 (d) accounts, audit and actuarial reports and abstract. Insurance was finally regulated in 1938 through the passing of the insurance act, 1938 (“act of 1938”). 63 (d) accounts, audit and actuarial reports and abstract. The all above said functions were performed by the controller of insurance earlier as per the insurance act, 1938. This act was passed in 1938 and was brought into force from 1st july, 1939.

Source: slideshare.net

Source: slideshare.net

Registration to obtain the certificate of registration is compulsory to the every insurance company. The insurance act, 1938 : The act was amended several times in the years 1950, 1968, 1988, 1999. In doing so, it took cognizance of the principles relating to investments enunciated by iais (appendix 3 to this report), existing provisions in the insurance act, 1938 and other principles such as corporate governance mechanism and robust independent mechanism for avoiding conflict of interest. The provisions under section 45 of the insurance act, 1938 provided that facts submitted in support of a policy cannot be questioned after the expiry of 2 years from the commencement of the policy.

Source: slideshare.net

Source: slideshare.net

An act further to amend the insurance act, 1938 and the general insurance business (nationalisation) act, 1972 and to amend the insurance regulatory and development authority act, 1999. 63 (d) accounts, audit and actuarial reports and abstract. Registration to obtain the certificate of registration is compulsory to the every insurance company. This act applies to the gic and the four subsidiaries. 4 of 1938 1 [26 th february, 1938.] an act to consolidate and amend the law relating to the business of insurance.

Source: slideshare.net

Source: slideshare.net

No 50 [person] shall, after the commencement of this act, begin to carry on any class of insurance business in 51 [india] and no insurer carrying on any class of insurance business in 51 [india] shall, after the expiry of three months from the commencement of this act, continue to carry on any such business, unless he has obtained from the 52 [authority] a certificate of. The all above said functions were performed by the controller of insurance earlier as per the insurance act, 1938. The insurance in india is administered by a number of legislation for the purpose of standardizing the insurance zone. Insurance was finally regulated in 1938 through the passing of the insurance act, 1938 (“act of 1938”). The act of 1938 along with various amendments over the years continues till date t o be the definitive piece of legislation on insurance and controls both lif e.

Source: slideshare.net

Source: slideshare.net

The insurance in india is administered by a number of legislation for the purpose of standardizing the insurance zone. Unit five again deals with the insurance act, 1938 and will help students in knowing applicability of important provisions of the act. — part i preliminary 1. No 50 [person] shall, after the commencement of this act, begin to carry on any class of insurance business in 51 [india] and no insurer carrying on any class of insurance business in 51 [india] shall, after the expiry of three months from the commencement of this act, continue to carry on any such business, unless he has obtained from the 52 [authority] a certificate of. Interpretation of certain words and expressions:

Source: slideshare.net

Source: slideshare.net

This act applies to the gic and the four subsidiaries. Appointment of controller of insurance: The act of 1938 along with various amendments over the years continues till date t o be the definitive piece of legislation on insurance and controls both lif e. The registration should be renewed annually. Prohibition of transaction of insurance business by certain persons:

Source: slideshare.net

Source: slideshare.net

Whereas it is expedient to consolidate and amend the law relating to the business of insurance ; Insurance regulatory and authority act, 1999 (to provide) for the establishment of an authority to protect the interest of the holder of insurance policy, to regulate, promote and ensure orderly growth of insurance industry and for matter. The first attempt of the central government to legalize and control insurance sector was the by enacting the insurance act in 1938. Framework under the insurance act, 1938. The act of 1938 along with various amendments over the years continues till date t o be the definitive piece of legislation on insurance and controls both lif e.

Source: kopykitab.com

Source: kopykitab.com

The provisions under section 45 of the insurance act, 1938 provided that facts submitted in support of a policy cannot be questioned after the expiry of 2 years from the commencement of the policy. Fourth will be so invested before the expiry of one year, not less. 63 (e) provisions relating to invwstments. Registration to obtain the certificate of registration is compulsory to the every insurance company. The all above said functions were performed by the controller of insurance earlier as per the insurance act, 1938.

The act of 1938 along with various amendments over the years continues till date t o be the definitive piece of legislation on insurance and controls both lif e. An act further to amend the insurance act, 1938 and the general insurance business (nationalisation) act, 1972 and to amend the insurance regulatory and development authority act, 1999. The act was amended several times in the years 1950, 1968, 1988, 1999. Registration to obtain the certificate of registration is compulsory to the every insurance company. In 1956, life insurance corporation act was passed to nationalize the life insurance division.

Source: slideshare.net

Source: slideshare.net

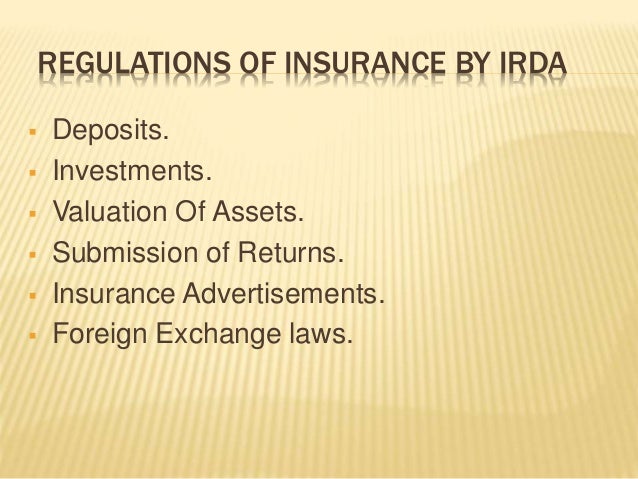

The provisions of the act may be briefly described as follows. Irda, act the insurance act, 1938 provided comprehensive regulation of the insurance business in india. Insurance was finally regulated in 1938 through the passing of the insurance act, 1938 (“act of 1938”). Interpretation of certain words and expressions: It provides the broad legal framework within which the industry operates.

Source: slideshare.net

Source: slideshare.net

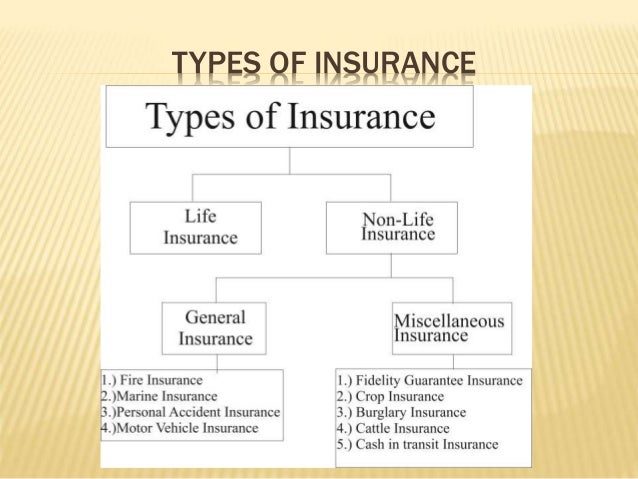

The first attempt of the central government to legalize and control insurance sector was the by enacting the insurance act in 1938. (1) where the insurer carries on business of more than one of the following classes, namely, life insurance, fire insurance, marine insurance or miscellaneous insurance, he shall keep a separate account of all receipts and payments in respect of each such class of insurances business and where the insurer carries on business of miscellaneous insurance whether alone or in. The act was amended several times in the years 1950, 1968, 1988, 1999. 60 important provisions of insurance act (a) incorporation of insurance companies. It provides the broad legal framework within which the industry operates.

Source: slideshare.net

Source: slideshare.net

Acts governing insurance the insurance act, 1938 to govern all form of insurance and to provide strict control over insurance business. Insurance regulatory and authority act, 1999 (to provide) for the establishment of an authority to protect the interest of the holder of insurance policy, to regulate, promote and ensure orderly growth of insurance industry and for matter. The insurance in india is administered by a number of legislation for the purpose of standardizing the insurance zone. An act to consolidate and amend the law relating to the business of insurance. Insurance was finally regulated in 1938 through the passing of the insurance act, 1938 (“act of 1938”).

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title the insurance act 1938 with important provisions by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information