The law of large numbers in insurance companies information

Home » Trend » The law of large numbers in insurance companies informationYour The law of large numbers in insurance companies images are available. The law of large numbers in insurance companies are a topic that is being searched for and liked by netizens now. You can Download the The law of large numbers in insurance companies files here. Find and Download all royalty-free vectors.

If you’re looking for the law of large numbers in insurance companies pictures information related to the the law of large numbers in insurance companies keyword, you have visit the ideal blog. Our site frequently gives you hints for downloading the highest quality video and picture content, please kindly hunt and locate more enlightening video content and images that fit your interests.

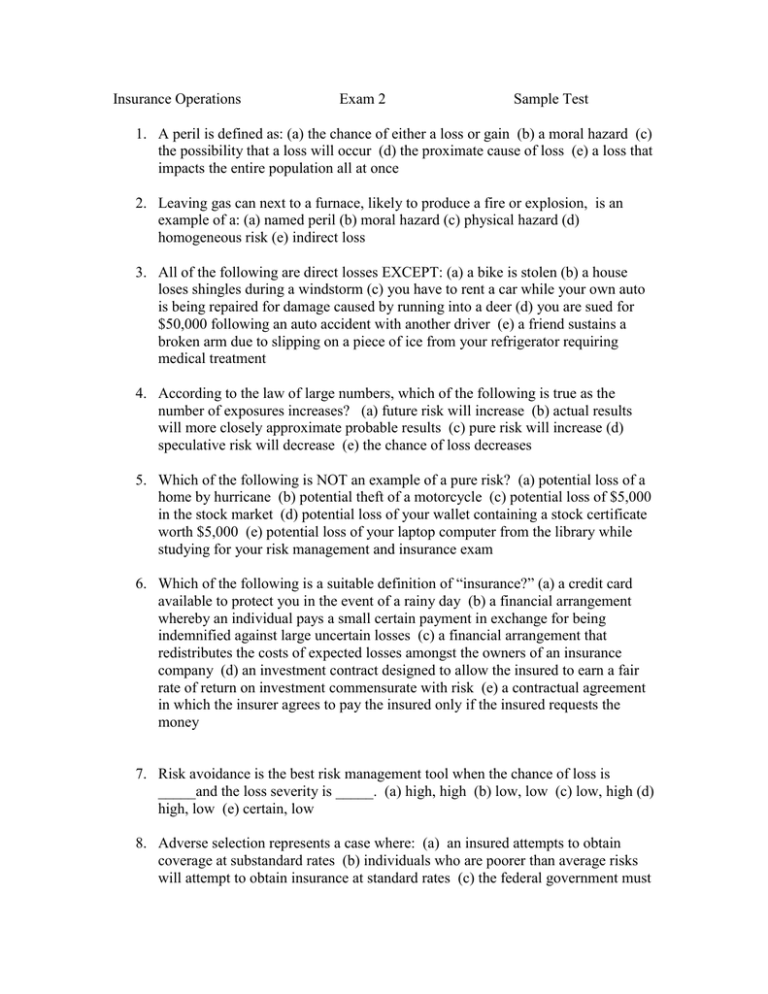

The Law Of Large Numbers In Insurance Companies. A principle that states that actual outcomes will approach the mean probability as the sample size increases. Large numbers law stipulates that if losses are increased or predicted, then loss can actually be greater than predicted. In other words, the credibility of data increases with the size of the data pool under consideration. Law of large numbers will increase the ability of the insurance companies to plan their operations and improve service delivery.

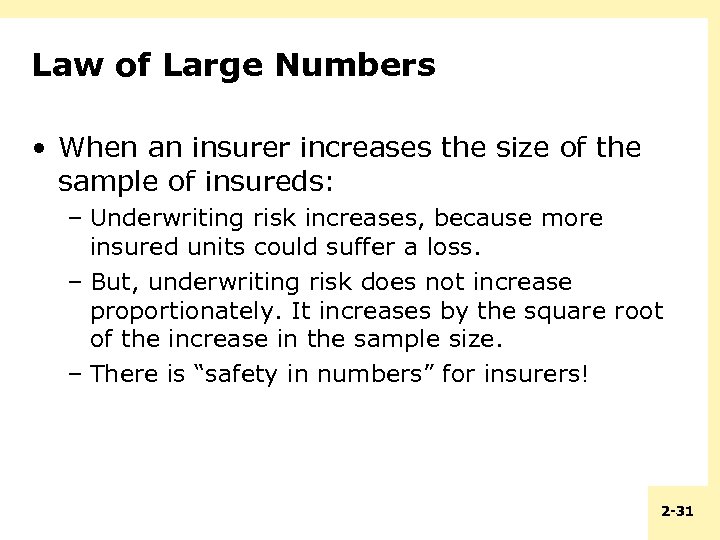

The larger the insurance participant is calculated, the more precise the prediction of the calendar and the calculation of the premium. As the number of exposure units (policyholders) increases, the probability that the actual loss per exposure unit will equal the expected loss per exposure unit is higher.to put it in economic language, there are returns to scale in insurance. The law of large numbers states that an observed sample average from a large sample will be close to the true population average and that it will get closer the larger the sample. The law of large numbers summarize the law of large numbers insurance companies can�t predict who will file a claim, but since they insure so many people they can predict how much money they will have to give out looking at the past. The law of large numbers is a statistical concept that calculates the average number of events or risks in a sample or population to predict something. Which of these is an example of the law of large numbers?

The law of large numbers enhances the success and competitiveness of insurance.

Static risks are more predictable, and, therefore, more insurable. The basic idea is that insurance companies can provide insurance to thousands of individuals who pay a certain premium each month and only a small percentage of the. Insurance companies also rely on the law of large numbers to remain profitable. Law of large numbers will increase the ability of the insurance companies to plan their operations and improve service delivery. As the number of exposure units (policyholders) increases, the probability that the actual loss per exposure unit will equal. In other words, the credibility of data increases with the size of the data pool under consideration.

Source: fashionblogbyalexis.blogspot.com

The competitiveness of the insurance companies relies on the availability of the information available in the market. No effect on predicting losses c. Insurance companies use the law of large numbers to estimate the losses a certain group of insureds may have in the future. Static risks are more predictable, and, therefore, more insurable. The basic idea is that insurance companies can provide insurance to thousands of individuals who pay a certain premium each month and only a small percentage of the.

Source: en101sp130403.blogspot.com

Source: en101sp130403.blogspot.com

In the field of insurance, the law of large numbers Calculating the insurance premium is based on an explanation known as “the law of large numbers” which identifies the risk for loss. A principle that states that actual outcomes will approach the mean probability as the sample size increases. Insurance companies use the law of large numbers to estimate the losses a certain group of insureds may have in the future. Insurance companies also rely on the law of large numbers to remain profitable.

Insurance companies use the law of large numbers to estimate the losses a certain group of insureds may have in the future. Life insurance, as a tool for risk spread, can only work if a life insurance company is able to bear the same risk in large numbers. The law of large numbers is a statistical concept that calculates the average number of events or risks in a sample or population to predict something. Describe the law of large numbers and why it is useful for insurance companies. The higher the exposure, the higher the cost of each loss b.

Source: en101sp130403.blogspot.com

Source: en101sp130403.blogspot.com

The larger the insurance participant is calculated, the more precise the prediction of the calendar and the calculation of the premium. The law of large numbers is a statistical concept that calculates the average number of events or risks in a sample or population to predict something. The law of large numbers enhances the success and competitiveness of insurance. The law of large numbers summarize the law of large numbers insurance companies can�t predict who will file a claim, but since they insure so many people they can predict how much money they will have to give out looking at the past. This allows them to charge premiums that will cover all claims and operating costs

Source: slideshare.net

Source: slideshare.net

Calculating the insurance premium is based on an explanation known as “the law of large numbers” which identifies the risk for loss. The basic idea is that insurance companies can provide insurance to thousands of individuals who pay a certain premium each month and only a small percentage of the individuals they ensure will actually need to use the insurance to pay for. In the insurance industry, the law of large numbers produces its axiom. The law of large numbers enhances the success and competitiveness of insurance. Which of these is an example of the law of large numbers?

Source: en101sp130403.blogspot.com

Source: en101sp130403.blogspot.com

Insurance companies use the law of large numbers to estimate the losses a certain group of insureds may have in the future. The larger the insurance participant is calculated, the more precise the prediction of the calendar and the calculation of the premium. Insurance companies rely on the law of large numbers to help estimate the value and frequency of future claims they will pay to policyholders. Basically, you see that the increase in the number of distinct risks grouped together into a single group will lead to more predictable predictions of future losses when compared to not having that group together. The law of large numbers is a statistical concept that calculates the average number of events or risks in a sample or population to predict something.

Source: es.slideshare.net

Source: es.slideshare.net

Describe the law of large numbers and why it is useful for insurance companies. The larger the insurance participant is calculated, the more precise the prediction of the calendar and the calculation of the premium. In the insurance industry, the law of large numbers produces its axiom. Here apply what is called the law of large number. The fact that this law holds true is critical to the foundation of life insurance.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

The fact that this law holds true is critical to the foundation of life insurance. This allows them to charge premiums that will cover all claims and operating costs The law of large numbers summarize the law of large numbers insurance companies can�t predict who will file a claim, but since they insure so many people they can predict how much money they will have to give out looking at the past. Definition law of large numbers — a statistical axiom that states that the larger the number of exposure units independently exposed to loss, the greater the probability that actual loss experience will equal expected loss experience. Insurance companies use the law of large numbers to estimate the losses a certain group of insureds may have in the future.

Source: slideshare.net

Source: slideshare.net

Describe the law of large numbers and why it is useful for insurance companies. The law of large numbers theorizes that the average of a large number of results closely mirrors the expected value, and that difference narrows as more results are introduced. According to the law of large numbers, how would losses be affected if the number of similar insured units increases? Pure risk is insurable, because the law of large numbers can be applied to estimate future losses, which allows insurance companies to calculate what premium to be charged based on expected losses. In the field of insurance, the law of large numbers

Source: present5.com

Source: present5.com

The law of large numbers in insurance. The law of large numbers defined. The law of large numbers enhances the success and competitiveness of insurance. In the insurance industry, the law of large numbers produces its axiom. No effect on predicting losses c.

Source: fashionblogbyalexis.blogspot.com

Source: fashionblogbyalexis.blogspot.com

Life insurance, as a tool for risk spread, can only work if a life insurance company is able to bear the same risk in large numbers. When it works perfectly, insurance companies run a stable business, consumers pay a fair and accurate premium, and the entire financial system avoids serious disruption. Ability to predict losses decreases Calculating the insurance premium is based on an explanation known as “the law of large numbers” which identifies the risk for loss. The larger the insurance participant is calculated, the more precise the prediction of the calendar and the calculation of the premium.

Source: slideserve.com

Source: slideserve.com

The law of large numbers defined. The larger the insurance participant is calculated, the more precise the prediction of the calendar and the calculation of the premium. Law of large numbers will increase the ability of the insurance companies to plan their operations and improve service delivery. Describe the law of large numbers and why it is useful for insurance companies. Life insurance, as a tool for risk spread, can only work if a life insurance company is able to bear the same risk in large numbers.

Source: present5.com

Source: present5.com

Life insurance, as a tool for risk spread, can only work if a life insurance company is able to bear the same risk in large numbers. Basically, you see that the increase in the number of distinct risks grouped together into a single group will lead to more predictable predictions of future losses when compared to not having that group together. The law of large numbers allows an insurance company to predict the expected losses of a group. The law of large numbers summarize the law of large numbers insurance companies can�t predict who will file a claim, but since they insure so many people they can predict how much money they will have to give out looking at the past. Describe the law of large numbers and why it is useful for insurance companies.

Source: en101sp130403.blogspot.com

Source: en101sp130403.blogspot.com

Insurance companies use the law of large numbers to lessen their own risk of loss by pooling a large enough number of people together in an insured group. It is one of the factors insurance companies use to determine their rates. Life insurance, as a tool for risk spread, can only work if a life insurance company is able to bear the same risk in large numbers. The higher the exposure, the higher the cost of each loss b. Predictability of losses will be improved d.

Source: en101sp130403.blogspot.com

Source: en101sp130403.blogspot.com

The fact that this law holds true is critical to the foundation of life insurance. Here apply what is called the law of large number. Basically, you see that the increase in the number of distinct risks grouped together into a single group will lead to more predictable predictions of future losses when compared to not having that group together. In the insurance industry, the law of large numbers produces its axiom. The larger the insurance participant is calculated, the more precise the prediction of the calendar and the calculation of the premium.

Source: slideserve.com

Source: slideserve.com

Understanding the law of large numbers in insurance in the insurance industry, the law of large numbers produces its axiom. Life insurance, as a tool for risk spread, can only work if a life insurance company is able to bear the same risk in large numbers. Insurance works through the magic of the law of large numbers. Large numbers law stipulates that if losses are increased or predicted, then loss can actually be greater than predicted. The law of large numbers is useful for insurance companies because the larger the insured pool, the more likely actual losses will approach expected losses, thereby reducing forecasting error.

Source: fashionblogbyalexis.blogspot.com

Source: fashionblogbyalexis.blogspot.com

The law of large numbers theorizes that the average of a large number of results closely mirrors the expected value, and that difference narrows as more results are introduced. Ability to predict losses decreases As the number of exposure units (policyholders) increases, the probability that the actual loss per exposure unit will equal the expected loss per exposure unit is higher.to put it in economic language, there are returns to scale in insurance. Life insurance, as a tool for risk spread, can only work if a life insurance company is able to bear the same risk in large numbers. The basic idea is that insurance companies can provide insurance to thousands of individuals who pay a certain premium each month and only a small percentage of the individuals they ensure will actually need to use the insurance to pay for.

Source: en101sp130403.blogspot.com

Source: en101sp130403.blogspot.com

The larger the population is calculated, the more accurate predictions. The law of large numbers is a statistical concept that relates to probability. Calculating the insurance premium is based on an explanation known as “the law of large numbers” which identifies the risk for loss. The larger the insurance participant is calculated, the more precise the prediction of the calendar and the calculation of the premium. The basic idea is that insurance companies can provide insurance to thousands of individuals who pay a certain premium each month and only a small percentage of the individuals they ensure will actually need to use the insurance to pay for.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title the law of large numbers in insurance companies by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information