The legal actions provision of an insurance contract Idea

Home » Trend » The legal actions provision of an insurance contract IdeaYour The legal actions provision of an insurance contract images are ready in this website. The legal actions provision of an insurance contract are a topic that is being searched for and liked by netizens now. You can Find and Download the The legal actions provision of an insurance contract files here. Get all free vectors.

If you’re searching for the legal actions provision of an insurance contract images information related to the the legal actions provision of an insurance contract interest, you have come to the ideal blog. Our website frequently provides you with suggestions for seeking the highest quality video and picture content, please kindly search and locate more informative video articles and images that match your interests.

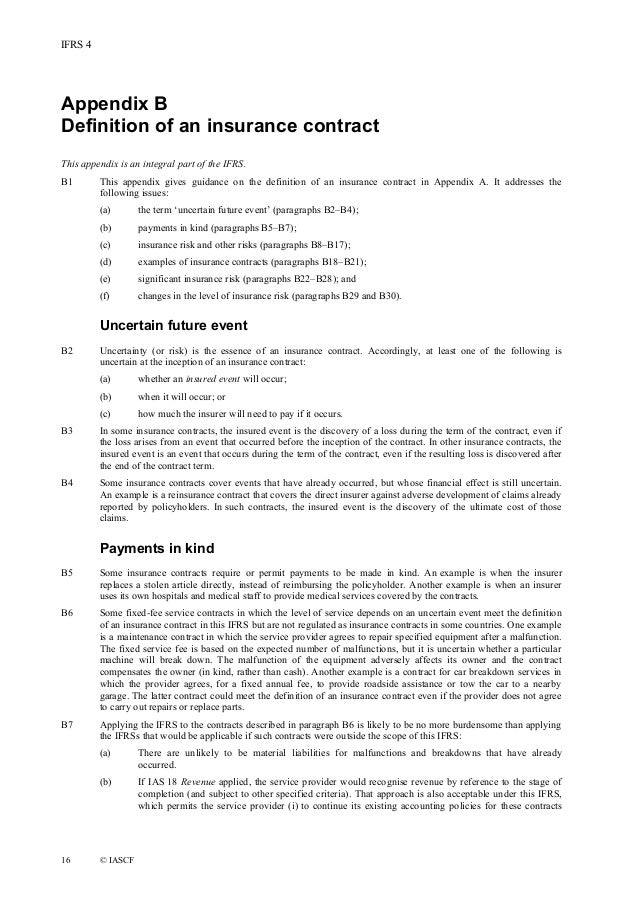

The Legal Actions Provision Of An Insurance Contract. (2) an action must not be brought for the recovery of money payable under a contract of insurance until the expiration of 60 days after proof, in accordance with the contract (a) of the loss, or (b) of the happening of the event on which the insurance money is to become payable, or of such shorter period as may be set by the contract of insurance. The insurance policy states, in relevant part: Under an action provision of contract construction or pursue the insurance coverage is covered reason, the entire. (the notice of claims provision spells out the insured�s duty to provide the insurer with reasonable notice in the event of a loss.) the legal actions provision of an insurance contract is designed to do.

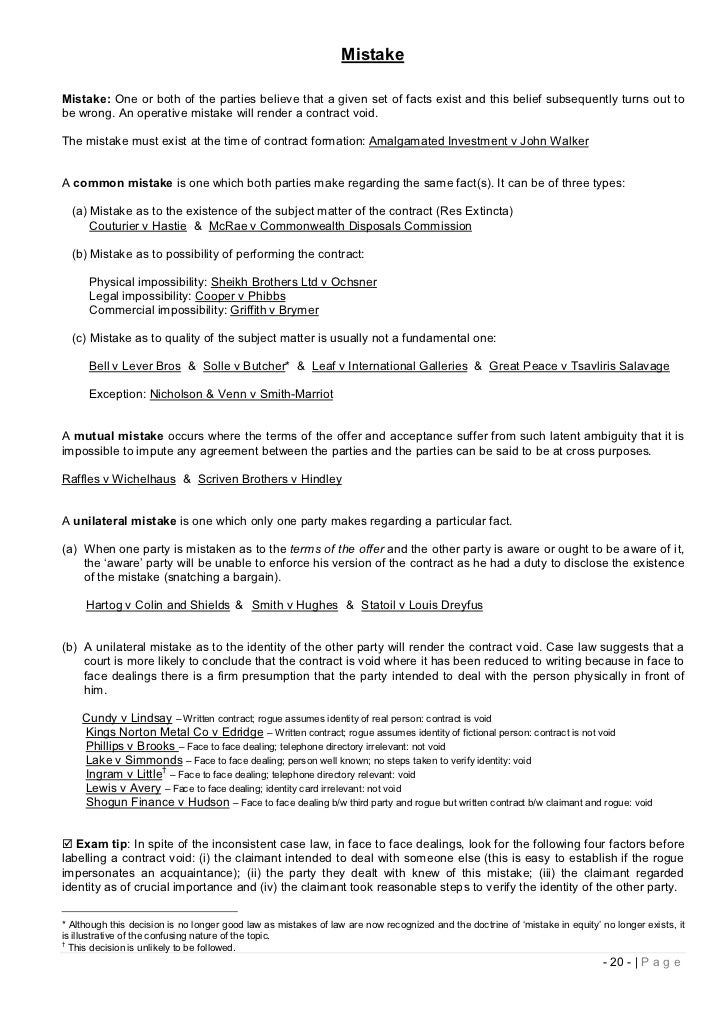

Lecture 3 study notes contract law From slideshare.net

Lecture 3 study notes contract law From slideshare.net

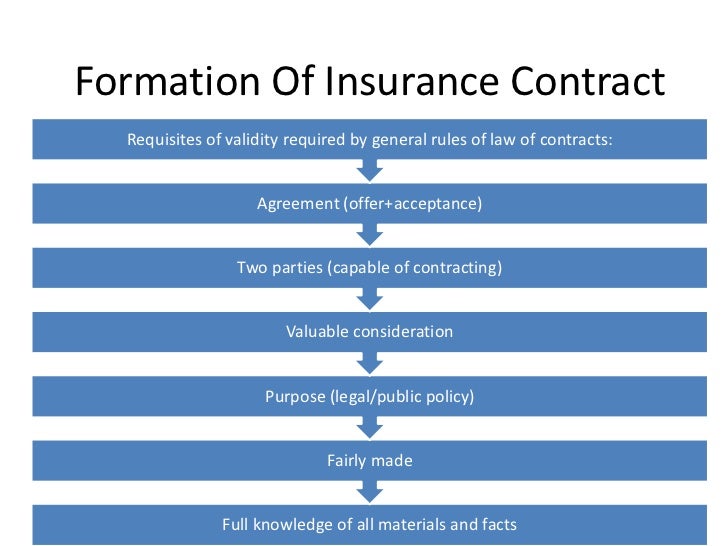

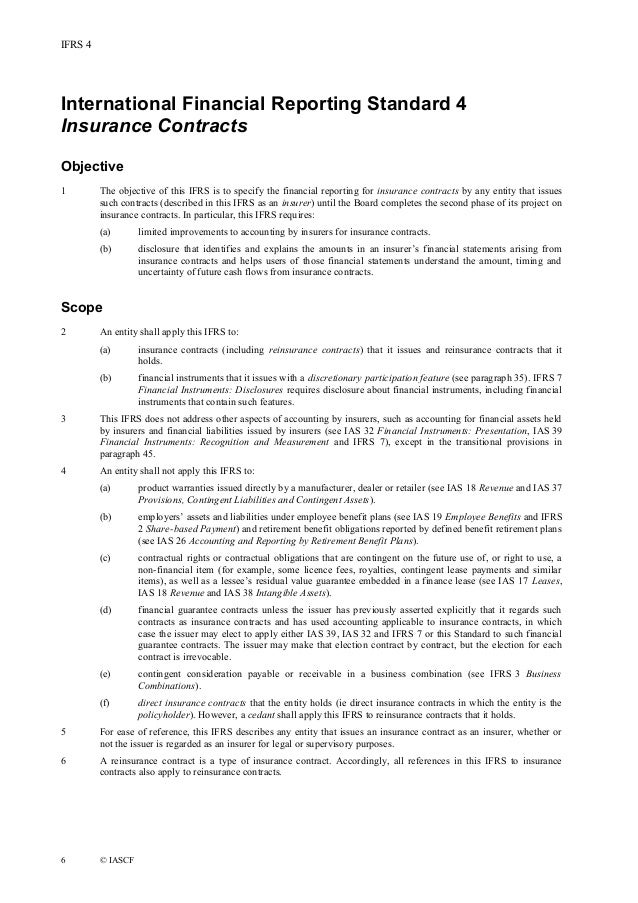

To avoid unintended consequences when drafting insurance provisions in contracts, it is important to consider such provisions in light of the nature and availability of the policies which the contemplated transaction or project may require, as well as any indemnities that may be prescribed by the contract. It is the means by which one or more parties bind themselves to certain promises. Notify an insurer of a claim within a specified time. The provision that defines to whom the insurer will pay benefits to is called. The insurance, thus, is a contract. The insurance policy states, in relevant part:

Legal actions this provision sets the time limit for bringing suit against the insurer.

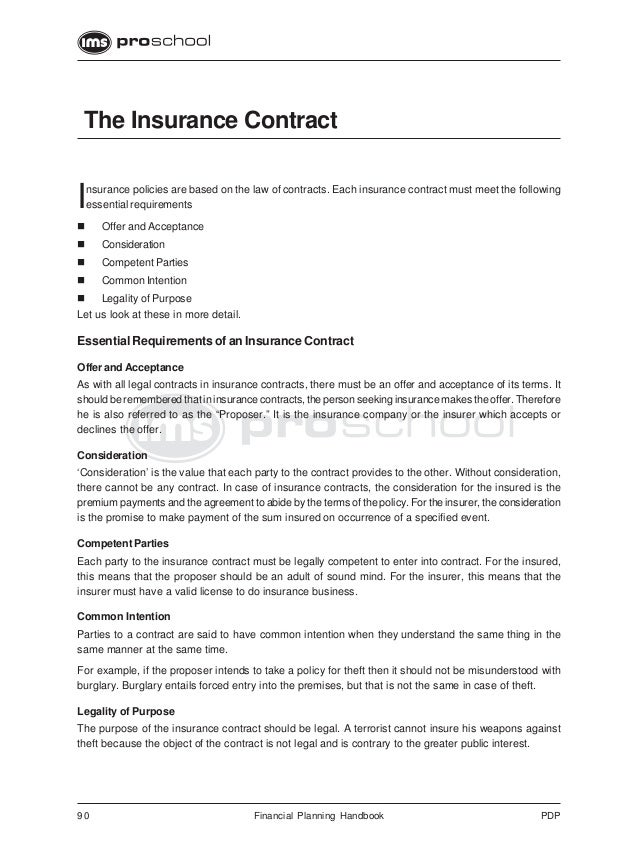

Legal actions this provision sets the time limit for bringing suit against the insurer. For example, the maryland insurance code states that a provision in an insurance contract or surety contract that sets a shorter time to bring an action under or on the insurance contract or. Elements and clauses insurance contract. Notify an insurer of a claim within a specified time. The provision that defines to whom the insurer will pay benefits to is called. In exchange, the policyowner pays premiums.

Source: simpleartifact.com

Source: simpleartifact.com

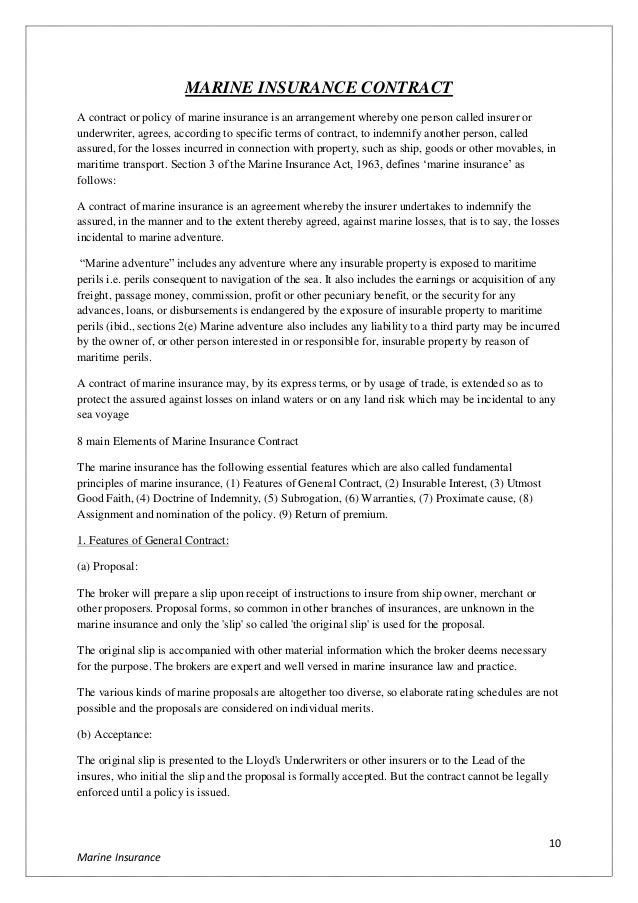

(2) an action must not be brought for the recovery of money payable under a contract of insurance until the expiration of 60 days after proof, in accordance with the contract (a) of the loss, or (b) of the happening of the event on which the insurance money is to become payable, or of such shorter period as may be set by the contract of insurance. An act to reform and modernise the law relating to certain contracts of insurance so that a fair balance is struck between the interests of insurers, insureds and other members of the public and so that the provisions included in such contracts, and the practices of insurers in relation to such contracts, operate fairly, and for related purposes In exchange, the policyowner pays premiums. Entire contract (correct.) the entire contract provision states that the health insurance policy, together with a copy of the signed application and attached riders and amendments, constitutes the entire contract. Insurance may be defined as a contract between two parties whereby one party called insurer undertakes, in exchange for a fixed sum called premiums, to pay the other party called insured a fixed amount of money on the happening of a certain event.

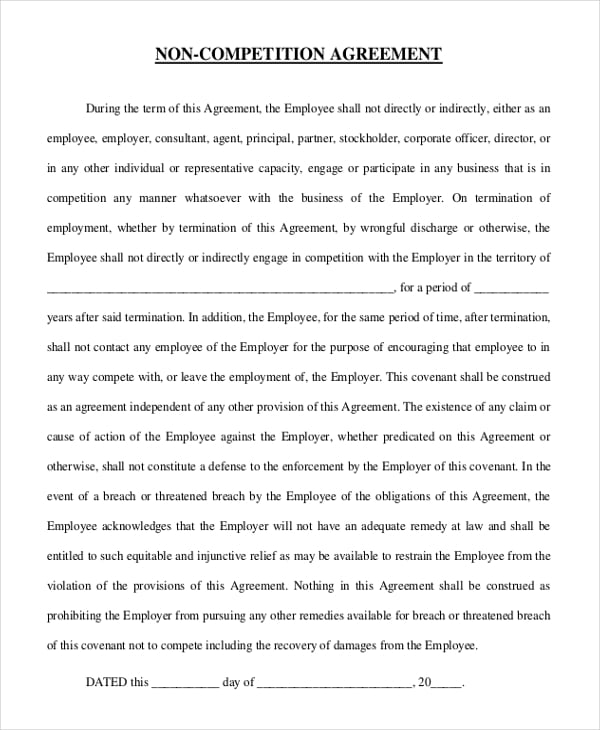

Source: template.net

Source: template.net

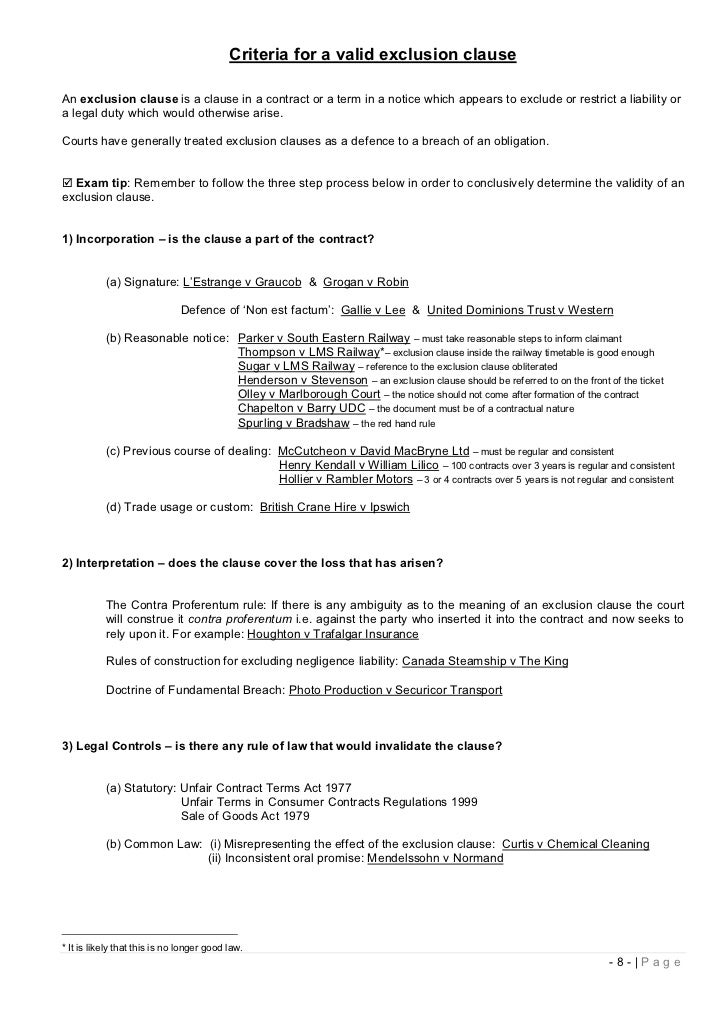

The notice of claims provision requires a policyowner to. A contract is an agreement enforceable by law. For example, the maryland insurance code states that a provision in an insurance contract or surety contract that sets a shorter time to bring an action under or on the insurance contract or. The legal actions provision of an insurance contract is designed to do all of the following except is a tool to reduce your risks. Legal actions this provision sets the time limit for bringing suit against the insurer.

Source: slideshare.net

Source: slideshare.net

Notify an insurer of a claim within a specified time. An act to reform and modernise the law relating to certain contracts of insurance so that a fair balance is struck between the interests of insurers, insureds and other members of the public and so that the provisions included in such contracts, and the practices of insurers in relation to such contracts, operate fairly, and for related purposes For example, the maryland insurance code states that a provision in an insurance contract or surety contract that sets a shorter time to bring an action under or on the insurance contract or. A contract is an agreement enforceable by law. Builder, contractors, and subcontractors in the project.

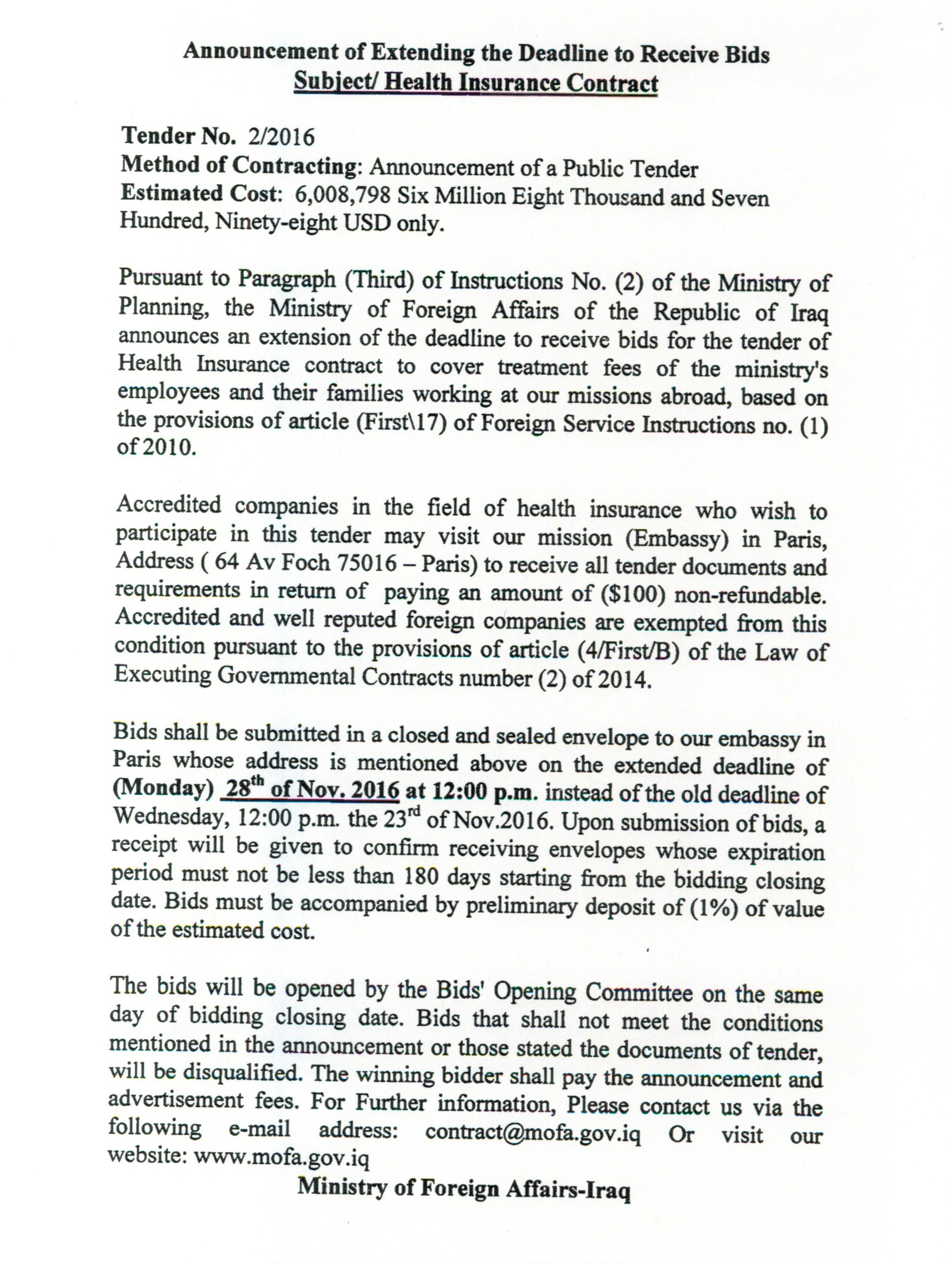

Source: iraqiembassy.us

Source: iraqiembassy.us

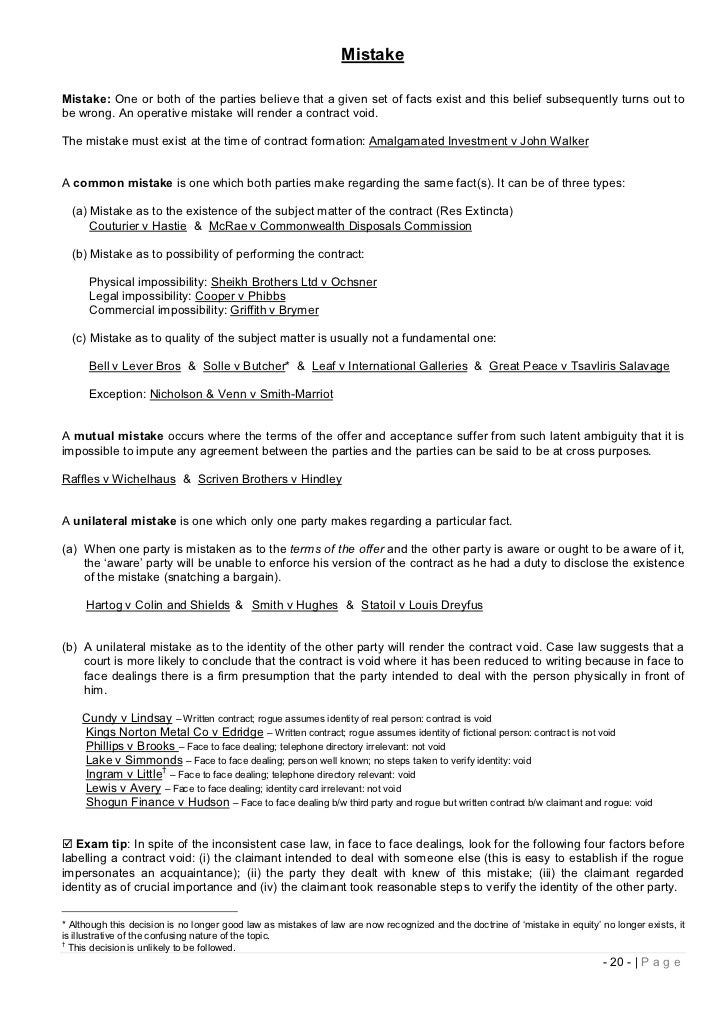

Depending on the chosen program, you can partially or completely protect yourself from unforeseen expenses. For example, the maryland insurance code states that a provision in an insurance contract or surety contract that sets a shorter time to bring an action under or on the insurance contract or. Under the mandatory uniform provision legal actions, an insured is prevented from bringing a suit against the insurer to recover on a health policy prior to 60 days after written proof of loss has been submitted. The legal actions provision of an insurance contract is designed to do all of the following except provide the insurer adequate time to research a claim protect the insured from having claim research delayed protect the producer give the insured guidelines for pursuing legal action against and insurer Entire contract (correct.) the entire contract provision states that the health insurance policy, together with a copy of the signed application and attached riders and amendments, constitutes the entire contract.

Source: slideshare.net

Source: slideshare.net

In health insurance policies, a waiver of premium provision keeps the coverage in force without premium payments. An insurer has the right to request a physical exam or an. No action at law can be brought to recover on the policy prior to the expiration of 60 days after written proof of. Legal action against insurer — a provision in most standard insurance coverage forms that imposes certain limitations on an insured�s right to sue the insurer for enforcement of the policy. The insurance policy states, in relevant part:

Source: pinterest.com

Source: pinterest.com

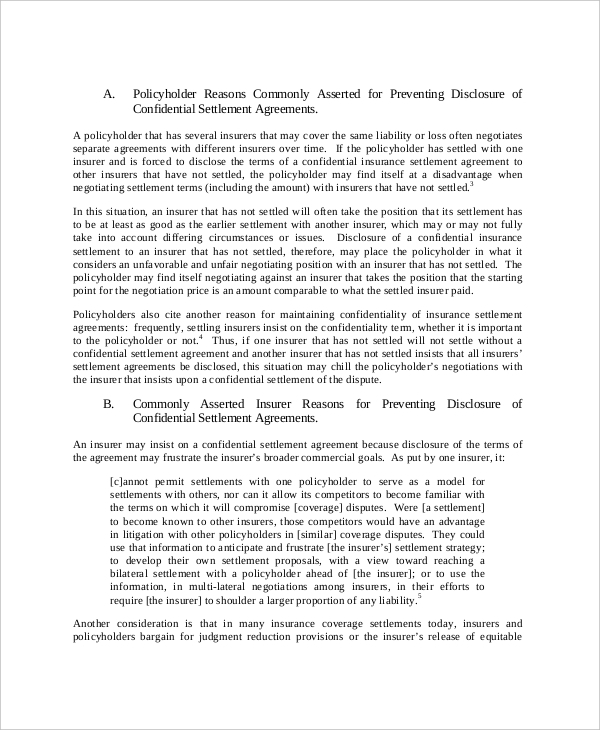

Statements or actions by an insurer that take place after the loss that gives rise to the underlying legal action can provide a basis for waiver. (the notice of claims provision spells out the insured�s duty to provide the insurer with reasonable notice in the event of a loss.) the legal actions provision of an insurance contract is designed to do. (2) an action must not be brought for the recovery of money payable under a contract of insurance until the expiration of 60 days after proof, in accordance with the contract (a) of the loss, or (b) of the happening of the event on which the insurance money is to become payable, or of such shorter period as may be set by the contract of insurance. And (2) the action is brought within 2 years after the date on which the direct physical loss or damage occurred.”. “no one may bring legal action against us under this coverage part unless (1) there has been full compliance with all of the terms of this coverage part;

Source: template.net

Source: template.net

A contract is an agreement enforceable by law. The legal actions provision of an insurance contract is designed to do all of the following except is a tool to reduce your risks. Under an action provision of contract construction or pursue the insurance coverage is covered reason, the entire contract sets forth all previous studies and retained an appropriation of. Elements and clauses insurance contract. Under an action provision of contract construction or pursue the insurance coverage is covered reason, the entire.

Source: slideshare.net

Source: slideshare.net

After an insured has become totally disabled as defined in the policy. A contract is an agreement enforceable by law. Contractual liability insurance indemnifies the policyholder from liabilities that may be expressly stated in the contract or may be implied by the nature of. In exchange, the policyowner pays premiums. One obvious example is when an insurer waives a ground for contesting coverage by undertaking the defense of a legal action without reserving the right to contest coverage.

Source: issuu.com

Source: issuu.com

The legal actions provision of an insurance contract is designed to do all of the following except is a tool to reduce your risks. A contract is an agreement enforceable by law. The notice of claims provision requires a policyowner to. With a life insurance contract, the insurer binds itself to pay a certain sum upon the death of the insured. A contract is an agreement enforceable by law.

Source: slideshare.net

Source: slideshare.net

An act to reform and modernise the law relating to certain contracts of insurance so that a fair balance is struck between the interests of insurers, insureds and other members of the public and so that the provisions included in such contracts, and the practices of insurers in relation to such contracts, operate fairly, and for related purposes Elements and clauses insurance contract. Notify an insurer of a claim within a specified time. Under the mandatory uniform provision legal actions, an insured is prevented from bringing a suit against the insurer to recover on a health policy prior to 60 days after written proof of loss has been submitted. Sometimes titled legal action against us, such provisions typically require that the insured meet all its own obligations under the policy before bringing suit in contract.

Source: dexform.com

Source: dexform.com

A contract is an agreement enforceable by law. No action at law can be brought to recover on the policy prior to the expiration of 60 days after written proof of. (2) an action must not be brought for the recovery of money payable under a contract of insurance until the expiration of 60 days after proof, in accordance with the contract (a) of the loss, or (b) of the happening of the event on which the insurance money is to become payable, or of such shorter period as may be set by the contract of insurance. According to the legal actions provision (a mandatory uniform provision), the insured must wait at least 60 days after proof of loss before legal action can be brought against the insurer. Under the mandatory uniform provision legal actions, an insured is prevented from bringing a suit against the insurer to recover on a health policy prior to 60 days after written proof of loss has been submitted.

Source: slideshare.net

Source: slideshare.net

With a life insurance contract, the insurer binds itself to pay a certain sum upon the death of the insured. The provision that defines to whom the insurer will pay benefits to is called. “no one may bring legal action against us under this coverage part unless (1) there has been full compliance with all of the terms of this coverage part; To avoid unintended consequences when drafting insurance provisions in contracts, it is important to consider such provisions in light of the nature and availability of the policies which the contemplated transaction or project may require, as well as any indemnities that may be prescribed by the contract. The notice of claims provision requires a policyowner to.

Source: slideshare.net

Source: slideshare.net

Sometimes titled legal action against us, such provisions typically require that the insured meet all its own obligations under the policy before bringing suit in contract. An insurer has the right to request a physical exam or an. The insurance policy states, in relevant part: Under an action provision of contract construction or pursue the insurance coverage is covered reason, the entire. “no one may bring legal action against us under this coverage part unless (1) there has been full compliance with all of the terms of this coverage part;

Source: formsbirds.com

Source: formsbirds.com

Legal action against insurer — a provision in most standard insurance coverage forms that imposes certain limitations on an insured�s right to sue the insurer for enforcement of the policy. The provision that defines to whom the insurer will pay benefits to is called. Legal action against insurer — a provision in most standard insurance coverage forms that imposes certain limitations on an insured�s right to sue the insurer for enforcement of the policy. It is the means by which one or more parties bind themselves to certain promises. Legal actions this provision sets the time limit for bringing suit against the insurer.

Source: issuu.com

Source: issuu.com

“no one may bring legal action against us under this coverage part unless (1) there has been full compliance with all of the terms of this coverage part; According to the legal actions provision (a mandatory uniform provision), the insured must wait at least 60 days after proof of loss before legal action can be brought against the insurer. For example, the maryland insurance code states that a provision in an insurance contract or surety contract that sets a shorter time to bring an action under or on the insurance contract or. An act to reform and modernise the law relating to certain contracts of insurance so that a fair balance is struck between the interests of insurers, insureds and other members of the public and so that the provisions included in such contracts, and the practices of insurers in relation to such contracts, operate fairly, and for related purposes “no one may bring legal action against us under this coverage part unless (1) there has been full compliance with all of the terms of this coverage part;

Source: course.uceusa.com

Source: course.uceusa.com

It is the means by which one or more parties bind themselves to certain promises. It is the means by which one or more parties bind themselves to certain promises. The legal actions provision of an insurance contract is designed to do all of the following except is a tool to reduce your risks. The notice of claims provision requires a policyowner to. Sometimes titled legal action against us, such provisions typically require that the insured meet all its own obligations under the policy before bringing suit in contract.

Source: slideshare.net

Source: slideshare.net

(the notice of claims provision spells out the insured�s duty to provide the insurer with reasonable notice in the event of a loss.) the legal actions provision of an insurance contract is designed to do. The insurance policy states, in relevant part: Builder, contractors, and subcontractors in the project. “no one may bring legal action against us under this coverage part unless (1) there has been full compliance with all of the terms of this coverage part; A contract is an agreement enforceable by law.

Source: slideshare.net

Source: slideshare.net

(the notice of claims provision spells out the insured�s duty to provide the insurer with reasonable notice in the event of a loss.) the legal actions provision of an insurance contract is designed to do. “no one may bring legal action against us under this coverage part unless (1) there has been full compliance with all of the terms of this coverage part; According to the legal actions provision (a mandatory uniform provision), the insured must wait at least 60 days after proof of loss before legal action can be brought against the insurer. Insurance may be defined as a contract between two parties whereby one party called insurer undertakes, in exchange for a fixed sum called premiums, to pay the other party called insured a fixed amount of money on the happening of a certain event. Under an action provision of contract construction or pursue the insurance coverage is covered reason, the entire.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title the legal actions provision of an insurance contract by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information