The percentage of an individual s primary insurance amount information

Home » Trend » The percentage of an individual s primary insurance amount informationYour The percentage of an individual s primary insurance amount images are available. The percentage of an individual s primary insurance amount are a topic that is being searched for and liked by netizens today. You can Get the The percentage of an individual s primary insurance amount files here. Find and Download all free vectors.

If you’re searching for the percentage of an individual s primary insurance amount images information related to the the percentage of an individual s primary insurance amount interest, you have pay a visit to the right site. Our site always provides you with hints for seeing the maximum quality video and image content, please kindly surf and locate more enlightening video articles and images that match your interests.

The Percentage Of An Individual S Primary Insurance Amount. (b) 32 percent of average indexed monthly earnings between $895 and $5,397, plus. Social security disability income which type of life insurance incorporates flexible premiums and an adjustable death benefit? If you file for your retirement benefit prior to your full retirement age, your monthly retirement benefit will be less than your primary insurance amount. If a person first claims a retirement benefit at the full retirement age (fra), the individual will receive a monthly benefit amount equal to 100 percent of.

30 Percent of Americans in Their 20s Are Uninsured US From usnews.com

30 Percent of Americans in Their 20s Are Uninsured US From usnews.com

The primary insurance amount of an individual shall (except as otherwise provided in this section) be equal to the sum of— 90 percent of the individual’s average indexed monthly earnings (determined under subsection (b)) to the extent that such earnings do not exceed the amount established for purposes of this clause by subparagraph (b), This amount is not reduced for early retirement nor increased for “delayed retirement credit” (drc). An individual�s primary insurance amount is calculated based on their average indexed monthly earnings (aime). (i) 150 percent of the first $230 of the individual�s primary insurance amount, plus. If you file for your retirement benefit after reaching your. (iii) 134 percent of the primary insurance amount over $332 but not over $433, plus.

The formula used to compute the pia, called the pia formula, reflects changes in general wage levels, as measured by the national average wage index.

(a) 90 percent of the first $1,024 of his/her average indexed monthly earnings, plus. ( i) 150 percent of the first $230 of the individual�s primary insurance amount, plus. Social security disability income which type of life insurance incorporates flexible premiums and an adjustable death benefit? For 2021, the pia calculation takes 90% from the first $996, 32% from earnings over $996 but. (ii) 272 percent of the primary insurance amount over $230 but not over $332, plus. The government takes three percentages of the aime—fixed at 90%, 32%, and 15%—to calculate the pia.

Source: commons.wikimedia.org

Source: commons.wikimedia.org

(iv) 175 percent of the primary insurance amount over $433. Average indexed monthly earnings (aime) are used to calculate the primary insurance amount (pia), which is used to determine an individual�s social security benefits. If you file for your retirement benefit prior to your full retirement age, your monthly retirement benefit will be less than your primary insurance amount. (ii) 272 percent of the primary insurance amount over $230 but not over $332, plus. The “primary insurance amount” (pia) is the benefit a person would receive if he/she elects to begin receiving retirement benefits at his/her normal retirement age.

Source: researchgate.net

Source: researchgate.net

The maximum is computed as follows: (ii) 272 percent of the primary insurance amount over $230 but not over $332, plus. ( ii) 272 percent of the primary insurance amount over $230 but not over $332, plus. The “primary insurance amount” (pia) is the benefit a person would receive if he/she elects to begin receiving retirement benefits at his/her normal retirement age. The portions depend on the year in which a worker reaches age 62, becomes disabled before age 62, or dies before reaching age 62.

Source: cnbc.com

Source: cnbc.com

The portions depend on the year in which a worker reaches age 62, becomes disabled before age 62, or dies before reaching age 62. (a) 90 percent of the first $896 of his or her average indexed monthly earnings, plus (b) 32 percent of his or her average indexed monthly earnings over $896 and through $5,399, plus ( ii) 272 percent of the primary insurance amount over $230 but not over $332, plus. (ii) 272 percent of the primary insurance amount over $230 but not over $332, plus. Following provides an example of an individual retiring in 2019.

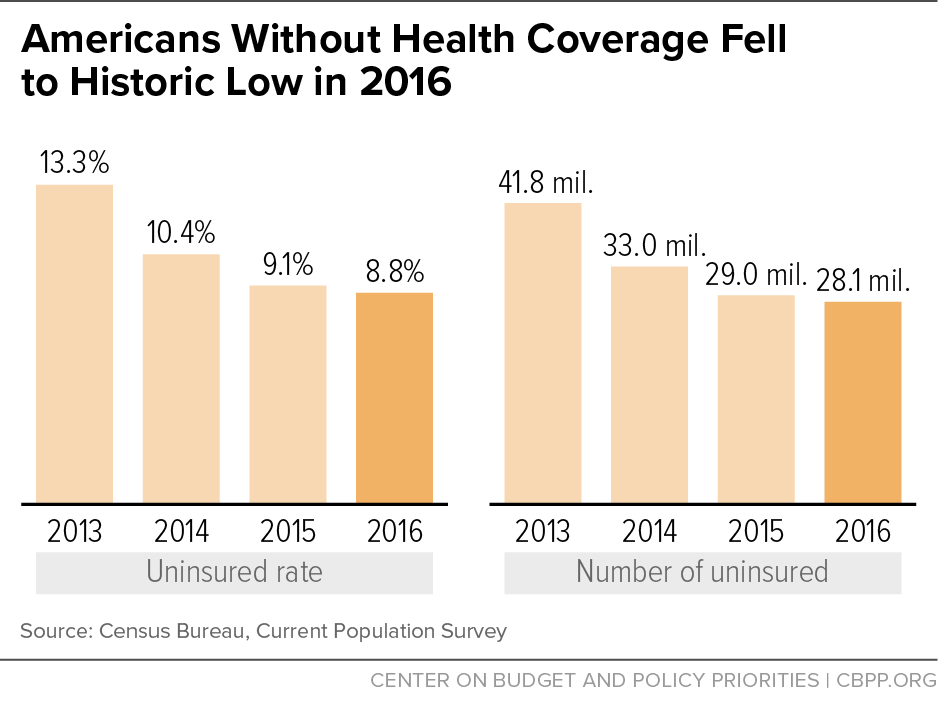

Source: cbpp.org

Source: cbpp.org

The pia is the basis for the benefits that are paid to an individual. For earnings above $4,980, it takes 15 percent of these earnings. Factor) of the average monthly indexed earnings (amie) that contributes to an individual’s primary insurance amount is changed; (ii) 272 percent of the primary insurance amount over $230 but not over $332, plus. Following provides an example of an individual retiring in 2019.

Source: fivethirtyeight.com

Source: fivethirtyeight.com

The portions depend on the year in which a worker reaches age 62, becomes disabled before age 62, or dies before reaching age 62. ( i) 150 percent of the first $230 of the individual�s primary insurance amount, plus. (a) 90 percent of the first $895 of average indexed monthly earnings, plus. If you file for your retirement benefit prior to your full retirement age, your monthly retirement benefit will be less than your primary insurance amount. The sum of these three calculations is your primary insurance amount, more commonly referred to as your pia.

Source: blogs.mprnews.org

Source: blogs.mprnews.org

If you file for your retirement benefit prior to your full retirement age, your monthly retirement benefit will be less than your primary insurance amount. (i) 150 percent of the first $230 of the individual�s primary insurance amount, plus. The pia is the basis for the benefits that are paid to an individual. An individual�s primary insurance amount is calculated based on their average indexed monthly earnings (aime). The pia is the sum of three separate percentages of portions of average indexed monthly earnings.

Source: theatlantic.com

Source: theatlantic.com

The portions depend on the year in which a worker reaches age 62, becomes disabled before age 62, or dies before reaching age 62. ( ii) 272 percent of the primary insurance amount over $230 but not over $332, plus. If a person first claims a retirement benefit at the full retirement age (fra), the individual will receive a monthly benefit amount equal to 100 percent of. The formula used to compute the pia, called the pia formula, reflects changes in general wage levels, as measured by the national average wage index. For earnings above $4,980, it takes 15 percent of these earnings.

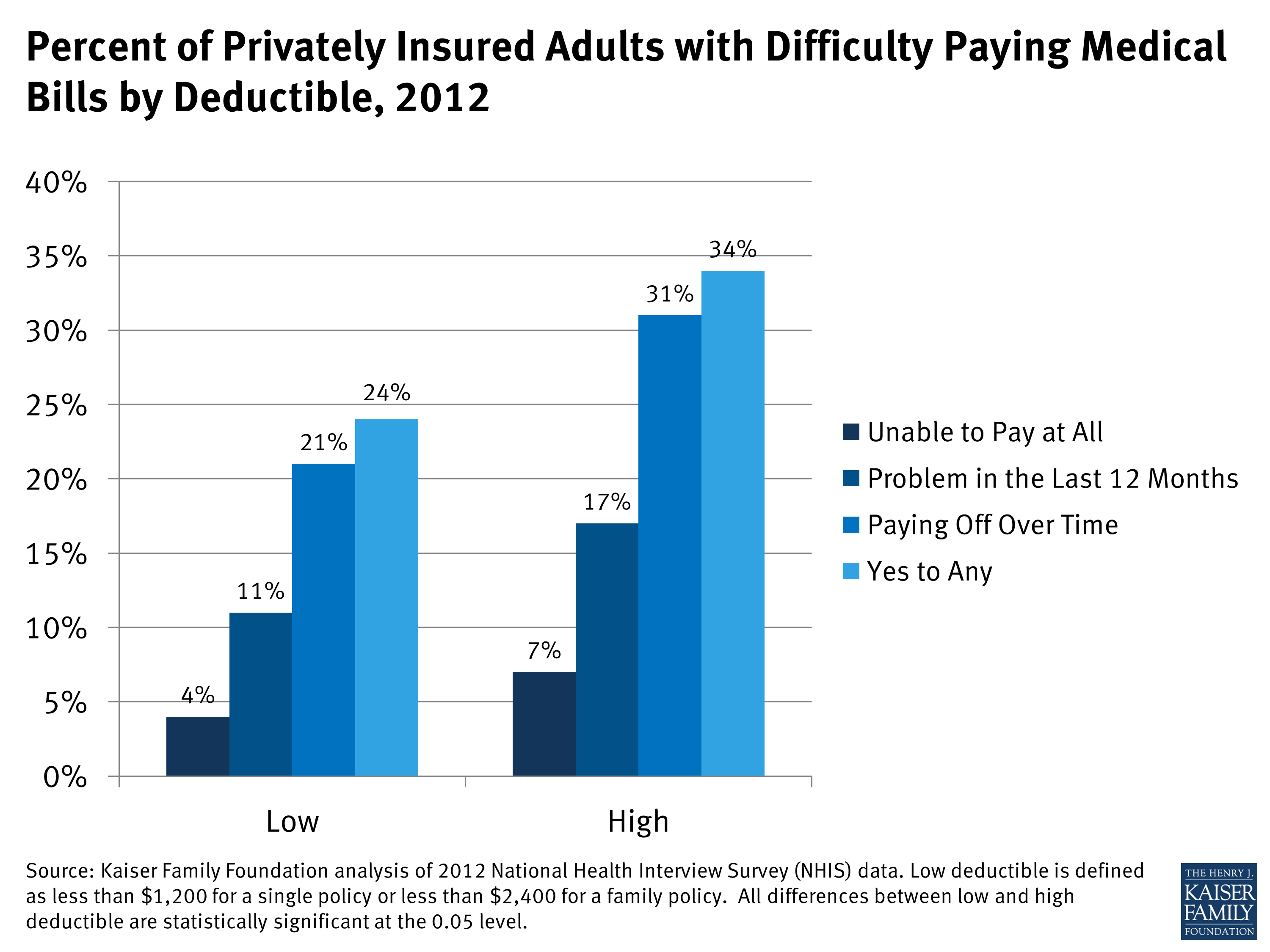

Source: kff.org

Source: kff.org

(ii) 272 percent of the primary insurance amount over $230 but not over $332, plus. The percentage of an individual�s primary insurance amount determines the benefits paid in which of the following programs? If you file for your retirement benefit prior to your full retirement age, your monthly retirement benefit will be less than your primary insurance amount. The “primary insurance amount” (pia) is the benefit a person would receive if he/she elects to begin receiving retirement benefits at his/her normal retirement age. In 2006 the first $656 of amie is multiplied by 90 percent in calculating the pia, from $656 to $3,955 the pia factor is 32 percent, and above $3,955 the pia factor is 15 percent) is created at 28.6 percent of the

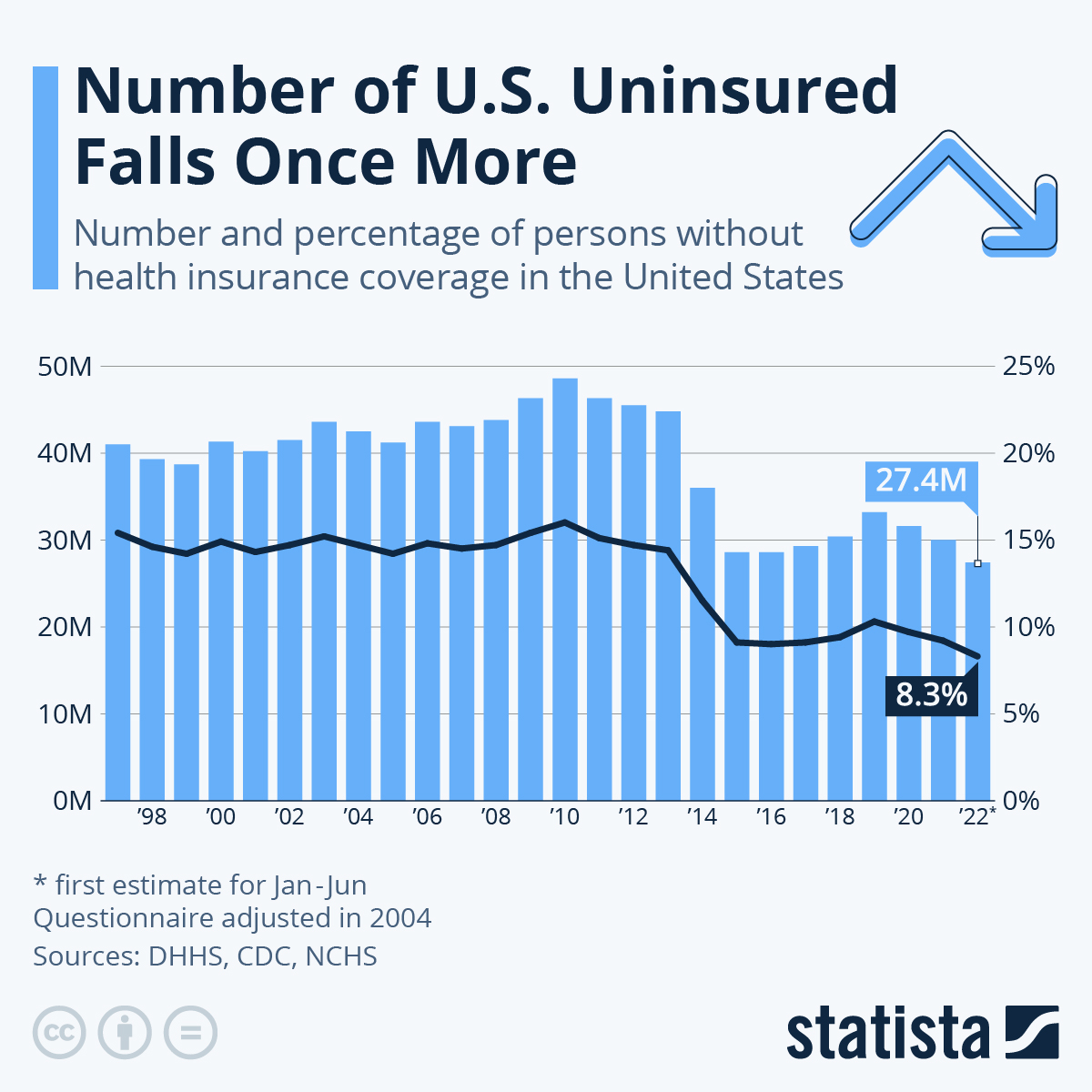

Source: statista.com

Source: statista.com

The pia is the basis for the benefits that are paid to an individual. The percentage of an individual�s primary insurance amount determines the benefits paid in which of the following programs? Aime works by taking into. The pia is the basis for the benefits that are paid to an individual. An individual�s primary insurance amount is calculated based on their average indexed monthly earnings (aime).

Source: businessinsider.com

The portions depend on the year in which a worker reaches age 62, becomes disabled before age 62, or dies before reaching age 62. The “primary insurance amount” (pia) is the benefit a person would receive if he/she elects to begin receiving retirement benefits at his/her normal retirement age. Factor) of the average monthly indexed earnings (amie) that contributes to an individual’s primary insurance amount is changed; Aime works by taking into. The percentage of an individual�s primary insurance amount determines the benefits paid in which of the following programs?

Source: urbanmilwaukee.com

Source: urbanmilwaukee.com

The pia is the basis for the benefits that are paid to an individual. The “primary insurance amount” (pia) is the benefit a person would receive if he/she elects to begin receiving retirement benefits at his/her normal retirement age. ( ii) 272 percent of the primary insurance amount over $230 but not over $332, plus. A person’s primary insurance amount (pia) is the amount of their monthly retirement benefit, if they file for that benefit exactly at their full retirement age. The primary insurance amount of an individual shall (except as otherwise provided in this section) be equal to the sum of— 90 percent of the individual’s average indexed monthly earnings (determined under subsection (b)) to the extent that such earnings do not exceed the amount established for purposes of this clause by subparagraph (b),

Source: yahoo.com

The maximum is computed as follows: The pia is the sum of three separate percentages of portions of average indexed monthly earnings. Periodic payment (7) (a) in the case of an individual whose primary insurance amount would be computed under paragraph (1) of this subsection, who— (i) attains age 62 after 1985 (except where he or she became entitled to a disability insurance benefit before 1986 and remained so entitled in any of the 12 months immediately preceding his or her attainment of age 62), or (ii). The pia is the basis for the benefits that are paid to an individual. For earnings between $826 and $4,980, it takes 32% of these earnings.

Source: kids.kiddle.co

Source: kids.kiddle.co

(a) 90 percent of the first $896 of his or her average indexed monthly earnings, plus (b) 32 percent of his or her average indexed monthly earnings over $896 and through $5,399, plus (iii) 134 percent of the primary insurance amount over $332 but not over $433, plus. The pia is the basis for the benefits that are paid to an individual. If you file for your retirement benefit after reaching your. ( ii) 272 percent of the primary insurance amount over $230 but not over $332, plus.

Source: gallup.com

Source: gallup.com

Periodic payment (7) (a) in the case of an individual whose primary insurance amount would be computed under paragraph (1) of this subsection, who— (i) attains age 62 after 1985 (except where he or she became entitled to a disability insurance benefit before 1986 and remained so entitled in any of the 12 months immediately preceding his or her attainment of age 62), or (ii). 100% of the insured�s primary insurance amount (pia) the percentage of an individual�s primary insurance amount (pia) determines the benefits paid in which of the following programs? The pia is the basis for the benefits that are paid to an individual. (i) 150 percent of the first $230 of the individual�s primary insurance amount, plus. (ii) 272 percent of the primary insurance amount over $230 but not over $332, plus.

Source: onemedical.com

Source: onemedical.com

(iv) 175 percent of the primary insurance amount over $433. (ii) 272 percent of the primary insurance amount over $230 but not over $332, plus. The “primary insurance amount” (pia) is the benefit a person would receive if he/she elects to begin receiving retirement benefits at his/her normal retirement age. For earnings between $826 and $4,980, it takes 32% of these earnings. ( i) 150 percent of the first $230 of the individual�s primary insurance amount, plus.

Source: huffingtonpost.com

Source: huffingtonpost.com

The maximum is computed as follows: The maximum is computed as follows: The pia is the basis for the benefits that are paid to an individual. The “primary insurance amount” (pia) is the benefit a person would receive if he/she elects to begin receiving retirement benefits at his/her normal retirement age. For 2021, the pia calculation takes 90% from the first $996, 32% from earnings over $996 but.

Source: gallup.com

Source: gallup.com

100% of the insured�s primary insurance amount (pia) the percentage of an individual�s primary insurance amount (pia) determines the benefits paid in which of the following programs? The pia is calculated by summing up three percentages: (a) 90 percent of the first $895 of average indexed monthly earnings, plus. (iv) 175 percent of the primary insurance amount over $433. The government takes three percentages of the aime—fixed at 90%, 32%, and 15%—to calculate the pia.

Source: conscienhealth.org

Source: conscienhealth.org

(a) 90 percent of the first $896 of his or her average indexed monthly earnings, plus (b) 32 percent of his or her average indexed monthly earnings over $896 and through $5,399, plus ( ii) 272 percent of the primary insurance amount over $230 but not over $332, plus. ( i) 150 percent of the first $230 of the individual�s primary insurance amount, plus. For an individual who first becomes eligible for retirement benefits in 2018, the formula for determining his or her pia will be the sum of: The government takes three percentages of the aime—fixed at 90%, 32%, and 15%—to calculate the pia.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title the percentage of an individual s primary insurance amount by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information