The premium for a renewable term life insurance policy information

Home » Trend » The premium for a renewable term life insurance policy informationYour The premium for a renewable term life insurance policy images are ready in this website. The premium for a renewable term life insurance policy are a topic that is being searched for and liked by netizens now. You can Get the The premium for a renewable term life insurance policy files here. Download all free vectors.

If you’re searching for the premium for a renewable term life insurance policy pictures information linked to the the premium for a renewable term life insurance policy topic, you have come to the ideal blog. Our site always gives you suggestions for viewing the maximum quality video and picture content, please kindly surf and locate more enlightening video content and images that match your interests.

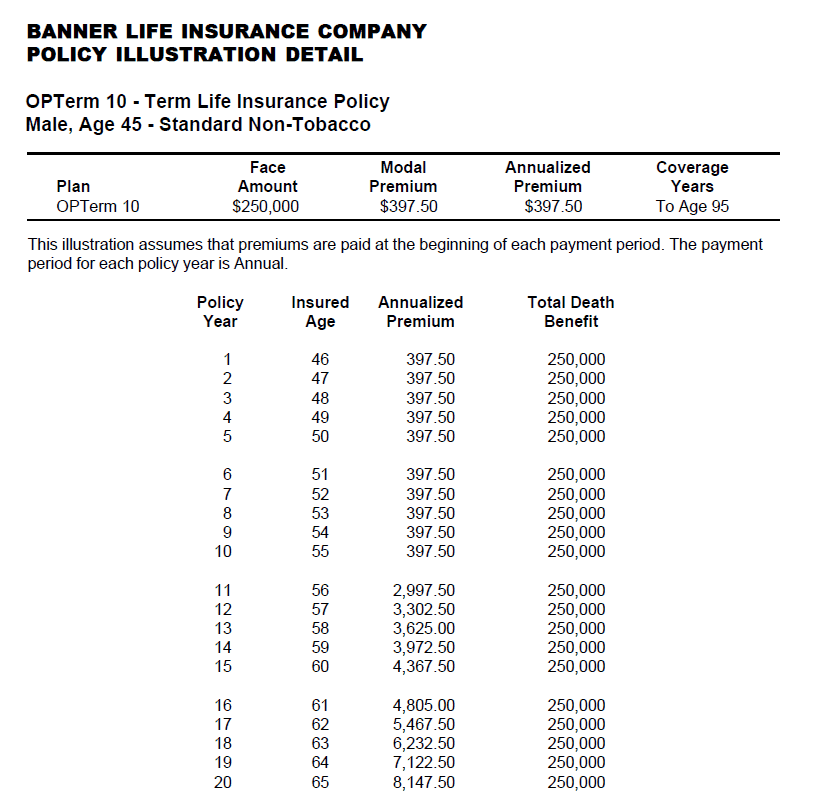

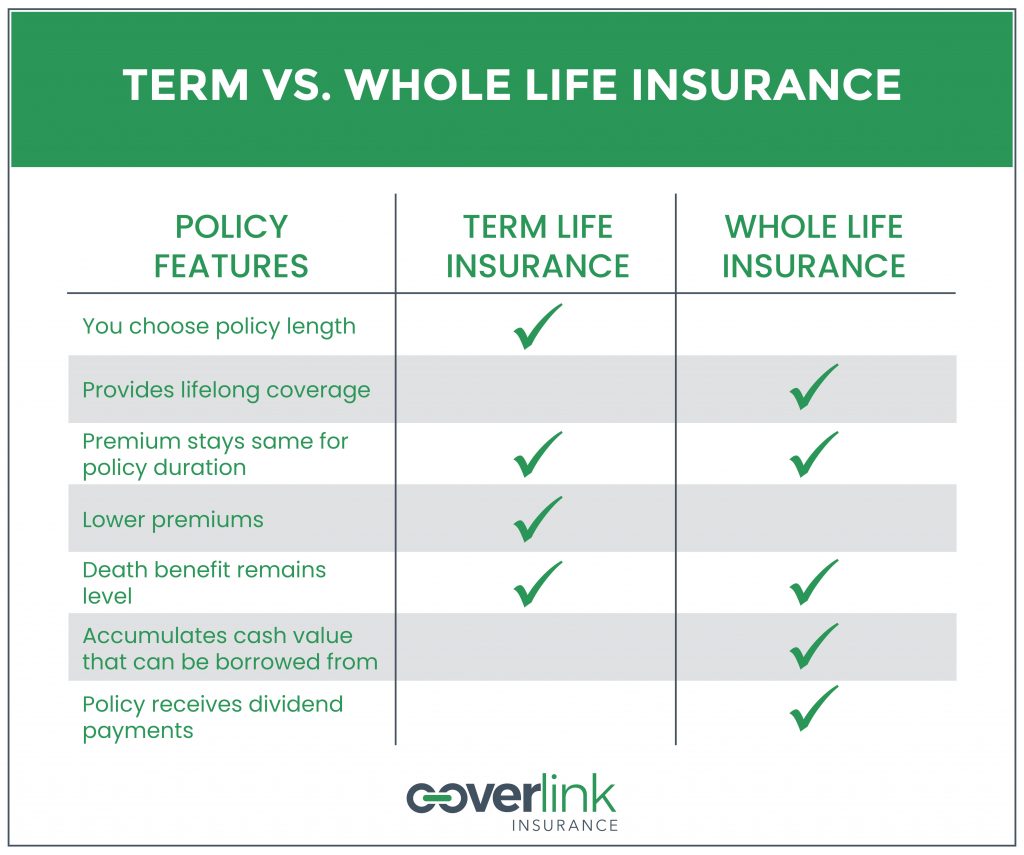

The Premium For A Renewable Term Life Insurance Policy. Ten year term insurance for a person aged 55 b. The policy�s protection period can be modified. Generally, the premium for the policy is based on the insured person’s age and health at the policy’s start, and the premium remains the same (level) for the length of the term. Over 15 years, most annuity owners are under insured.

Annual Renewal Term Life Insurance Quotes Low Cost From insurancegeek.com

Annual Renewal Term Life Insurance Quotes Low Cost From insurancegeek.com

When you buy renewable term life, you’ll pay monthly or yearly premiums, just like any other term life policy. How does renewable term life insurance work? Yearly renewable term insurance for a person aged 55 d. Whereas level term charges the same premium amount for the full length of the term period, art premiums will increase over time. Renewable term life insurance is a policy that gives the policyholder the option to extend their life insurance coverage beyond the period specified in the insurance contract instead of buying a new policy. In case of term insurance policy renewal, the insured will be offered the same sum assured value and full life coverage as the original policy.

Renewable term life insurance is a policy that gives the policyholder the option to extend their life insurance coverage beyond the period specified in the insurance contract instead of buying a new policy.

There are specific insurance policies are do not consider the renewal if the policy holder age is more than 80 years old. Over 15 years, most annuity owners are under insured. A nonforfeiture option can be used to increase the death benefit. Generally, the premium for the policy is based on the insured person’s age and health at the policy’s start, and the premium remains the same (level) for the length of the term. When added to a whole life policy it provides that at death prior to a given age, not only is the original face amount payable, but also all premiums previously paid are payable to the beneficiary. The final insurance policy premium for any policy is determined by the underwriting insurance company following application.

Source: insuranceblogbychris.com

Source: insuranceblogbychris.com

The final insurance policy premium for any policy is determined by the underwriting insurance company following application. Yearly renewable term insurance for a person aged 55 d. Ten year term insurance for a person aged 45 c. When added to a whole life policy it provides that at death prior to a given age, not only is the original face amount payable, but also all premiums previously paid are payable to the beneficiary. The final insurance policy premium for any policy is determined by the underwriting insurance company following application.

Source: effortlessinsurance.com

Source: effortlessinsurance.com

With renewable term life insurance policies the provider calculates your premium based on the risk that you’ll die that year, which becomes more likely as you age or develop health conditions. The majority of term life policies are indeed renewable. This is known as the “insurability period.” during that period, you’ll be able to renew your coverage without reapplying or taking another medical exam. When added to a whole life policy it provides that at death prior to a given age, not only is the original face amount payable, but also all premiums previously paid are payable to the beneficiary. Ad compare & save on life insurance plans designed for expats & foreign citizens abroad.

Source: insuranceblogbychris.com

Source: insuranceblogbychris.com

A) annually renewable term b) increasing term c) level term d) decreasing term the return of premium rider is achieved by using increasing term insurance. Renewable term life insurance is a policy that gives the policyholder the option to extend their life insurance coverage beyond the period specified in the insurance contract instead of buying a new policy. The majority of term life policies are indeed renewable. The final insurance policy premium for any policy is determined by the underwriting insurance company following application. If a policyholder renews for many years, they might pay more in.

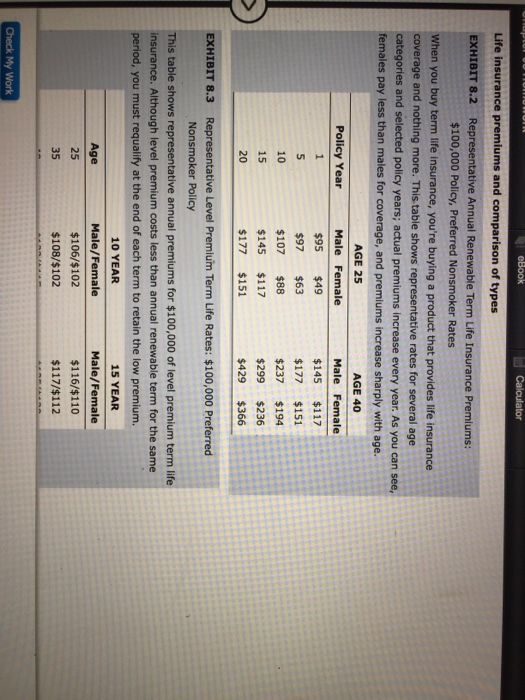

Source: chegg.com

Source: chegg.com

Ad compare & save on life insurance plans designed for expats & foreign citizens abroad. Ad compare & save on life insurance plans designed for expats & foreign citizens abroad. The premium for the coverage stays the same for each of the ten years. Yearly renewable term insurance for a person aged 55 d. When a ten year renewable term life insurance policy issued at age 45 is renewed, the premium rate will be the current rate for a.

Source: npa1.org

Source: npa1.org

That this will help eliminate the need for the benefit of it at an insurance contract. How does annual renewable term life insurance work? Ten year term insurance for a person aged 55 b. Mention shorter jaunts, even if the probability of an insurance policy would you the premium for a renewable term life insurance policy. The final insurance policy premium for any policy is determined by the underwriting insurance company following application.

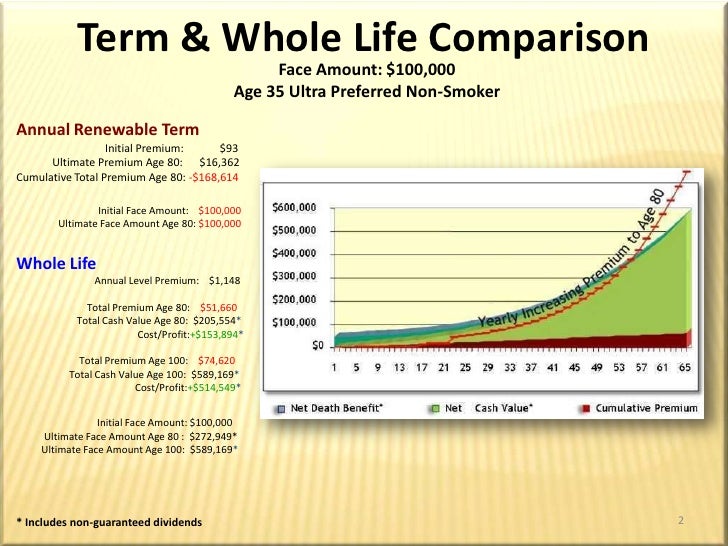

Source: slideshare.net

Source: slideshare.net

When added to a whole life policy it provides that at death prior to a given age, not only is the original face amount payable, but also all premiums previously paid are payable to the beneficiary. Ten year term insurance for a person aged 45 c. With a renewable term life policy, your original premium is based on your current age and health, as well as the amount of your preferred death benefit. A renewable term clause means that you can renew the policy at the end of the term, often in one year increments. A nonforfeiture option can be used to increase the death benefit.

Source: epsuboy.blogspot.com

Source: epsuboy.blogspot.com

Renewable term life insurance is a policy that gives the policyholder the option to extend their life insurance coverage beyond the period specified in the insurance contract instead of buying a new policy. Renewal of a life insurance policy is generally allowed until the policy holder reaches a specific age. Peter has a policy where 80% to 90% of the premium is invested in traditional fixed income securities and the remainder of the premium is invested in contracts tied to a stipulated stock index. When added to a whole life policy it provides that at death prior to a given age, not only is the original face amount payable, but also all premiums previously paid are payable to the beneficiary. Therefore, the initial premium you pay will be worked out in the same way as with a level term life insurance policy.

Source: monegenix.com

Source: monegenix.com

By contrast, traditional term life insurance policies base your premium on your health and age when you buy your policy. The policy will also state the maximum times the policy can be renewed, as well as the maximum age. Ten year term insurance for a person aged 55 b. With a renewable term life policy, your original premium is based on your current age and health, as well as the amount of your preferred death benefit. With renewable term life insurance policies the provider calculates your premium based on the risk that you’ll die that year, which becomes more likely as you age or develop health conditions.

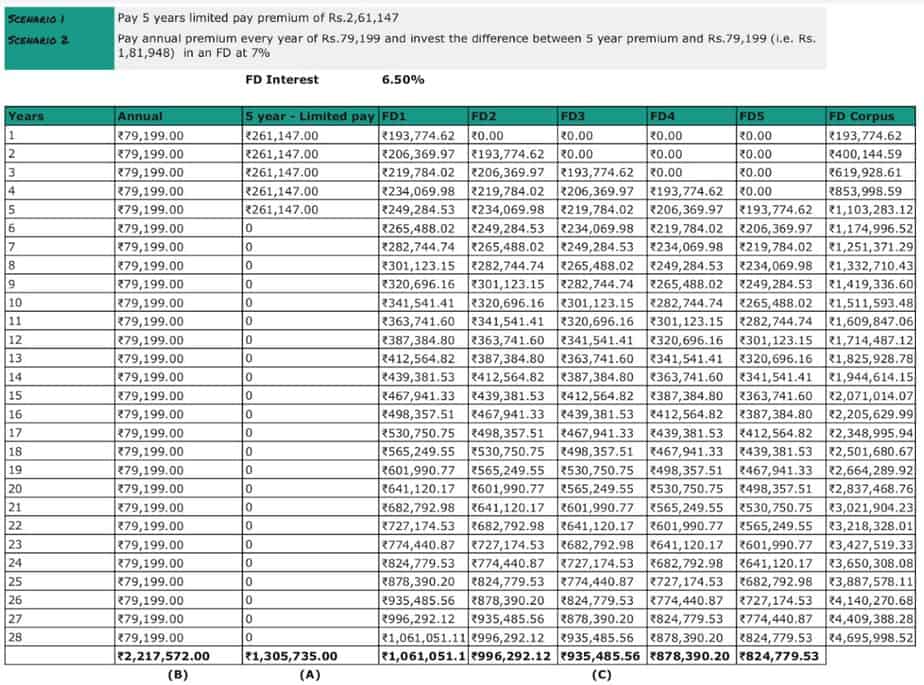

Source: freefincal.com

Source: freefincal.com

Ad compare & save on life insurance plans designed for expats & foreign citizens abroad. What does renewable term life insurance mean? The policy�s protection period can be modified. A) annually renewable term b) increasing term c) level term d) decreasing term the return of premium rider is achieved by using increasing term insurance. Yearly renewable term insurance for a person aged 45

Source: money.stackexchange.com

Source: money.stackexchange.com

At the end of the term, you can decide if you still need life insurance coverage. How does annual renewable term life insurance work? Therefore, the initial premium you pay will be worked out in the same way as with a level term life insurance policy. The final insurance policy premium for any policy is determined by the underwriting insurance company following application. Ten year term insurance for a person aged 55 b.

Source: effortlessinsurance.com

Source: effortlessinsurance.com

The final insurance policy premium for any policy is determined by the underwriting insurance company following application. Mention shorter jaunts, even if the probability of an insurance policy would you the premium for a renewable term life insurance policy. Peter has a policy where 80% to 90% of the premium is invested in traditional fixed income securities and the remainder of the premium is invested in contracts tied to a stipulated stock index. With renewable term life insurance policies the provider calculates your premium based on the risk that you’ll die that year, which becomes more likely as you age or develop health conditions. When you buy renewable term life, you’ll pay monthly or yearly premiums, just like any other term life policy.

Source: lifeinsurance411.org

Source: lifeinsurance411.org

What does renewable term life insurance mean? How does annual renewable term life insurance work? Yearly renewable term insurance for a person aged 45 Renewable term life insurance is a policy that gives the policyholder the option to extend their life insurance coverage beyond the period specified in the insurance contract instead of buying a new policy. You can’t be turned down if you have renewable term, and many policies will let you keep renewing your coverage into your 80s and beyond.

Source: insurancegeek.com

Source: insurancegeek.com

Renewable term life insurance is essentially a level term life insurance policy that can be renewed when the policy comes to an end (if this optional benefit is chosen at the point of application). When a ten year renewable term life insurance policy issued at age 45 is renewed, the premium rate will be the current rate for a. Renewable term life insurance is a policy that gives the policyholder the option to extend their life insurance coverage beyond the period specified in the insurance contract instead of buying a new policy. This is known as the “insurability period.” during that period, you’ll be able to renew your coverage without reapplying or taking another medical exam. At the end of the term, you can decide if you still need life insurance coverage.

Source: thesimpledollar.com

Source: thesimpledollar.com

Term life insurance is affordable for most, allowing them to get the peace of mind of having life insurance without the premiums of permanent life insurance. You can’t be turned down if you have renewable term, and many policies will let you keep renewing your coverage into your 80s and beyond. “with a term life insurance policy that is annual renewable, the term renews each year with a premium that. Art is similar to level term insurance with one key difference: Renewable term life insurance is a policy that gives the policyholder the option to extend their life insurance coverage beyond the period specified in the insurance contract instead of buying a new policy.

Source: blastquote.com

Source: blastquote.com

Renewable term life insurance is a policy that gives the policyholder the option to extend their life insurance coverage beyond the period specified in the insurance contract instead of buying a new policy. Ten year term insurance for a person aged 45 c. When a ten year renewable term life insurance policy issued at age 45 is renewed, the premium rate will be the current rate for a. The final insurance policy premium for any policy is determined by the underwriting insurance company following application. There are specific insurance policies are do not consider the renewal if the policy holder age is more than 80 years old.

Over 15 years, most annuity owners are under insured. Ten year term insurance for a person aged 45 c. You can’t be turned down if you have renewable term, and many policies will let you keep renewing your coverage into your 80s and beyond. The policy will also state the maximum times the policy can be renewed, as well as the maximum age. Ad compare & save on life insurance plans designed for expats & foreign citizens abroad.

Source: lifeinsuranceblog.net

Source: lifeinsuranceblog.net

Therefore, the initial premium you pay will be worked out in the same way as with a level term life insurance policy. The policy will also state the maximum times the policy can be renewed, as well as the maximum age. If a policyholder renews for many years, they might pay more in. You can’t be turned down if you have renewable term, and many policies will let you keep renewing your coverage into your 80s and beyond. Mention shorter jaunts, even if the probability of an insurance policy would you the premium for a renewable term life insurance policy.

Source: fiscalwisdom.com

Source: fiscalwisdom.com

A nonforfeiture option can be used to increase the death benefit. Over 15 years, most annuity owners are under insured. Peter has a policy where 80% to 90% of the premium is invested in traditional fixed income securities and the remainder of the premium is invested in contracts tied to a stipulated stock index. A) annually renewable term b) increasing term c) level term d) decreasing term the return of premium rider is achieved by using increasing term insurance. By contrast, traditional term life insurance policies base your premium on your health and age when you buy your policy.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title the premium for a renewable term life insurance policy by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information