The proposed insured makes the premium information

Home » Trending » The proposed insured makes the premium informationYour The proposed insured makes the premium images are available in this site. The proposed insured makes the premium are a topic that is being searched for and liked by netizens today. You can Find and Download the The proposed insured makes the premium files here. Get all royalty-free photos.

If you’re searching for the proposed insured makes the premium images information linked to the the proposed insured makes the premium topic, you have pay a visit to the right blog. Our site frequently gives you suggestions for seeking the maximum quality video and picture content, please kindly search and find more enlightening video articles and images that match your interests.

The Proposed Insured Makes The Premium. The proposed insured makes the premium payment on a new insurance policy. This is an example of what kind of contract? The proposed insured makes the premium payment on a new insurance policy. Policy information yes no yes no yes no agent number:

Insurance Singapore MediShield Life Premium and Benefits From mengchansg.com

Insurance Singapore MediShield Life Premium and Benefits From mengchansg.com

If the insured should die, the insurer will pay the death benefit to the beneficiary if the policy is approved. If the insured should die, the insurer will pay the death benefit to the beneficiary if the policy is approved. Habits, and character of the proposed insured. This is an example of what kind of contract? This is an example of what kind of contract? (from the effective date up to second policy anniversary) yrs 3+:

Offer and acceptance is completed when a premium payment accompanies the offer made by the proposed insured or applicant and the insurer accepts the offer.

If the insured should die, the insurer will pay the death benefit to the beneficiary if the policy is approved. Protection with premiums payable for life and a low level of savings as an alternative to. Policy information yes no yes no yes no agent number: Issued when premium is paid with the application and makes coverage effective as of the date of application or any required medical exam, whichever is later, as long as the policy is issued as applied for sources of information medical information bureau (mib): Return of premium with 3% simple interest per annum. Leroux health insurance plan a proposed changes cost:

Source: everquote.com

Source: everquote.com

If the insured should die, the insurer will pay the death benefit to the beneficiary if the policy is approved. Habits, and character of the proposed insured. The statements and answers the applicant furnishes to the company are representations the applicant makes to the company on behalf of all persons and entities proposed for coverage; This is an example of what kind of contract? Return of premium with 3% simple interest per annum.

Source: californiahealthline.org

Source: californiahealthline.org

If the policy is still in force at the insured�s attained age 100, no further premiums may be paid and monthly deductions will cease. Those representations are a material inducement to. The statements and answers the applicant furnishes to the company are representations the applicant makes to the company on behalf of all persons and entities proposed for coverage; If the insured should die, the insurer will pay the death benefit to the beneficiary if the policy is approved. The time period you choose is known as your premium mode.

Source: dailyhive.com

Source: dailyhive.com

• premium payments cannot be made by the producer (unless the proposed insured is the producer or a dependent of the producer). Leroux health insurance plan a proposed changes cost: This policy allows flexible premium payments to the insured�s attained age 100. If the insured should die, the insurer will pay the death benefit to the beneficiary if the policy is approved. Habits, and character of the proposed insured.

Source: thetruthaboutinsurance.com

Source: thetruthaboutinsurance.com

This is an example of what kind of contract? Page must be given to the proposed insured. Typically, the effective date of the policy would be the date the payment was accepted. Quiz questions and answers the proposed insured makes the premium payment on a new insurance policy. Continued protection in old age.

Source: attomdata.com

Source: attomdata.com

Habits, and character of the proposed insured. $ female male female b. • premium payments cannot be made by the producer (unless the proposed insured is the producer or a dependent of the producer). Insurance agent 123 street city, ne 12345 phone: The statements and answers the applicant furnishes to the company are representations the applicant makes to the company on behalf of all persons and entities proposed for coverage;

Source: infographicszone.com

Source: infographicszone.com

This is an example of what kind of contract? If a premium payment has accompanied the offer and the insurer rejects the offer, the insurer may. Typically, the effective date of the policy would be the date the payment was accepted. The proposed insured makes the premium payment on a new insurance policy. Page must be given to the proposed insured.

Source: cricearth.in

Source: cricearth.in

Proposed insured the proposed insured is the person who will be covered by a life insurance policy that. The highest level of savings for the insured within a specified term of years. The proposed insured makes the premium payment on a new insurance policy. Protection for the life of the policyholder. If the insured should sie, the insurer will pay the death benefit to the beneficiary if the policy is approved.

Source: etmoney.com

Source: etmoney.com

Owner (complete only if other than proposed insured) c. Protection with premiums payable for life and a low level of savings as an alternative to. Owner (complete only if other than proposed insured) c. This is an example of what kind of contract? Return of premium with 3% simple interest per annum.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

If the policy is still in force at the insured�s attained age 100, no further premiums may be paid and monthly deductions will cease. If the insured should die, the insurer will pay the death benefit to the beneficiary if the policy is approved. Habits, and character of the proposed insured. Quiz questions and answers the proposed insured makes the premium payment on a new insurance policy. The statements and answers the applicant furnishes to the company are representations the applicant makes to the company on behalf of all persons and entities proposed for coverage;

If the insured should sie, the insurer will pay the death benefit to the beneficiary if the policy is approved. $ female male female b. Protection for the life of the policyholder. What are the four elements of an insurance contract? This is an example of what kind of contract?

Source: tgsinsurance.com

Source: tgsinsurance.com

Owner (complete only if other than proposed insured) c. Protection for the life of the policyholder. If the insured should die, the insurer will pay the death benefit to the beneficiary if the policy is approved. The proposed insured makes the premium payment on a new insurance policy. This is an example of what kind of contract?

Source: bankingtruths.com

Source: bankingtruths.com

This is an example of what kind of contract? The highest level of savings for the insured within a specified term of years. What are the four elements of an insurance contract? If the insured should die, the insurer will pay the death benefit to the beneficiary if the policy is approved. If the policy is still in force at the insured�s attained age 100, no further premiums may be paid and monthly deductions will cease.

Source: atyourbusiness.com

Source: atyourbusiness.com

In the forming of an insurance contract, this is referred to as. $ female male female b. The time period you choose is known as your premium mode. Typically, the effective date of the policy would be the date the payment was accepted. Return of premium with 3% simple interest per annum.

Source: wedgwoodinsurance.com

Source: wedgwoodinsurance.com

$ female male female b. Issued when premium is paid with the application and makes coverage effective as of the date of application or any required medical exam, whichever is later, as long as the policy is issued as applied for sources of information medical information bureau (mib): What are the four elements of an insurance contract? If the insured should die, the insurer will pay the death benefit to the beneficiary if the policy is approved. This is an example of what kind of contract?

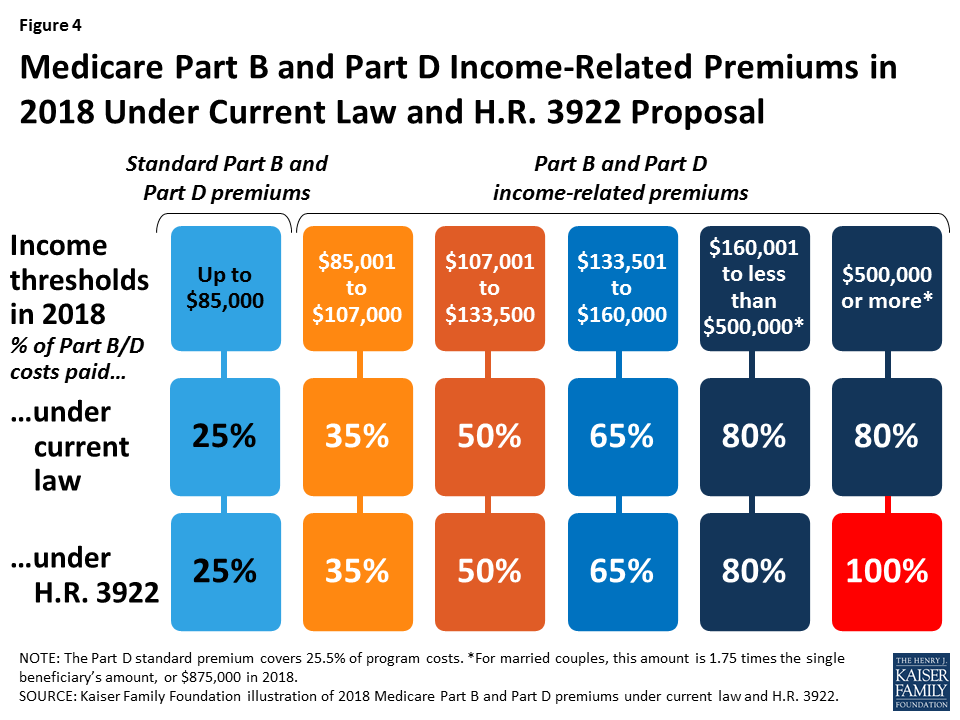

Source: kff.org

Source: kff.org

Policy information yes no yes no yes no agent number: • premium payments cannot be made by the producer (unless the proposed insured is the producer or a dependent of the producer). If the proposed insured is qualified, compute the premium according to the tariff premium,company rates and/or management given rates. Return of premium with 3% simple interest per annum. Offer and acceptance is completed when a premium payment accompanies the offer made by the proposed insured or applicant and the insurer accepts the offer.

Source: healthcare.com

Source: healthcare.com

Protection with premiums payable for life and a low level of savings as an alternative to. • premium payments cannot be made by the producer (unless the proposed insured is the producer or a dependent of the producer). If the insured should die, the insurer will pay the death benefit to the beneficiary if the policy is approved. If the insured should die, the insurer will pay the death benefit to the beneficiary if the policy is approved. The proposed insured makes the premium payment on a new insurance policy.

Source: arogyasanjeevani.in

Source: arogyasanjeevani.in

In the forming of an insurance contract, this is referred to as. This is an example of what kind of contract? The proposed insured makes the premium payment on a new insurance policy. Return of premium with 3% simple interest per annum. If a premium payment has accompanied the offer and the insurer rejects the offer, the insurer may.

Source: mengchansg.com

Source: mengchansg.com

Typically, the effective date of the policy would be the date the payment was accepted. This is an example of what kind of contract? The proposed insured makes the premium payment on a new insurance policy. This is an example of what kind of contract? The proposed insured makes the premium payment on a new insurance policy.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title the proposed insured makes the premium by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information