The provision that defines to whom the insurer Idea

Home » Trending » The provision that defines to whom the insurer IdeaYour The provision that defines to whom the insurer images are available. The provision that defines to whom the insurer are a topic that is being searched for and liked by netizens now. You can Download the The provision that defines to whom the insurer files here. Find and Download all free vectors.

If you’re searching for the provision that defines to whom the insurer pictures information linked to the the provision that defines to whom the insurer interest, you have pay a visit to the right site. Our website frequently provides you with hints for refferencing the highest quality video and image content, please kindly surf and locate more enlightening video content and graphics that match your interests.

The Provision That Defines To Whom The Insurer. The accidental benefits will be paid to. When this provision is inserted into an insurance contract, the insurer is agreeing to fulfill their duties as described in the contract, including: Section 5 defines what the insurer “knows”, “ought to know” and “is presumed to know” for the purposes of the section 3(5) exceptions to the duty of disclosure. The payment of claims provision in a health insurance policy states to whom claims will be paid.

Articles Junction What is Insurance? Meaning, Definition From articles-junction.blogspot.com

Articles Junction What is Insurance? Meaning, Definition From articles-junction.blogspot.com

The payment of claims provision in a health insurance policy states to whom claims will be paid. The massachusetts supreme judicial court recently held that g.l. The provision that defines to whom the insurer will pay benefits to is called ? Life and health insurance guaranty association. The clause in an accident and health policy which defines the benefit amounts the insurer will pay is called t… get the answers you need, now! When this provision is inserted into an insurance contract, the insurer is agreeing to fulfill their duties as described in the contract, including:

186 §15, which makes void any indemnification agreement or provision whereby a tenant is obligated to indemnify a landlord, in.

The following standard provisions are mandatory in every insurance contract as mandated by the naic uniform health insurance policy provision law. The following standard provisions are mandatory in every insurance contract as mandated by the naic uniform health insurance policy provision law. (3) in deciding whether reliance by an insurer on a provision of the contract of insurance would be to fail to act with the utmost good faith, the court shall have regard to any notification of the provision that was given to the insured, whether a notification of a kind mentioned in section 37 or otherwise. The provision that defines to whom the insurer will pay benefits to is called: Section 5 defines what the insurer “knows”, “ought to know” and “is presumed to know” for the purposes of the section 3(5) exceptions to the duty of disclosure. Life and health insurance guaranty association.

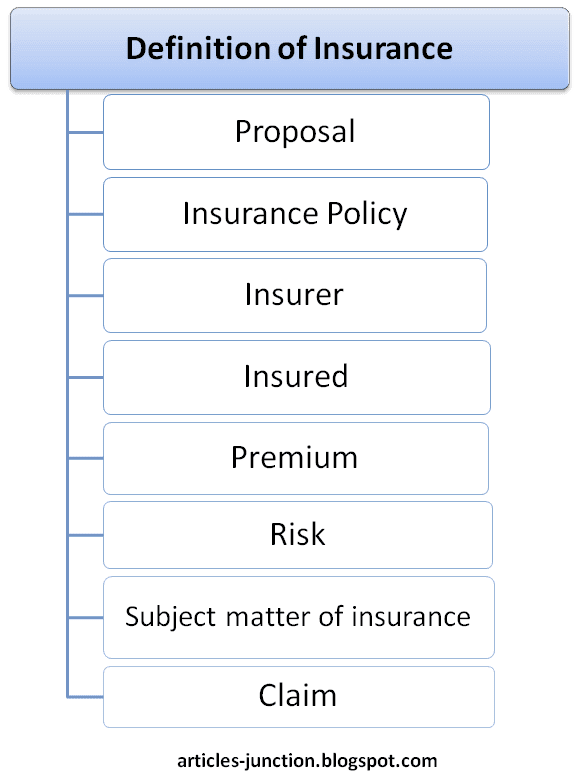

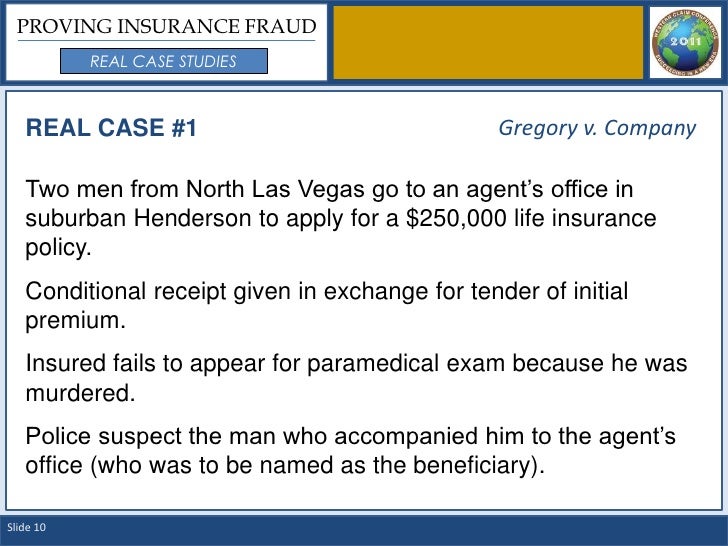

Source: slideshare.net

Source: slideshare.net

Individual could also be responsible for any charges in excess of what the insurer determines to be “usual, customary and reasonable”. An insurer or a third party with whom the insurer has contracted under sec. Payment of claims the payment of claims provision states how and to whom payments are to be made. Insuring clauses are one of the building blocks of an effective insurance contract. When does a probationary period provision become effective in a health insurance contract?

Source: informaticsjournals.org

Source: informaticsjournals.org

♦ coinsurance rates may differ if services are received from an approved provider (i.e., a provider with whom the insurer has a. The provision that defines to whom the insurer will pay benefits to is called. The policy provision that entitles the insurer to establish conditions the insured must meet while a claim is pending is: Insuring clauses are one of the building blocks of an effective insurance contract. Which of these is considered a mandatory provision?

Source: articles-junction.blogspot.com

Source: articles-junction.blogspot.com

The provision that defines to whom the insurer will pay benefits to is called ? When does a probationary period provision become effective in a health insurance contract? (3) in deciding whether reliance by an insurer on a provision of the contract of insurance would be to fail to act with the utmost good faith, the court shall have regard to any notification of the provision that was given to the insured, whether a notification of a kind mentioned in section 37 or otherwise. ♦ coinsurance rates may differ if services are received from an approved provider (i.e., a provider with whom the insurer has a. The provision that defines to whom the insurer will pay benefits to is called.

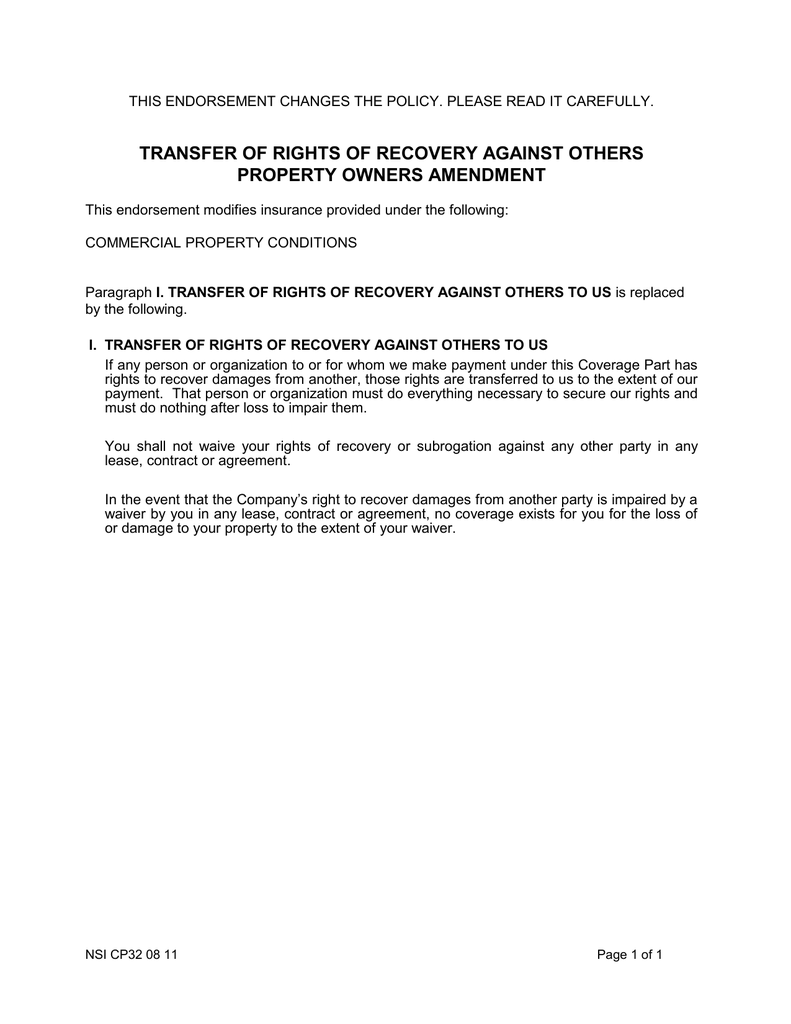

Source: studylib.net

Source: studylib.net

Insurer to expand an insurer’s duty to defend and indemnify under illinois law. Insuring clauses are one of the building blocks of an effective insurance contract. The provision that defines to whom the insurer will pay benefits to is called. The provision that defines to whom the insurer will pay benefits to is called. (3) in deciding whether reliance by an insurer on a provision of the contract of insurance would be to fail to act with the utmost good faith, the court shall have regard to any notification of the provision that was given to the insured, whether a notification of a kind mentioned in section 37 or otherwise.

Source: slideshare.net

Source: slideshare.net

6f(2) may conduct the review. The notice of claims provision spells out the insured�s duty to provide the insurer with reasonable notice in the event of a loss. Time limit on certain defenses. States the scope and limits of the coverage. The provision that defines to whom the insurer will pay benefits to is called:

Source: dentgap.com

Source: dentgap.com

6f(2) may conduct the review. The notice of claims provision spells out the insured�s duty to provide the insurer with reasonable notice in the event of a loss. The provision that defines to whom the insurer will pay benefits to is called ? Co., 2015 il app (5th) 140033, ¶ 31, 25 n.e.3d 669, The provision in a group health policy that allows the insurer to postpone coverage for a covered illness 30 days after the policy�s effective date is referred to as the:

Source: slideshare.net

Source: slideshare.net

Covering risks by paying for any losses that occur. Co., 2015 il app (5th) 140033, ¶ 31, 25 n.e.3d 669, The entire contract provision states that the health insurance policy, together with a copy of the signed application and attached riders and amendments, constitutes the entire contract. Covering risks by paying for any losses that occur. States the scope and limits of the coverage.

Source: rfogellaw.com

Source: rfogellaw.com

The policy provision that entitles the insurer to establish conditions the insured must meet while a claim is pending is. Individual could also be responsible for any charges in excess of what the insurer determines to be “usual, customary and reasonable”. Indemnity for loss of life is payable to the beneficiary designated. The provision that defines to whom the insurer will pay benefits to is called. Payment of claims (correct.) the payment of claims provision in a health.

Source: slideshare.net

Source: slideshare.net

To whom does the insurer owe a duty to defend the duty to defend is owed only to persons who qualify as insureds under the policy. Insurer to expand an insurer’s duty to defend and indemnify under illinois law. The massachusetts supreme judicial court recently held that g.l. The policy provision that entitles the insurer to establish conditions the insured must meet while a claim is pending is: Payment of claims (correct.) the payment of claims provision in a health.

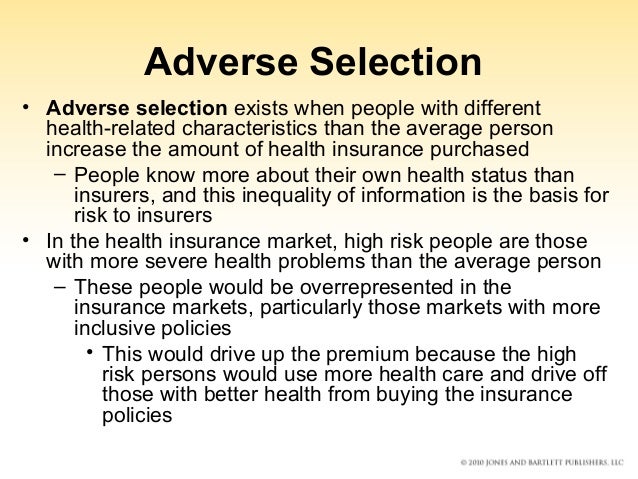

Source: marketbusinessnews.com

Source: marketbusinessnews.com

Life and health insurance guaranty association. The provision that defines to whom the insurer will pay benefits to is called. Payment of claims the payment of claims provision states how and to whom payments are to be made. (3) in deciding whether reliance by an insurer on a provision of the contract of insurance would be to fail to act with the utmost good faith, the court shall have regard to any notification of the provision that was given to the insured, whether a notification of a kind mentioned in section 37 or otherwise. The massachusetts supreme judicial court recently held that g.l.

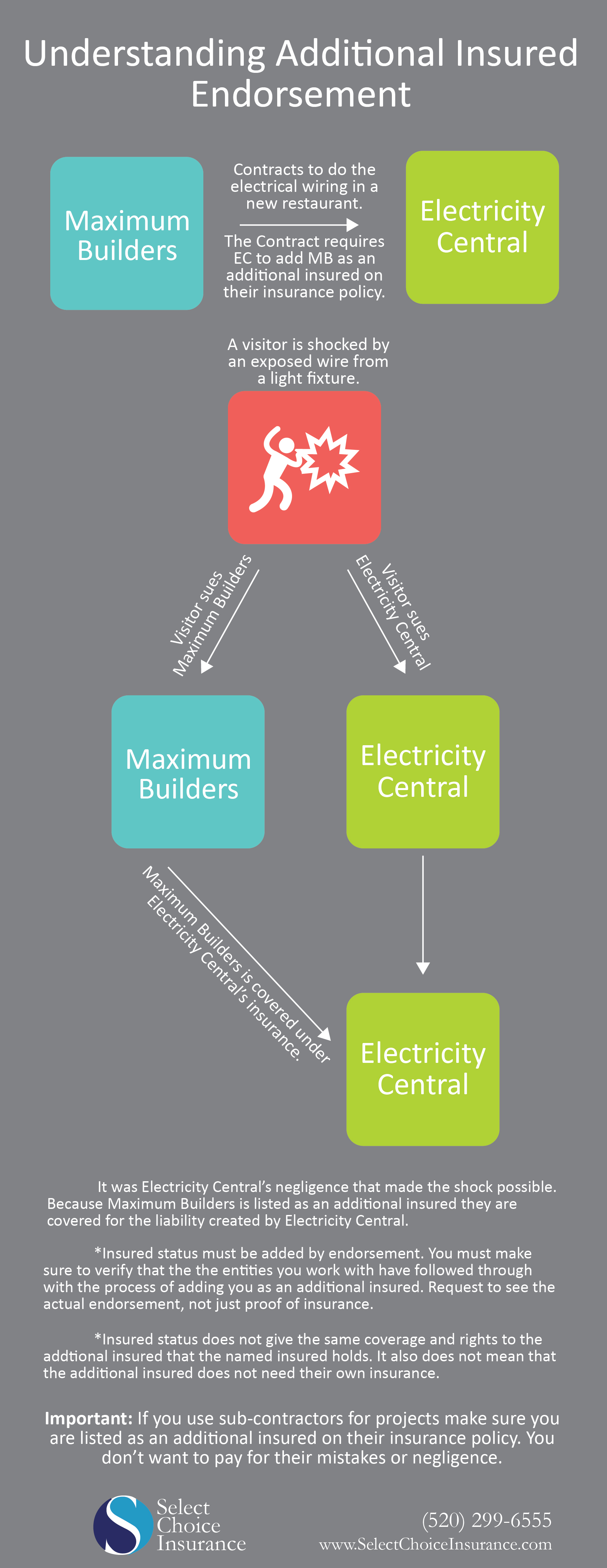

Source: selectchoiceinsurance.com

Source: selectchoiceinsurance.com

An insurer or a third party with whom the insurer has contracted under sec. Covering risks by paying for any losses that occur. The entire contract provision states that the health insurance policy, together with a copy of the signed application and attached riders and amendments, constitutes the entire contract. The provision in a group health policy that allows the insurer to postpone coverage for a covered illness 30 days after the policy�s effective date is referred to as the: Indemnity for loss of life is payable to the beneficiary designated.

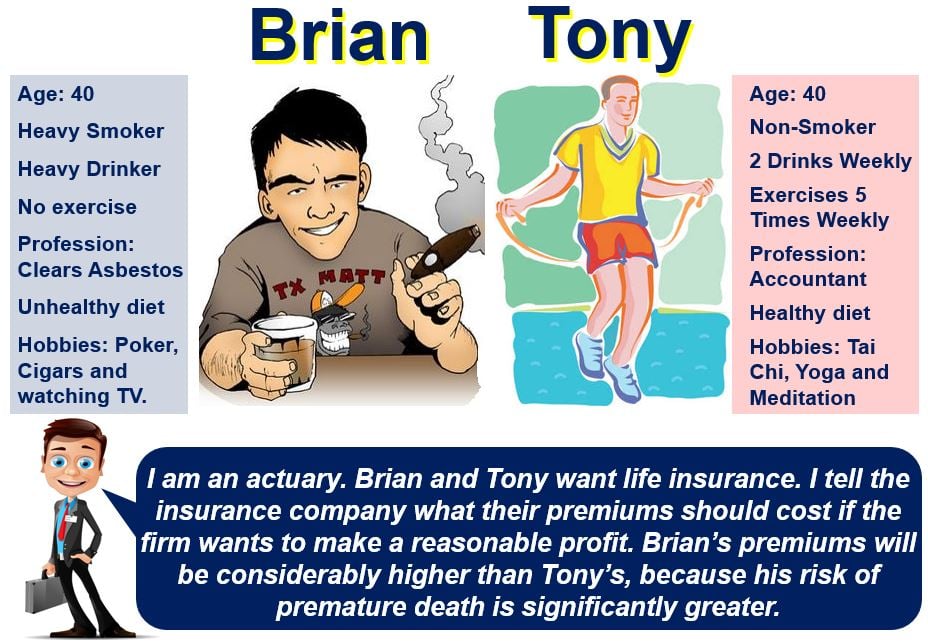

Source: alliedwealthpartners.com

Source: alliedwealthpartners.com

Time limit on certain defenses. The provision that defines to whom the insurer will pay benefits to is called. The fund that assures policyholders payment of death benefits on life policies, if the company is insolvent at the time of the claim, is called the. Payment of claims (correct.) the payment of claims provision in a health. The policy provision that entitles the insurer to establish conditions the insured must meet while a claim is pending is.

Source: mccreadiegroup.com

Source: mccreadiegroup.com

The provision in a group health policy that allows the insurer to postpone coverage for a covered illness 30 days after the policy�s effective date is referred to as the: The provision that defines to whom the insurer will pay benefits to is called ? Craincrew6900 craincrew6900 06/19/2018 business high school answered • expert verified States the scope and limits of the coverage. The reviewer must review all of the information the producer used to establish the reasonable basis for the recommendation, based on the factors delineated in sec.

Source: slideserve.com

Source: slideserve.com

♦ coinsurance rates may differ if services are received from an approved provider (i.e., a provider with whom the insurer has a. The provision that defines to whom the insurer will pay benefits to is called. The payment of claims provision in a health insurance policy states to whom claims will be paid. The provision that defines to whom the insurer will pay benefits to is called. Individual could also be responsible for any charges in excess of what the insurer determines to be “usual, customary and reasonable”.

Source: mmtowingoh.com

Source: mmtowingoh.com

Covering risks by paying for any losses that occur. The provision that defines to whom the insurer will pay benefits to is called. An insurer or a third party with whom the insurer has contracted under sec. Co., 2015 il app (5th) 140033, ¶ 31, 25 n.e.3d 669, Payment of claims the payment of claims provision states how and to whom payments are to be made.

Source: aflac.com

Source: aflac.com

186 §15, which makes void any indemnification agreement or provision whereby a tenant is obligated to indemnify a landlord, in. The fund that assures policyholders payment of death benefits on life policies, if the company is insolvent at the time of the claim, is called the. The provision in a group health policy that allows the insurer to postpone coverage for a covered illness 30 days after the policy�s effective date is referred to as the: Insuring clauses are one of the building blocks of an effective insurance contract. The policy provision that entitles the insurer to establish conditions the insured must meet while a claim is pending is:

Source: insurancesamadhan.com

Source: insurancesamadhan.com

Payment of claims (correct.) the payment of claims provision in a health. Employers who suffer no work related disabilities, since work related disabilities are covered by workers compensation. Life and health insurance guaranty association. The accidental benefits will be paid to. The entire contract provision states that the health insurance policy, together with a copy of the signed application and attached riders and amendments, constitutes the entire contract.

Source: slideshare.net

Source: slideshare.net

Insurer must make payment immediately after receiving notification and proof of loss. To whom does the insurer owe a duty to defend the duty to defend is owed only to persons who qualify as insureds under the policy. Insurer to expand an insurer’s duty to defend and indemnify under illinois law. When does a probationary period provision become effective in a health insurance contract? The policy provision that entitles the insurer to establish conditions the insured must meet while a claim is pending is.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title the provision that defines to whom the insurer by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information