The type of term insurance that provides increasing death benefits Idea

Home » Trending » The type of term insurance that provides increasing death benefits IdeaYour The type of term insurance that provides increasing death benefits images are available in this site. The type of term insurance that provides increasing death benefits are a topic that is being searched for and liked by netizens today. You can Find and Download the The type of term insurance that provides increasing death benefits files here. Find and Download all royalty-free images.

If you’re searching for the type of term insurance that provides increasing death benefits images information related to the the type of term insurance that provides increasing death benefits keyword, you have come to the right blog. Our website frequently gives you suggestions for refferencing the highest quality video and image content, please kindly surf and locate more informative video content and graphics that fit your interests.

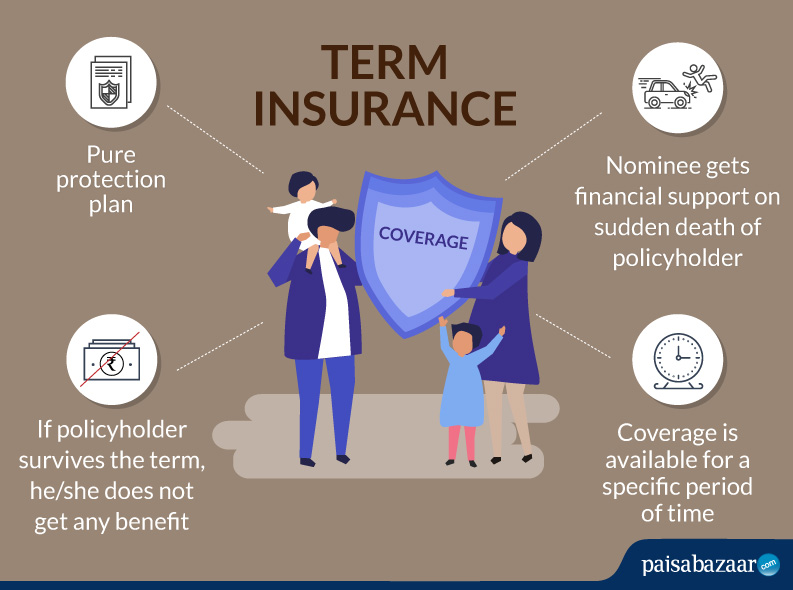

The Type Of Term Insurance That Provides Increasing Death Benefits. The most common term life insurance policies last 10, 20 or 30 years. D.) the insured only has to pay on this type of policy for a certain number of years. Increasing term increasing term insurance provides a death benefit that from aa 1 Affordable premium, life coverage with financial security and income tax benefits is an important feature of term insurance plans.

What are the Benefits of Life Insurance in 2020 Benefits From pinterest.com

What are the Benefits of Life Insurance in 2020 Benefits From pinterest.com

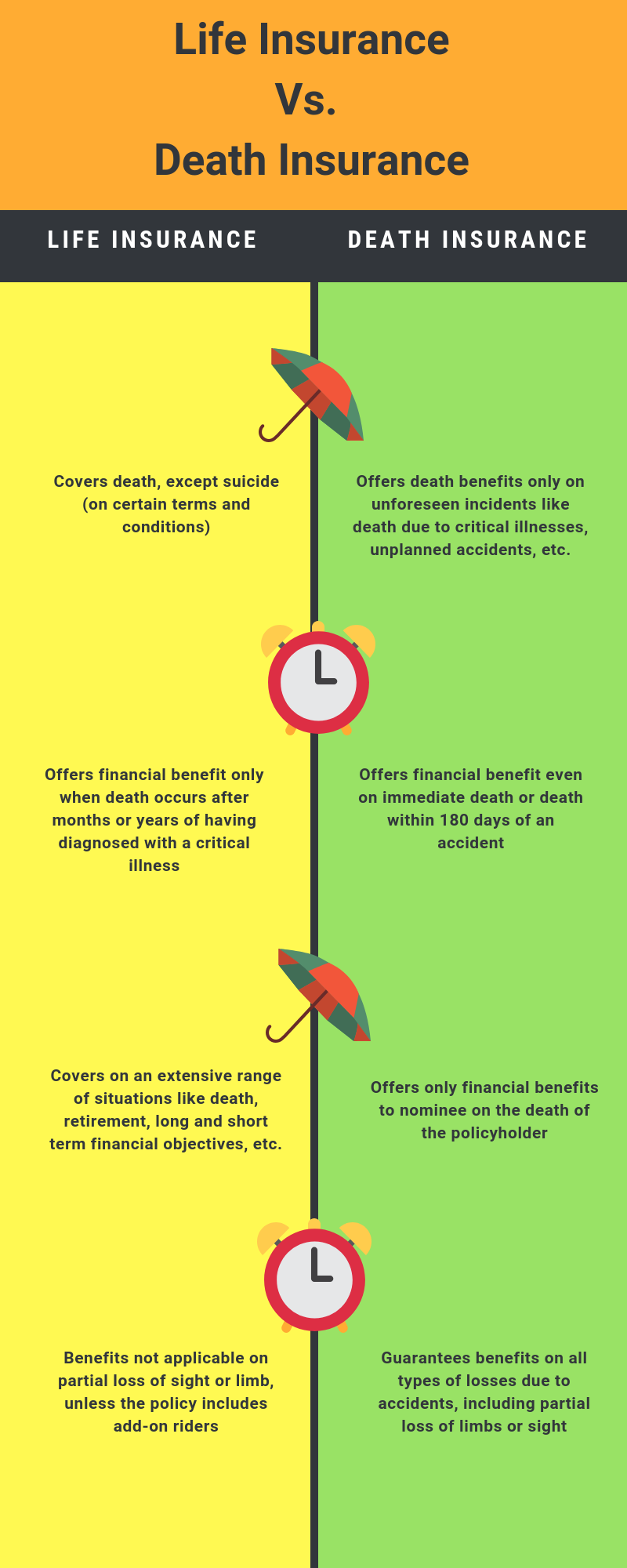

A level death benefit is a type of payout associated with life insurance policies. When the term is up you stop paying, and you no longer have coverage. C.) ordinary whole life insurance has some value as an investment. Contrast with decreasing term life insurance. If you�ve chosen a term life policy of 20 years, and pay the premium, your beneficiaries receive your death benefit if you die during that time. It means that the death benefit paid to the life insurance policy’s beneficiaries is.

Increasing term increasing term insurance provides a death benefit that from aa 1

Increasing term increasing term insurance provides a death benefit that from aa 1 Home » unlabelled increasing term insurance death benefit : Decreasing term policies policy that features a level premium and a death benefit that decreases each year over the duration of the policy term. If you die after the term, your beneficiary receives nothing. When the term is up you stop paying, and you no longer have coverage. The type of term insurance that provides increasing death benefits as the insured ages is called?

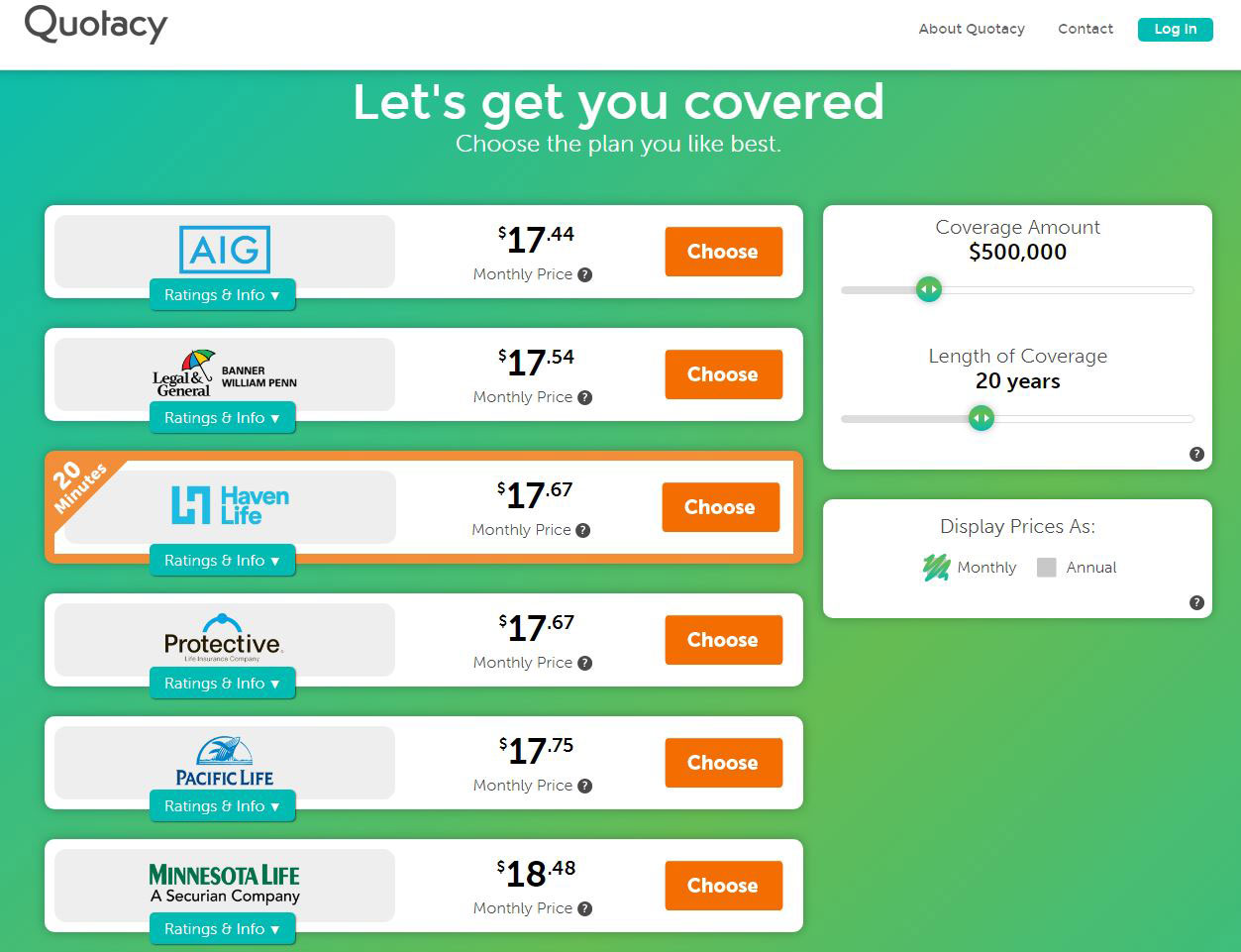

Source: quotacy.com

Source: quotacy.com

A.) the insured pays premiums on this type of insurance until his death. Contrast with decreasing term life insurance. Ad compare & save on life insurance plans designed for expats & foreign citizens abroad. Term insurance is a pure life insurance product, which provides financial protection to the policyholder. If you�ve chosen a term life policy of 20 years, and pay the premium, your beneficiaries receive your death benefit if you die during that time.

Source: 99employee.com

Source: 99employee.com

If you�ve chosen a term life policy of 20 years, and pay the premium, your beneficiaries receive your death benefit if you die during that time. Contrast with decreasing term life insurance. 233 increasing term increasing term insurance provides a death benefit that from aa 1 Term insurance is a type of life insurance policy that provides coverage for a certain period of time or a specified term of years. If you die during this time, your beneficiary receives a death benefit from the life insurance company.

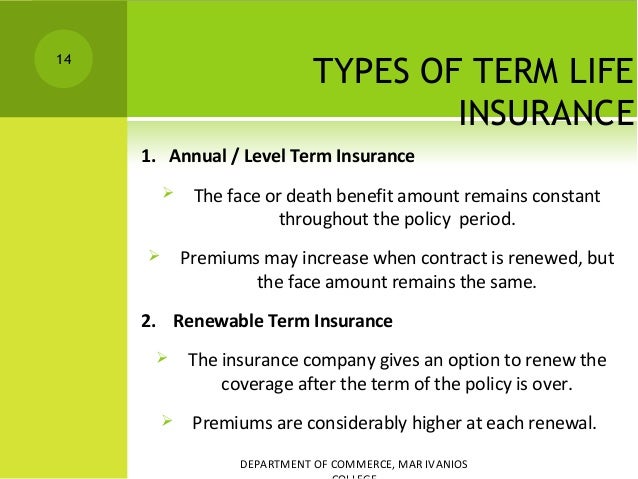

Source: slideshare.net

Source: slideshare.net

If you expect to outlive the term, you�d better get another one, extend it or convert to a permanent policy. Increases each year with the age of the insured. In a whole life policy with a level death benefit, fees and sales charges are deducted from the premium and the remainder is credited to the cash value. The cost of insurance is then deducted from the cash value each month. Contrast with decreasing term life insurance.

Source: westernsouthern.com

Source: westernsouthern.com

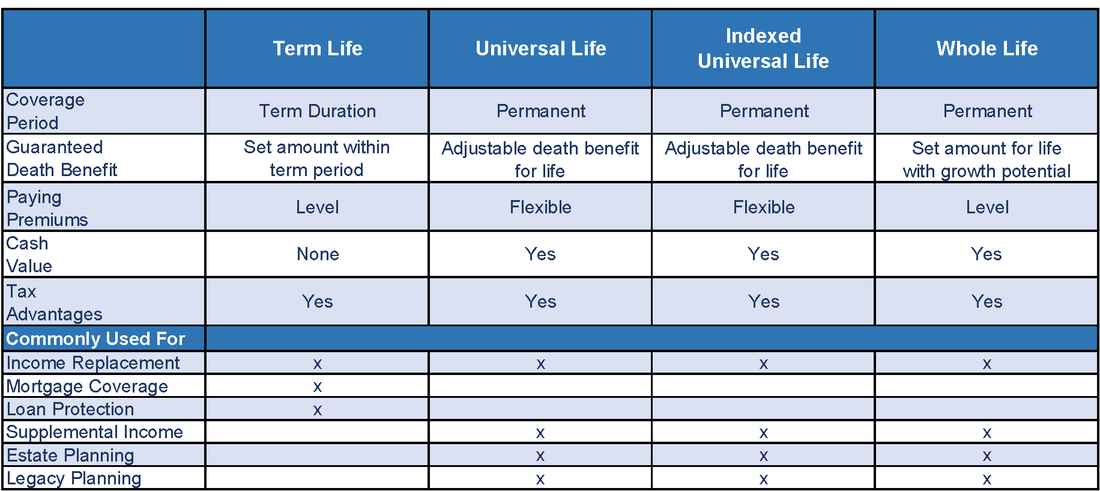

Increases each year with the age of the insured. Increasing term annually renewable term policies provide a level death benefit for a premium that? With a level death benefit, the life insurance payout amount stays the same throughout the duration of the policy. A level death benefit is a type of payout associated with life insurance policies. Two common death benefit types are level death benefits and increasing death benefits.

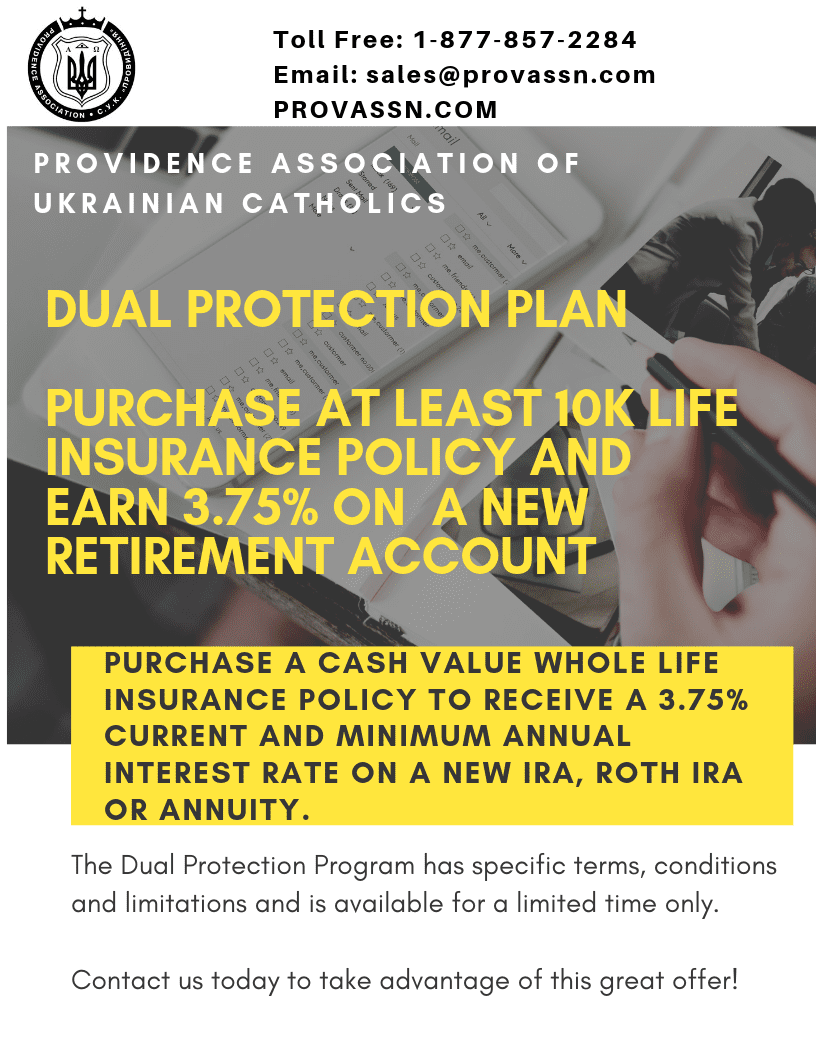

Source: provassn.com

Source: provassn.com

The most common term life insurance policies last 10, 20 or 30 years. In a whole life policy with a level death benefit, fees and sales charges are deducted from the premium and the remainder is credited to the cash value. The type of term insurance that provides increasing death benefits as the insured ages is called? If you die after the term, your beneficiary receives nothing. If you die during this time, your beneficiary receives a death benefit from the life insurance company.

Source: youraffordablelife.com

Source: youraffordablelife.com

A level death benefit is a type of payout associated with life insurance policies. C.) ordinary whole life insurance has some value as an investment. Increasing term increasing term insurance provides a death benefit that from aa 1 Term insurance is a pure life insurance product, which provides financial protection to the policyholder. If you die after the term, your beneficiary receives nothing.

Source: paisabazaar.com

Source: paisabazaar.com

When the term is up you stop paying, and you no longer have coverage. Home » unlabelled increasing term insurance death benefit : The cost of insurance is then deducted from the cash value each month. It means that the death benefit paid to the life insurance policy’s beneficiaries is. With a level death benefit, the life insurance payout amount stays the same throughout the duration of the policy.

Source: policybazaar.com

Source: policybazaar.com

The most common term life insurance policies last 10, 20 or 30 years. When the term is up you stop paying, and you no longer have coverage. Term life insurance policies usually offer a level death benefit. Most term life policies are level, meaning your premiums are. If you die during this time, your beneficiary receives a death benefit from the life insurance company.

Source: aegonlife.com

Source: aegonlife.com

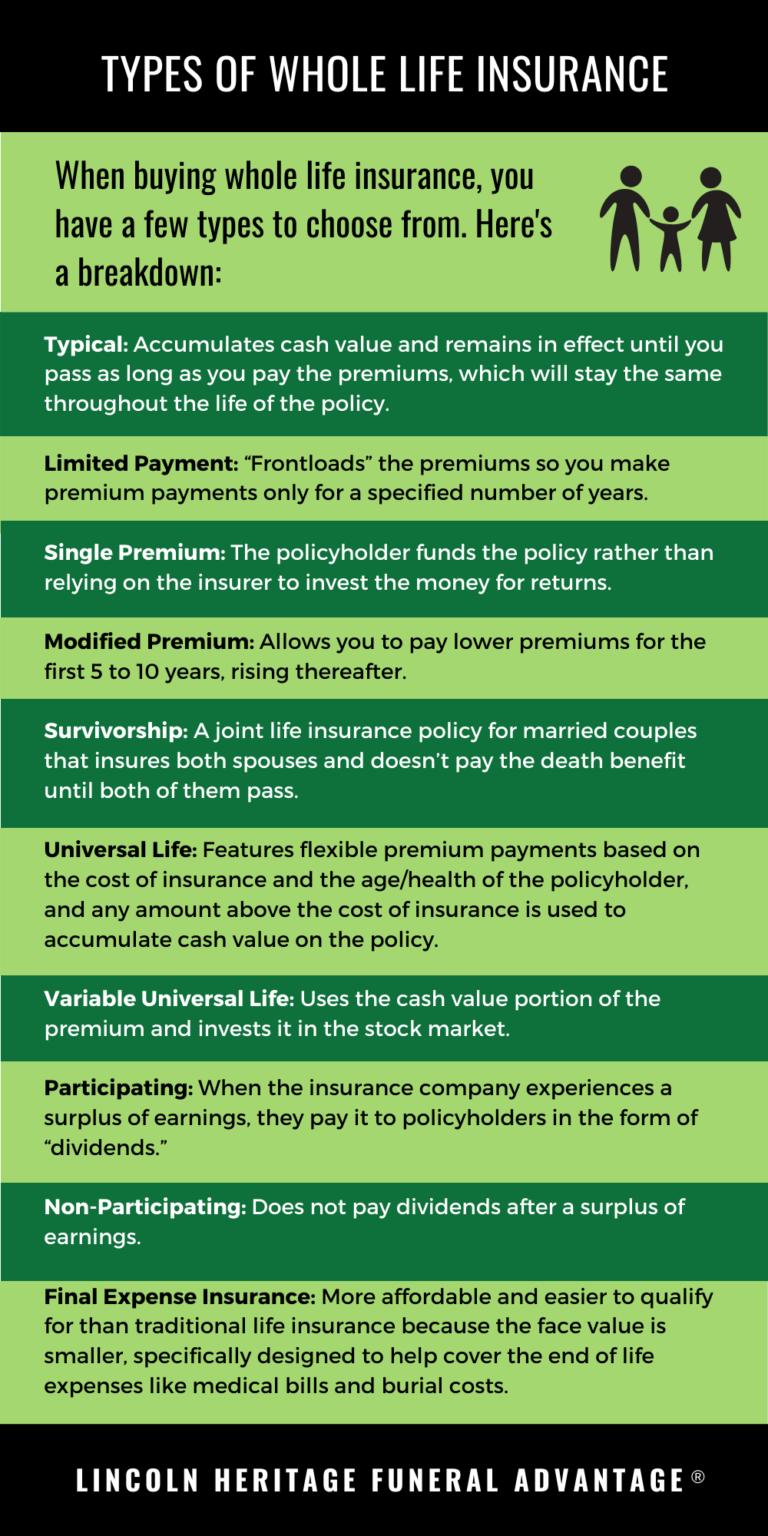

Some universal and whole life insurance policies also offer a level death benefit, but. Increasing term increasing term insurance provides a death benefit that from aa 1 The purest form of level term insurance that offers the most insurance at the lowest cost level premium provides a level death benefit and a level premium during the policy term. Ad compare & save on life insurance plans designed for expats & foreign citizens abroad. In a whole life policy with a level death benefit, fees and sales charges are deducted from the premium and the remainder is credited to the cash value.

Source: insuringgurgaon.com

Source: insuringgurgaon.com

Decreasing term policies policy that features a level premium and a death benefit that decreases each year over the duration of the policy term. It means that the death benefit paid to the life insurance policy’s beneficiaries is. Term life insurance policies usually offer a level death benefit. The type of term insurance that provides increasing death benefits as the insured ages is called grace period what required provision protects against unintentional lapse of the policy? A level death benefit is a type of payout associated with life insurance policies.

Source: provassn.com

Source: provassn.com

233 increasing term increasing term insurance provides a death benefit that from aa 1 Your client wants both protection and savings from the insurance, and is willing to pay premiums until retirement at age 65. In case of death of the insured during the policy period, the beneficiary receives a death benefit as defined under the chosen term insurance plan. 233 increasing term increasing term insurance provides a death benefit that from aa 1 A type of term life insurance that provides a death benefit that increases by some specified amount or percentage at stated intervals over the policy term.

Source: lifeinsuranceblog.net

Source: lifeinsuranceblog.net

233 increasing term increasing term insurance provides a death benefit that from aa 1 In a whole life policy with a level death benefit, fees and sales charges are deducted from the premium and the remainder is credited to the cash value. If you expect to outlive the term, you�d better get another one, extend it or convert to a permanent policy. 233 increasing term increasing term insurance provides a death benefit that from aa 1 B.) ordinary whole life insurance covers the insured for the stated term of the policy.

Source: lhlic.com

Source: lhlic.com

C.) ordinary whole life insurance has some value as an investment. The cost of insurance is then deducted from the cash value each month. If you die during this time, your beneficiary receives a death benefit from the life insurance company. C.) ordinary whole life insurance has some value as an investment. Two common death benefit types are level death benefits and increasing death benefits.

Source: meetrv.com

Source: meetrv.com

233 increasing term increasing term insurance provides a death benefit that from aa 1 The purest form of level term insurance that offers the most insurance at the lowest cost level premium provides a level death benefit and a level premium during the policy term. C.) ordinary whole life insurance has some value as an investment. Term insurance is a pure life insurance product, which provides financial protection to the policyholder. The most common term life insurance policies last 10, 20 or 30 years.

Source: coverfox.com

Source: coverfox.com

A level death benefit is a type of payout associated with life insurance policies. If you die after the term, your beneficiary receives nothing. The most common term life insurance policies last 10, 20 or 30 years. Contrast with decreasing term life insurance. With a level death benefit, the life insurance payout amount stays the same throughout the duration of the policy.

Source: provassn.com

Source: provassn.com

If you expect to outlive the term, you�d better get another one, extend it or convert to a permanent policy. Term insurance is a pure life insurance product, which provides financial protection to the policyholder. If you expect to outlive the term, you�d better get another one, extend it or convert to a permanent policy. In a whole life policy with a level death benefit, fees and sales charges are deducted from the premium and the remainder is credited to the cash value. B.) ordinary whole life insurance covers the insured for the stated term of the policy.

Source: pinterest.com

Source: pinterest.com

A.) the insured pays premiums on this type of insurance until his death. It means that the death benefit paid to the life insurance policy’s beneficiaries is. If you die after the term, your beneficiary receives nothing. Term life insurance policies usually offer a level death benefit. Most term life policies are level, meaning your premiums are.

Source: ifec.org.hk

Source: ifec.org.hk

Term insurance is a type of life insurance policy that provides coverage for a certain period of time or a specified term of years. When the term is up you stop paying, and you no longer have coverage. Term insurance is a type of life insurance policy that provides coverage for a certain period of time or a specified term of years. If you�ve chosen a term life policy of 20 years, and pay the premium, your beneficiaries receive your death benefit if you die during that time. A level death benefit is a type of payout associated with life insurance policies.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title the type of term insurance that provides increasing death benefits by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information