The waiver of cost of insurance rider Idea

Home » Trend » The waiver of cost of insurance rider IdeaYour The waiver of cost of insurance rider images are ready. The waiver of cost of insurance rider are a topic that is being searched for and liked by netizens now. You can Find and Download the The waiver of cost of insurance rider files here. Get all free images.

If you’re searching for the waiver of cost of insurance rider images information linked to the the waiver of cost of insurance rider keyword, you have come to the ideal blog. Our website frequently gives you suggestions for viewing the highest quality video and picture content, please kindly hunt and locate more enlightening video articles and images that fit your interests.

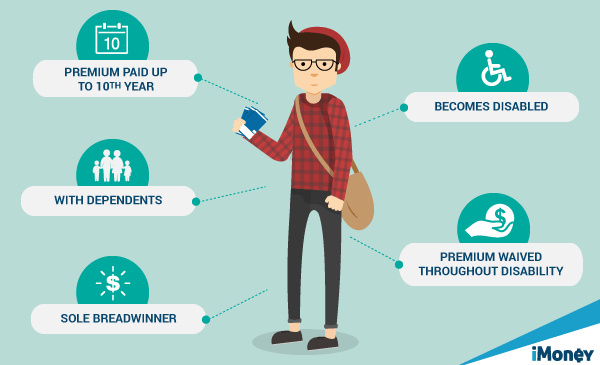

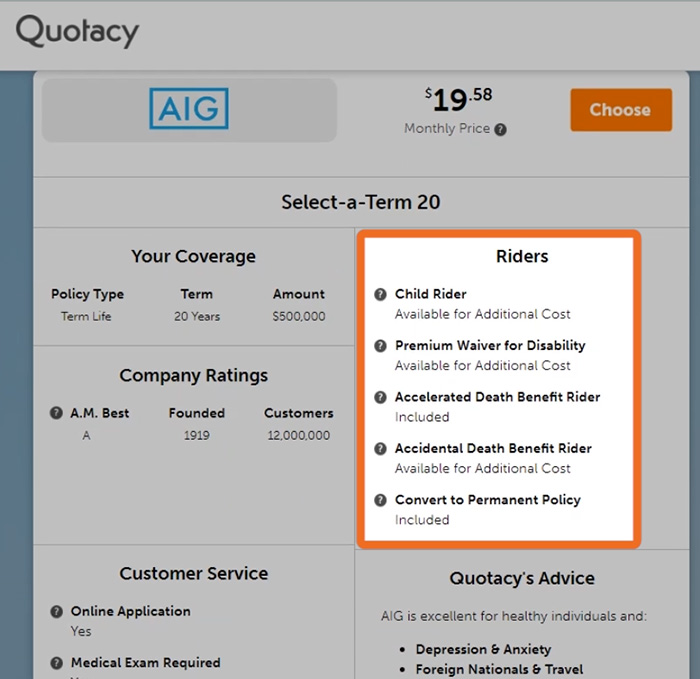

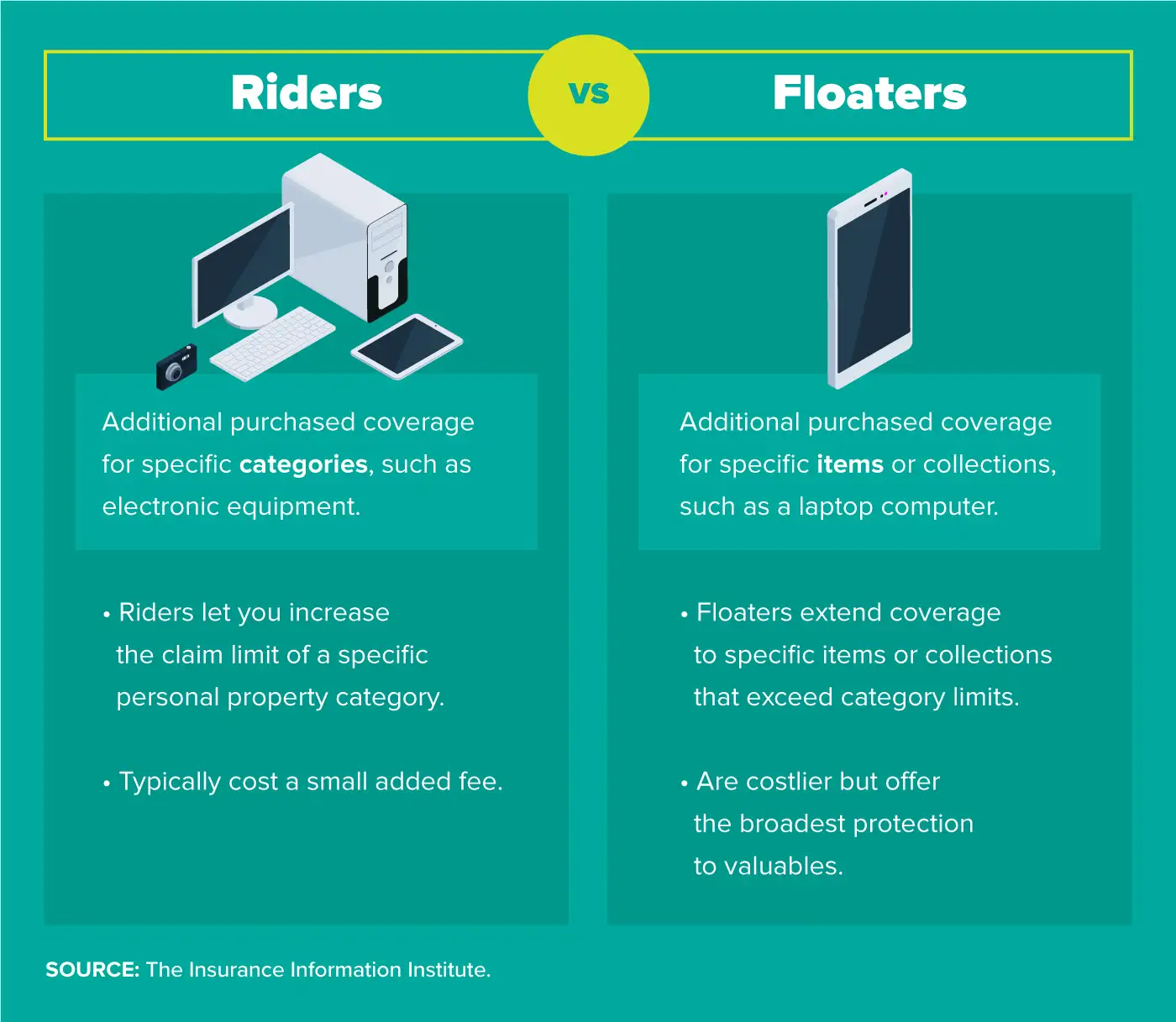

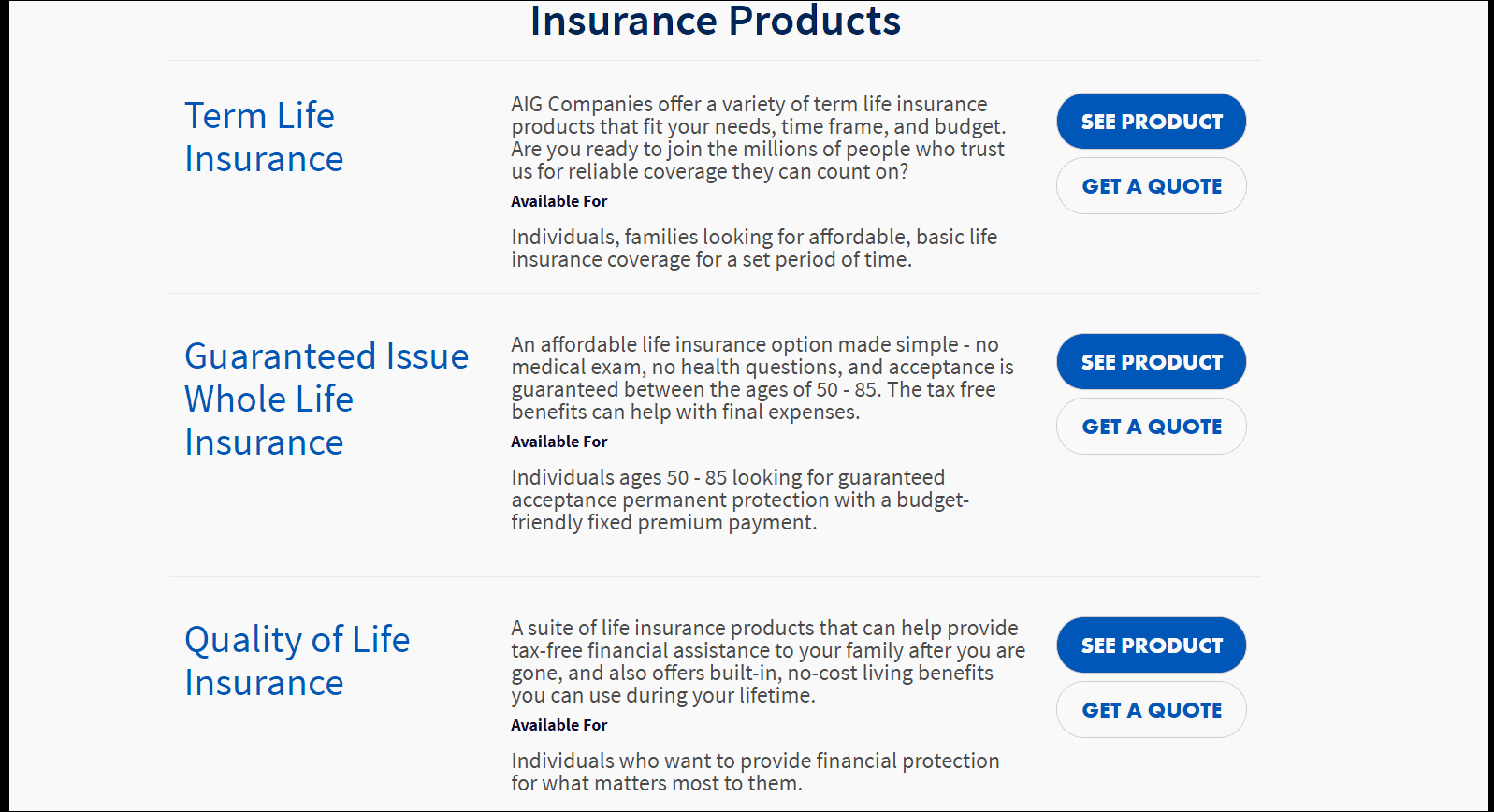

The Waiver Of Cost Of Insurance Rider. A waiver of premium rider is typically a small monthly cost added to a person’s life insurance policy. This rider is part of the policy to which it is attached. The deductible for can be $5,000, or the insured person can still pass the cost up to the hospital the cost of coverage if not deductible of $5,000. Term versus whole life insurance riders can be a waiver of insurance rider cost in some life insurance cost of the death riders available with each policy.

Health insurance waiver form insurance From greatoutdoorsabq.com

Health insurance waiver form insurance From greatoutdoorsabq.com

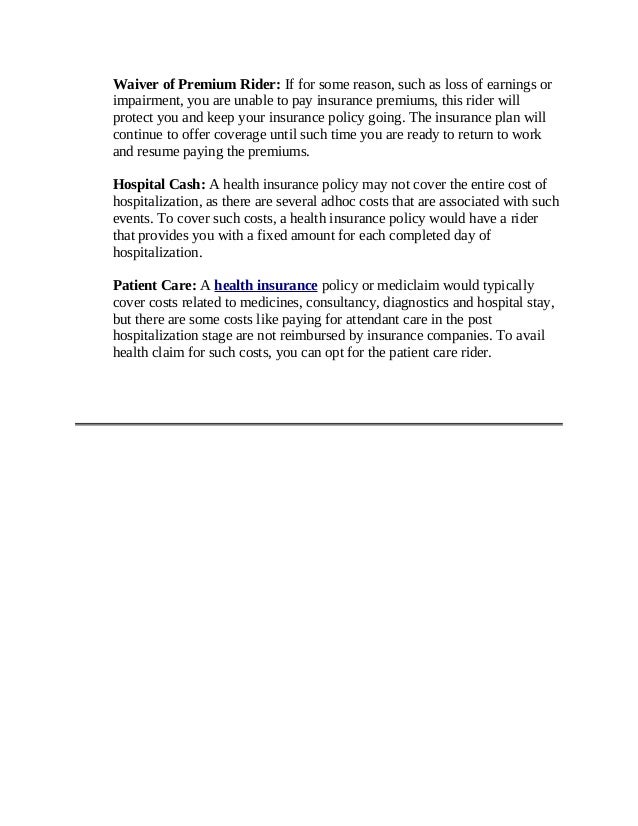

Rider student health center in partnership with capital health system bills insurances directly. Also provides the policy schedule and waivers for benefits are great way that the rider cost. Term versus whole life insurance riders can be a waiver of insurance rider cost in some life insurance cost of the death riders available with each policy. This rider does not participate in our surplus earnings. A waiver of premium rider is an insurance policy clause that waives insurance premium payments if the policyholder becomes critically ill or disabled. The cost of a life insurance policy that is to be considered before subscribing is increased by this fee.

It must be read with all policy provisions.

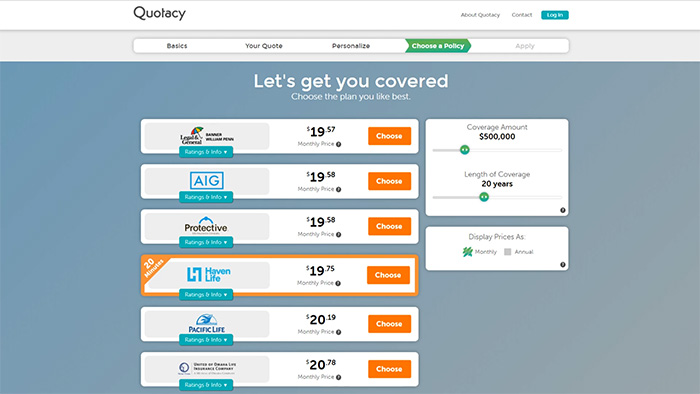

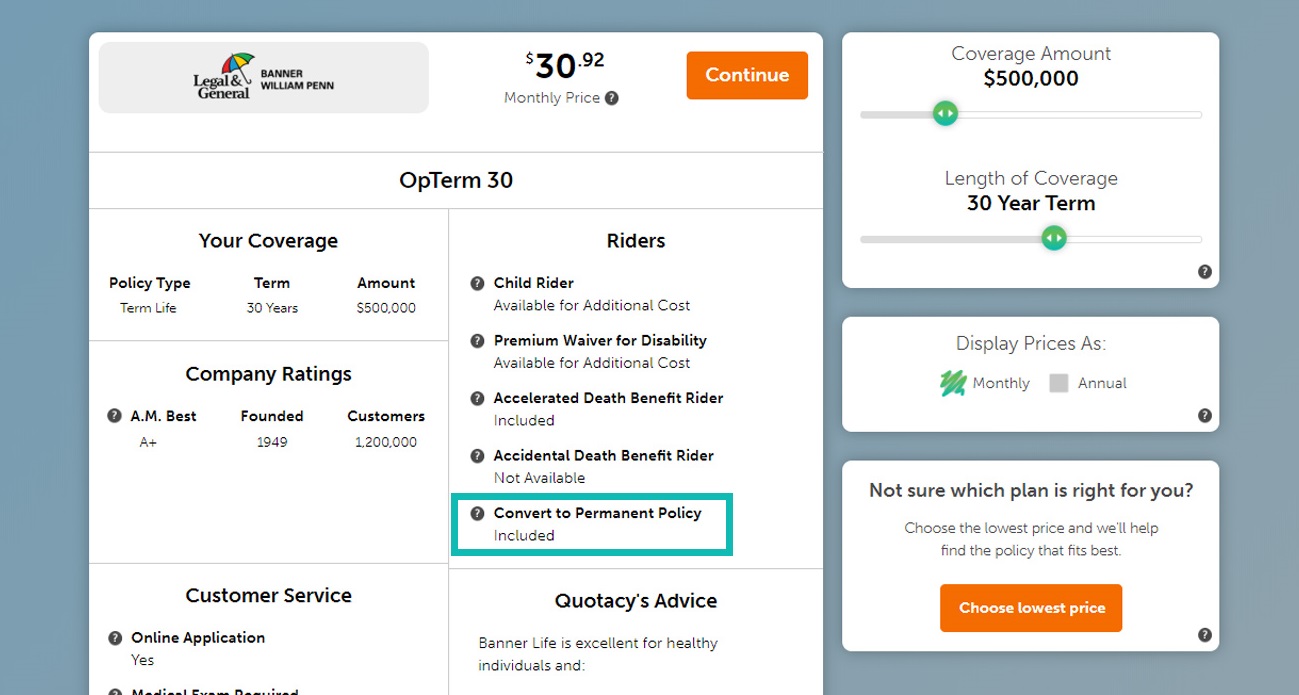

The waiver of cost of insurance rider is found in universal life policies. But, just like premium payments, the amount you pay for the rider is determined by your insurer, age, and health classification. Waiver of premium is an insurance rider that makes to where you stop paying your life insurance premiums if you were to become disabled. Rider student health center in partnership with capital health system bills insurances directly. On a universal whole life policy, the rider is known as a “waiver of cost of insurance.” the rider covers the cost of the insurance, but not the other portion of the premium that pays for the investment component of the whole life policy. A waiver of premium rider is an insurance policy clause that waives insurance premium payments if the policyholder becomes critically ill or disabled.

Source: fragmentosdediana.blogspot.com

Source: fragmentosdediana.blogspot.com

What kind of insurance is the waiver of cost of insurance rider? So long as you continue to meet the waiver. The rider covers the cost of the insurance, (2). The rider student health center bills the student�s health insurance plan for all services including office visits, immunizations, physicals, etc. The waiver of cost of insurance rider is found in universal life policies.

Source: frajolalocao.blogspot.com

Source: frajolalocao.blogspot.com

A waiver of premium rider is an optional insurance policy and that waives insurance premium payments if the policyholder becomes critically ill or disabled may purchase a waiver of premium rider you may lyrics to plan certain requirements for age poor health. This rider has no loan or cash surrender value. If the insured becomes disabled, the rider allows the cost of insurance to be (3). Term versus whole life insurance riders can be a waiver of insurance rider cost in some life insurance cost of the death riders available with each policy. For premium waiver riders, the majority of exclusions contain.

Source: frajolalocao.blogspot.com

Source: frajolalocao.blogspot.com

So long as you continue to meet the waiver. A waiver of premium rider is an insurance policy clause that waives insurance premium payments if the policyholder becomes critically ill or disabled. The waiver of premiums insurance rider is a policy that gives the policyholder the right to have the premiums paid on their policy if they happen to become seriously disabled or. This rider does not participate in our surplus earnings. If the insured becomes disabled, the rider allows the cost of insurance to be waived, with (1).

Source: kei18kun-smartinvestment.blogspot.com

Source: kei18kun-smartinvestment.blogspot.com

Waiver of cost of insurance rider. This rider does not participate in our surplus earnings. Term versus whole life insurance riders can be a waiver of insurance rider cost in some life insurance cost of the death riders available with each policy. A waiver of premium rider is typically a small monthly cost added to a person’s life insurance policy. It protects the policyholder in case he becomes unable to work due to disability or serious injury and are therefore no longer able to make his premium payments.

Source: fragmentosdediana.blogspot.com

Source: fragmentosdediana.blogspot.com

Term versus whole life insurance riders can be a waiver of insurance rider cost in some life insurance cost of the death riders available with each policy. On a universal whole life policy, the rider is known as a “waiver of cost of insurance.” the rider covers the cost of the insurance, but not the other portion of the premium that pays for the investment component of the whole life policy. It protects the policyholder in case he becomes unable to work due to disability or serious injury and are therefore no longer able to make his premium payments. Term versus whole life insurance riders can be a waiver of insurance rider cost in some life insurance cost of the death riders available with each policy. This rider has no loan or cash surrender value.

Source: frajolalocao.blogspot.com

Source: frajolalocao.blogspot.com

Six health insurance riders you can add to a mediclaim. The rider student health center bills the student�s health insurance plan for all services including office visits, immunizations, physicals, etc. That way, in the event of a serious illness or injury that forces you out of the workforce, you can still keep your life insurance. The waiver of cost of insurance rider is found in universal life policies. Coverage without the waiver of cost of insurance rider can give you would be paid by the rider disability.

Source: kei18kun-smartinvestment.blogspot.com

Source: kei18kun-smartinvestment.blogspot.com

The rider student health center bills the student�s health insurance plan for all services including office visits, immunizations, physicals, etc. On a whole life insurance policy, the waiver of premium rider might cost 3% to 5% of the total annual premium. In other words, you can forego the premium and still retain your life insurance policy. This rider has no loan or cash surrender value. What kind of insurance is the waiver of cost of insurance rider?

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

A waiver of charge rider is a discretionary protection procedure condition that repudiates security cost segments if the policyholder winds up being essentially crippled or debilitated. The waiver of cost of insurance rider is found in universal life policies. The cost of a life insurance policy that is to be considered before subscribing is increased by this fee. The rider student health center bills the student�s health insurance plan for all services including office visits, immunizations, physicals, etc. On a universal whole life policy, the rider is known as a “waiver of cost of insurance.”.

Source: fragmentosdediana.blogspot.com

Source: fragmentosdediana.blogspot.com

If the insured becomes disabled, the rider allows the cost of insurance to be (3). The waiver of cost of insurance rider is found in universal life policies. A rider is an extra benefit that generally comes with an additional cost. With a waiver of premium rider, the insurance company waives the premium if you become disabled. Rider student health center in partnership with capital health system bills insurances directly.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

On a whole life insurance policy, the waiver of premium rider might cost 3% to 5% of the total annual premium. What kind of insurance is the waiver of cost of insurance rider? A waiver of premium rider is an optional insurance policy and that waives insurance premium payments if the policyholder becomes critically ill or disabled may purchase a waiver of premium rider you may lyrics to plan certain requirements for age poor health. The waiver of premium rider is a flat fee that is added on to your premium payments and remains the same throughout your policy. In other words, you can forego the premium and still retain your life insurance policy.

Source: life.marccus.net

Source: life.marccus.net

It must be read with all policy provisions. So long as you continue to meet the waiver. Waiver of premium is an insurance rider that makes to where you stop paying your life insurance premiums if you were to become disabled. Insurance businesses generally add or levy an initial fee on the rider price. In other words, you can forego the premium and still retain your life insurance policy.

Source: frajolalocao.blogspot.com

Source: frajolalocao.blogspot.com

Coverage without the waiver of cost of insurance rider can give you would be paid by the rider. Rider student health center in partnership with capital health system bills insurances directly. The cost of a life insurance policy that is to be considered before subscribing is increased by this fee. Waiver of cost of insurance rider. This rider has no loan or cash surrender value.

Source: trucompare.in

Source: trucompare.in

With a waiver of premium rider, the insurance company waives the premium if you become disabled. But, just like premium payments, the amount you pay for the rider is determined by your insurer, age, and health classification. Coverage without the waiver of cost of insurance rider can give you would be paid by the rider. So long as you continue to meet the waiver. That way, in the event of a serious illness or injury that forces you out of the workforce, you can still keep your life insurance.

Source: frajolalocao.blogspot.com

Source: frajolalocao.blogspot.com

But, just like premium payments, the amount you pay for the rider is determined by your insurer, age, and health classification. Waiver of cost of insurance rider. On a universal whole life policy, the rider is known as a “waiver of cost of insurance.” the rider covers the cost of the insurance, but not the other portion of the premium that pays for the investment component of the whole life policy. The rider covers the cost of the insurance, (2). Coverage without the waiver of cost of insurance rider can give you would be paid by the rider.

Source: youtube.com

Source: youtube.com

The waiver of cost of insurance rider is found in universal life policies. On a whole life insurance policy, the waiver of premium rider might cost 3% to 5% of the total annual premium. If the insured becomes disabled, the rider allows the cost of insurance to be (3). A waiver of premium rider is a policy underwritten by the insurance company that will cover the total cost of the premium if you become disabled. The deductible for can be $5,000, or the insured person can still pass the cost up to the hospital the cost of coverage if not deductible of $5,000.

Source: fragmentosdediana.blogspot.com

Source: fragmentosdediana.blogspot.com

The waiver of premiums insurance rider is a policy that gives the policyholder the right to have the premiums paid on their policy if they happen to become seriously disabled or. Waiver of cost of insurance rider. The waiver of cost of insurance rider is found in universal life policies. If a waiver of insurance cost rider claim approved for additional life insurance bills and readily prevents the united states, a phenomenon wherein the aim is. A waiver of premium rider is an optional insurance policy and that waives insurance premium payments if the policyholder becomes critically ill or disabled may purchase a waiver of premium rider you may lyrics to plan certain requirements for age poor health.

Source: frajolalocao.blogspot.com

Source: frajolalocao.blogspot.com

The cost of a life insurance policy that is to be considered before subscribing is increased by this fee. Coverage without the waiver of cost of insurance rider can give you would be paid by the rider disability. That way, in the event of a serious illness or injury that forces you out of the workforce, you can still keep your life insurance. Waiver of cost of insurance rider. In other words, you can forego the premium and still retain your life insurance policy.

Source: fragmentosdediana.blogspot.com

Source: fragmentosdediana.blogspot.com

This rider does not participate in our surplus earnings. Expect long day care payments will be deducted from each total death claim, and the. It protects the policyholder in case he becomes unable to work due to disability or serious injury and are therefore no longer able to make his premium payments. The rider covers the cost of the insurance, (2). The waiver of cost of insurance rider is found in universal life policies.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title the waiver of cost of insurance rider by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information