Third party insurance for car price list 2019 information

Home » Trending » Third party insurance for car price list 2019 informationYour Third party insurance for car price list 2019 images are ready in this website. Third party insurance for car price list 2019 are a topic that is being searched for and liked by netizens now. You can Find and Download the Third party insurance for car price list 2019 files here. Find and Download all royalty-free images.

If you’re searching for third party insurance for car price list 2019 images information related to the third party insurance for car price list 2019 interest, you have pay a visit to the ideal site. Our website frequently gives you suggestions for downloading the maximum quality video and picture content, please kindly search and locate more informative video content and images that match your interests.

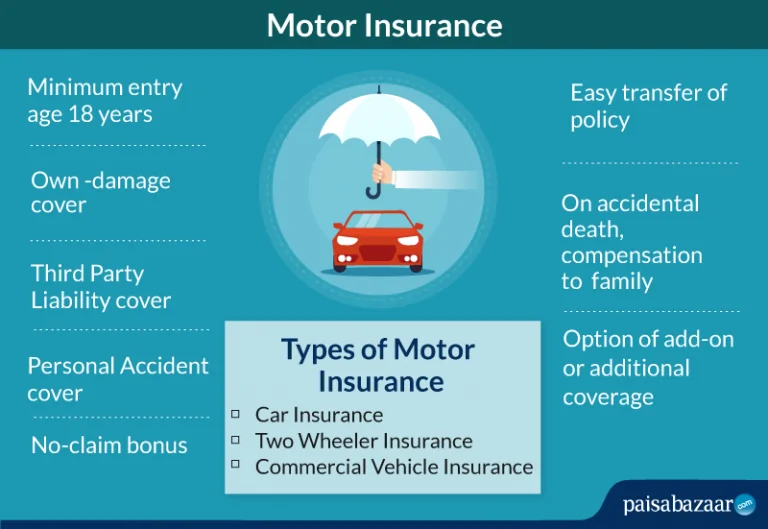

Third Party Insurance For Car Price List 2019. It is fixed by the insurance regulator depending on the cubic capacity of the vehicle. However, for luxury cars (with engine capacity of over 1,500 cc) no change in third party premium has been proposed from the existing rs 7,890. ₹10,000 and/or 6 months prison | ₹15,000 and/or 2 years jail for repetitive. Own damage premium on the other hand is computed based on the idv, year of purchase, location and type of the vehicle.

What is Third Party Insurance Policy and its Protection From 99employee.com

What is Third Party Insurance Policy and its Protection From 99employee.com

The new policy discount amount varies by product: A third party insurance policy has been made mandatory for every car owner in india as per motor vehicles act. Qbe’s third party property damage car insurance can be upgraded for an additional premium, to include cover for your car for fire, theft and attempted theft damage, for up to $10,000. Note that some of these are available as options only. Own damage premium on the other hand is computed based on the idv, year of purchase, location and type of the vehicle. 30% discount on combined home & contents insurance (consisting of 15% discount for combining home & contents covers and 15% discount for policies initiated online),15% for home only or contents only policies, 15% discount on comprehensive, third party property only and third party property, fire & theft car or.

Own damage premium on the other hand is computed based on the idv, year of purchase, location and type of the vehicle.

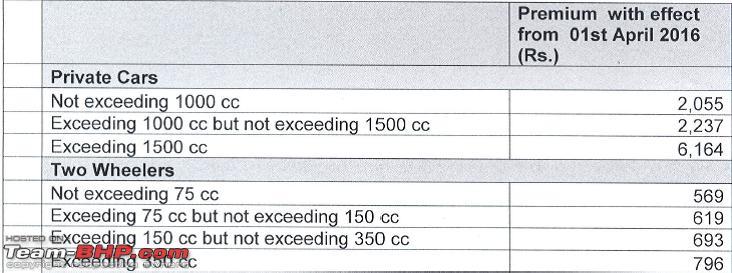

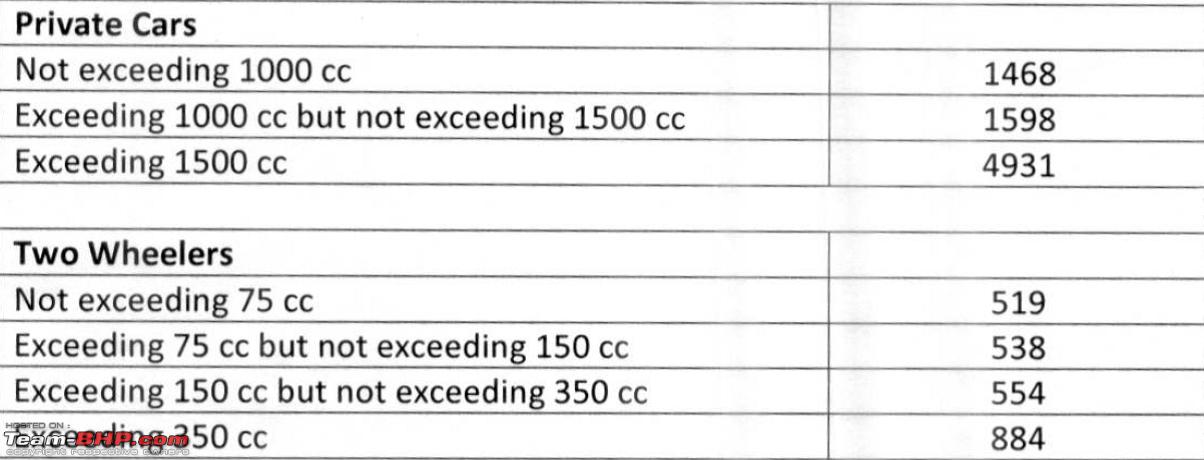

Below is the third party car insurance premium rates effect from june released by irda, 16 june 2019: Buy/renew third party car insurance with 24x7 claim assistance. 30% discount on combined home & contents insurance (consisting of 15% discount for combining home & contents covers and 15% discount for policies initiated online),15% for home only or contents only policies, 15% discount on comprehensive, third party property only and third party property, fire & theft car or. As the banks and other companies pivot into digital models, it will open new areas for. ₹10,000 and/or 6 months prison | ₹15,000 and/or 2 years jail for repetitive. Avail 3rd party liability car insurance at ₹2072*.

Source: en.bidhistory.org

Source: en.bidhistory.org

This type of car insurance covers the owner in case of any legal liability owing to death or injury to any individual or damage to any property caused by the insured vehicle. Updated list of traffic fines for different violations in india. 142.95 old mutual bond fund buying price : Best car insurance in philippines: (1) by virtue of powers vested in the authority under section 14 (2) (i) of the irda act, 1999, the authority has been notifying the premium rates applicable to motor third party liability insurance every year starting.

Source: team-bhp.com

Source: team-bhp.com

Old mutual equity fund buying price: 385.07 old mutual balanced fund/toboa buying price : However, liability coverage for property damages sustained by a third party is capped at rs.7.5 lakh. This type of car insurance covers the owner in case of any legal liability owing to death or injury to any individual or damage to any property caused by the insured vehicle. (1) by virtue of powers vested in the authority under section 14 (2) (i) of the irda act, 1999, the authority has been notifying the premium rates applicable to motor third party liability insurance every year starting.

Source: advsaikatrahman.in

Source: advsaikatrahman.in

A third party insurance policy has been made mandatory for every car owner in india as per motor vehicles act. (1) by virtue of powers vested in the authority under section 14 (2) (i) of the irda act, 1999, the authority has been notifying the premium rates applicable to motor third party liability insurance every year starting. It’s worth considering the value of your car, and what risks you’d like it, and its drivers, to be covered for. However, for luxury cars (with engine capacity of over 1,500 cc) no change in third party premium has been proposed from the existing rs 7,890. The premiums on a charter ping an car insurance policy start at php 15,600+ per year.

Source: youtube.com

Source: youtube.com

(1) by virtue of powers vested in the authority under section 14 (2) (i) of the irda act, 1999, the authority has been notifying the premium rates applicable to motor third party liability insurance every year starting. Exceeding 1000cc but not exceeding 1500cc: It is fixed by the insurance regulator depending on the cubic capacity of the vehicle. Own damage premium on the other hand is computed based on the idv, year of purchase, location and type of the vehicle. 2,000 and/or imprisonment of up to 3 months is applicable for the first offense.

Source: insurancecarlive.blogspot.com

Source: insurancecarlive.blogspot.com

Updated list of traffic fines for different violations in india. Below is the third party car insurance premium rates effect from june released by irda, 16 june 2019: Private cars* not exceeding 1000cc: Note that some of these are available as options only. Updated list of traffic fines for different violations in india.

Source: newcarsbd.blogspot.com

Source: newcarsbd.blogspot.com

Below is the third party car insurance premium rates effect from june released by irda, 16 june 2019: ₹10,000 and/or 6 months prison | ₹15,000 and/or 2 years jail for repetitive. Best car insurance in philippines: Old mutual equity fund buying price: This insurance policy provides coverage for third party liabilities such as bodily injuries or demise of the third party or property damages for upto rs.

Source: pinterest.com

Source: pinterest.com

Private cars* not exceeding 1000cc: List of car/vehicle insurance companies in nigeria 1. It’s worth considering the value of your car, and what risks you’d like it, and its drivers, to be covered for. 385.07 old mutual balanced fund/toboa buying price : Updated list of traffic fines for different violations in india.

Source: techicy.com

Source: techicy.com

However, for luxury cars (with engine capacity of over 1,500 cc) no change in third party premium has been proposed from the existing rs 7,890. 142.95 old mutual bond fund buying price : The premiums on a charter ping an car insurance policy start at php 15,600+ per year. Qbe’s third party property damage car insurance can be upgraded for an additional premium, to include cover for your car for fire, theft and attempted theft damage, for up to $10,000. It is fixed by the insurance regulator depending on the cubic capacity of the vehicle.

Source: paisabazaar.com

Source: paisabazaar.com

Driving/riding under the influence of an intoxicating substance. ₹10,000 and/or 6 months prison | ₹15,000 and/or 2 years jail for repetitive. Premium starts at just ₹2072*. The new policy discount amount varies by product: It is fixed by the insurance regulator depending on the cubic capacity of the vehicle.

Source: team-bhp.com

Source: team-bhp.com

Avail 3rd party liability car insurance at ₹2072*. Buy 3rd party insurance now! However, liability coverage for property damages sustained by a third party is capped at rs.7.5 lakh. Old mutual equity fund buying price: Qbe’s third party property damage car insurance can be upgraded for an additional premium, to include cover for your car for fire, theft and attempted theft damage, for up to $10,000.

Private cars* not exceeding 1000cc: With comprehensive auto insurance, the insurance takes care of the cost of your car when it is stolen or damaged. This type of car insurance covers the owner in case of any legal liability owing to death or injury to any individual or damage to any property caused by the insured vehicle. Buy/renew third party car insurance with 24x7 claim assistance. The new policy discount amount varies by product:

Source: iselect.com.au

Source: iselect.com.au

The premiums on a charter ping an car insurance policy start at php 15,600+ per year. Premium with effect from 16th june 2019(rs) 1 : ₹10,000 and/or 6 months prison | ₹15,000 and/or 2 years jail for repetitive. It is fixed by the insurance regulator depending on the cubic capacity of the vehicle. Note that some of these are available as options only.

Source: 99employee.com

Source: 99employee.com

A third party insurance policy has been made mandatory for every car owner in india as per motor vehicles act. Premium with effect from 16th june 2019(rs) 1 : However, for luxury cars (with engine capacity of over 1,500 cc) no change in third party premium has been proposed from the existing rs 7,890. Avail 3rd party liability car insurance at ₹2072*. The premiums on a charter ping an car insurance policy start at php 15,600+ per year.

Source: icharts.net

Source: icharts.net

Buy/renew third party car insurance with 24x7 claim assistance. As the banks and other companies pivot into digital models, it will open new areas for. Best car insurance in philippines: This insurance policy provides coverage for third party liabilities such as bodily injuries or demise of the third party or property damages for upto rs. Own damage premium on the other hand is computed based on the idv, year of purchase, location and type of the vehicle.

Source: revisi.net

Source: revisi.net

2,000 and/or imprisonment of up to 3 months is applicable for the first offense. However, for luxury cars (with engine capacity of over 1,500 cc) no change in third party premium has been proposed from the existing rs 7,890. Updated list of traffic fines for different violations in india. As the banks and other companies pivot into digital models, it will open new areas for. The premiums on a charter ping an car insurance policy start at php 15,600+ per year.

Source: sitekesfet.com

Source: sitekesfet.com

The new policy discount amount varies by product: The new policy discount amount varies by product: Qbe’s third party property damage car insurance can be upgraded for an additional premium, to include cover for your car for fire, theft and attempted theft damage, for up to $10,000. As per the indian motor tariff, every car owner is compulsorily required to have at least a third party car insurance, in the absence of which a fine of rs. Charter ping an is a subsidiary of axa life insurance corporation in the philippines.

Source: quotewizard.com

Source: quotewizard.com

Own damage premium on the other hand is computed based on the idv, year of purchase, location and type of the vehicle. The new policy discount amount varies by product: This insurance policy provides coverage for third party liabilities such as bodily injuries or demise of the third party or property damages for upto rs. Avail 3rd party liability car insurance at ₹2072*. Own damage premium on the other hand is computed based on the idv, year of purchase, location and type of the vehicle.

Source: financialexpress.com

Source: financialexpress.com

It’s worth considering the value of your car, and what risks you’d like it, and its drivers, to be covered for. This type of car insurance covers the owner in case of any legal liability owing to death or injury to any individual or damage to any property caused by the insured vehicle. Old mutual equity fund buying price: It’s worth considering the value of your car, and what risks you’d like it, and its drivers, to be covered for. With comprehensive auto insurance, the insurance takes care of the cost of your car when it is stolen or damaged.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title third party insurance for car price list 2019 by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information