Third party ownership life insurance information

Home » Trend » Third party ownership life insurance informationYour Third party ownership life insurance images are ready in this website. Third party ownership life insurance are a topic that is being searched for and liked by netizens now. You can Download the Third party ownership life insurance files here. Get all free vectors.

If you’re looking for third party ownership life insurance pictures information linked to the third party ownership life insurance interest, you have pay a visit to the right blog. Our site always provides you with hints for seeking the highest quality video and picture content, please kindly surf and find more enlightening video content and graphics that fit your interests.

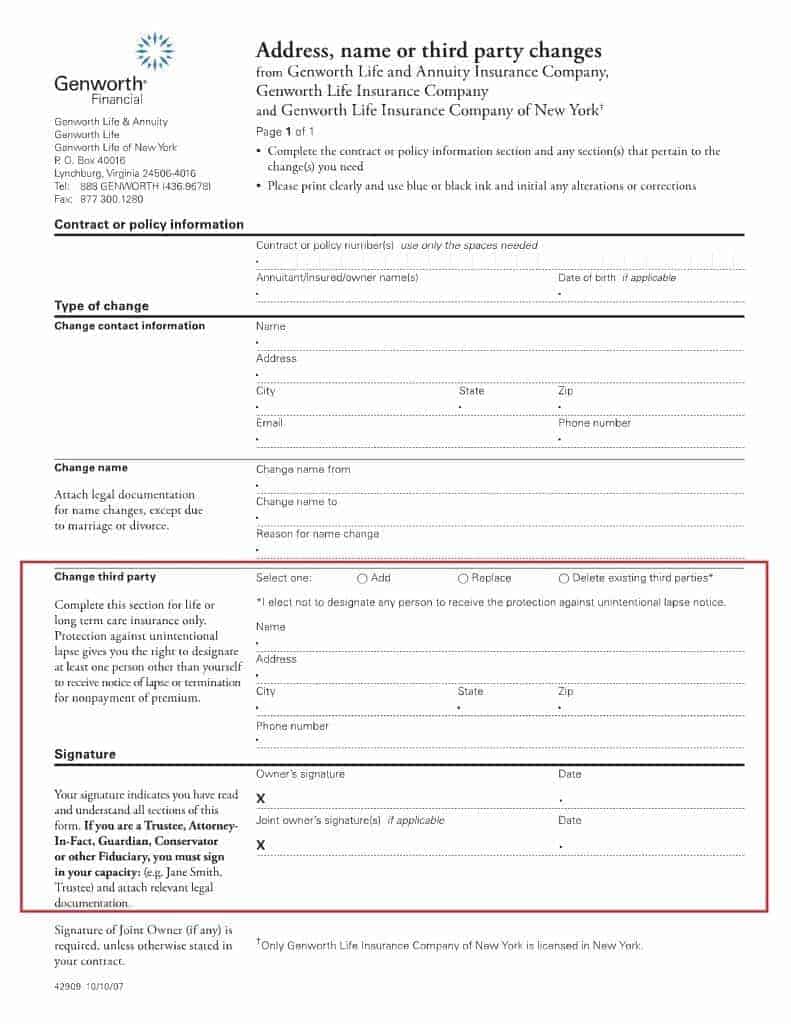

Third Party Ownership Life Insurance. The benefit of buying a third party life insurance policy is that you protect yourself from the financial risks of another person�s death. Life insurance policies transfers by third party owners* assume that a life insu ance policy is owned by someone other than the in sured. The policy owner and the insured may be and often are the same person. A policy owner who is not the prospective insured.

![]() Third Party Ownership Life Insurance at Insurance From revisi.net

Third Party Ownership Life Insurance at Insurance From revisi.net

What is an example of third party ownership in life insurance? All you need to do is fill out a simple form and send it to the life insurance company. A policy owner who is not the prospective insured. Who is a third party owner in life insurance? The new policyholder pays the monthly premiums and receives the full benefit upon the death of the insured person. Third party ownership life insurance.

The advantage to third party life insurance ownership is that upon the death of the insured the beneficiary receives a cash payout.

*upon the insured employee’s death, the surviving family receives the. *upon the insured employee’s death, the surviving family receives the. If quotacy is your agency, you can always call us and we will get you the forms you need. The policy owner and the insured may be and often. If you are the owner of your policy, you can transfer ownership. A life settlement, or viatical settlement, is when an insured person sells their policy to a third party.

Source: newsmax.com

When an insured purchased a new home, the insured made an absolute assignment of a life insurance policy to the mortgage company b. B an insured borrows money from the bank and makes a collateral assignment of a part of the death benefit to secure the loan. A policy owner who is not the prospective insured. Traditional life contracts insuring only one life are frequently appropriate to fund such needs as survivor income, educational needs, and final expenses. A life settlement, or viatical settlement, is when an insured person sells their policy to a third party.

Source: comparepolicy.com

Source: comparepolicy.com

All you need to do is fill out a simple form and send it to the life insurance company. Life settlements betting on life insurance during a from www.newsmax.com When an insured purchased a new home, the insured made an absolute assignment of a life insurance policy to the mortgage company b. Life insurance policies transfers by third party owners* assume that a life insu ance policy is owned by someone other than the in sured. B an insured borrows money from the bank and makes a collateral assignment of a part of the death benefit to secure the loan.

Source: uiservices.com

Source: uiservices.com

What is an example of third party ownership in life insurance? Traditional life contracts insuring only one life are frequently appropriate to fund such needs as survivor income, educational needs, and final expenses. Click to see full answer. In general, a third party life insurance policy is where the insurance company promises the owner of the policy that the insurance company will pay the beneficiary upon the death of the insured. A life insurance policy would be considered a wagering contract without insurable interest at what point does the life and health insurance guaranty association become.

Source: comparepolicy.com

Source: comparepolicy.com

The policy owner and the insured may be and often. In general, a third party life insurance policy is where the insurance company promises the owner of the policy that the insurance company will pay the. An insured borrow money from the bank and makes a collateral assignment of a part of the death benefit to secure the loan c. The benefit of buying a third party life insurance policy is that you protect yourself from the financial risks of another person�s death. If you are the owner of your policy, you can transfer ownership.

Source: lisguide.com

Source: lisguide.com

In respect to this, who is a third party owner in life insurance? Ownership may be in this third person because he procured the issu ance of the policy and was its owner from the outset, or because the insured took out the policy designating such third party owner, or later, by assign You can call the life insurance company directly and ask for this form. The policy owner and the insured may be and often. What’s a third party life insurance policy?

Source: iaclife.net

Source: iaclife.net

What’s a third party life insurance policy? A policy owner who is not the prospective insured. Who is a third party owner in life insurance? A life insurance policy would be considered a wagering contract without insurable interest at what point does the life and health insurance guaranty association become. In respect to this, who is a third party owner in life insurance?

Source: murrayins.com

Source: murrayins.com

What’s a third party life insurance policy? If you are the owner of your policy, you can transfer ownership. Also, many life insurance policies have a primary and a successor beneficiary; The successor is the person who would receive the benefit if something were to happen to both the insured and the. What is an example of third party ownership in life insurance?

Source: coverfox.com

Source: coverfox.com

In general, a third party life insurance policy is where the insurance company promises the owner of the policy that the insurance company will pay the. Also, many life insurance policies have a primary and a successor beneficiary; The new policyholder pays the monthly premiums and receives the full benefit upon the death of the insured person. What’s a third party life insurance policy? Practically every person has insurance policy today.

Source: garanta.ro

Source: garanta.ro

When an insured purchased a new home, the insured made an absolute assignment of a life insurance policy to the mortgage company b. Should i buy a life. The policy owner and the insured may be and often are the same person. In general, a third party life insurance policy is where the insurance company promises the owner of the policy that the insurance company will pay the beneficiary upon the death of the insured. The world is developing at a frantic pace.

Source: a2zvehicle.com

Source: a2zvehicle.com

Ownership may be in this third person because he procured the issu ance of the policy and was its owner from the outset, or because the insured took out the policy designating such third party owner, or later, by assign Practically every person has insurance policy today. The advantage to third party life insurance ownership is that upon the death of the insured the beneficiary receives a cash payout. Life settlements betting on life insurance during a from www.newsmax.com What is 3rd party life insurance?

Source: coverfox.com

Source: coverfox.com

Who are the parties in a third party life insurance ownership. The advantage to third party life insurance ownership is that upon the death of the insured the beneficiary receives a cash payout. The new policyholder pays the monthly premiums and receives the full benefit upon the death of the insured person. The advantage to third party life insurance ownership is that upon the death of the insured the beneficiary receives a cash payout. What’s a third party life insurance policy?

Source: policybachat.com

Source: policybachat.com

The policy owner and the insured may be and often are the same person. Traditional life contracts insuring only one life are frequently appropriate to fund such needs as survivor income, educational needs, and final expenses. You can call the life insurance company directly and ask for this form. In general, a third party life insurance policy is where the insurance company promises the owner of the policy that the insurance company will pay the beneficiary upon the death of the insured. Third party ownership life insurance.

Source: blog.ovidlife.com

Source: blog.ovidlife.com

Practically every person has insurance policy today. If quotacy is your agency, you can always call us and we will get you the forms you need. A life insurance policy would be considered a wagering contract without insurable interest at what point does the life and health insurance guaranty association become. A policy owner who is not the prospective insured. Life settlements betting on life insurance during a from www.newsmax.com

Source: ltcshop.com

Source: ltcshop.com

The benefit of buying a third party life insurance policy is that you protect yourself from the financial risks of another person�s death. A life settlement, or viatical settlement, is when an insured person sells their policy to a third party. Click to see full answer. Traditional life contracts insuring only one life are frequently appropriate to fund such needs as survivor income, educational needs, and final expenses. Who is a third party owner in life insurance?

Source: noclutter.cloud

Source: noclutter.cloud

You can call the life insurance company directly and ask for this form. If quotacy is your agency, you can always call us and we will get you the forms you need. What is an example of third party ownership in life insurance? The successor is the person who would receive the benefit if something were to happen to both the insured and the. The benefit of buying a third party life insurance policy is that you protect yourself from the financial risks of another person�s death.

Source: bankonus.com

Source: bankonus.com

Click to see full answer. A life settlement, or viatical settlement, is when an insured person sells their policy to a third party. Life insurance policies transfers by third party owners* assume that a life insu ance policy is owned by someone other than the in sured. A life insurance policy would be considered a wagering contract without insurable interest at what point does the life and health insurance guaranty association become. In general, a third party life insurance policy is where the insurance company promises the owner of the policy that the insurance company will pay the.

Source: pinterest.com

Source: pinterest.com

B an insured borrows money from the bank and makes a collateral assignment of a part of the death benefit to secure the loan. What’s a third party life insurance policy? Should i buy a life. If quotacy is your agency, you can always call us and we will get you the forms you need. The benefit of buying a third party life insurance policy is that you protect yourself from the financial risks of another person�s death.

![]() Source: revisi.net

Source: revisi.net

Life insurance policies transfers by third party owners* assume that a life insu ance policy is owned by someone other than the in sured. When an insured purchased a new home, the insured made an absolute assignment of a life insurance policy to the mortgage company b. An insured borrow money from the bank and makes a collateral assignment of a part of the death benefit to secure the loan c. Click to see full answer. Who is a third party owner in life insurance?

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title third party ownership life insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information